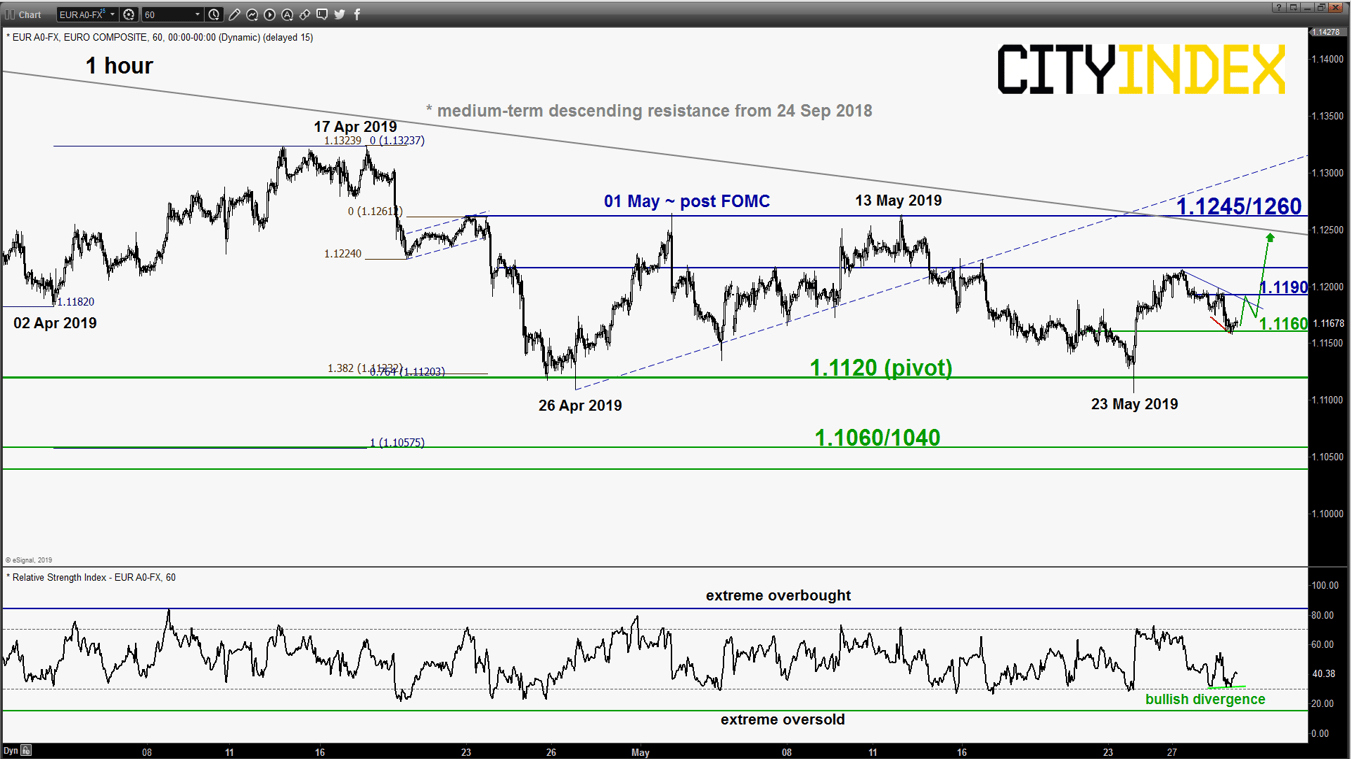

EUR/USD – 1.1120 remains the key support to watch

click to enlarge chart

- The pair had dipped down as expected from Mon, 27 May high of 1.1215 and manged to hold above the 1.1120 key short-term pivotal support as per highlighted in our previous report (click here for a recap). In addition, the hourly RSI oscillator has shaped a bullish divergence signal at its oversold region which suggests a slowdown in the downside momentum seen yesterday.

- Maintain bullish bias above 1.1120 key short-term pivotal support and a break above the minor descending trendline at 1.1190 reinforces a further potential push up to target the minor range resistance at 1.1245/1260 (recent post FOMC swing high areas & medium-term descending resistance from 24 Sep 2018).

- On the other hand, an hourly close below 1.1120 resumes the bearish impulsive downleg sequence towards the next near-term support at 1.1060/1040 (Fibonacci retracement/expansion cluster).

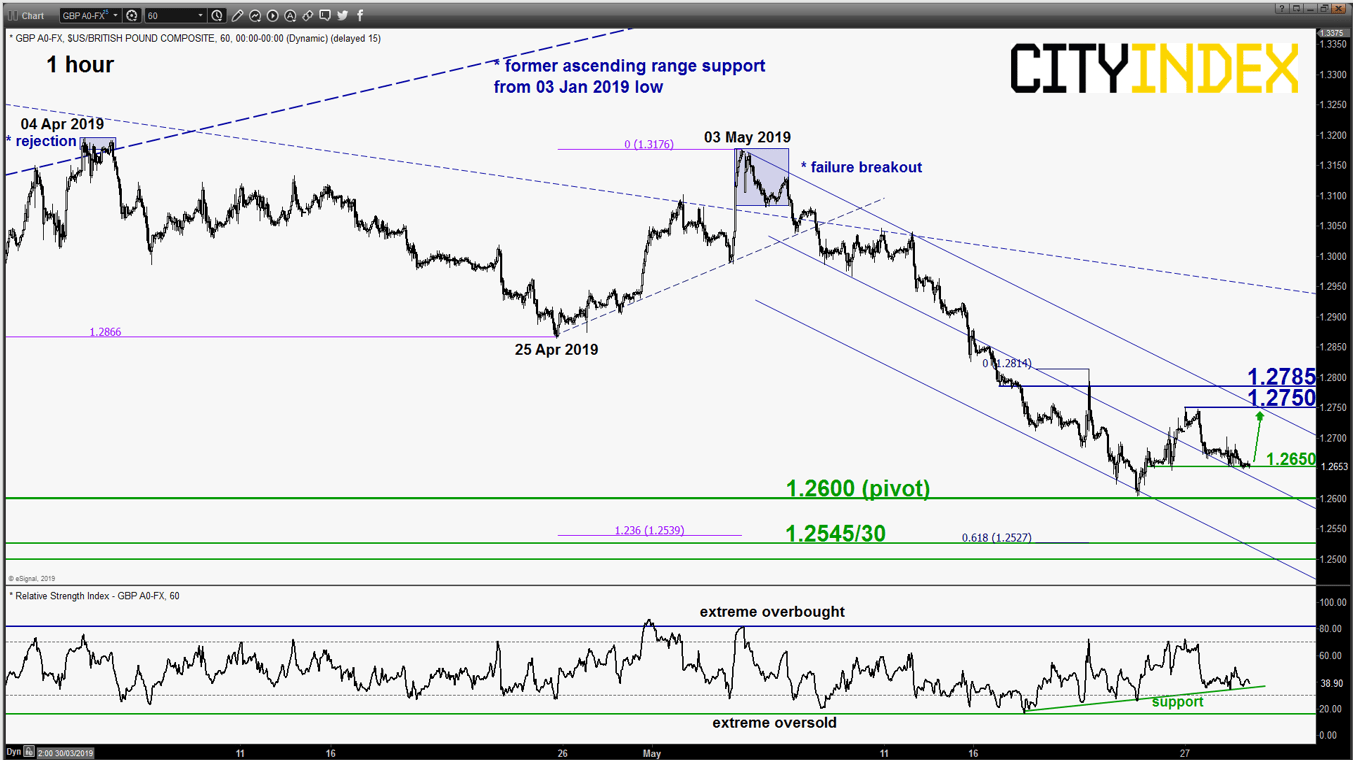

GBP/USD – 1.2600 remains the key support to watch

click to enlarge chart

- No major changes on its short-term elements; maintain bullish bias above 1.2600 key short-term pivotal support for a further potential corrective rebound to target the 1.2750/1.2785 intermediate resistance (also the upper boundary of the minor descending channel in place since 03 May 2019).

- On the other hand, an hourly close below 1.2600 resumes the slide towards the major support at 1.2545/2530 (also the primary ascending range support in place since 07 Oct 2016 low).

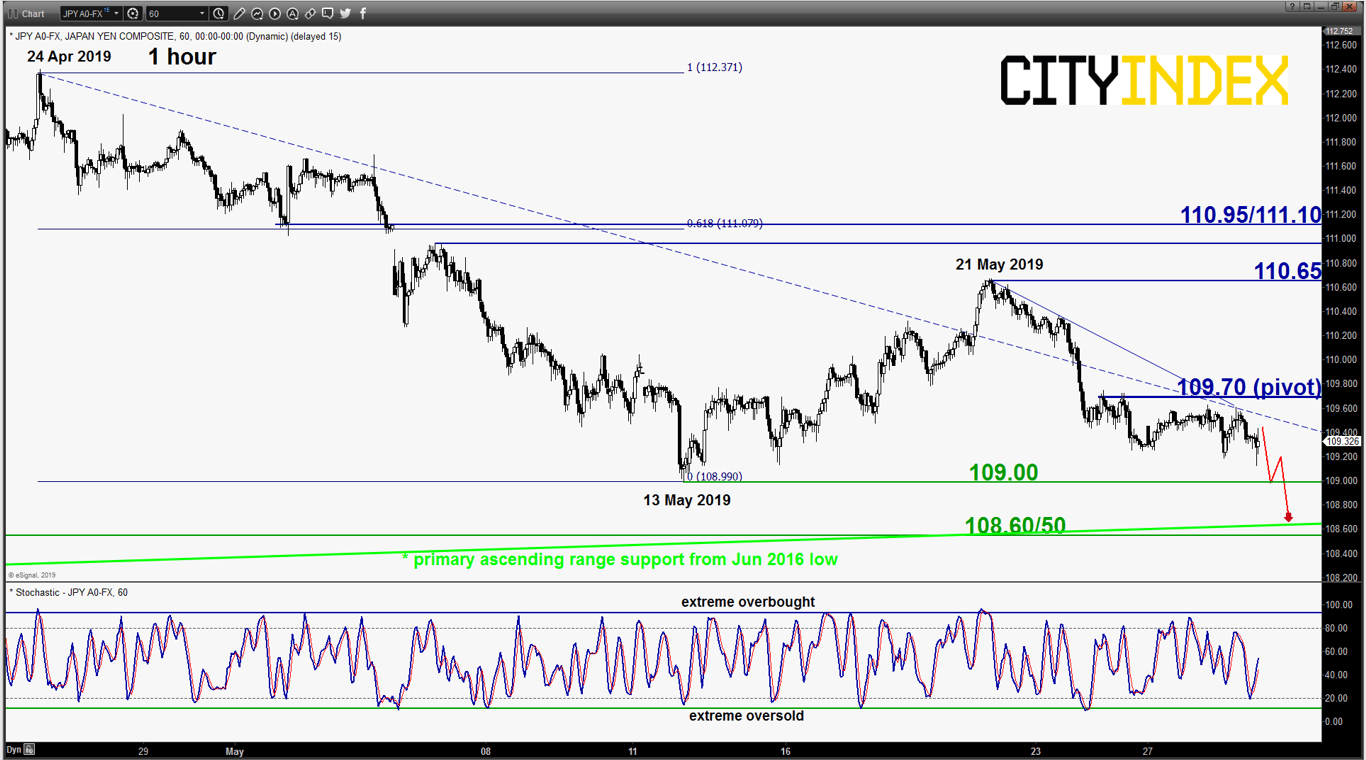

USD/JPY – Further downside towards major support

click to enlarge chart

- Drifted down lower as expected towards the 13 May 2019 minor swing low area of 109.00. Maintain bearish bias with a tightened key short-term pivotal resistance at 109.70 (also the minor swing high area of 24 May 2019 & the descending trendline from 24 Apr 2019 high) for a further potential push down to target the major support at 108.50.

- On the other hand, an hourly close above 109.95 invalidates the bearish scenario for a squeeze up towards the next resistance at 110.65 (21 May 2019 swing high area).

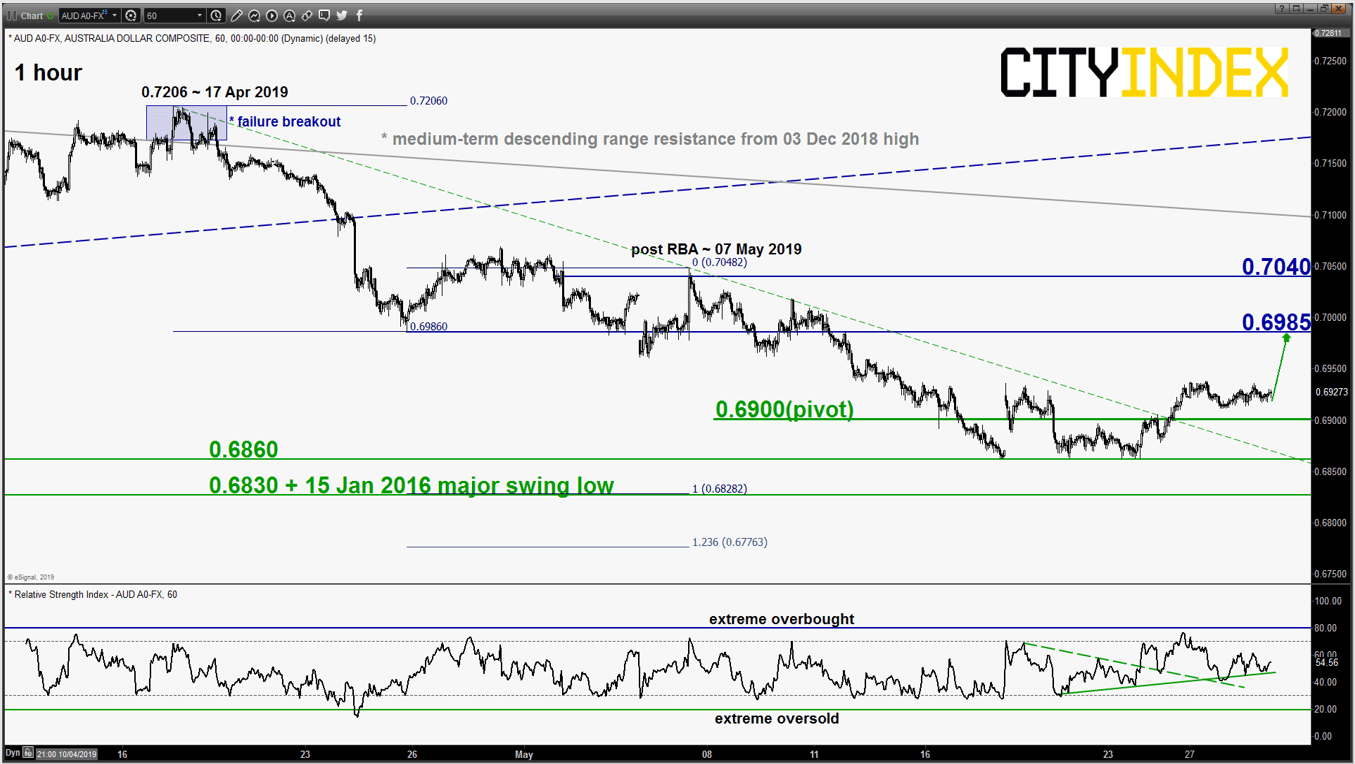

AUD/USD – Corrective bounce scenario remains intact

click to enlarge chart

- Traded sideways yesterday above the 0.6900 key short-term pivotal support. No major changes on its elements, maintain bullish bias for another potential leg of corrective rebound sequence to target the next intermediate resistance at 0.6985.

- On the other hand, an hourly close below 0.6900 resumes the slide for a retest on 0.6860 before targeting 0.6830 next.

Charts are from eSignal

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM