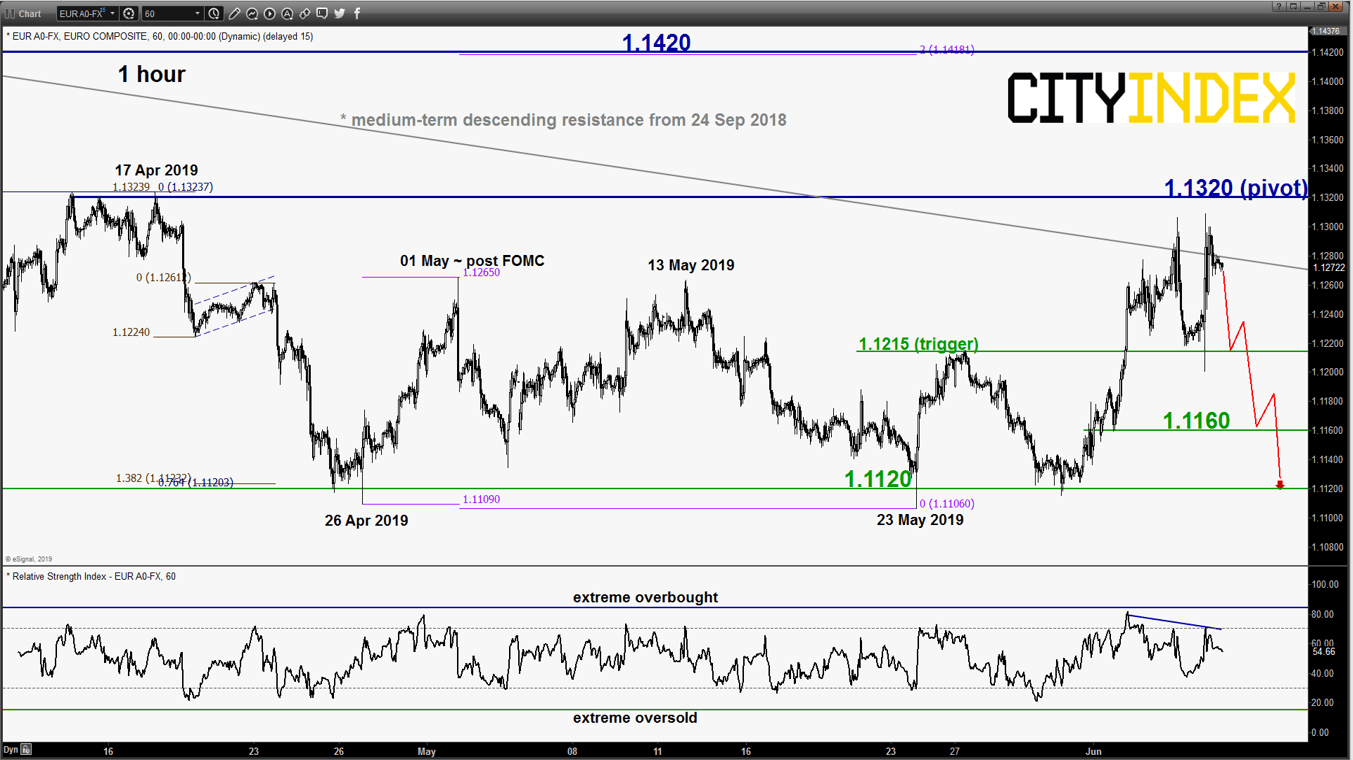

EUR/USD – 1.1320 remains the key resistance to watch

click to enlarge chart

- In yesterday, 07 Jun 2019 post ECB session, the pair had traded lower initially to test the 1.1215 downside trigger level before it rebounded towards the 1.1320 key short-term pivotal resistance despite the latest dovish ECB monetary policy stance to support Eurozone economy in times of rising uncertainties and also raised the prospect of interest rate cuts or restarting QE programme.

- No change, 1.1320 remains the key short-term pivotal resistance as per highlighted in our previous report (click here for a recap). A break with an hourly close below 1.1215 reinforces a potential slide towards 1.1160 and the 1.1120 range support in place since 26 Apr 2019.

- On the other hand, an hourly close above 1.1320 invalidates the bearish tone for a further squeeze up towards the key medium-term resistance at 1.1420 (also the major descending trendline in place since 15 Feb 2018 & the 20 Mar 2019 swing high area).

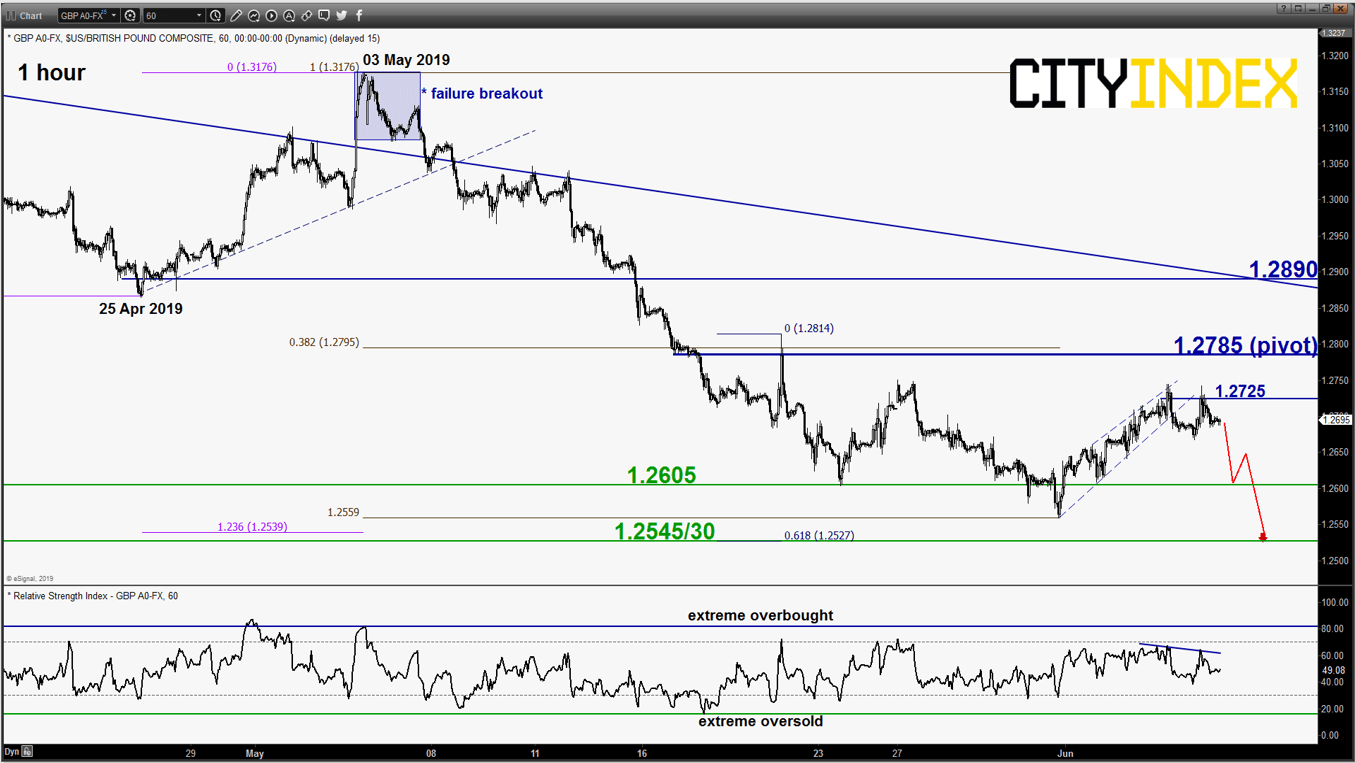

GBP/USD – Sideways below key resistance

click to enlarge chart

- No major changes on its key technical elements and ended yesterday, 06 Jun U.S. session with a daily “Spinning Top” candlestick pattern. Maintain bearish bias below 1.2785 key short-term pivotal resistance for a further potential drop towards 1.2605 before targeting the major support of 1.2545/30 (also the primary ascending range support in place since 07 Oct 2016 low).

- On the other hand, an hourly close above 1.2890 invalidates the bearish scenario for an extension of the corrective rebound towards the 1.2890 key medium-term resistance (also the descending trendline from 13 Mar 2019).

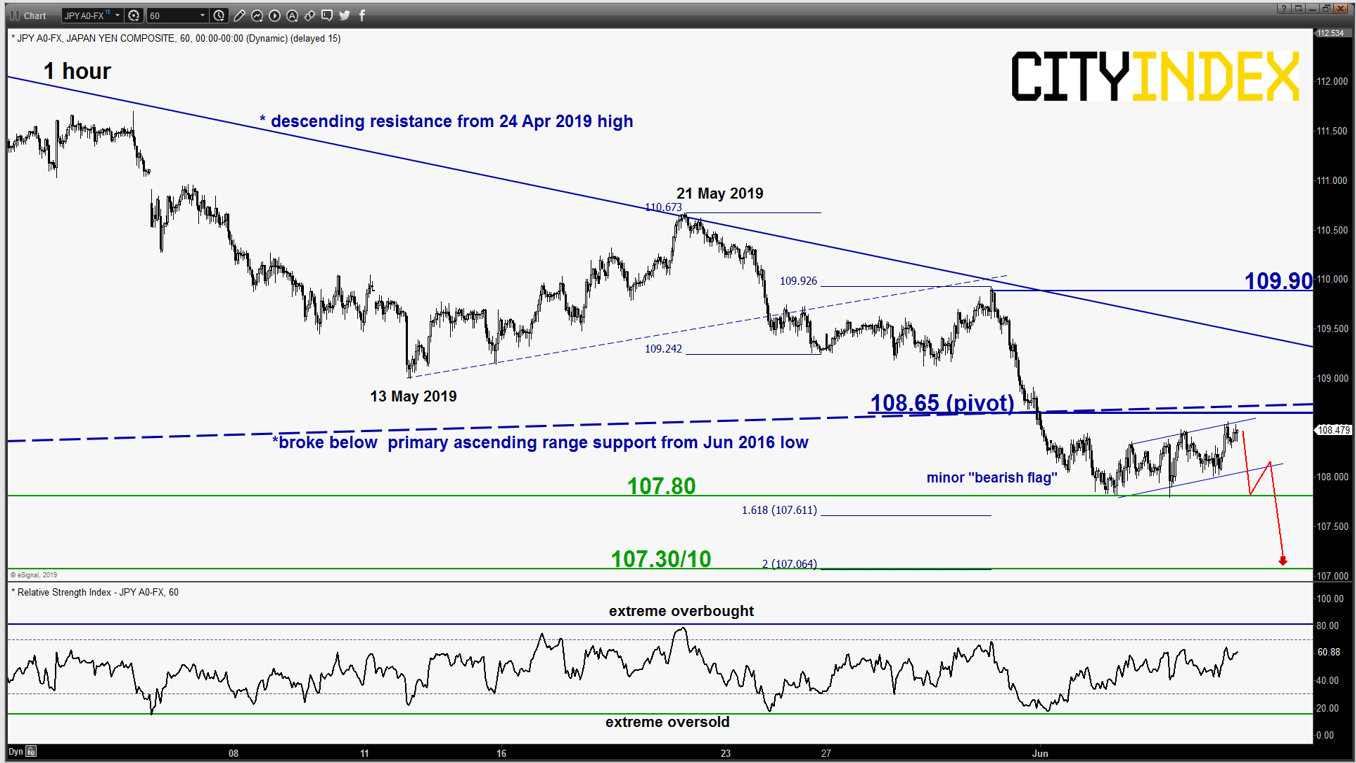

USD/JPY – Bearish consolidation configuration sighted below key resistance

click to enlarge chart

- Since its 04 Jun 2019 low of 107.80, the pair has traded sideways for the past 3-days and formed a minor “bearish flag” ascending range configuration below the 108.65 key short-term pivotal resistance. Maintain bearish bias below 108.65 for another round of potential downleg to retest 107.80 before targeting the next near-term support at 107.30/10 (Fibonacci expansion cluster).

- On the other hand, an hourly close above 108.65 invalidates the bearish scenario for a squeeze up to retest 109.90 (also the descending trendline resistance in place since 24 Apr 2019 high that has capped previous bounces).

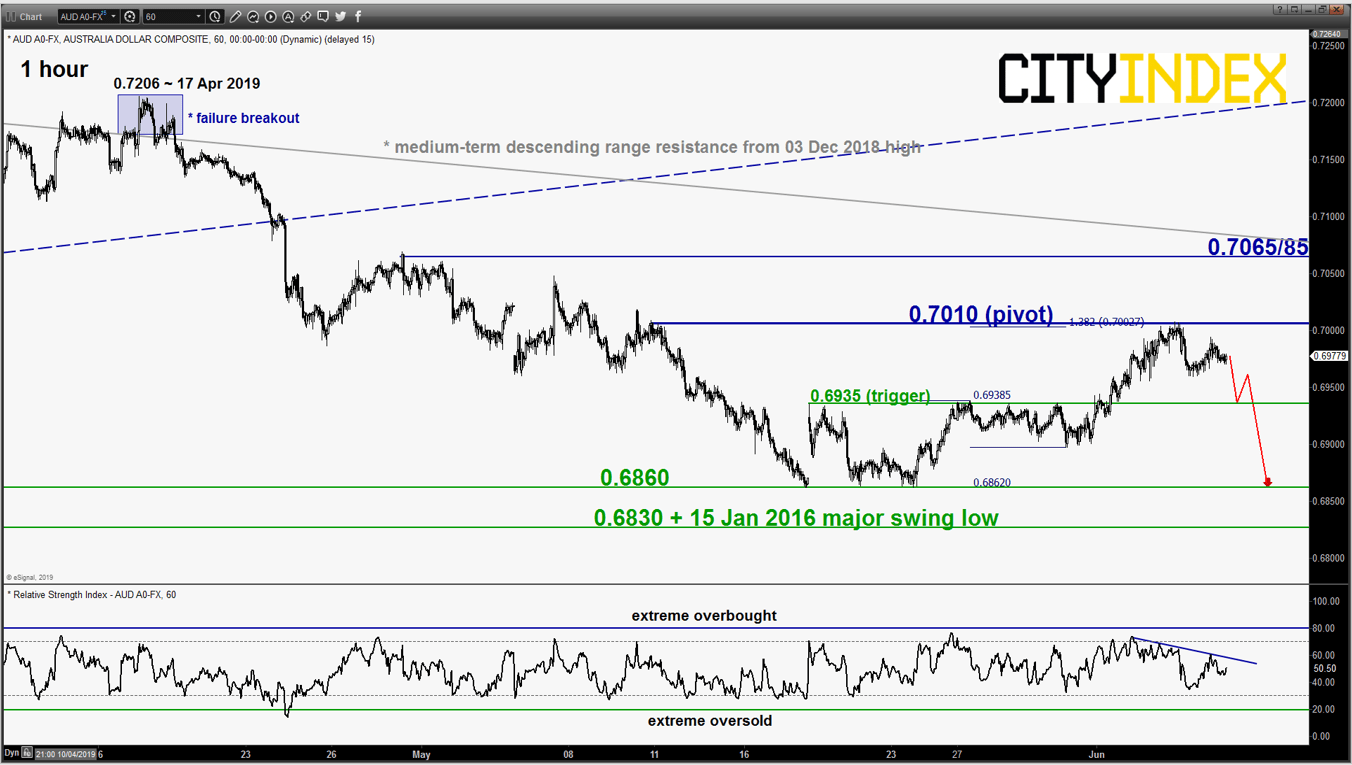

AUD/USD – 0.7010 remains the key resistance to watch

click to enlarge chart

- No major changes on its key technical elements. Maintain bearish bias below 0.710 key short-term pivotal resistance and a break with an hourly close below 0.6935 reinforces a further potential slide to retest 0.6860 range support.

- On the other hand, an hourly close above 0.7010 negates the bearish tone for an extension of the corrective rebound towards the key medium-term resistance at 0.7065/85.

Charts are from eSignal

Latest market news

Today 07:55 AM

Today 04:47 AM

Yesterday 11:23 PM

Yesterday 10:19 PM

Yesterday 08:00 PM