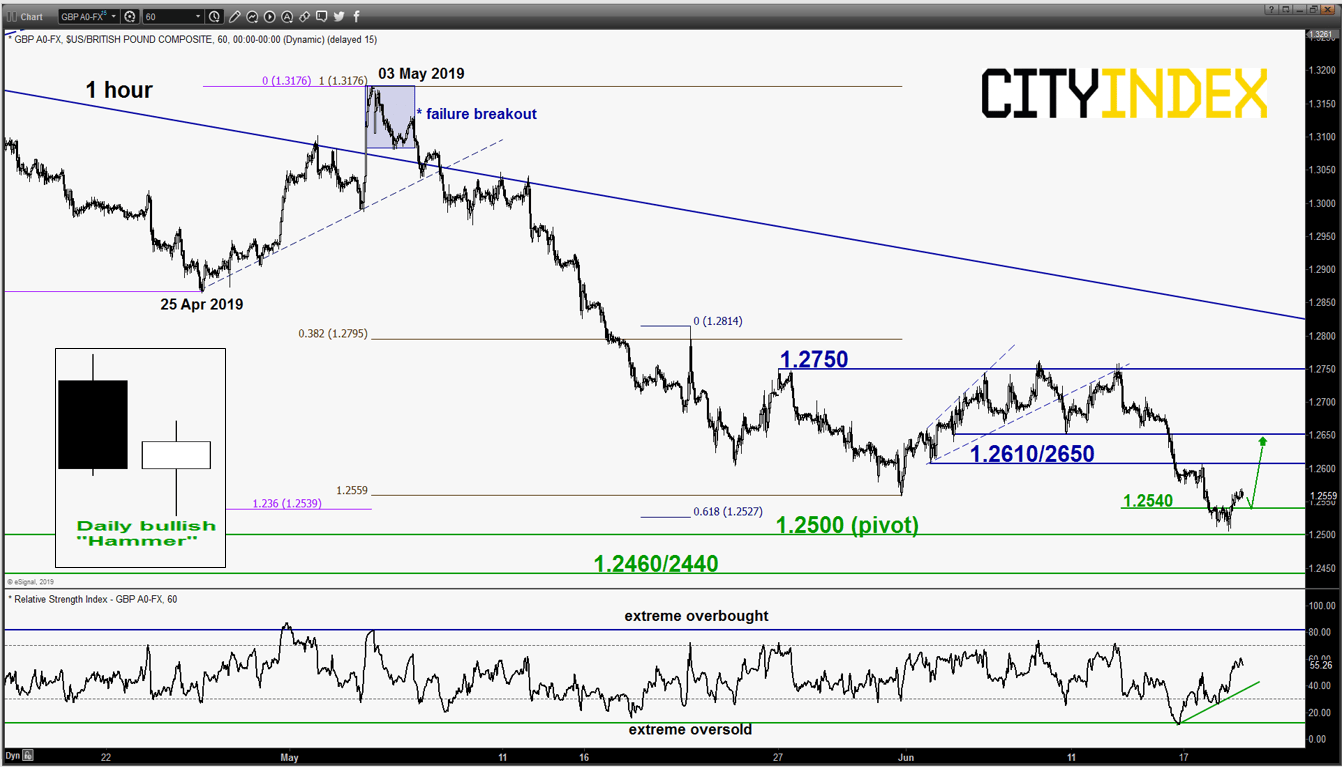

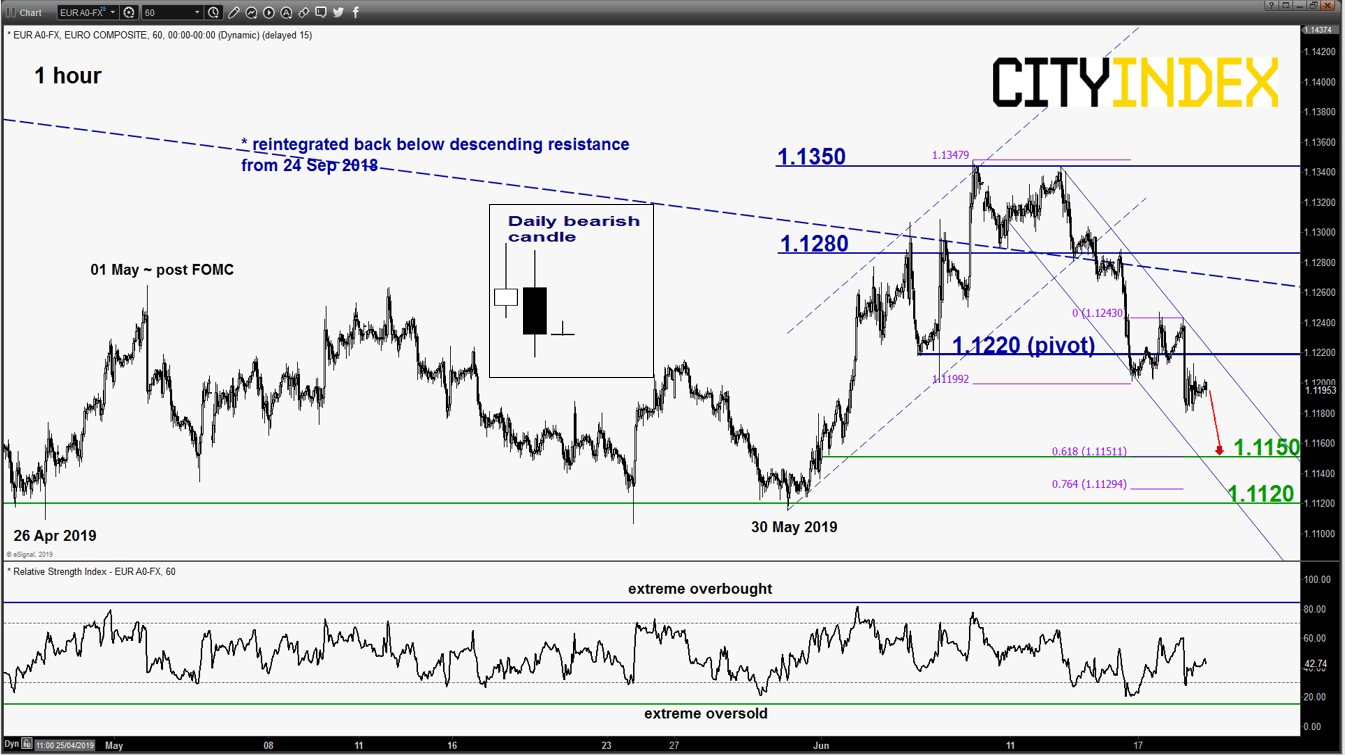

EUR/USD – Further potential push down towards medium-term range support

click to enlarge chart

- Broke below the 1.1200 lower limit of the short-term neutrality zone as per highlighted in our previous report. Yesterday’s drop has been triggered by a dovish speech made by “soon to be outgoing” ECB President Draghi that ECB could cut interest rates again or kickstart another round of QE.

- Momentum has turned negative again, flip back to a bearish bias below 1.1220 key short-term pivotal resistance (also the upper boundary of a minor descending channel from 12 Jun 2019 high) for a potential residual push down to target 1.1150 support with a maximum limit set at 1.1120 medium-term range support.

- However, a clearance with an hourly close above 1.1220 triggers a corrective rebound towards the next intermediate resistance at 1.1280.

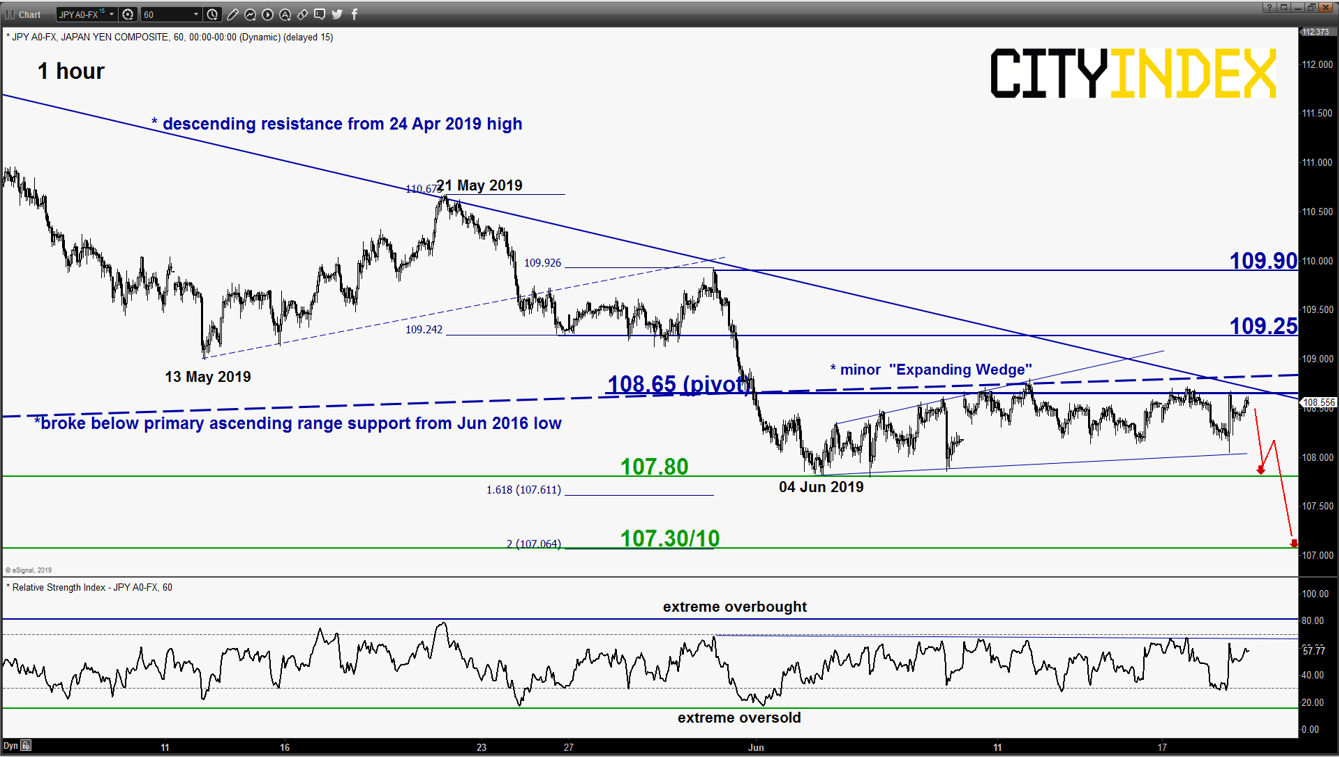

GBP/USD – Minor corrective rebound in progress

click to enlarge chart

- Staged the expected bounce above the 1.2500 key pivotal support as per highlighted in our previous report (click here for a recap).

- It ended yesterday’s U.S. session with a daily bullish “Hammer” candlestick pattern and printed a current intraday high of 1.2570 in today’s Asian morning session. No change, maintain bullish bias in any dips above the 1.2500 pivotal support for a further potential corrective bounce towards the intermediate resistance zone of 1.2610/2650.

- However, a break with an hourly close below 1.2500 may see spike down to towards the next support at 1.2460/2440 (03 Jan 2019 swing low & Fibonacci expansion cluster).

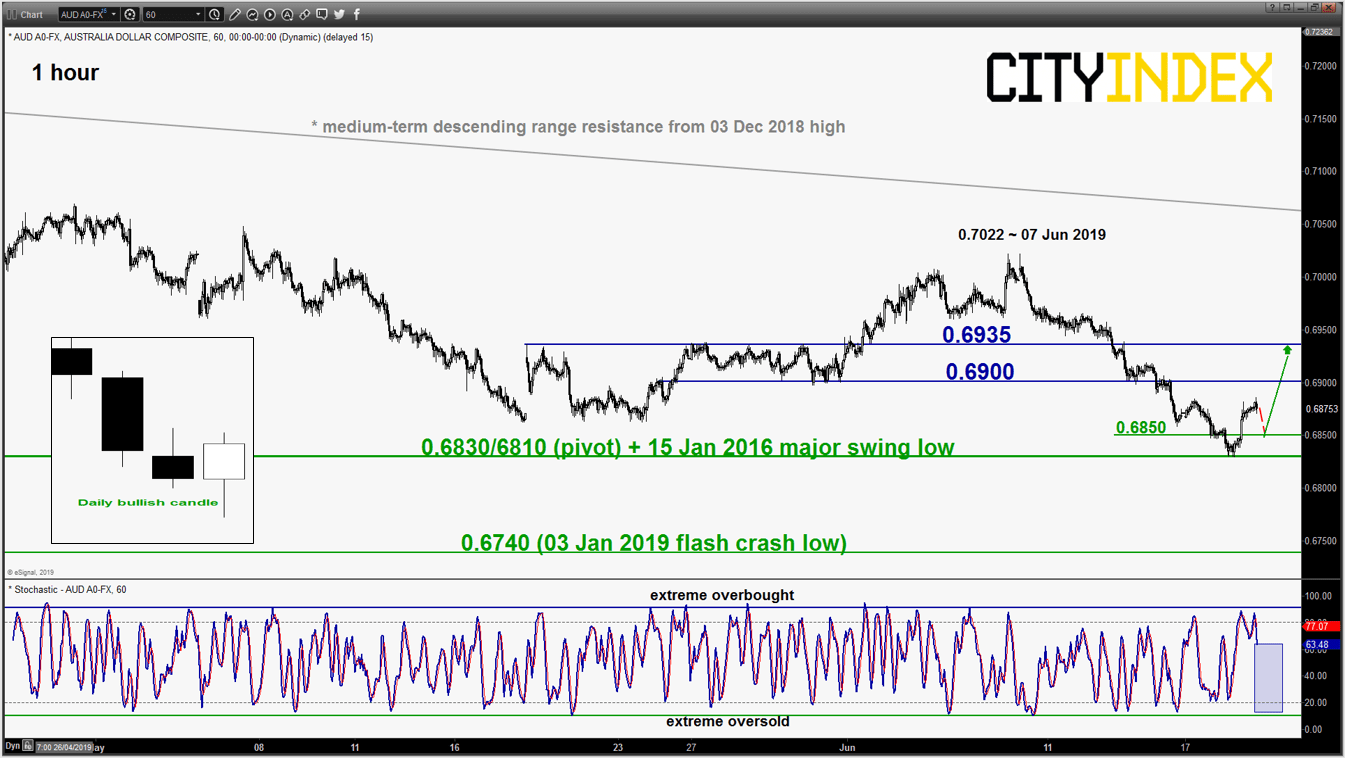

USD/JPY – 108.65 remains the key resistance to watch

click to enlarge chart

- Continued to trade sideways within the minor “Expanding Wedge” range configuration for the past 3 weeks since 04 Jun 2019. Yesterday’s push up seen in the U.S. session led to a retest on the 108.65 key pivotal resistance after news broke out that a planned meeting between U.S. President Trump and China’s Xi to take place during the G20 summit on 28/29 Jun 2019.

- Maintain bearish bias for a slide to retest 107.80 and a break below it reinforces a further drop towards the next near-term support at 107.30/10 (Fibonacci expansion cluster).

- However, an hourly close above 108.65 invalidates the bearish scenario for a squeeze up towards the next intermediate resistance at 109.25.

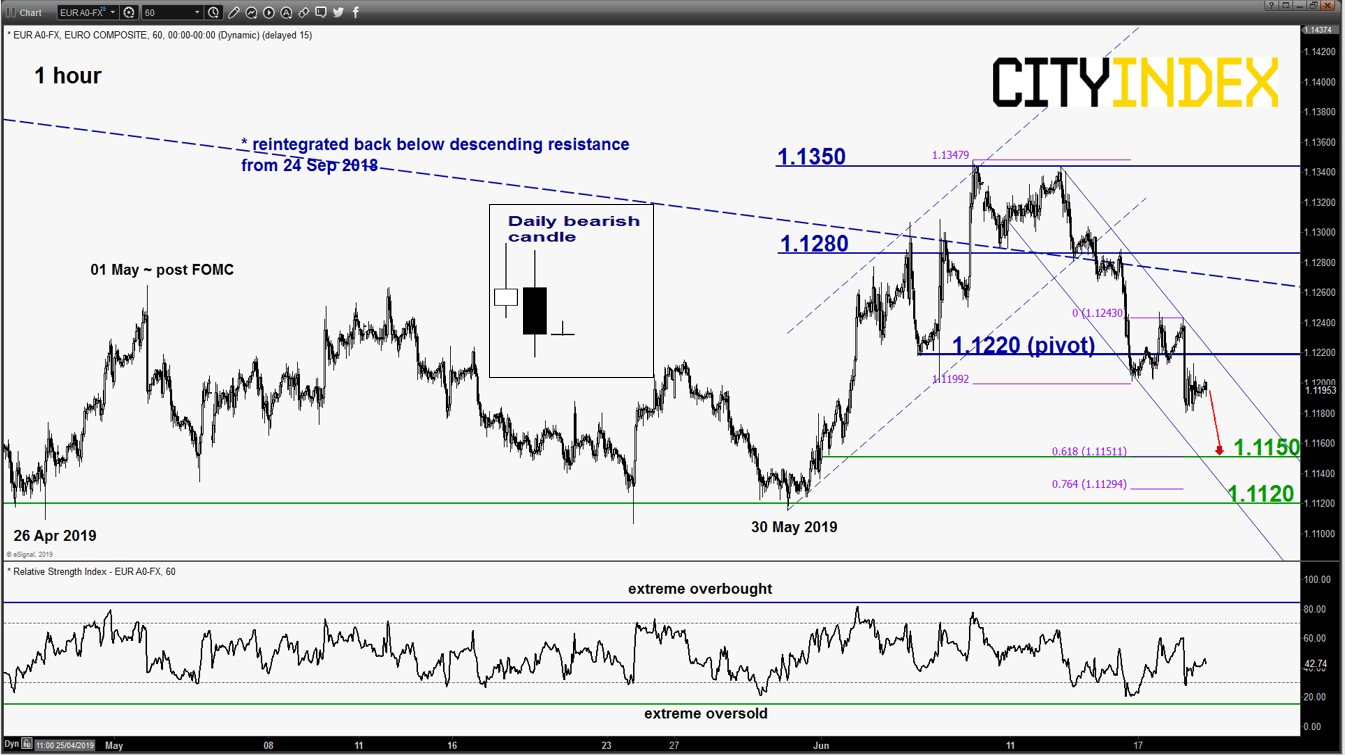

AUD/USD – Minor corrective rebound in progress

click to enlarge chart

- Managed to stage the expected bounce at the 0.6830/6810 key short-term pivotal support as per highlighted in our previous report. It printed a current intraday high of 0.6885 in today’s Asian morning session. Maintain bullish bias in any dips for a further potential corrective bounce towards the intermediate resistance zone of 0.6900/6930.

- However, a break with an hourly close below 0.6810 resumes the down move sequence to test the 03 Jan 2019 flash crash low of 0.6740 in the first step.

Charts are from eSignal

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM