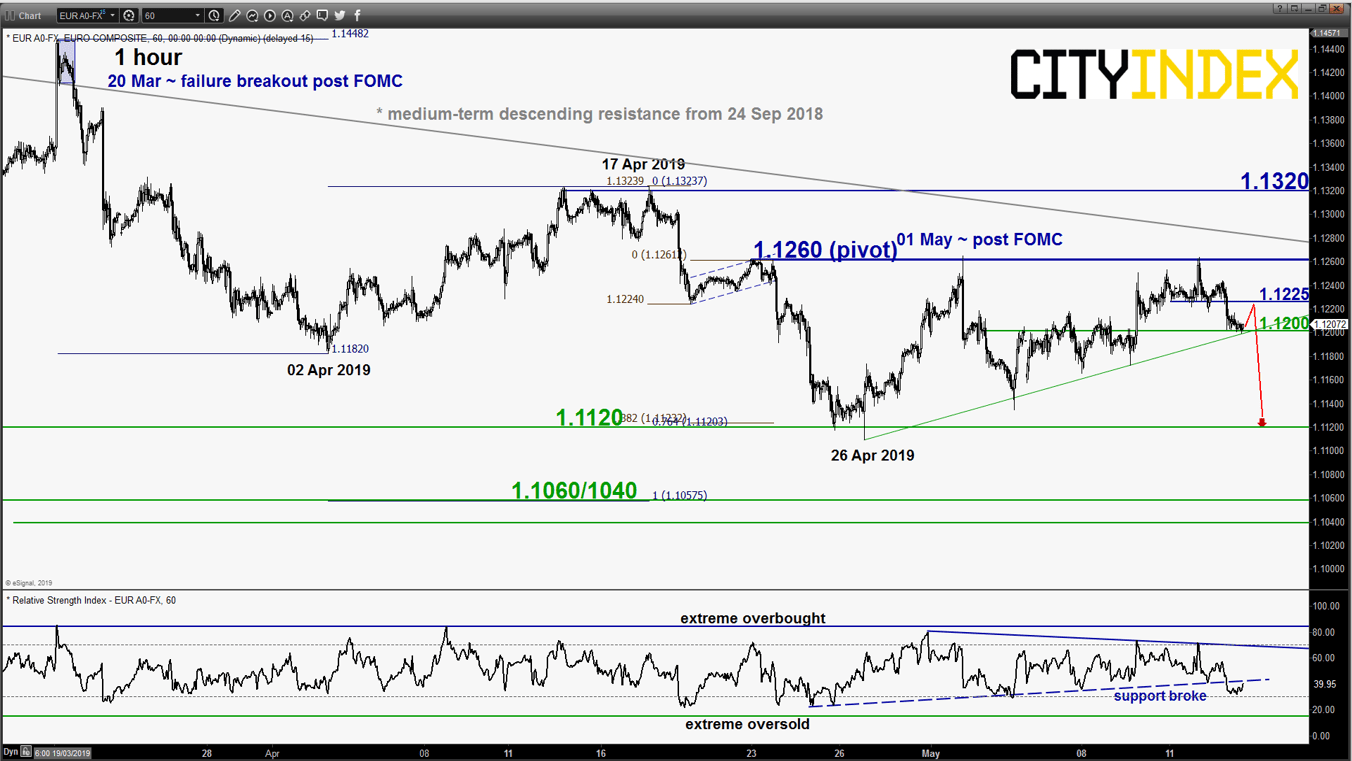

EUR/USD – Further push down in progress

click to enlarge chart

- Drifted down as expected from the 1.1260 key short-term pivotal resistance as per highlighted in our previous report (click here for a recap). In today’s early Asian session, it tested the 1.1200 downside trigger level (the minor ascending support in place since 26 Apr 2019 low) before it traded sideways. Interestingly, the parallel ascending support seen in the hourly RSI oscillator has already been broken to the downside which suggests a revival of short-term downside momentum in price action.

- Maintain bearish bias with 1.1260 remains as the key short-term pivotal resistance and an hourly close below 1.1200 reinforces a potential slide to retest 1.1120 in the first step. However, an hourly close above 1.1260 invalidates the bearish scenario for a further corrective push up towards the key 1.1320 medium-term resistance.

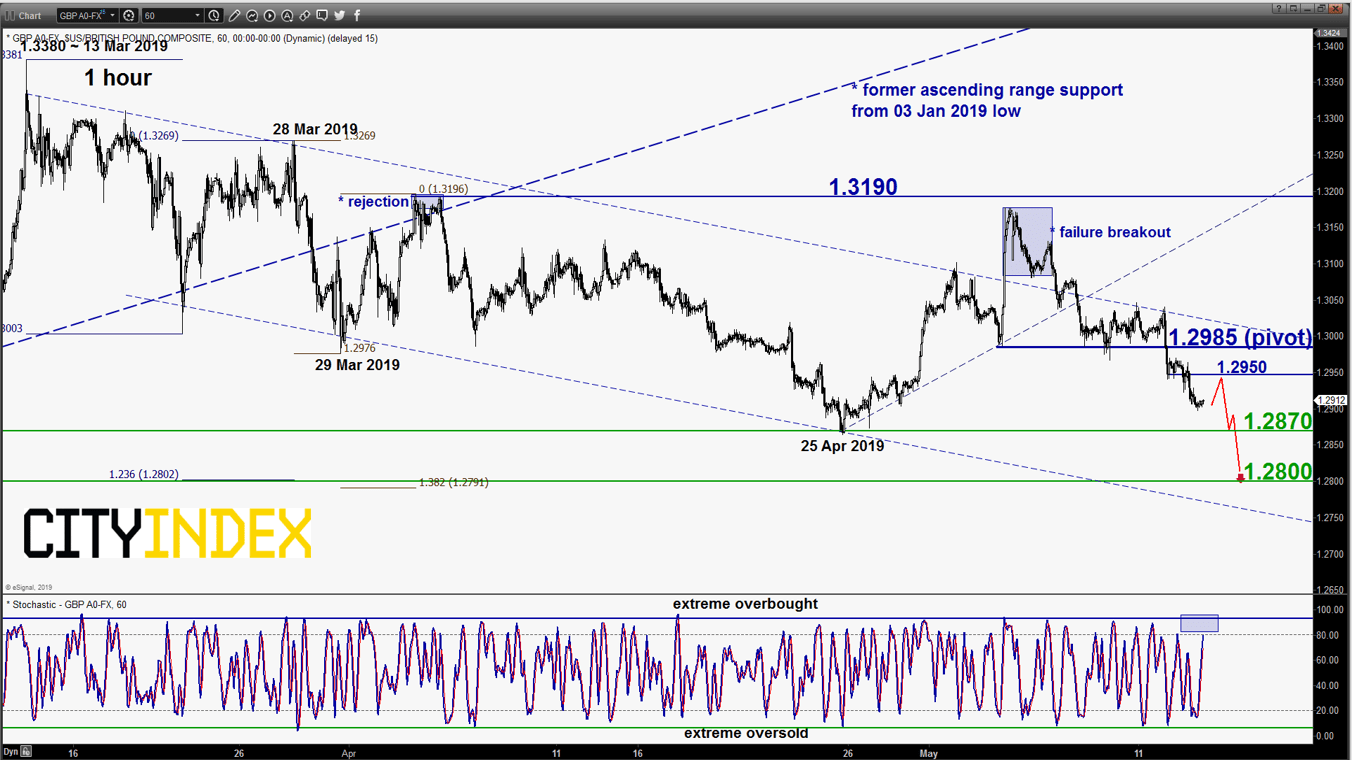

GBP/USD – Further push down within range in progress

click to enlarge chart

- Continued its downward drift to print another lower daily close at 1.2908 at the end of yesterday, 14 May U.S. session. Maintain bearish bias with a tightened key short-term pivotal resistance now at 1.2985 (former minor swing low areas from 03/09 May 2019) for a for a further potential push down towards the 25 Apr 2019 low of 1.2870 follow by 1.2800 next (lower boundary of the descending channel & Fibonacci retracement/expansion cluster).

- However, an hourly close above 1.2985 invalidates the bearish tone for a squeeze up towards the next intermediate resistance at 1.3190.

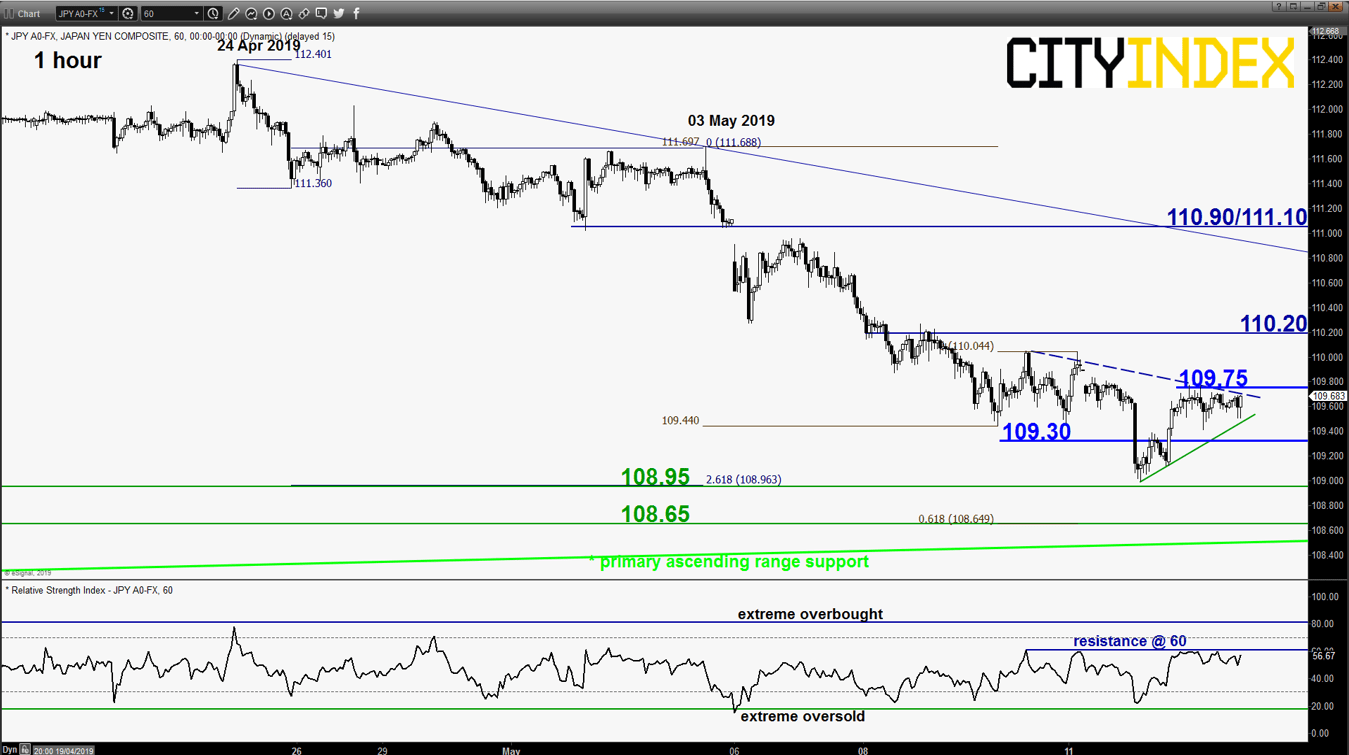

USD/JPY – Sideways with risk of corrective rebound

click to enlarge chart

- Inched higher and challenged the 109.65 key short-term pivotal resistance before it traded sideways. Mix elements now, prefer to turn neutral between 109.75 and 109.30 where an hourly close above 109.75 opens up scope for a corrective rebound towards 110.20 (minor swing high area of 08 May 2019 & Fibonacci retracement/expansion cluster).

- On the flipside, an hourly close below 109.30 revives the bearish tone for a potential residual push down to target the 108.65 major support (also the primary ascending range support from Jun 2016 low),

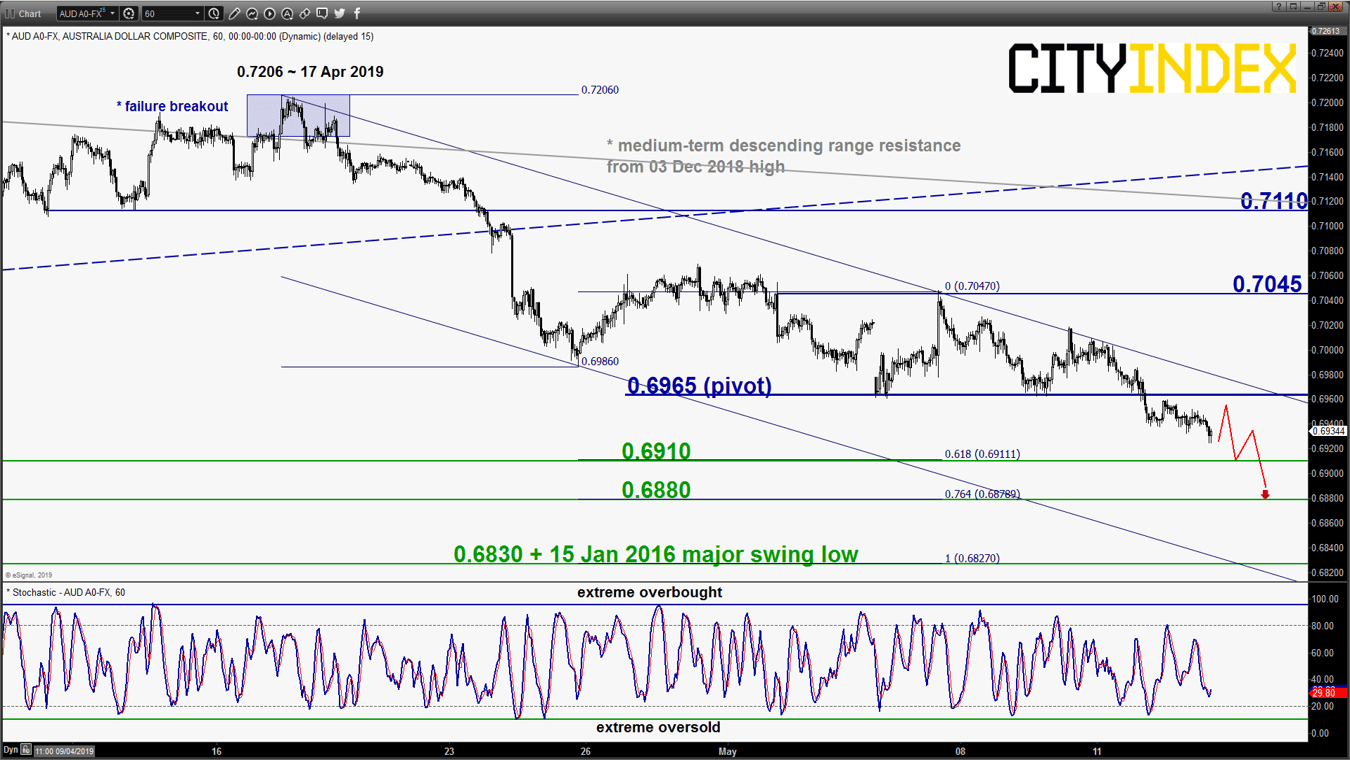

AUD/USD – Further drop in progress

click to enlarge chart

- Continued to extend its expected drop on the backdrop of a weaker than expected Q1 AU wage data and China retail sales and industrial production for April. No clear signs of bearish exhaustion yet, maintain bearish bias with a tightened key short-term pivotal resistance now at 0.6965 (former medium-term range support from 03 Jan 2019 low & upper boundary of the minor descending channel from 17 Apr 2019 high) for a further potential drop to target 0.6910 and 0.6880 next.

- However, an hourly close above 0.6990 negates the bearish tone for squeeze up towards the minor range resistance 0.7045 formed after the recent RBA meeting on 07 May.

Charts are from eSignal

Latest market news

April 25, 2024 03:09 PM

April 25, 2024 03:00 PM

April 25, 2024 01:12 PM

April 25, 2024 11:14 AM