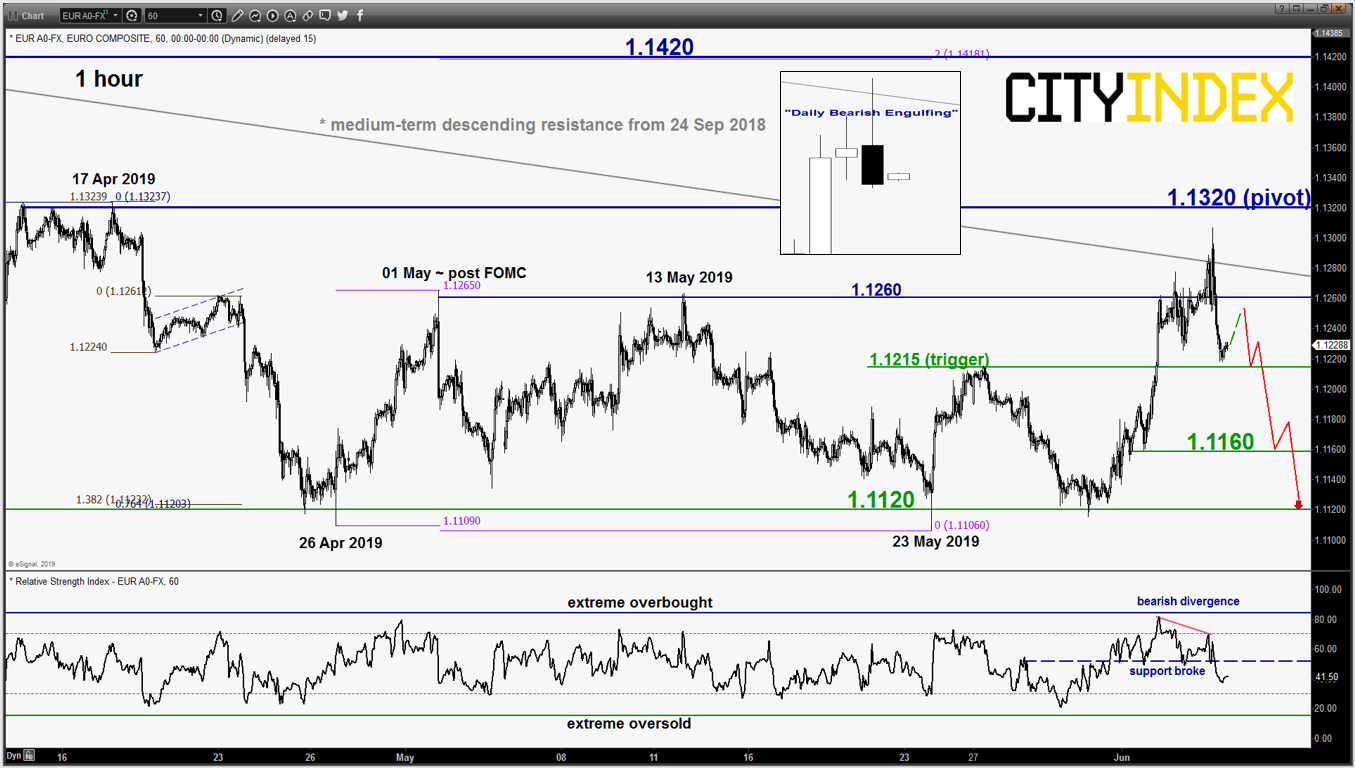

EUR/USD – Retreated from key resistance

click to enlarge chart

- Squeezed up but rejected as expected right below the 1.1320 key short-term pivotal resistance highlighted in our previous report (click here for a recap). The pair printed an intraday high of 1.1306 in yesterday, 05 Jun European session and ended the U.S. session with a daily “Bearish Engulfing” candlestick pattern that reinforces the bearish scenario.

- Maintain bearish bias with 1.1320 as the key short-term pivotal resistance and a break below 1.1215 sees another potential slide towards 1.1160 and 1.1120 (the range support in place since 26 Apr 2019). However, an hourly close above 1.1320 invalidates the bearish tone for a further squeeze up towards the key medium-term resistance at 1.1420 (also the major descending trendline in place since 15 Feb 2018 & the 20 Mar 2019 swing high area

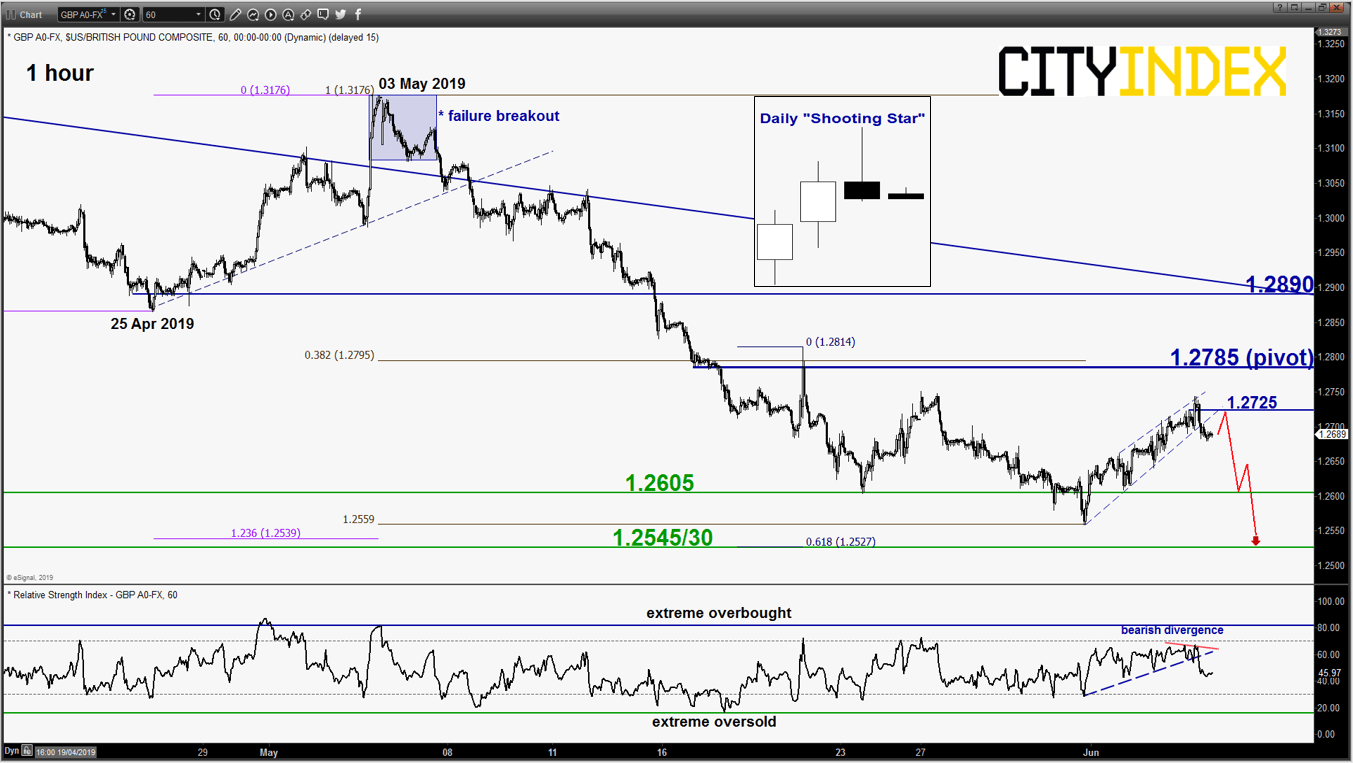

GBP/USD – Corrective rebound target almost reached

click to enlarge chart

- Pushed up as expected and almost reached the corrective rebound target of 1.2785 as per highlighted in our previous report. It printed a high of 1.2744 in yesterday, 05 Jun European session and elements have turned negative with a daily “Shooting Star” candlestick pattern seen at the end of the U.S. session.

- Flip back to a bearish bias below 1.2785 key short-term pivotal resistance for a further potential drop towards 1.2605 before targeting the major support of 1.2545/30 (also the primary ascending range support in place since 07 Oct 2016 low). However, an hourly close above 1.2890 invalidates the bearish scenario for an extension of the corrective rebound towards the 1.2890 key medium-term resistance (also the descending trendline from 13 Mar 2019).

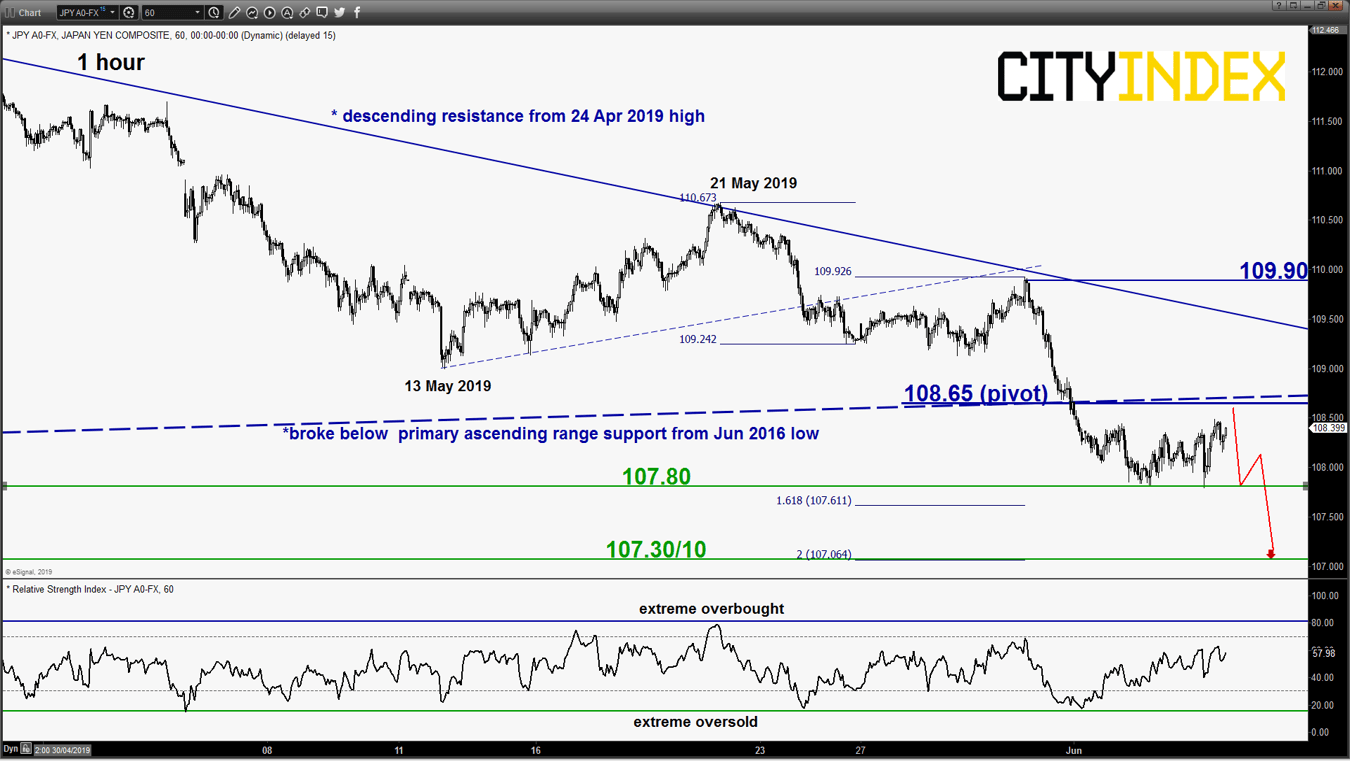

USD/JPY – 108.65 remains the key resistance to watch

click to enlarge chart

- Traded sideways below the 108.65 key short-term pivotal resistance. No major changes on its key elements, maintain bearish bias for another round of potential slide to retest 107.80 before target the next near-term support at 107.30/10 (Fibonacci expansion cluster).

- However, an hourly close above 108.65 invalidates the bearish scenario for a squeeze up to retest 109.90 (also the descending trendline resistance in place since 24 Apr 2019 high that has capped previous bounces).

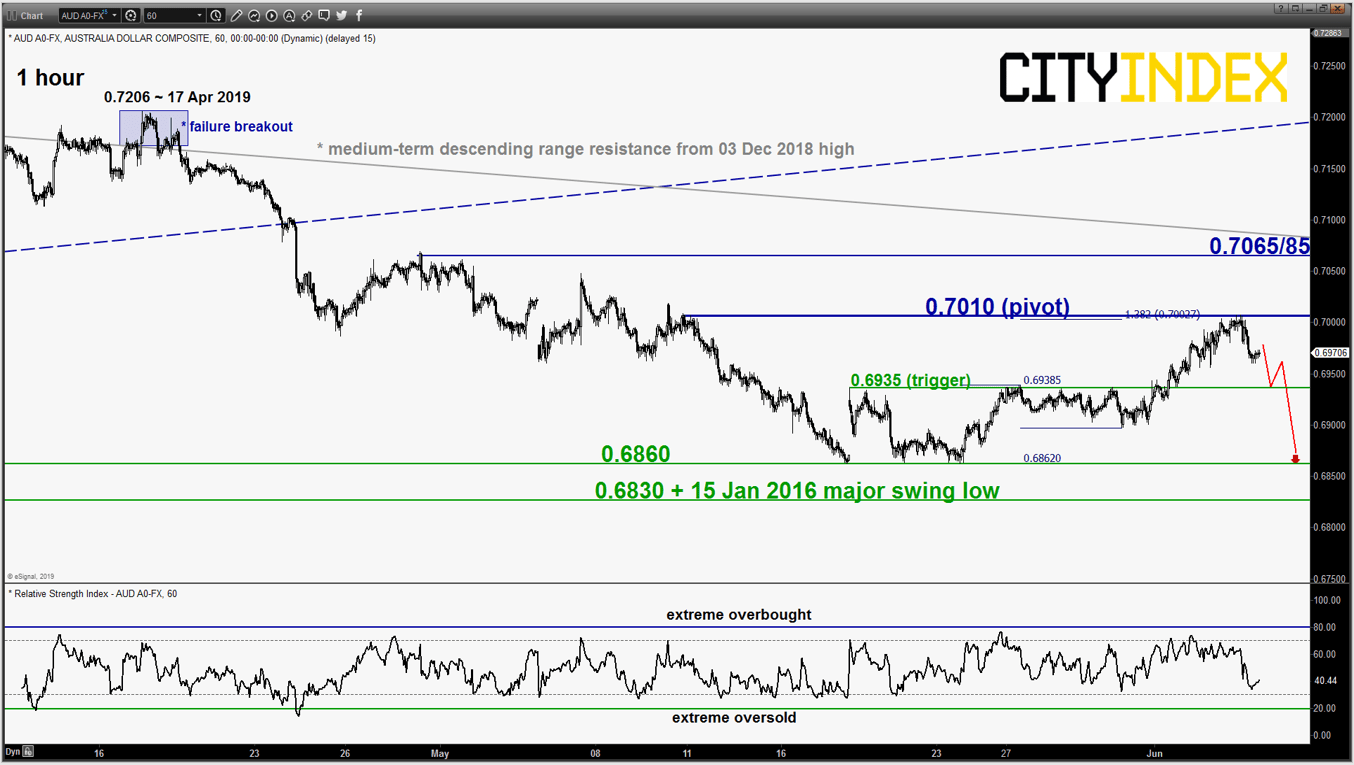

AUD/USD – Bounce rejected at 0.7010 resistance

click to enlarge chart

- The recent post RBA bounce has been rejected right at the 0.7010 key short-term pivotal resistance as per highlighted in our previous report. Maintain bearish bias and a break below 0.6935 reinforces a further potential slide to retest 0.6860 range support.

- However, an hourly close above 0.7010 negates the bearish tone for an extension of the corrective rebound towards the key medium-term resistance at 0.7065/85.

Charts are from eSignal

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM