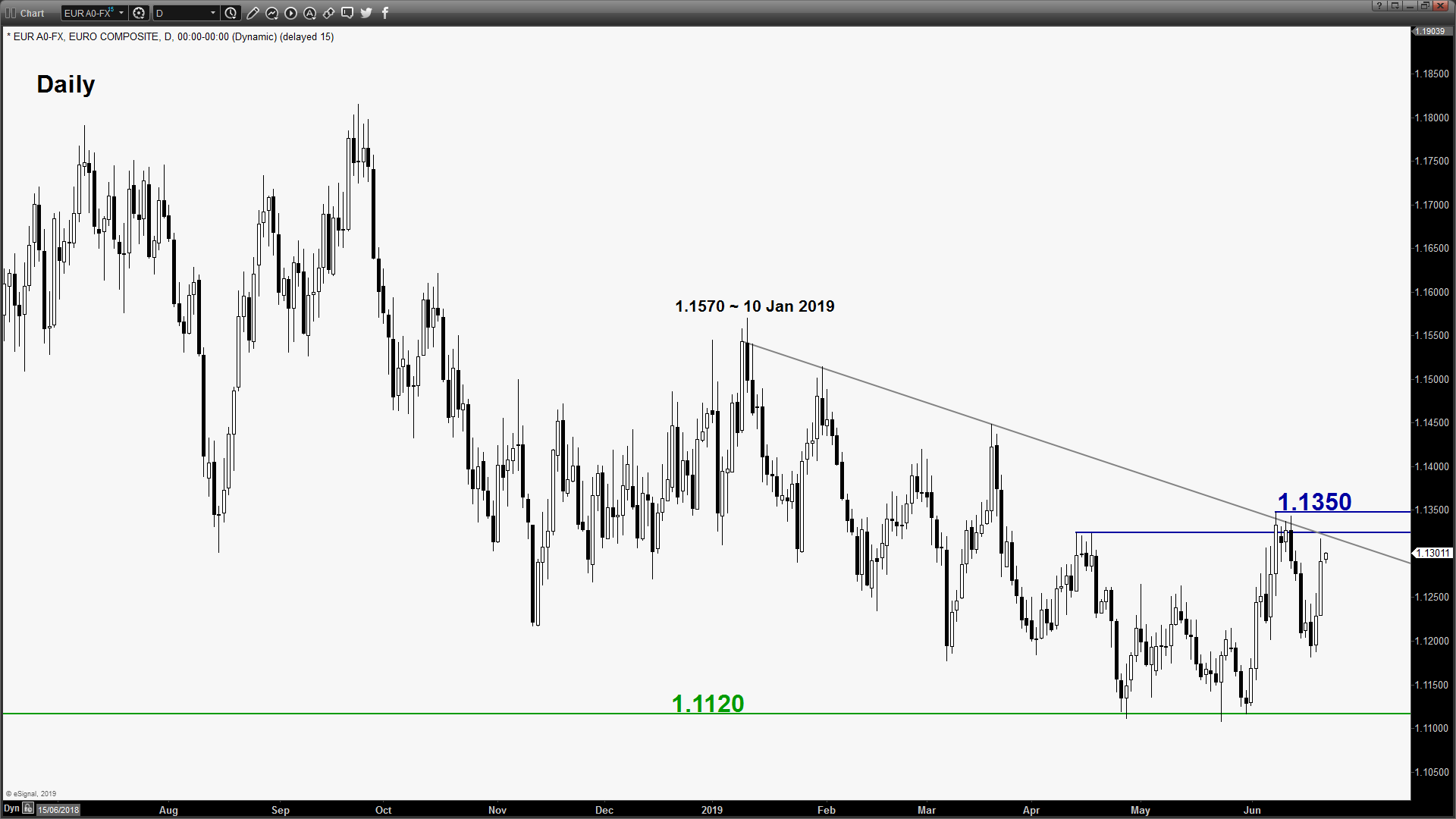

EUR/USD – Watch the 1.1350 resistance

click to enlarge charts

- Continued to inch higher and right now it is hovering below the 1.1350 resistance (07/12 Jun 2019 swing high areas & the descending trendline from 10 Jan 2019 swing high). Prefer to turn neutral now between 1.1350 and 1.1245.

- A break with an hourly close above 1.1350 opens up scope for an extension of the corrective rebound towards the next intermediate resistance at 1.1420 (Fibonacci expansion & 21 Mar 2019 swing high area). On the flipside, an hourly close below 1.1245 revives the bearish tone for a slide back to retest this week’s current low of 1.1180.

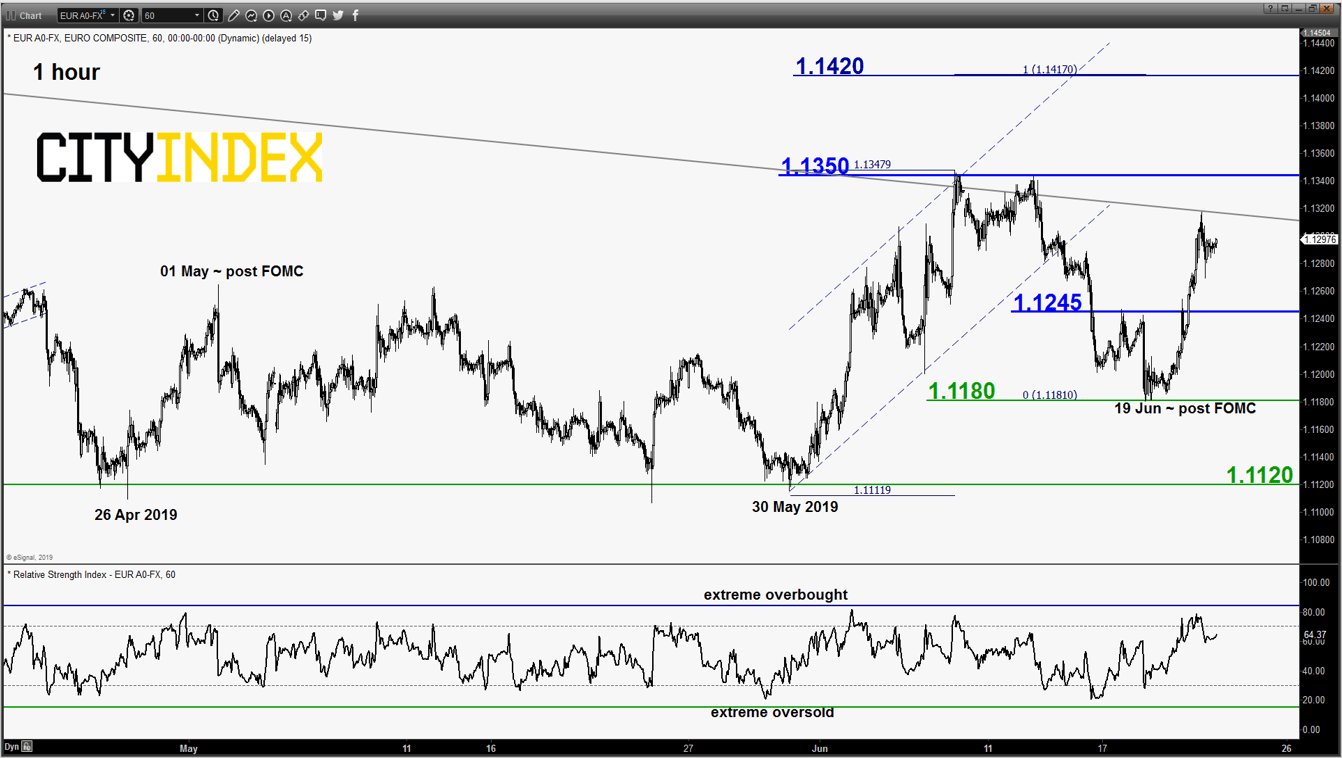

GBP/USD – 1.2760 remains the key resistance to watch

click to enlarge chart

- Managed to hold below the 1.2760 key short-term pivotal resistance as expected post BoE. Click here to recap our previous report. Maintain bearish bias and added 1.2665 as the trigger level to reinforce a potential slide to retest the near-term support of 1.2560 in the first step.

- However, an hourly close above 1.2760 invalidates the bearish scenario for a further corrective rebound towards the next resistance at 1.2875.

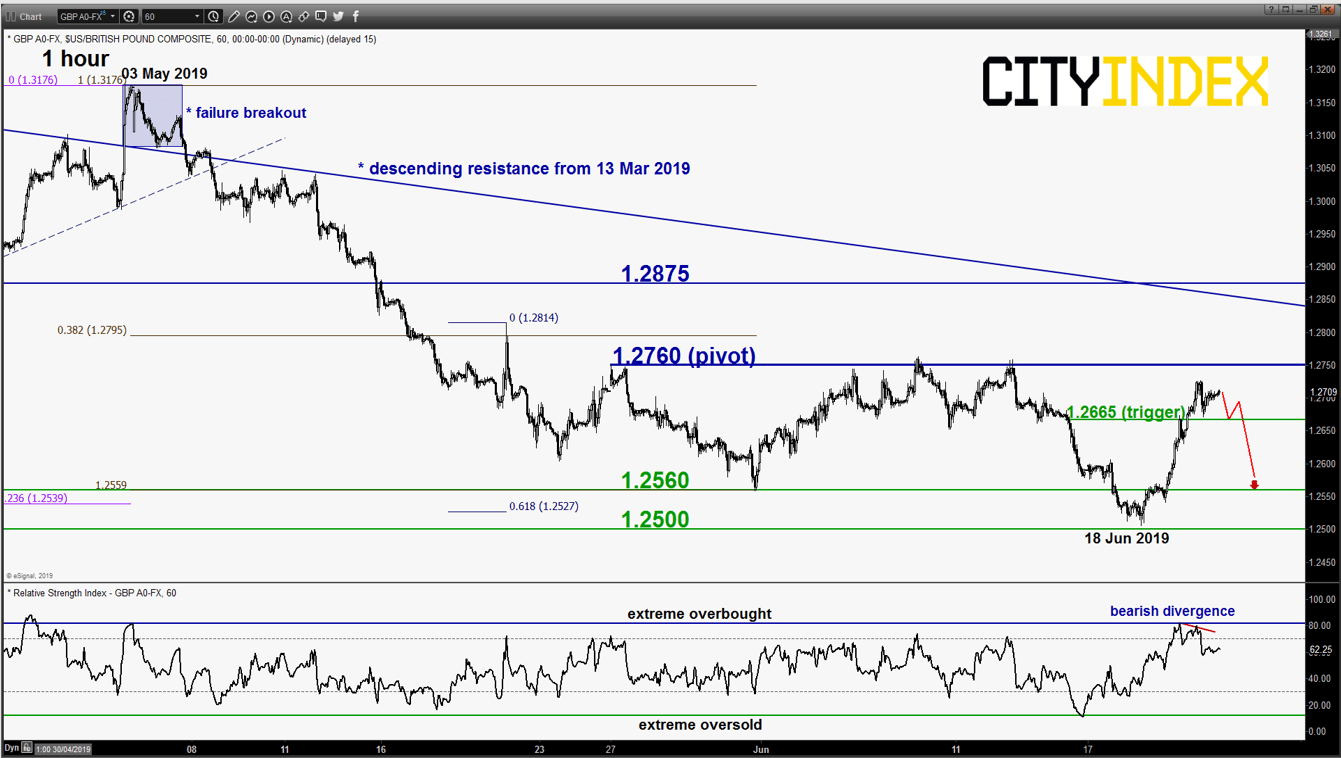

USD/JPY – Further potential drop

click to enlarge chart

- Managed to drift down lower as expected and it is now coming close to the downside target/support of 107.10 as per highlighted in our previous report. No clear signs of bearish exhaustion at this juncture, maintain bearish bias below a tightened key short-term pivotal resistance now 107.85 for a further potential drop to target the next support at 106.60/50 (the lower limit of the descending channel & a Fibonacci expansion cluster).

- However, an hourly close above 108.20 negates the bearish tone for a squeeze up to retest the 108.65 key medium-term resistance.

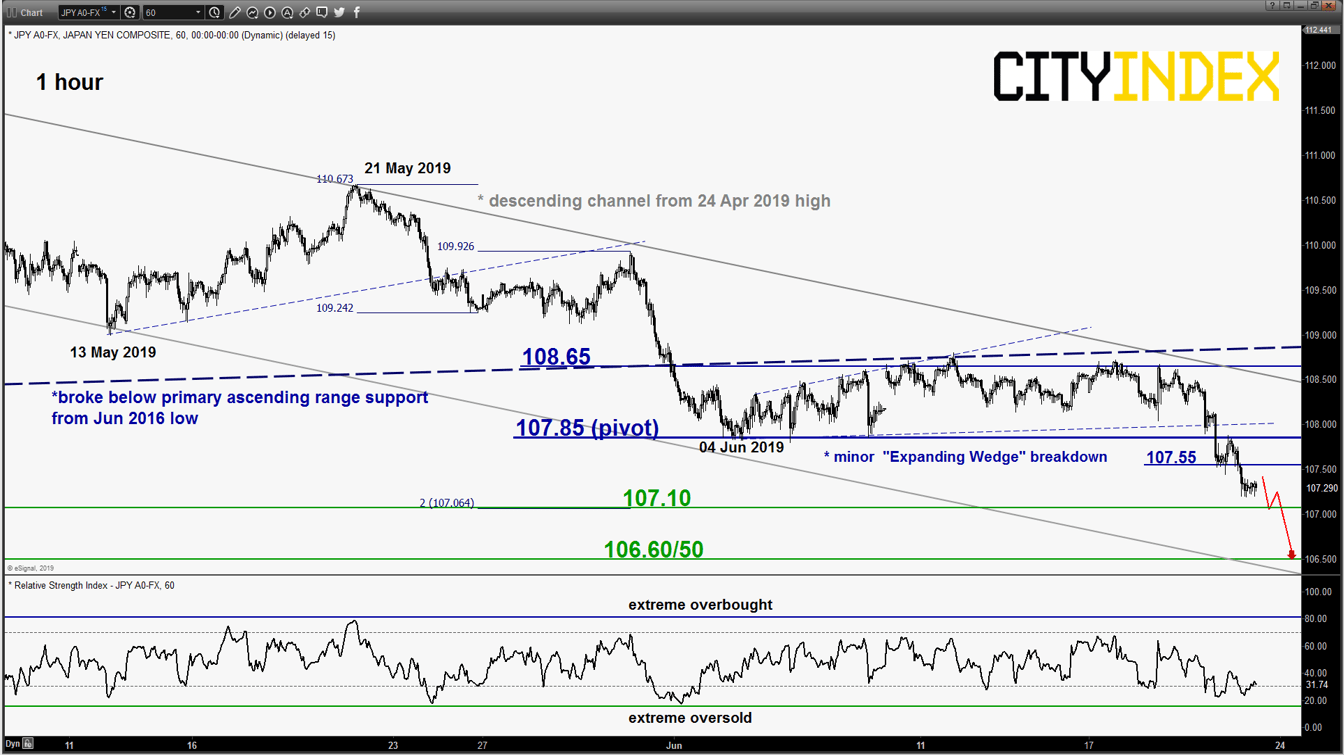

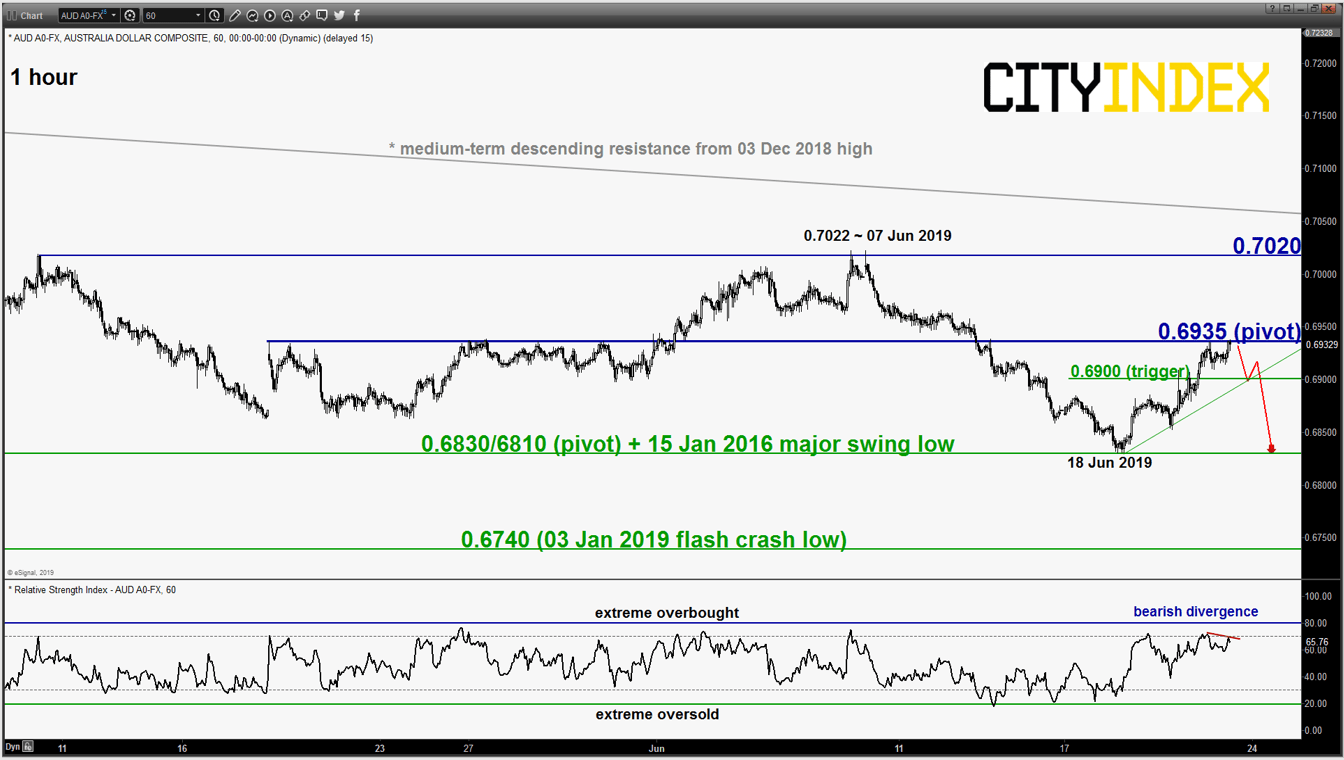

AUD/USD – 0.6935 remains the key resistance to watch

click to enlarge chart

- Tested the 0.6935 key short-term pivotal resistance as per highlighted in our previous report with the hourly RSI oscillator that has started to exhibit exhaustion in short-term upside momentum.

- Maintain bearish bias and added 0.6900 as the downside trigger level to reinforce a potential slide back to retest the 0.6830/6810 significant support. However, an hourly close above 0.6935 invalidates the bearish tone for an extension of the corrective rebound towards the key medium-term resistance at 0.7020 (also the descending resistance from 03 Dec 2018 high).

Charts are from eSignal

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM