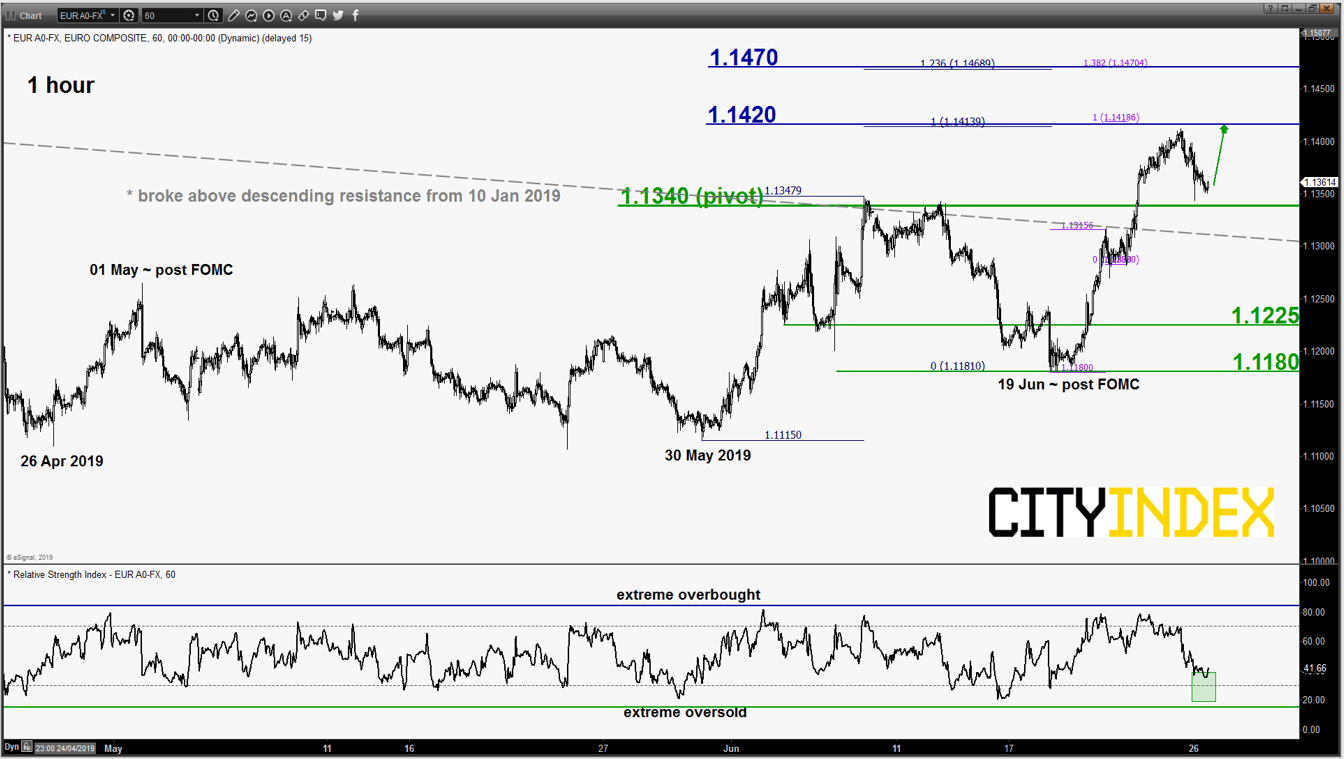

EUR/USD – 1.1340 remains the key support to watch

click to enlarge chart

- Yesterday’s slide has managed to stall near the 1.1340 key short-term pivotal support as per highlighted in our previous report (click here for a recap). No change, maintain bullish bias for a potential upleg to target the 1.1420 resistance in the first step.

- On the other hand, a break with an hourly close below 1.1340 invalidates the bullish scenario for a slide back towards the 1.1225/1180 support zone in the first step.

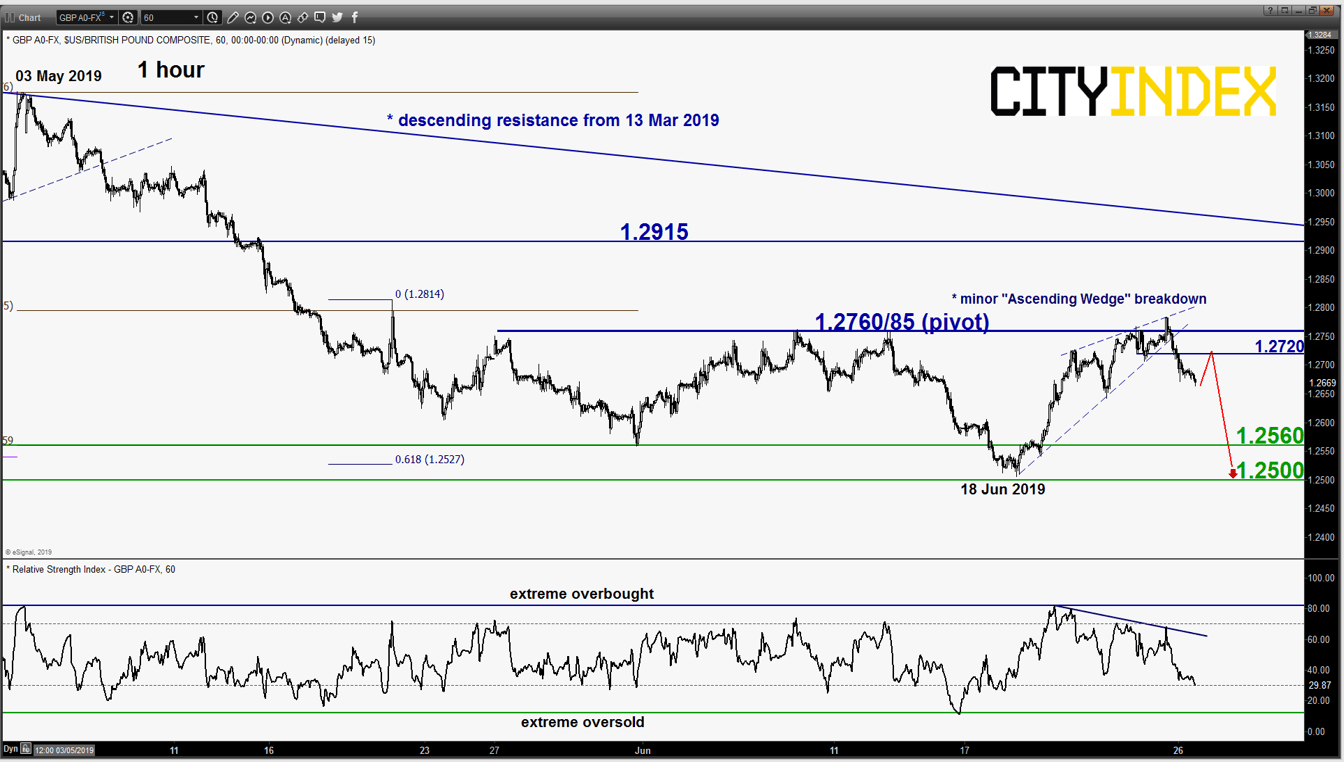

GBP/USD – Bearish elements have resurfaced

click to enlarge chart

- After a challenge on the 1.2760 upper limit of the short-term neutrality zone in yesterday, 25 Jun early European session, the pair has drifted lower and broke below the minor “Ascending Wedge” support. In addition, the hourly RSI oscillator has continued to exhibit negative momentum reading.

- Flip back to a bearish bias below the 1.2760/2785 key short-term pivotal resistance for a further potential slide to retest the major support zone of 1.2560/2500 (the ascending trendline from Oct 2016 swing low).

- On the other hand, a break with an hourly close above 1.2760 sees an extension of the corrective rebound towards the next resistance at 1.2915 (also the descending trendline from 13 Mar 2019 high).

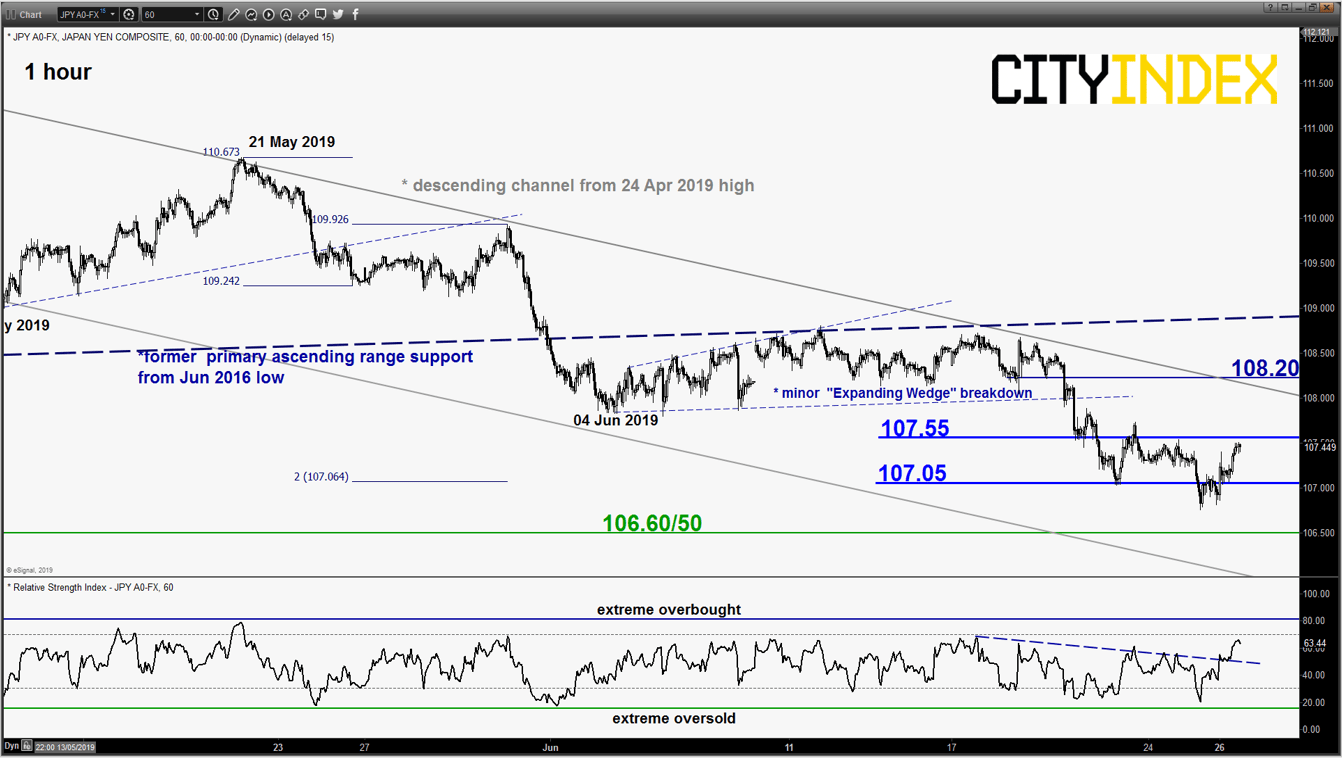

USD/JPY – Short-term downside momentum starts to ease

click to enlarge chart

- Inched down lower as expected and printed a low of 106.75 in yesterday, 25 Jun late Asian session which came close to the target/support of 106.60/50 as per highlighted in our previous report.

- Short-term downside momentum has started to ease as indicated by the hourly RSI oscillator. Prefer to turn neutral now between 107.55 and 107.05. A break above 107.55 sees the start of a corrective rebound towards the next intermediate resistance at 108.20.

- On the flipside, failure to hold at 107.05 revives the bears for a slide towards the 106.60/50 support.

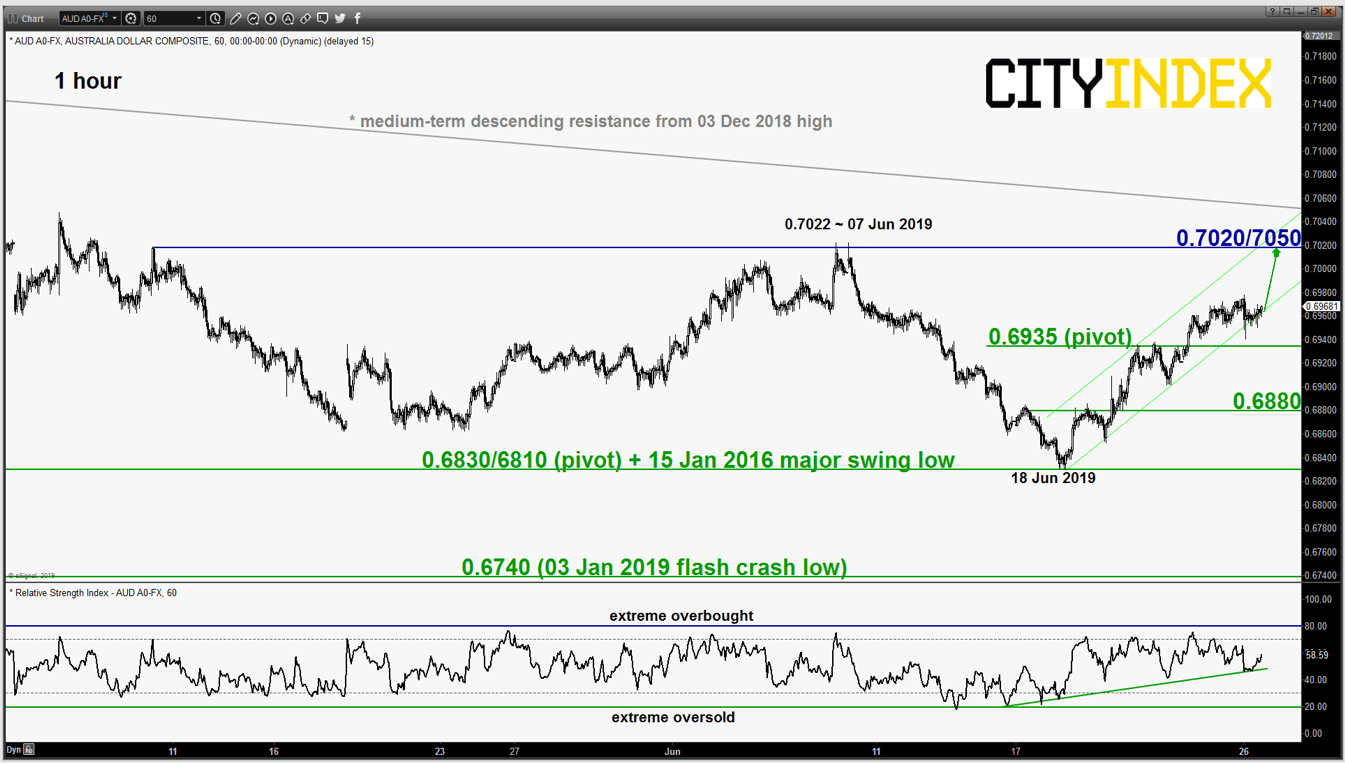

AUD/USD – Further corrective rebound in progress

click to enlarge chart

- Yesterday’s slide has managed to hold above the 0.6935 short-term pivotal support as per highlighted in our previous report (printed a low of 0.6940). No change, maintain bullish bias for a further potential corrective rebound towards the key medium-term resistance at 0.7020/7050 (also a Fibonacci expansion/retracement cluster & the minor ascending channel resistance).

- On the other hand, a break with an hourly close below 0.6935 revives the bears for a slide back towards the 0.6880/0.6830 support zone in the first step.

Charts are from eSignal

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM