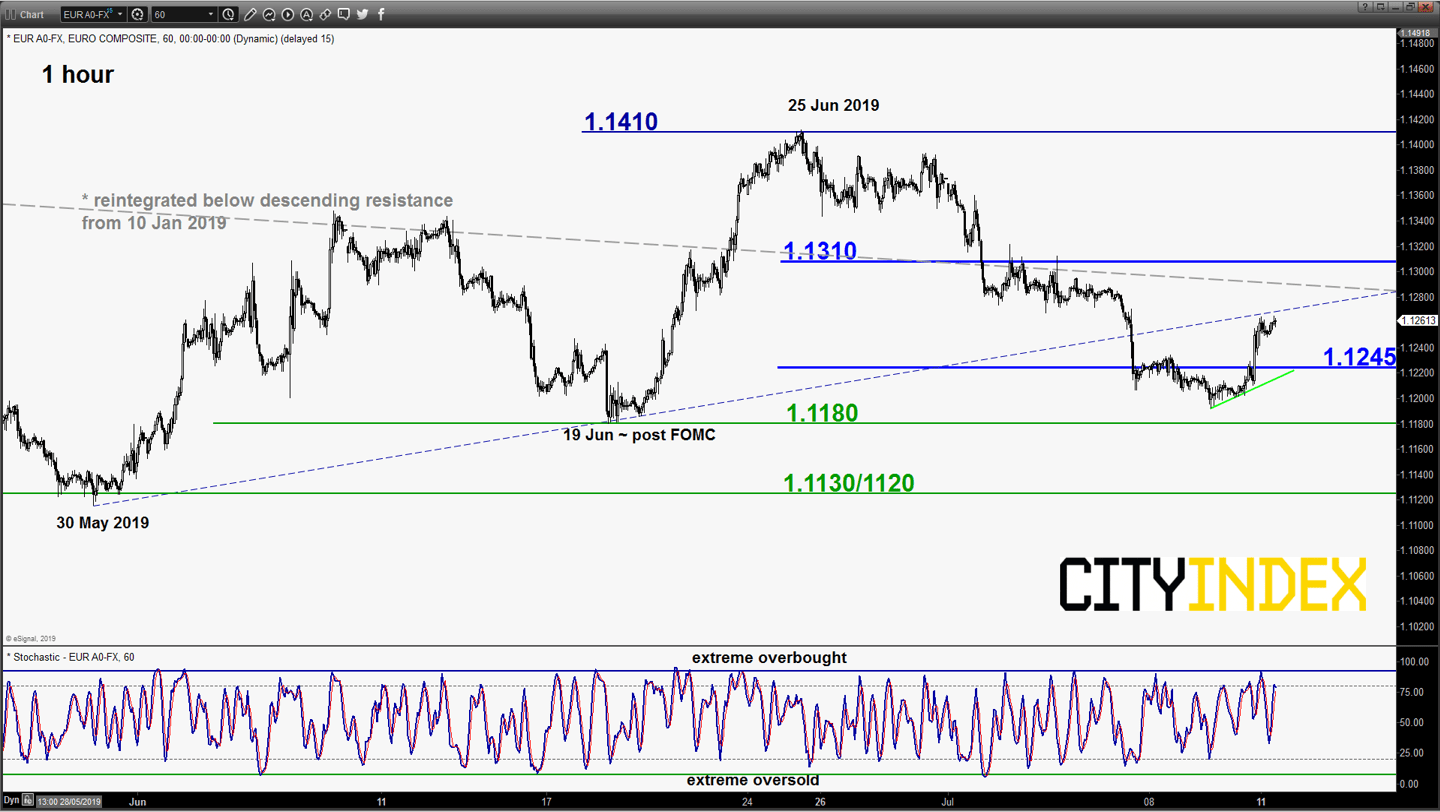

EUR/USD – Mix elements

click to enlarge chart

- Drifted lower to print an intraday low of 1.1192 in yesterday, 10 Jul European session before it rebounded by 70 pips after Fed Chair Powell’s testimony to U.S. Congress that reiterated Fed’s dovish stance on its current monetary policy.

- Even though the pair is still below the 1.1275 key short-term pivotal resistance as per highlighted in the previous report (click here for a recap) but mix elements now. Thus, prefer to turn neutral between 1.1310 (50% retracement of the slide from 25 Jun high to yesterday’s low of 1.1192) and 1.1245. Only an hourly close below 1.1245 reinstates the bearish tone for a push down to target the next near-term support at 1.1180 follow by 1.1130/1120 next.

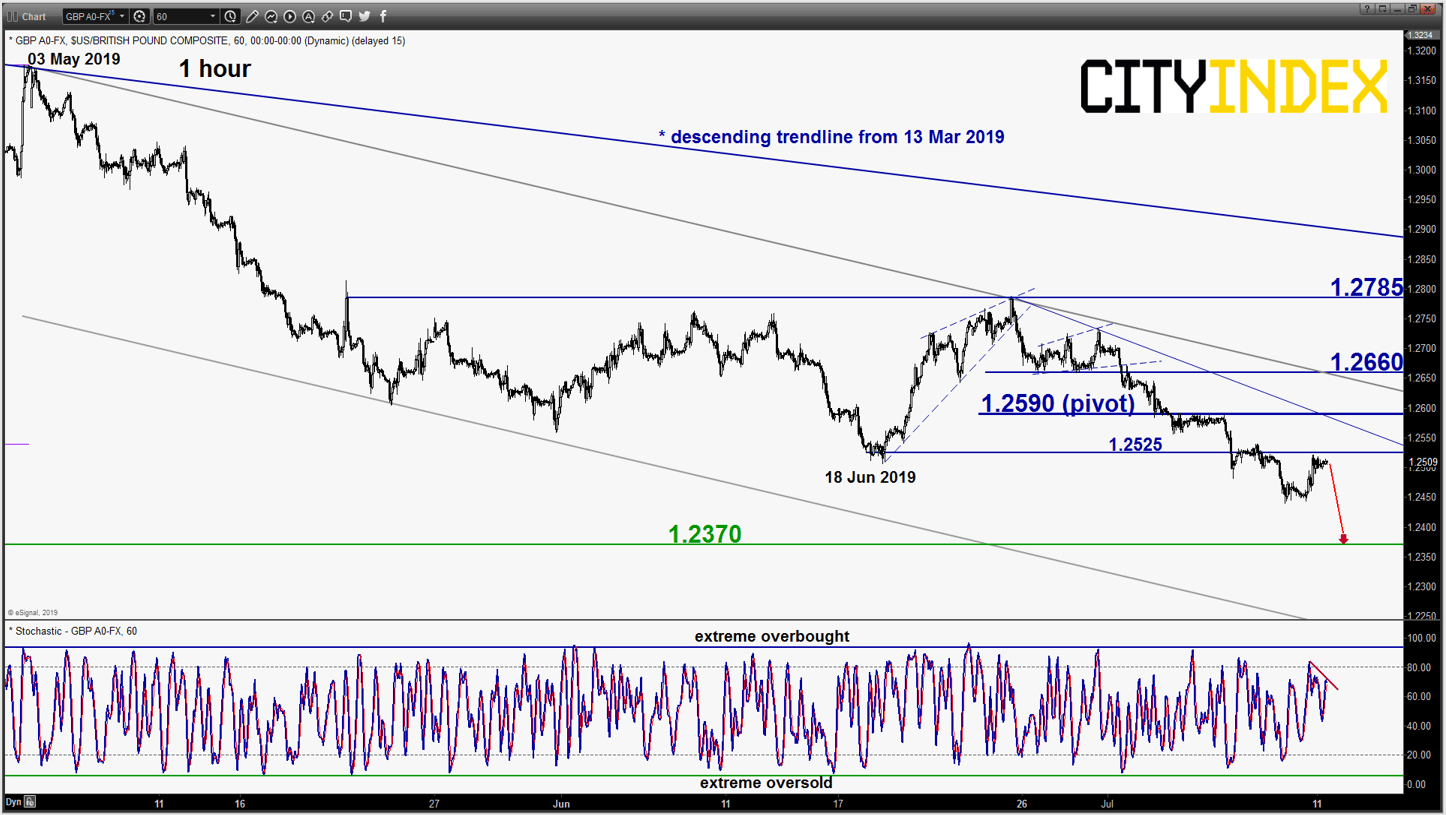

GBP/USD – 1.2590 remains the key short-term resistance to watch

click to enlarge chart

- Yesterday’s push up in the pair was lesser in magnitude versus the EUR/USD and in other majors as well (CAD, JPY & CHF). Maintain bearish bias with 1.2590 remains as the key short-term pivotal resistance now at 1.2590 for a further potential push down to target the next near-term support at 1.2370 in the first step.

- However, a clearance with an hourly close above 1.2590 negates the bearish tone for a further push up to probe 1.2660 (descending channel resistance from 03 May 2019 high).

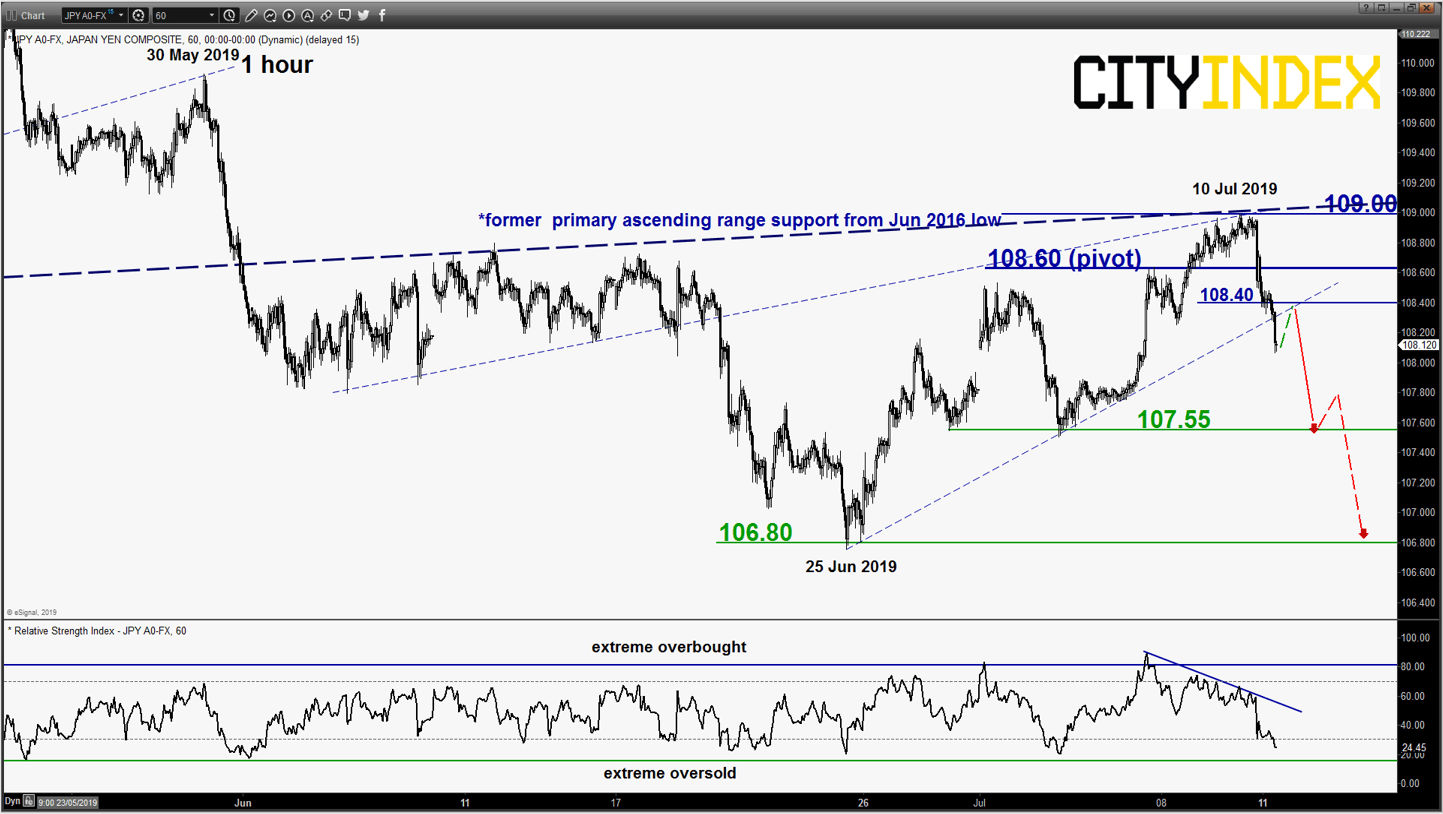

USD/JPY – Bears regain control

click to enlarge chart

- After a test and retreat from the key medium-term resistance of 109.00 (also the former primary ascending range support from Jun 2016 low), the pair broke below the 108.25 lower limit of the short-term neutrality zone as per highlighted in our previous report.

- Bearish scenario has been validated. Flip back to a bearish bias in any bounces below key short-term pivotal resistance at 108.60 (61.8% retracement of the on-going slide from 10 Jul high to current Asian session intraday low of 108.00) for a further potential push down to target the near-term support of 107.55 in the first step.

- However, a clearance with an hourly close above 108.60 negates the bearish tone again for a squeeze up to retest the 109.00 key medium-term resistance.

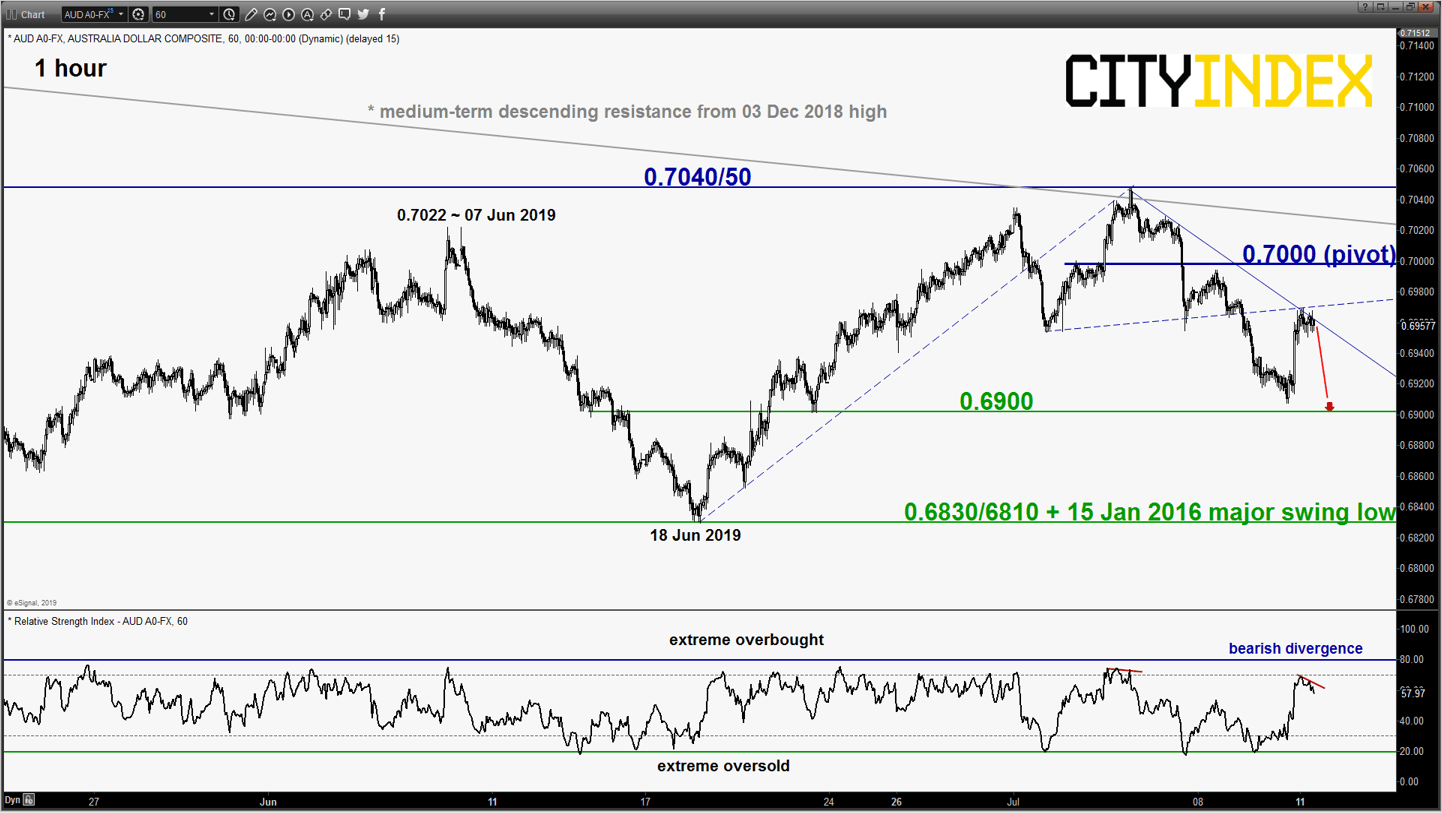

AUD/USD – 0.7000 remains the key short-term resistance to watch

click to enlarge chart

- Dropped lower as expected and almost hit the 0.6900 short-term downside target of 0.6900 as per highlighted in our previous report (printed a low of 0.6907 in yesterday, 10 Jul European session).

- Elements remain negative, maintain bearish bias below 0.7000 key short-term pivotal resistance for another round of potential push down to target the 0.6900 near-term support in first step.

- However, a clearance with an hourly close above 0.7000 negates the bearish tone for a squeeze up to retest the medium-term resistance at 0.7040/50.

Charts are from eSignal

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM