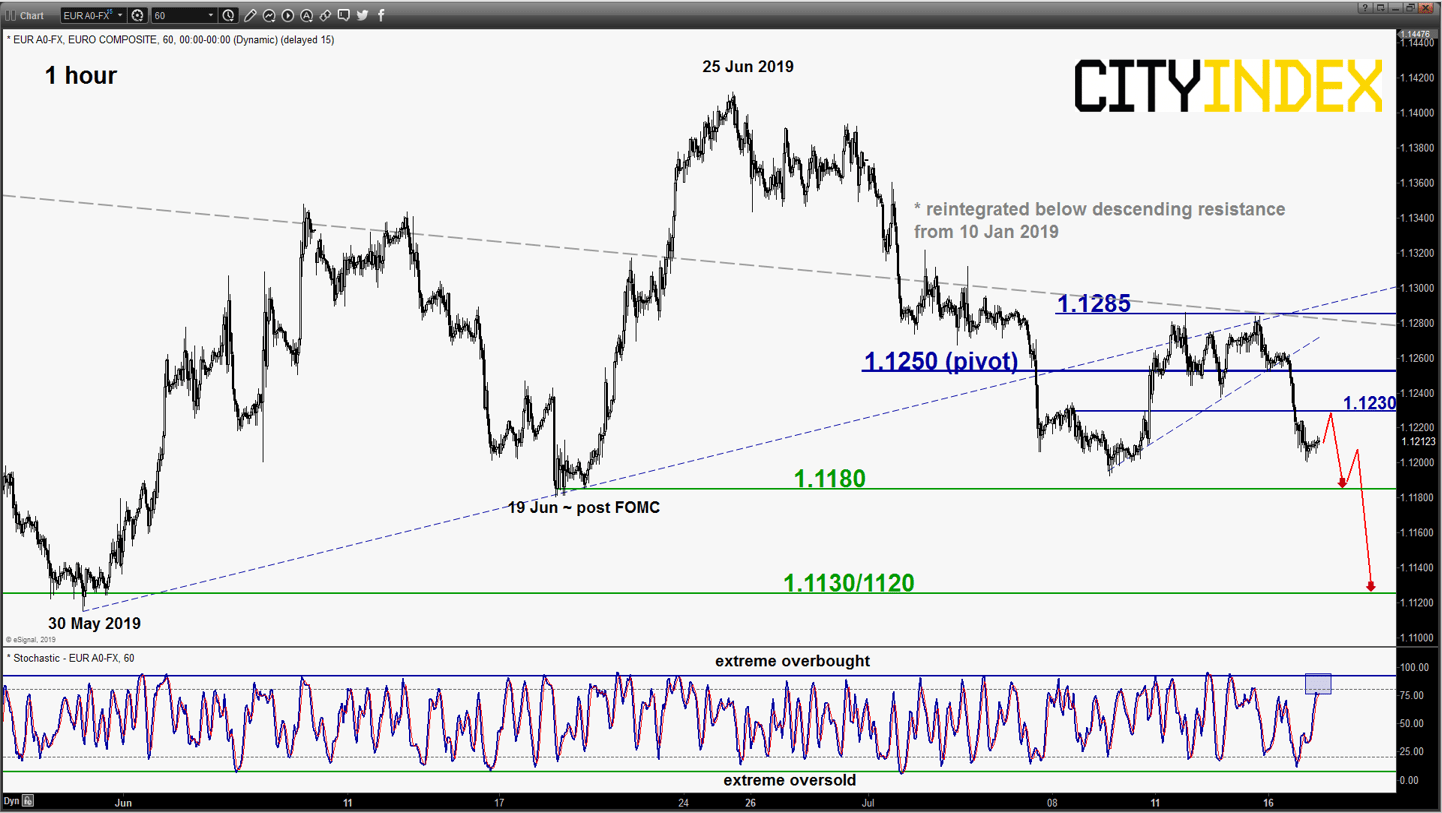

EUR/USD – Further drop in progress

click to enlarge chart

- Pushed down lower and hit the first short-term downside target/support of 1.1210 as per highlighted in our previous report (click here for a recap). Key short-term elements remain negative, maintain bearish bias with a tightened key short-term pivotal resistance at 1.1250 for a further potential push down to target 1.1180 follow by the 1.1130/1120 key medium-term range support in place since Apr 2019 (also a Fibonacci projection cluster).

- On the other hand, a break with an hourly close above 1.1250 negates the bearish tone for a squeeze up to retest the intermediate swing high of 1.1285 (also the medium-term descending resistance from 10 Jan 2019).

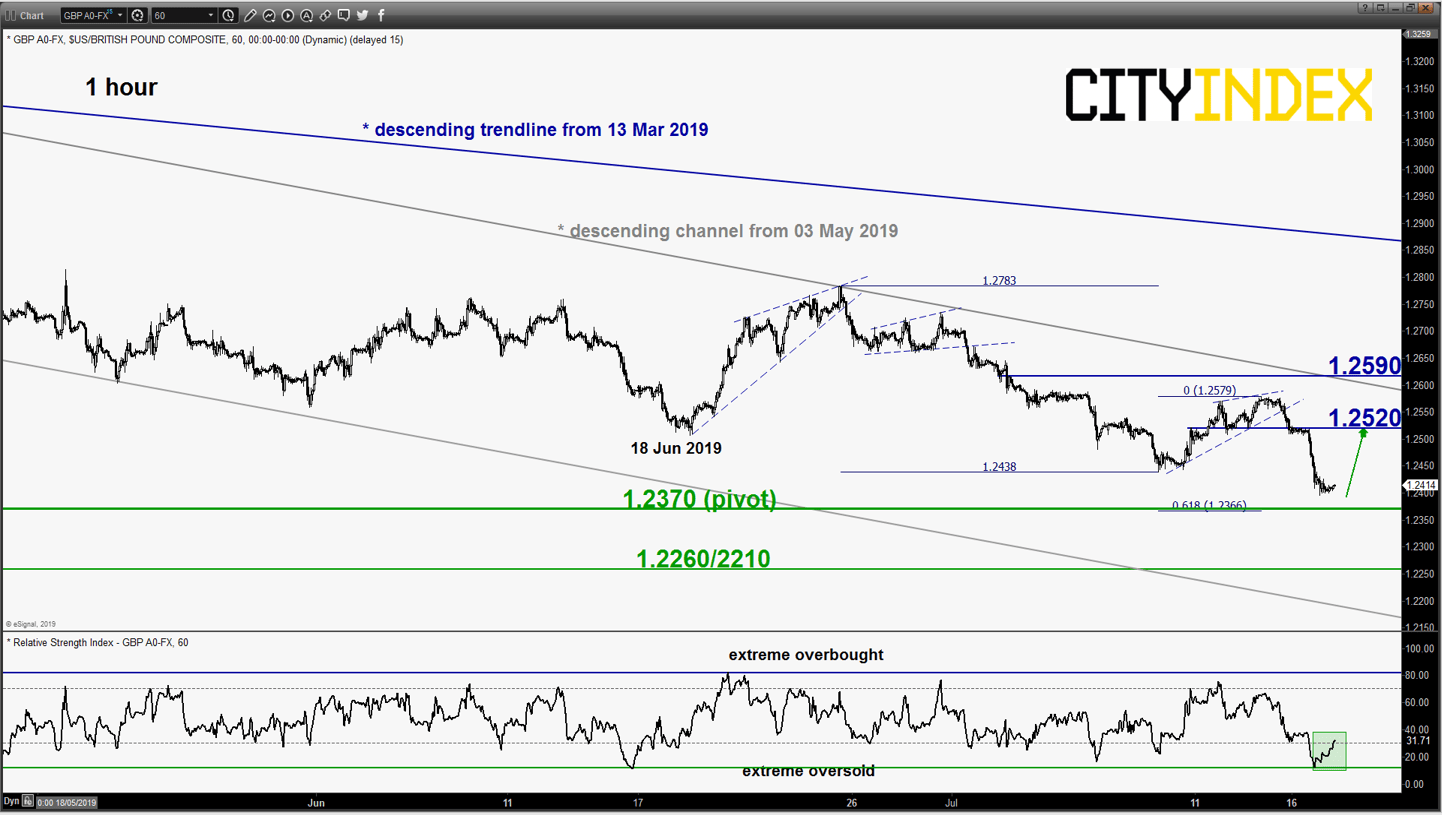

GBP/USD – At risk of a countertrend rebound

click to enlarge chart

- Tumbled down as expected and almost hit the downside target/support of 1.2370 ((06 Apr 2017 low & Fibonacci projection cluster) as per highlighted in our previous report. Printed a low of 1.2395 in yesterday, 16 Jul U.S. session.

- Short-term momentum analysis as indicated by the hourly RSI oscillator (exit from extreme oversold level) and Elliot Wave/fractal analysis suggests the risk of a countertrend rebound. Flip to a bullish bias above 1.2370 key short-term pivotal support for a potential minor rebound to target the intermediate resistance at 1.2520 with maximum limit set at 1.2590 (also the descending channel resistance from 03 May 2019).

- On the other hand, failure to hold at 1.2370 sees the continuation of the impulsive down move towards the next support at 1.2260/2210.

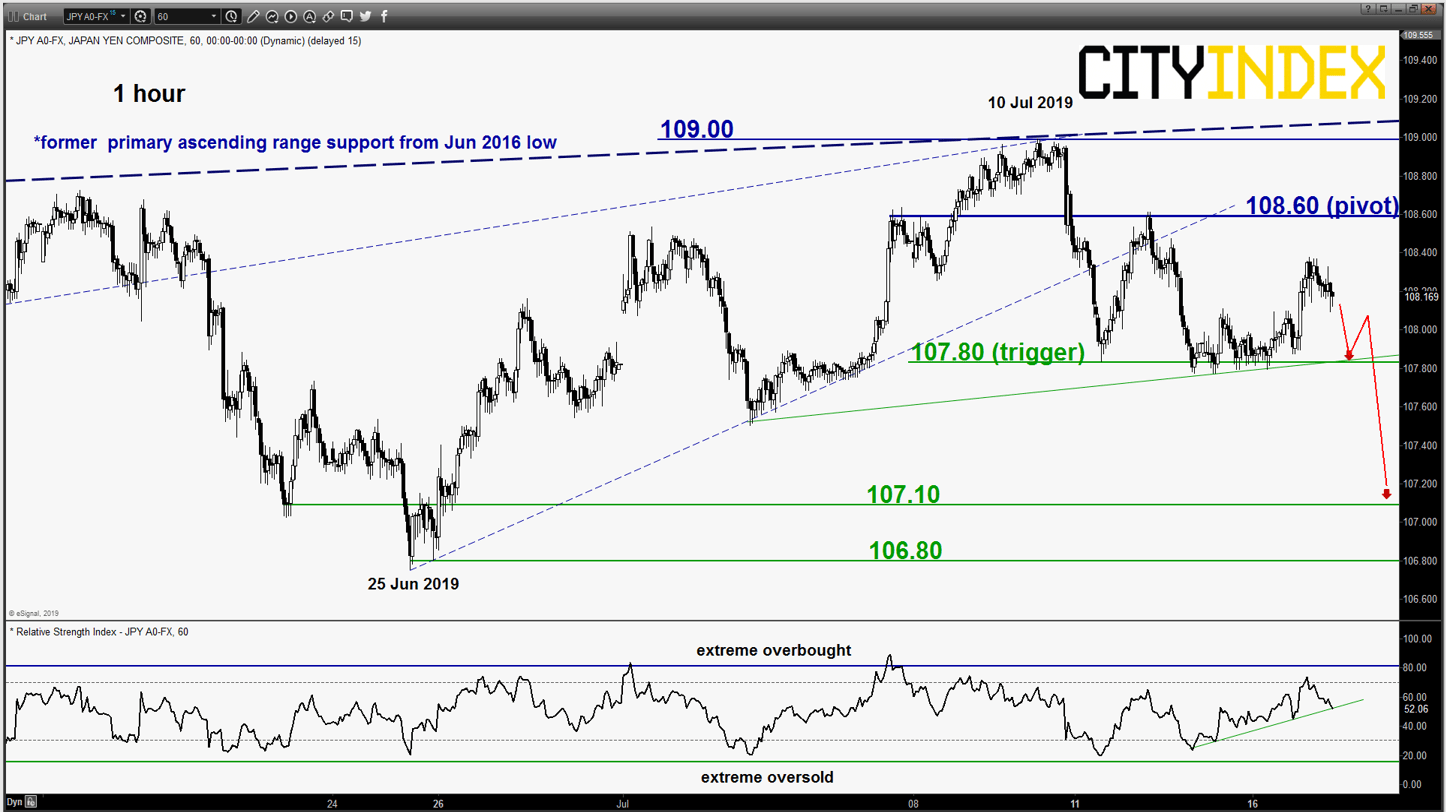

USD/JPY – 107.80 potential downside trigger level

click to enlarge chart

- No major changes on its key short-term elements. Maintain bearish bias below 108.60 key short-term pivotal resistance and added 107.80 as the downside trigger level. An hourly close below 107.80 reinforces another round of slide to target the near-term support of 107.10.

- On the other hand, a break with an hourly close above 108.60 negates the bearish tone again for a squeeze up to retest the 109.00 key medium-term resistance.

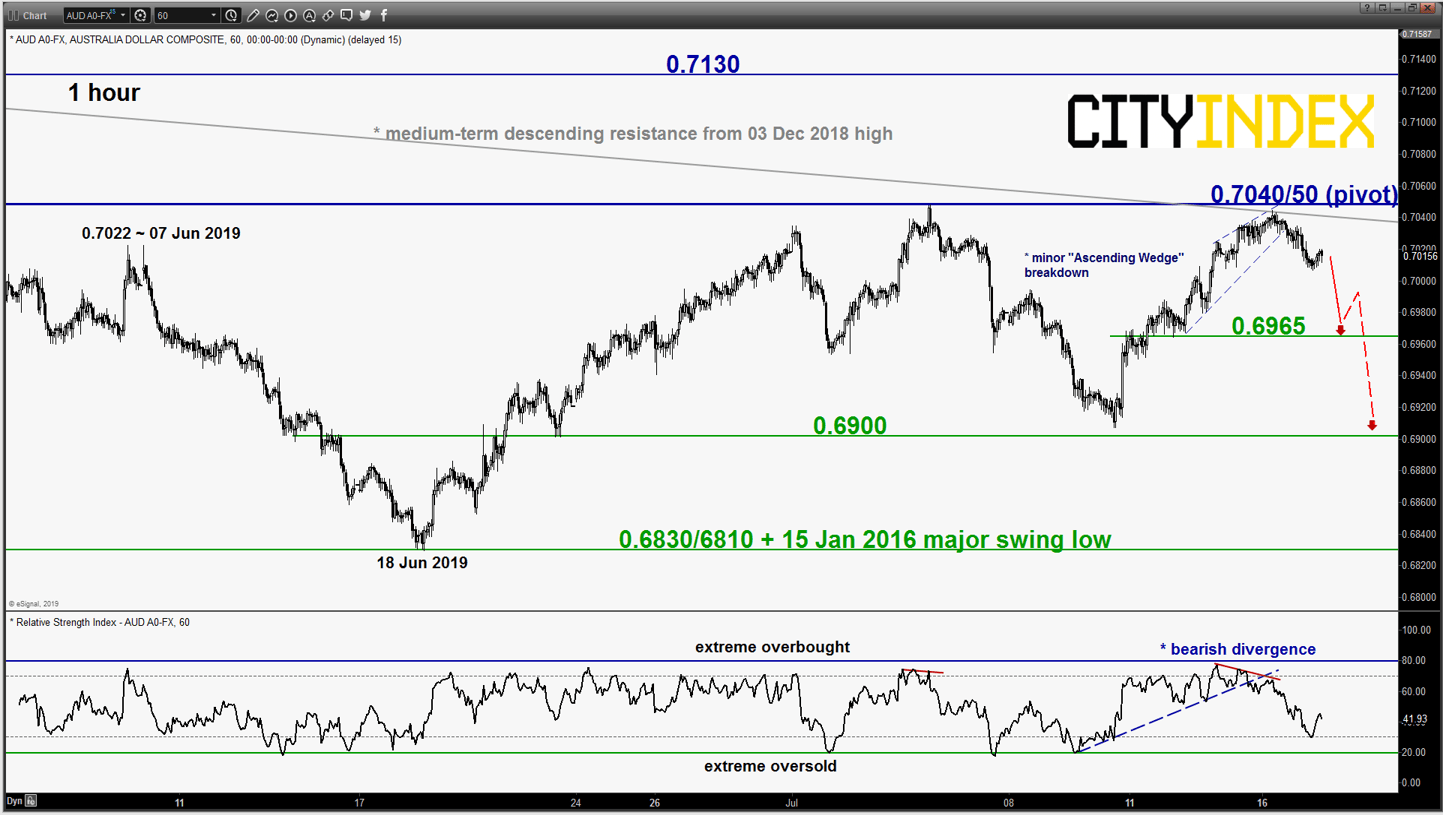

AUD/USD – Further slide in progress

click to enlarge chart

- Inched down lower from the 0.7040/7050 key medium-term resistance as expected. Maintain bearish bias in any bounces below the 0.7050 pivotal resistance for a further potential push down to retest 0.6965 before targeting the minor range support of 0.6900.

- On the other hand, a clearance with a daily close above 0.7050 invalidates the medium-term down move sequence in place since 03 Dec 2018 high for a further recovery towards the next intermediate resistance at 0.7130.

Charts are from eSignal

Latest market news

April 25, 2024 03:09 PM

April 25, 2024 03:00 PM

April 25, 2024 01:12 PM

April 25, 2024 11:14 AM