EUR/USD – Still evolving within a short-term bearish configuration

click to enlarge chart

- Traded sideways below the 1.1350 key short-term pivotal resistance as per highlighted in our previous report (click here for a recap). Since its minor swing high of 1.1390 printed on 28 Jun 2019, the pair has started to evolve within a minor descending channel.

- No change, maintain bearish bias below 1.1350 key short-term pivotal resistance for a further potential push down towards the next near-term supports at 1.1225 and 1.1180. On the other hand, a clearance with an hourly close above 1.1350 negates the bearish tone for a squeeze up to retest 1.1420 (25 Jun 2019 swing high).

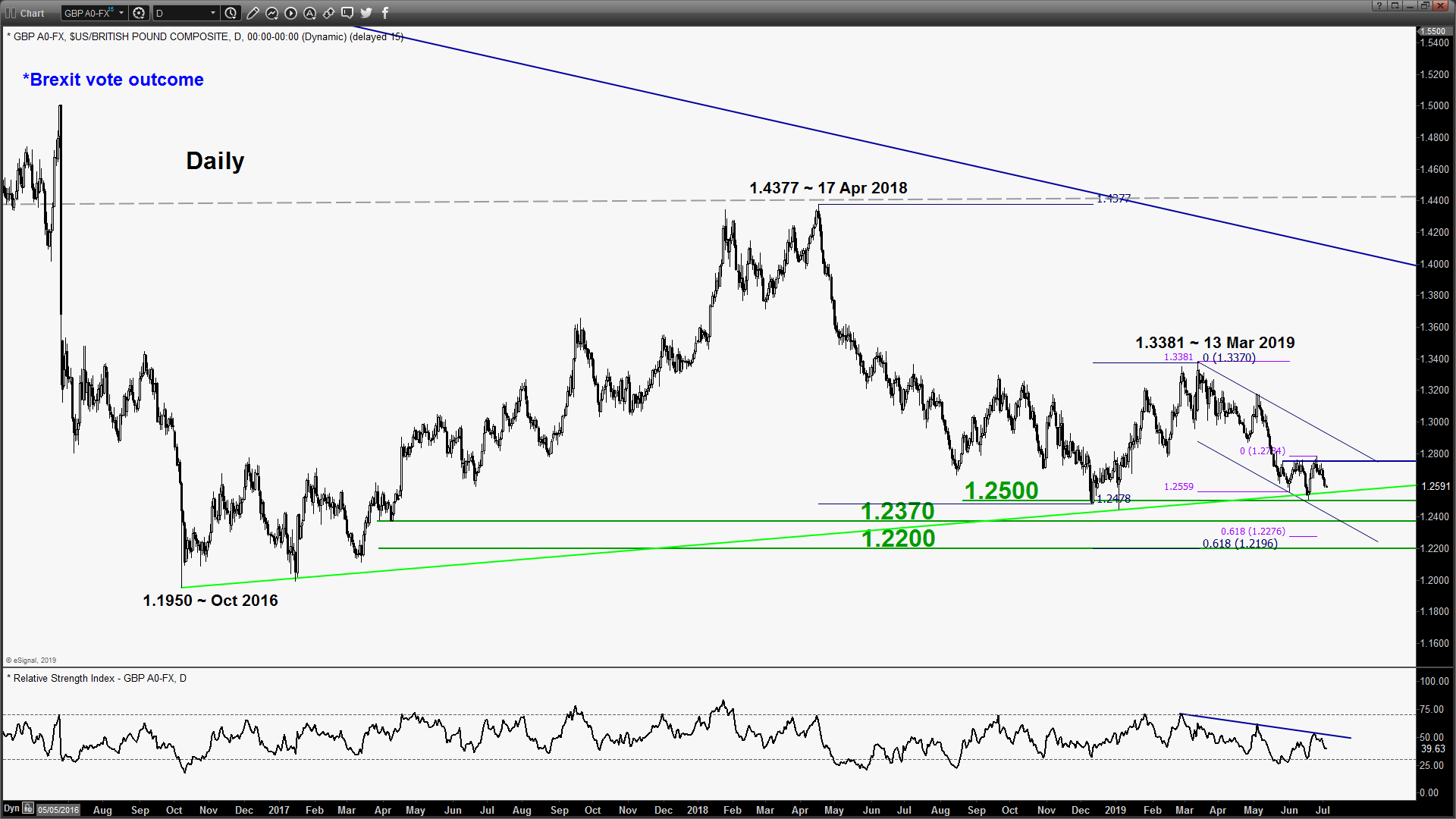

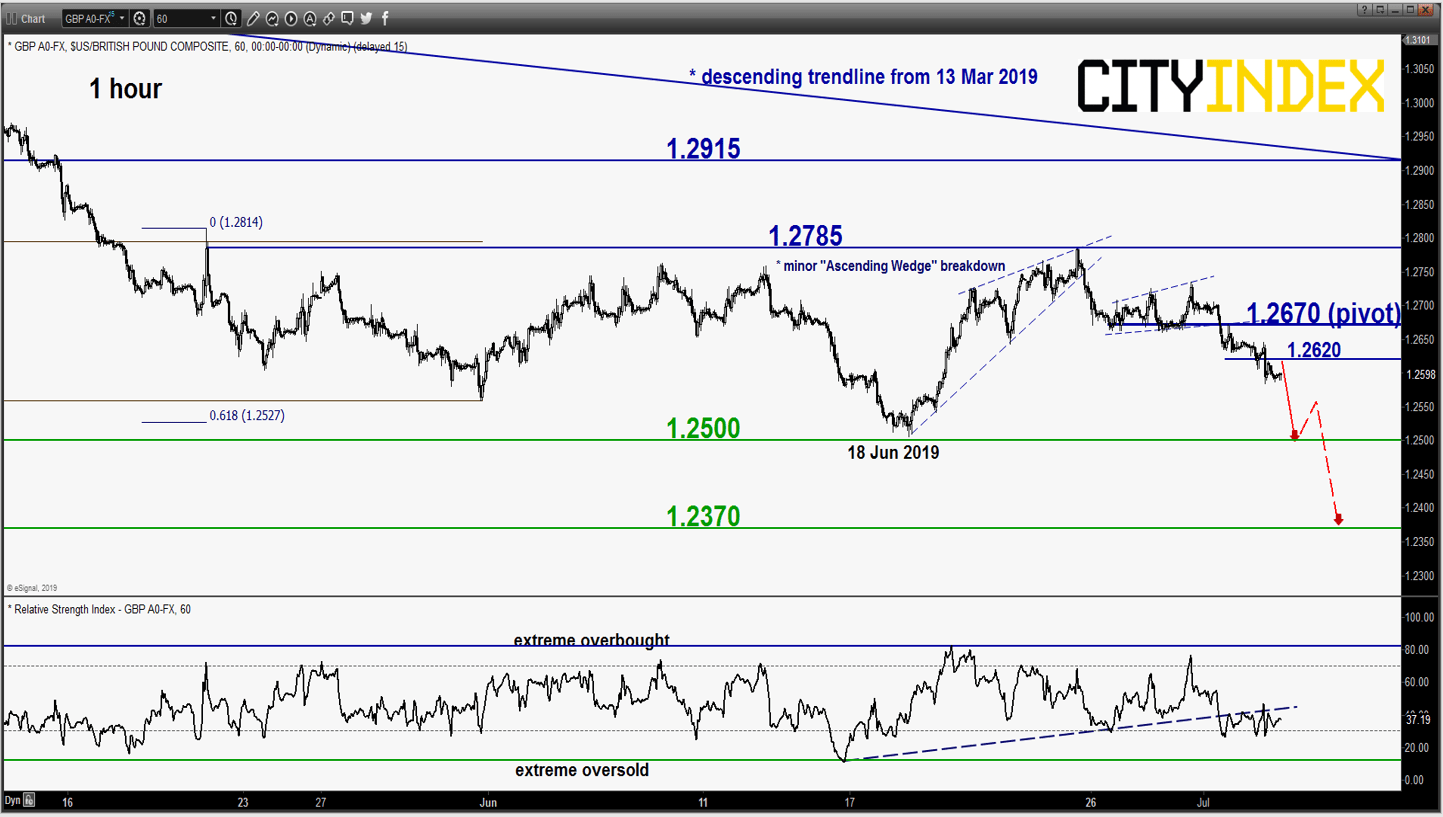

GBP/USD – Vulnerable for a major bearish breakdown

click to enlarge charts

- Drifted down lower as expected. No signs of bearish exhaustion yet and right now elements are suggested a potential major bearish breakdown below its ascending support (1.2500) in place since Oct 2016 major low (aftermath of the Brexit vote).

- Maintain bearish bias below a tightened key short-term pivotal resistance at 1.2670 for a further potential push down to test 1.2500 and a daily close below it sees an extension of the impulsive downleg to target the next support at 1.2370.

- On the other hand, a clearance with an hourly close above 1.2670 negates the bearish tone for a squeeze up towards the range resistance of 1.2785.

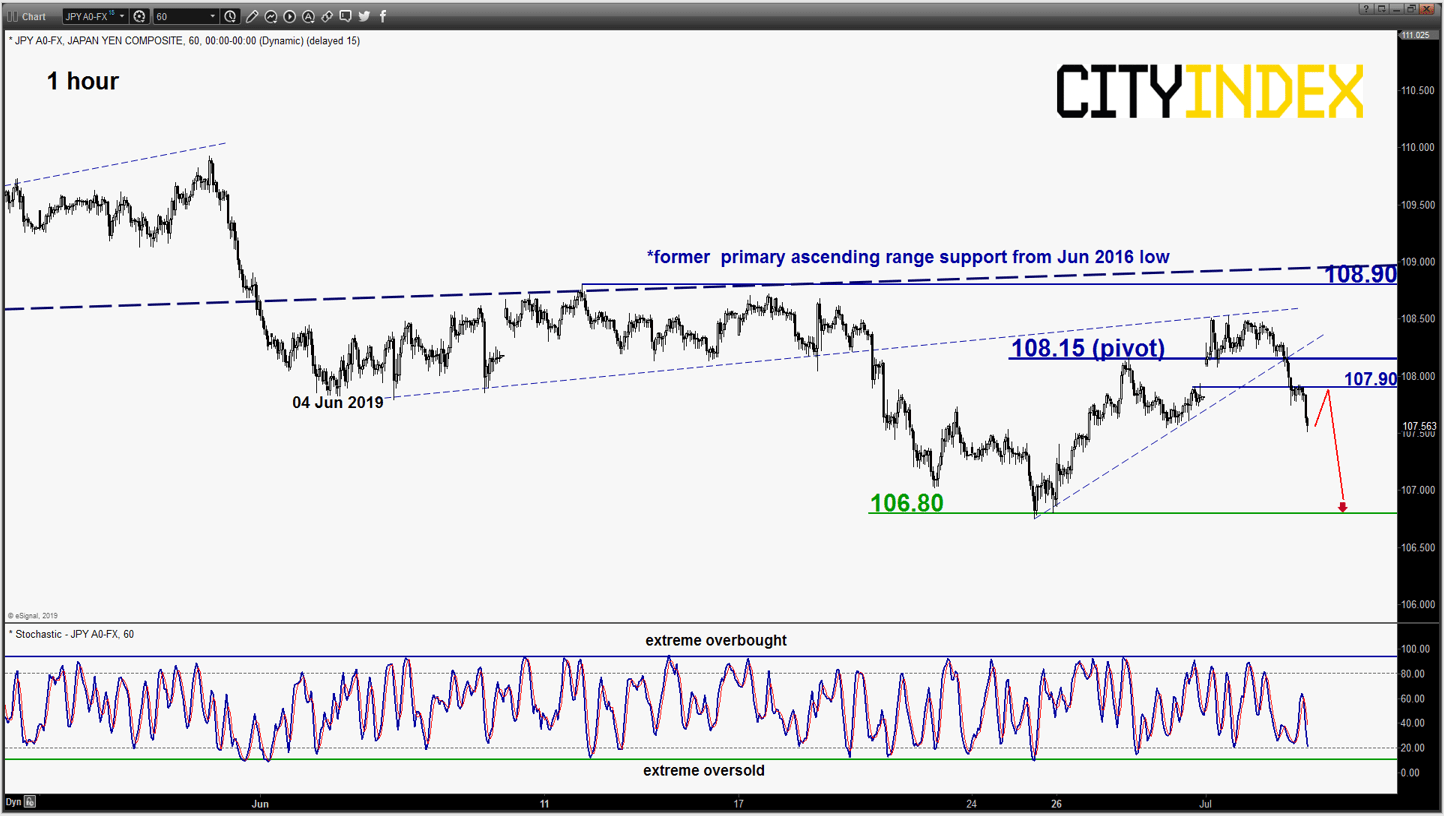

USD/JPY – Further push down in progress

click to enlarge chart

- Staged the expected push down below major pull-back resistance of the former primary ascending range support from Jun 2016 low as per highlighted in the previous report. Maintain bearish bias in any bounces below a tightened key short-term pivotal resistance at 108.15 for a further potential push down to retest the 25 Jun 2019 swing low of 106.80 in the first step.

- On the other hand, a clearance with an hourly close above 108.15 negates the bearish tone for a squeeze up to retest the 108.55/90 major resistance.

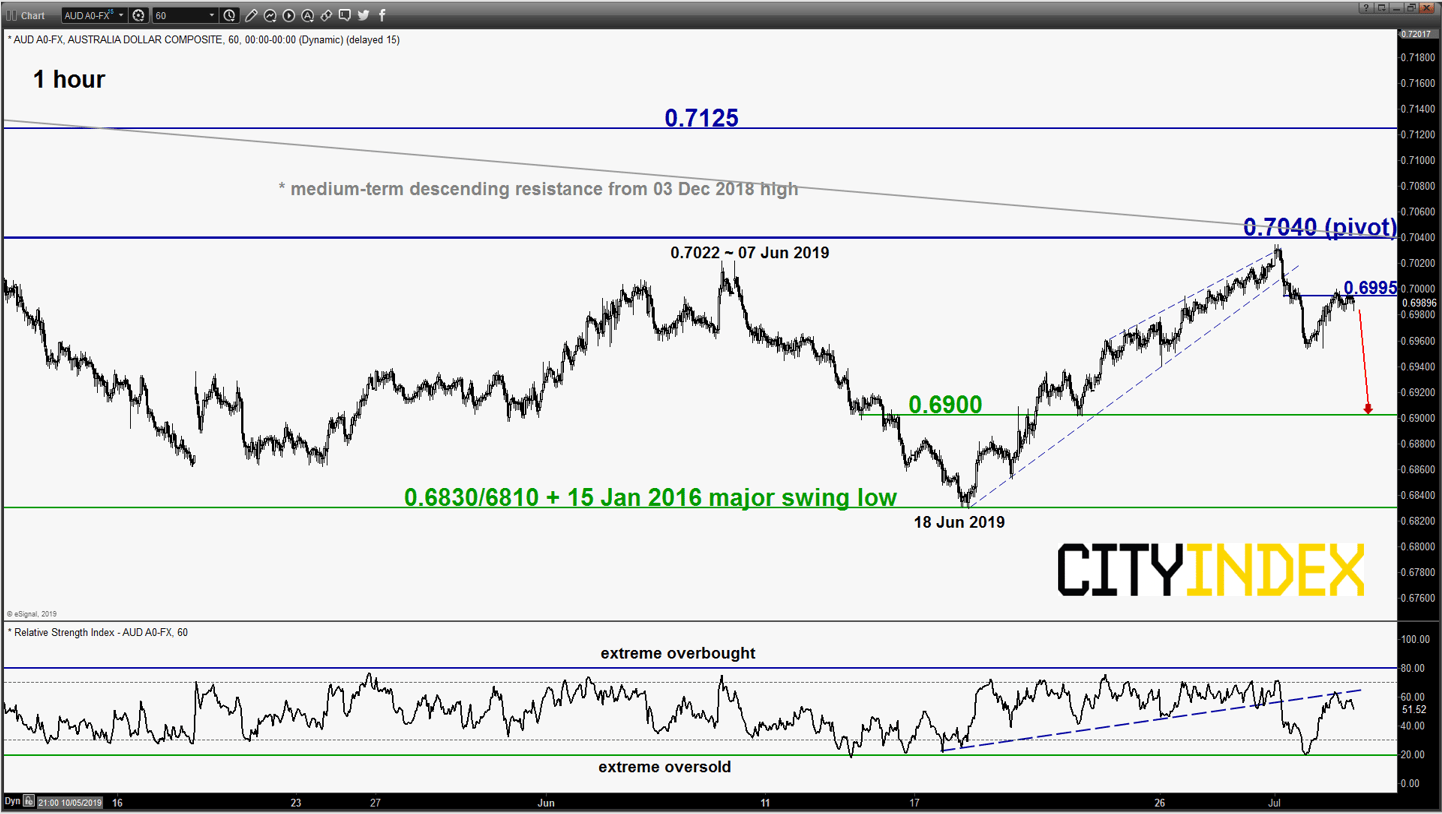

AUD/USD – 0.7040 remains the key resistance to watch

click to enlarge chart

- Maintain bearish bias below 0.7040 key pivotal resistance for a potential push down to target the 0.6900 near-term support in the first step.

- On the other hand, a clearance with a daily close above 0.7040 invalidates the bearish scenario for an extension of the corrective rebound towards the next resistance at 0.7125.

Charts are from eSignal