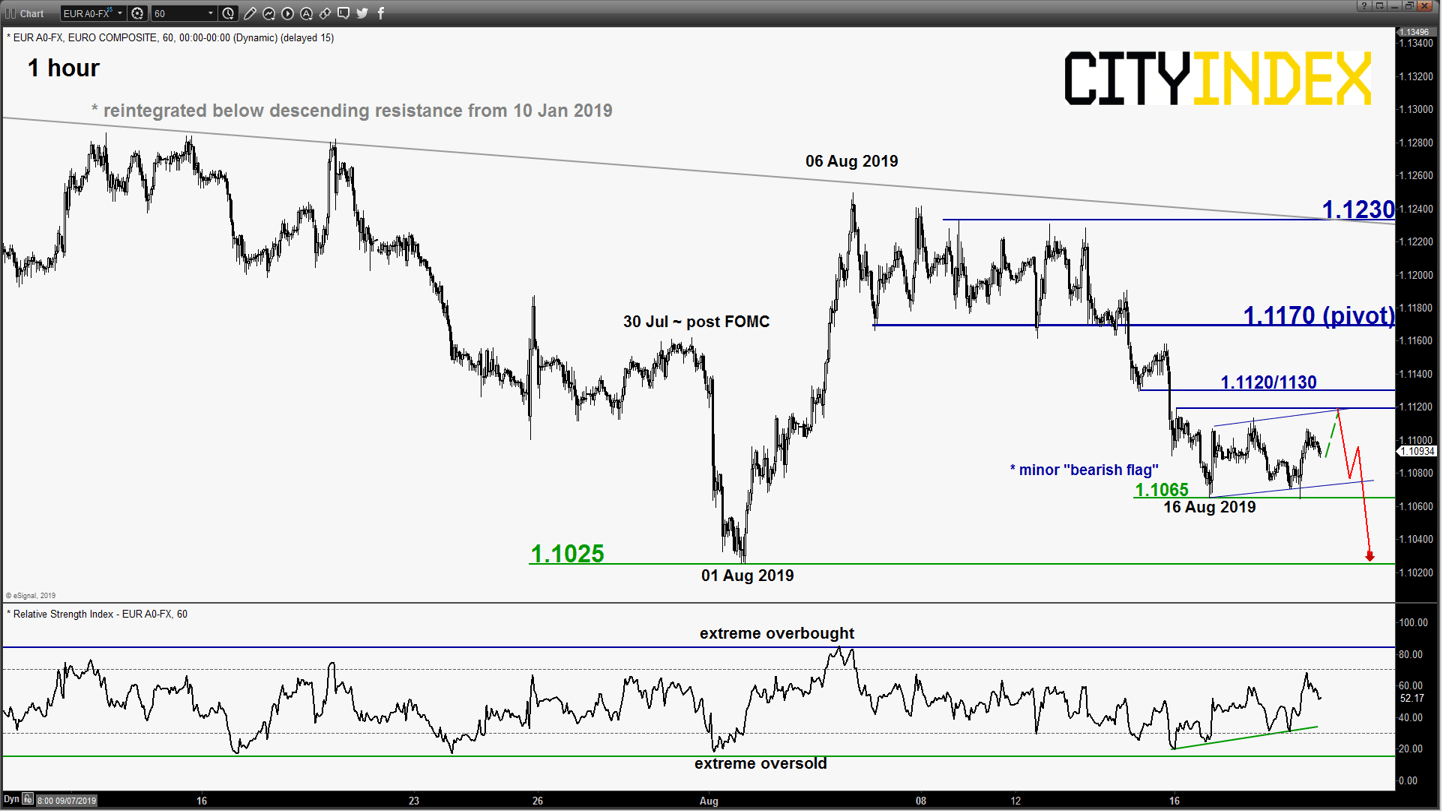

EUR/USD – Residual bounce before risk of new drop

click to enlarge chart

- The pair has shaped expected bounce within the minor “bearish flag” ascending range configuration in place since 16 Aug 2019. Rang top/resistance of the “bearish flag” remains at 1.1120/1130 (click here to recap our previous report).

- Maintain bearish bias in any bounces below 1.1170 key short-term pivotal resistance for another potential downleg to retest the 1.1025 near-term support in the first step.

- However, a clearance with an hourly close above 1.1170 negates the bearish tone for an extension of the corrective rebound towards the next resistance at 1.1230 (also the descending trendline from 10 Jan 2019 high).

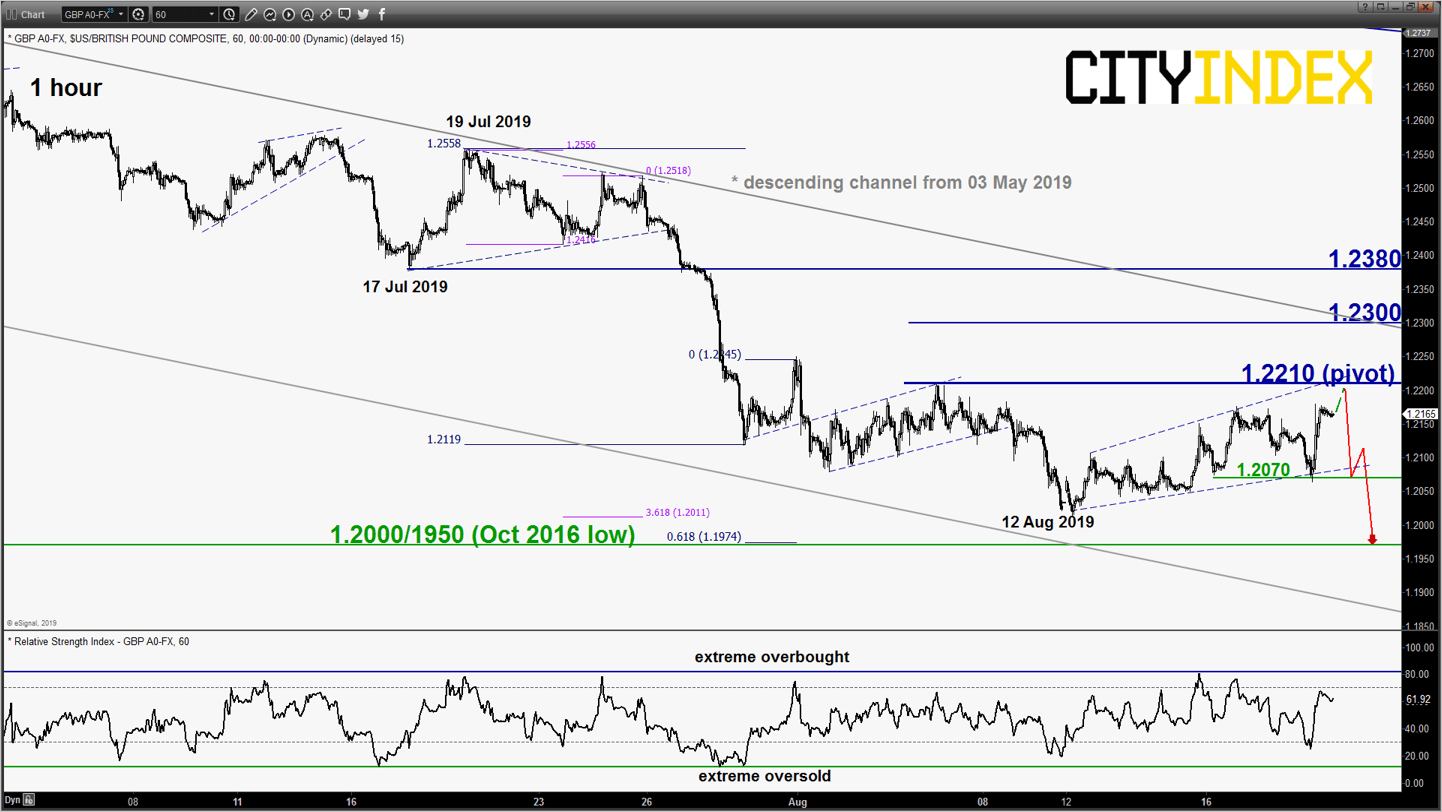

GBP/USD – 1.2210 remains the key resistance to watch

click to enlarge chart

- The pair pushed down, tested the 1.2095/2070 lower limit/support of a minor “Expanding Wedge” range configuration in place since 12 Aug 2019 before a bounce of 125 pips bounce to print a high of 1.2180 in yesterday’s U.S. session. The steep bounce came on the backdrop of potential “soft Brexit” revival after German Chancellor, Merkel commented that EU must think about practical solutions regarding the Irish backstop.

- The 1 -hour RSI oscillator is now coming close to an extreme overbought level. No change, maintain bearish bias with 1.2210 remains as the key short-term pivotal resistance (also the “Expanding Wedge” upper limit) for a potential push down to retest 1.2070 and a break below it may see a further drop to target the 1.2000/1950 support.

- However, a clearance with an hourly close above 1.2210 negates the bearish tone for an extended corrective rebound towards the medium-term descending channel resistance at 1.2300.

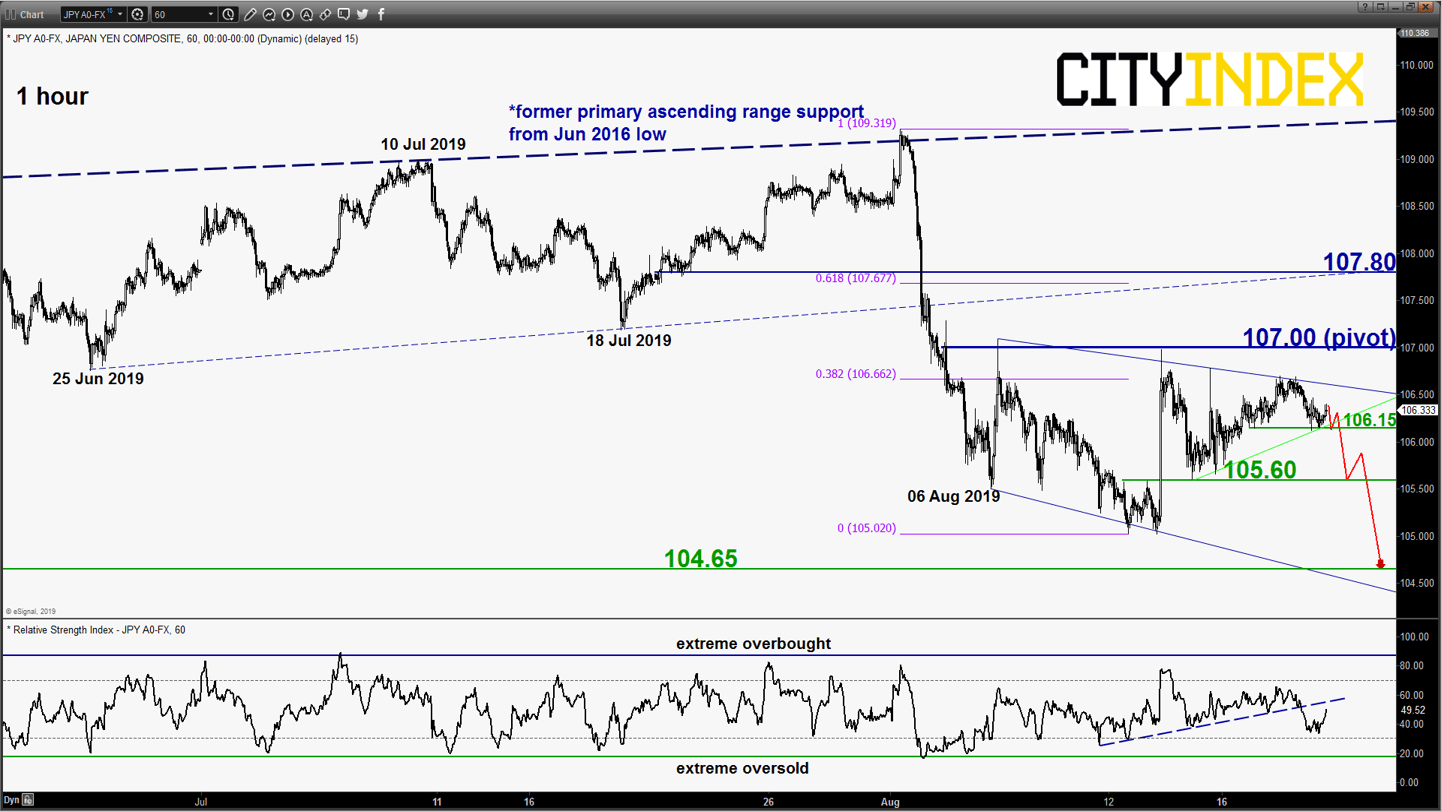

USD/JPY – Further potential downside below 107.00

click to enlarge chart

- The pair has staged the expected drift down from the upper limit/resistance of the minor “descending range” configuration in place since 06 Aug 2019. Tested the intermediate support at 106.15 and traded sideways thereafter.

- No change, maintain bearish bias below 107.00 key short-term pivotal resistance and a break below 106.15 is likely to see a potential drop towards 105.60 follow by 104.65 support (03 Jan 2019 flash crash low area & 22/23 Jan 2018 swing low). However, a clearance with an hourly close above 107.00 sees a squeeze up towards 107.80.

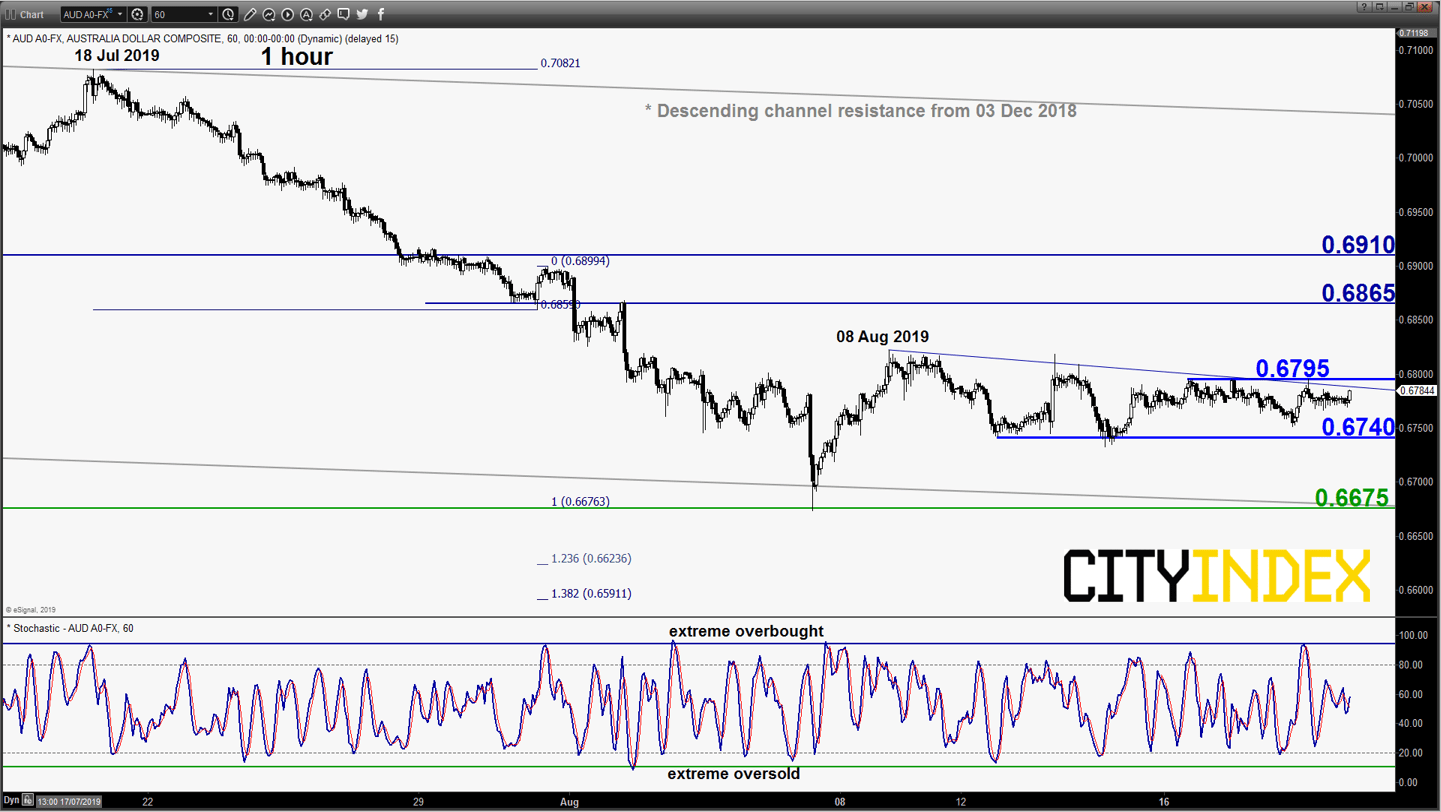

AUD/USD – Stuck inside a range configuration

click to enlarge chart

- Since its 08 Aug 2019 high of 0.6822, the pair has started to evolve within a minor “triangle” range configuration with upper and lower limits at 0.6795 and 0.6740 respectively.

- No change, maintain neutral stance between 0.6795 and 0.6740. Only an hourly close above 0.6795 validates a potential corrective rebound towards the next intermediate resistance at 0.6865. On the flipside, a break above 0.6795 sees an extension of the corrective rebound towards the next resistance at 0.6865 (also close to the 50% Fibonacci retracement of the recent steep decline from 18 Jul high to 07 Aug 2019 low).

Charts are from eSignal

Latest market news

Today 08:15 AM