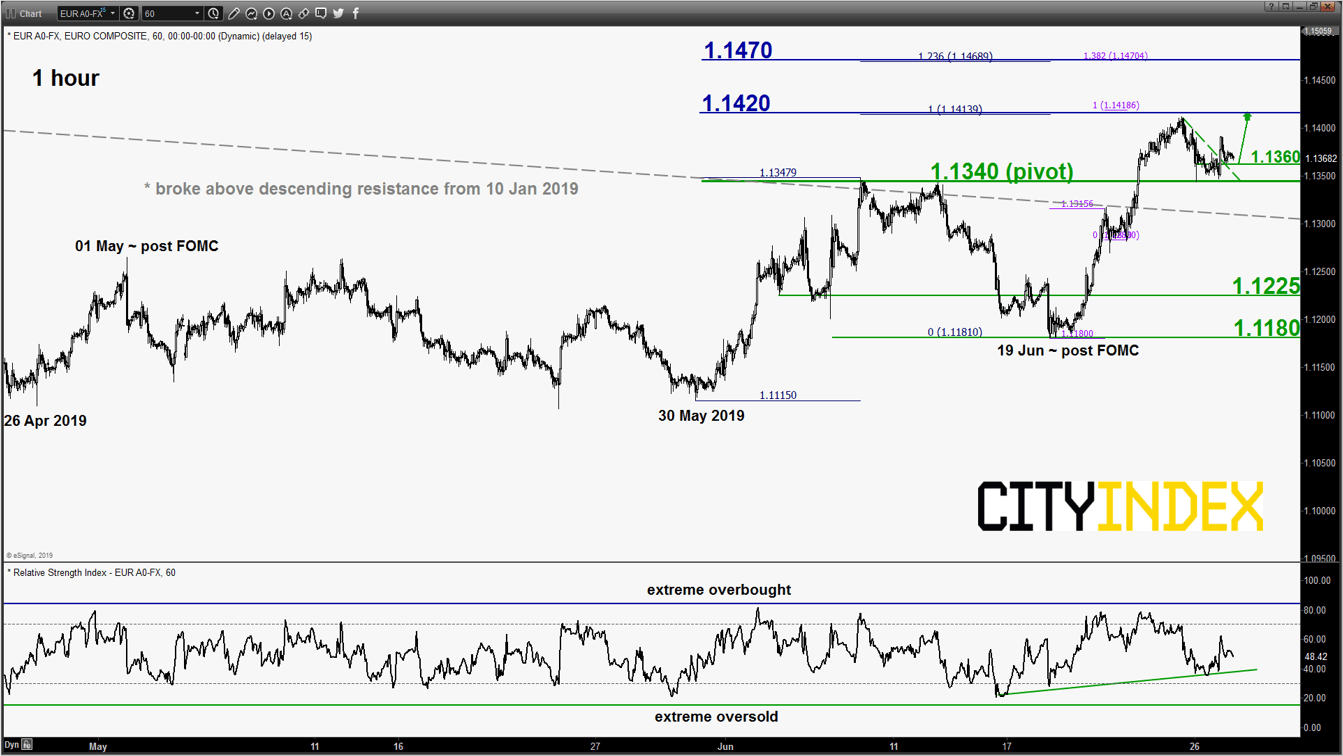

EUR/USD – 1.1340 remains the key support to watch

click to enlarge chart

- Staged a minor push up from the 1.1340 key short-term pivotal support by 45 pips to print a high of 1.1391 in yesterday’s 26 Jun U.S. session before it traded sideways (click here for a recap). No change in key short-term elements, maintain bullish bias for a potential push up towards the next intermediate resistance at 1.1420.

- However, a break with an hourly close below 1.1340 invalidates the bullish scenario for a slide back towards the 1.1225/1180 support zone in the first step.

click to enlarge chart

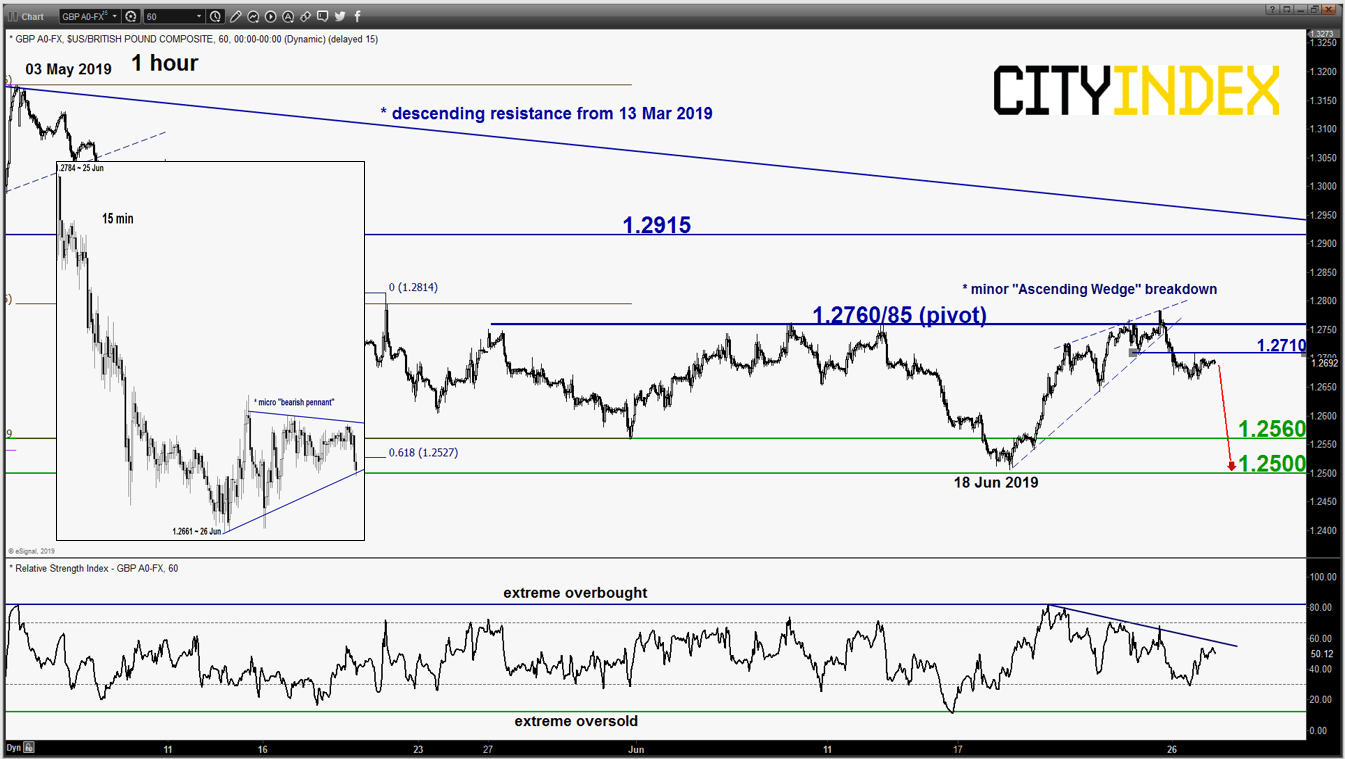

- Yesterday’s 26 Jun narrow price range of 47 pips has formed a micro “bearish pennant” configuration as seen on the 15-minute time frame. Maintain bearish bias below the 1.2760/2785 key short-term pivotal resistance for a further potential slide to retest the major support zone of 1.2560/2500 (the ascending trendline from Oct 2016 swing low).

- However, a break with an hourly close above 1.2760 sees an extension of the corrective rebound towards the next resistance at 1.2915 (also the descending trendline from 13 Mar 2019 high).

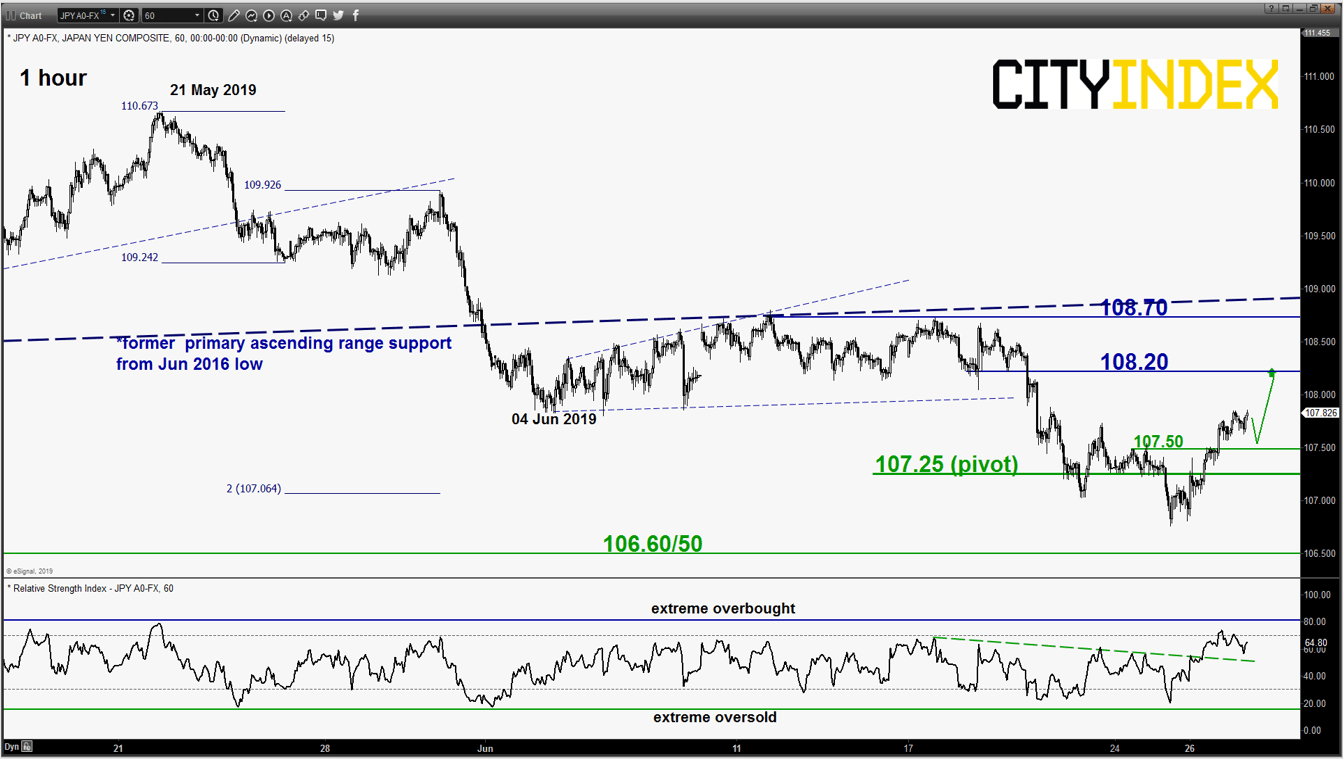

USD/JPY – Corrective rebound in progress

click to enlarge chart

- Broke above the 107.55 upper limit of the short-term neutrality zone as per highlighted in our previous report. The corrective rebound scenario has been validated, bullish in any dips above the 107.25 key short-term pivotal support for a further potential push up to target the next intermediate resistance at 108.20 in the first step.

- However, an hourly close below 107.25 revives the bears for a downleg towards the next support at 106.60/50.

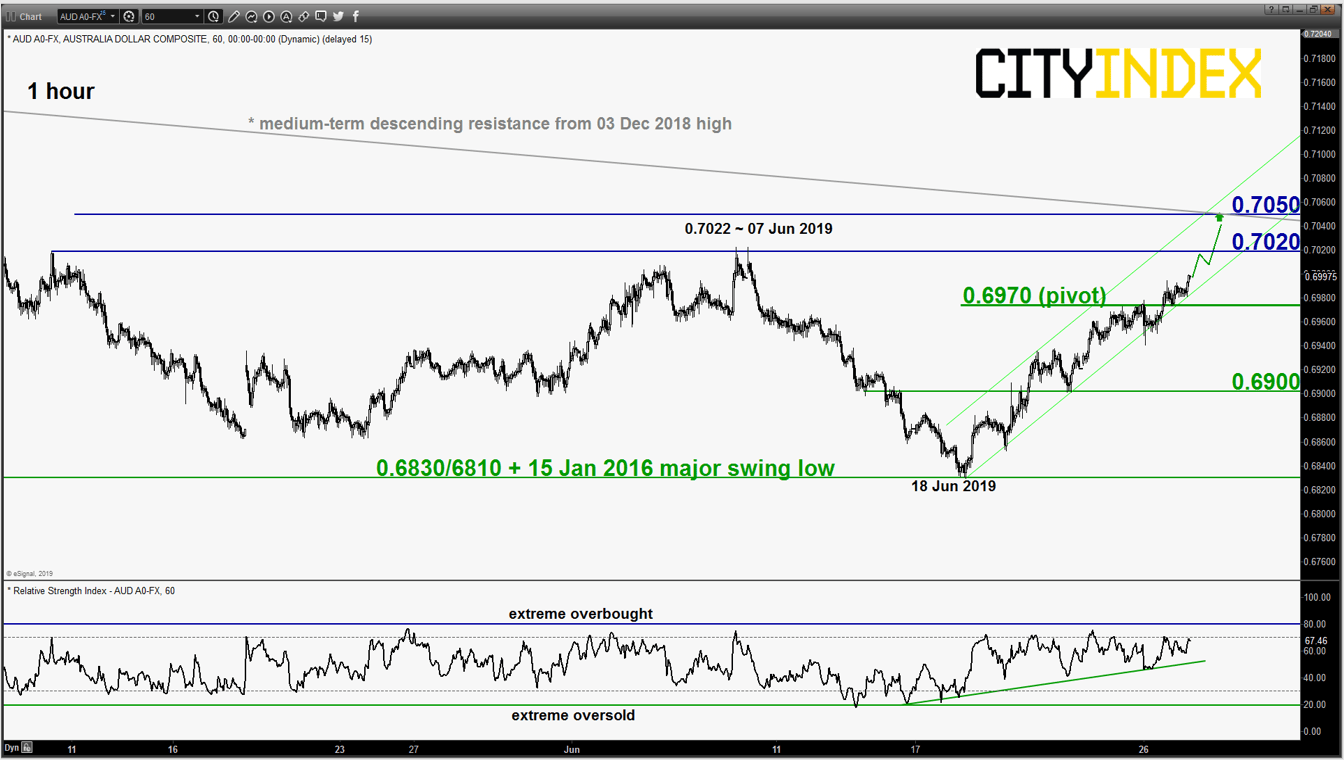

AUD/USD – Further push up towards 0.7050 key medium-term resistance

click to enlarge chart

- Continued to inch higher as expected. Maintain bullish bias with a tightened key short-term support now at 0.6970 for a further potential push towards 0.7020 follow by key medium-term resistance at 0.7050 (also a Fibonacci expansion/retracement cluster & the minor ascending channel resistance).

- However, a break with an hourly close below 0.6970 negates the bullish tone for a deeper pull-back towards the next near-term support at 0.6900 (also the 61.8% Fibonacci retracement of the on-going rebound from 18 Jun low to today, 27 Jun Asian session current intraday high of 0.6998).

Charts are from eSignal