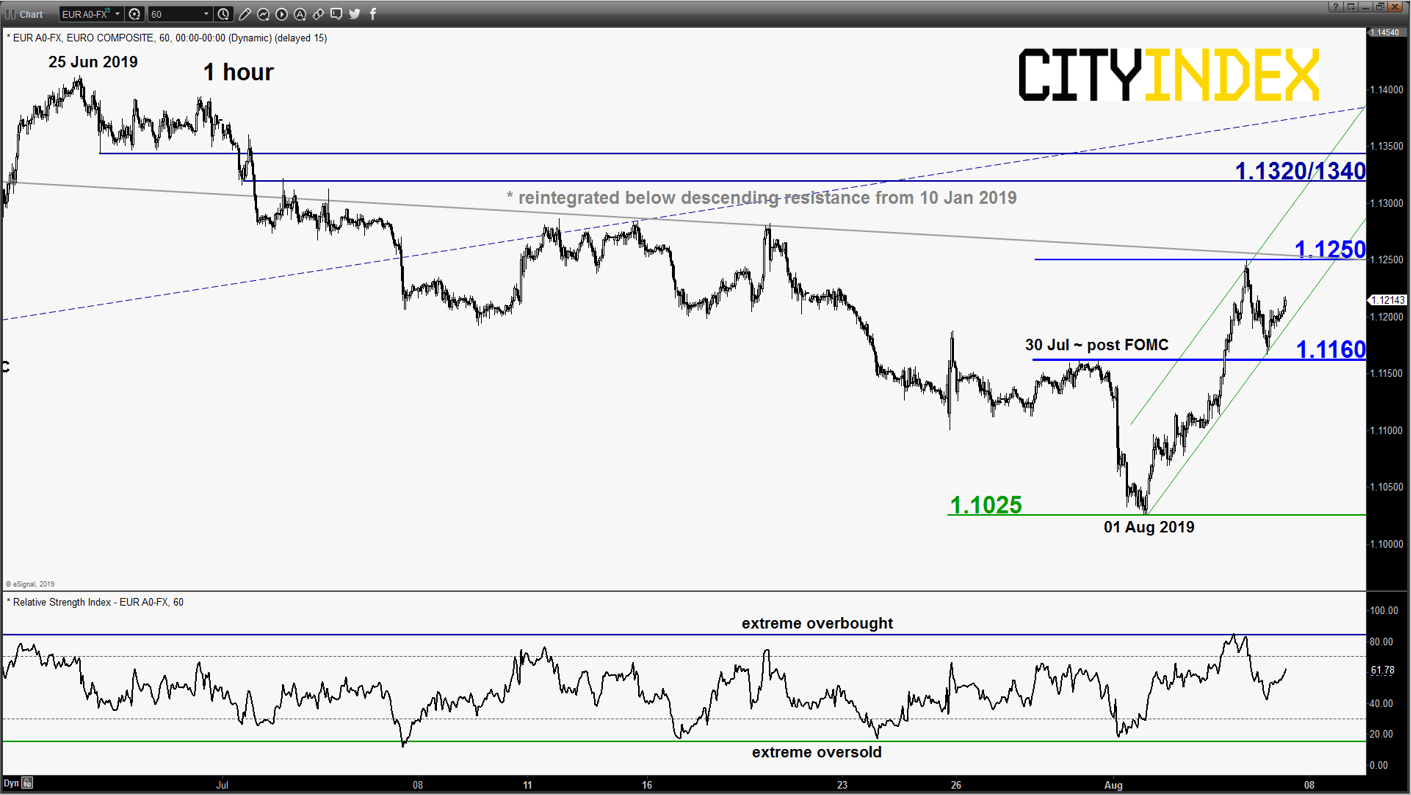

EUR/USD – Mix elements; watch 1.1160 support

click to enlarge chart

- Since its post FOMC low of 1.1025 printed on 01 Aug 2019, the pair has staged a squeeze up by 220 pips to print a high of 1.1250 yesterday, 06 Aug before it pulled-back right at the descending resistance from 10 Jan 2019.

- Mix elements and ended yesterday U.S. session with a daily ‘Spinning Top” candlestick pattern. Prefer to turn neutral now between 1.1250 and 1.1160. Only an hourly close below 1.1160 reignites the bearish tone for a push down to retest 1.1025. On the flipside, an hourly close above 1.1250 sees an extended corrective rebound towards the next resistance at 1.1320/1340.

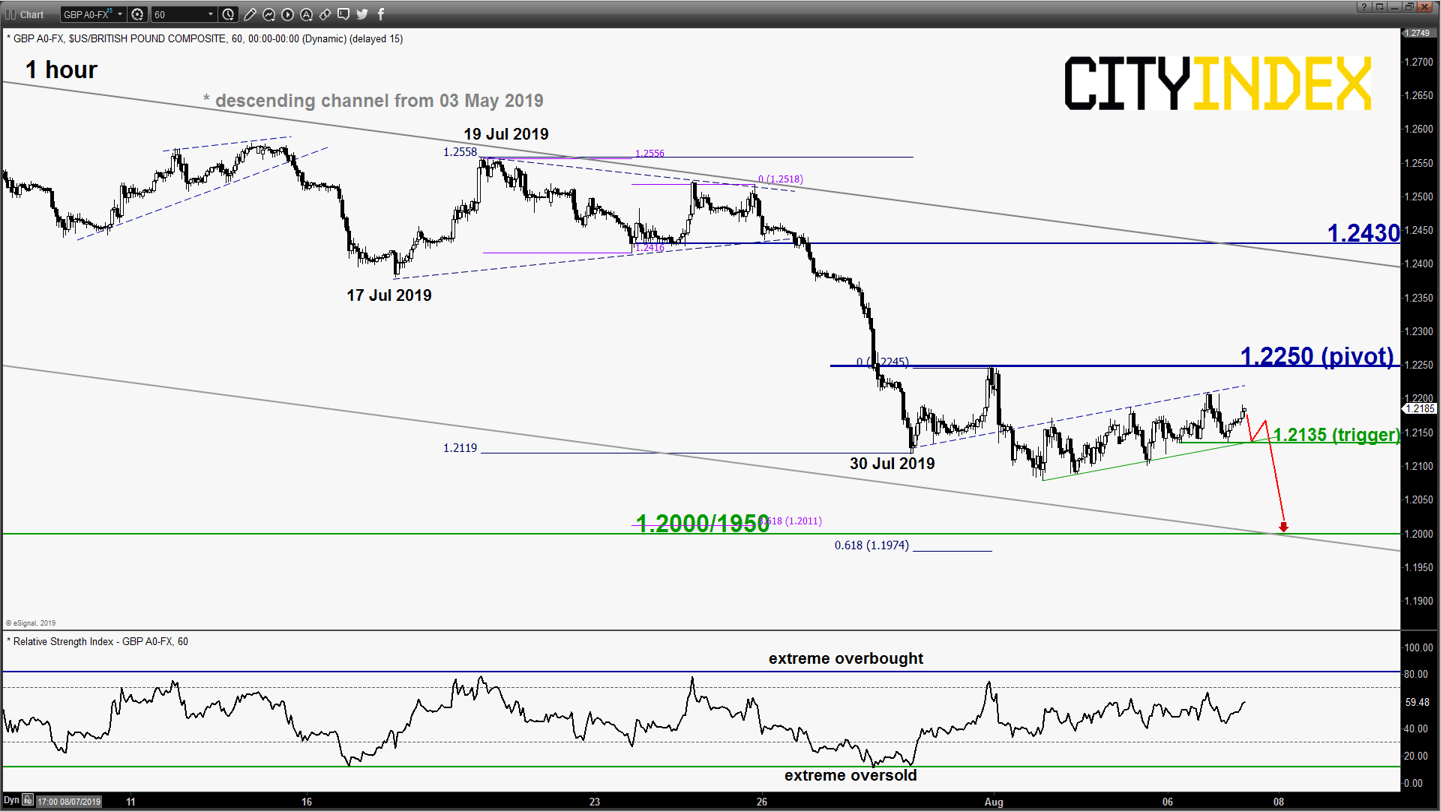

GBP/USD – 1.2250 remains the key resistance to watch

click to enlarge chart

- Pair has traded sideways below the 1.2250 key short-term pivotal resistance since our last report. Maintain bearish bias and added 1.2135 as the downside trigger level. An hourly close below 1.2135 reinforces a potential downleg to target the next near-term support at 1.2000/1950 (Fibonacci projection cluster & Oct 2016 low).

- However, a clearance with an hourly close above 1.2250 negates the bearish tone for an extension of the corrective rebound towards the 1.2430 resistance.

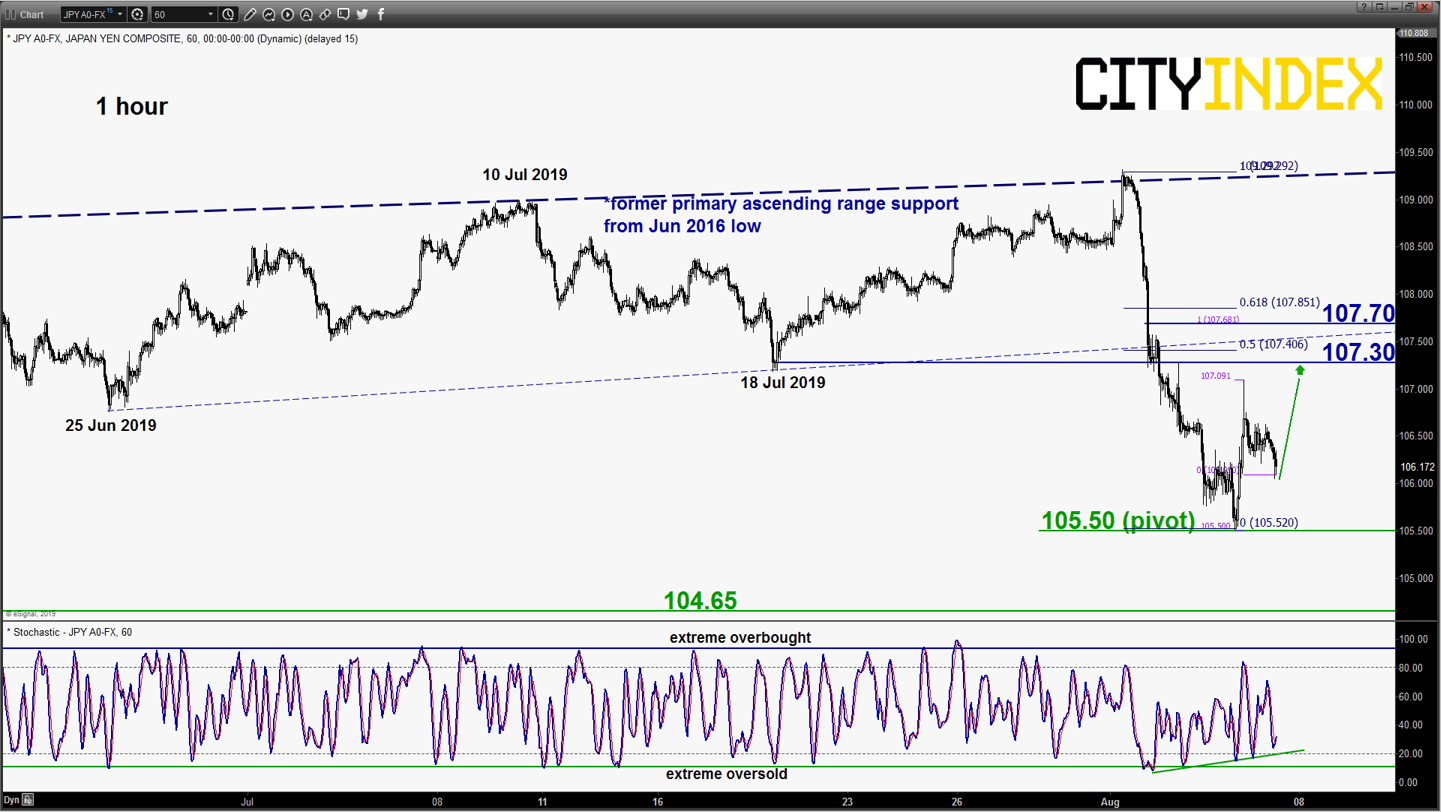

USD/JPY – Further minor corrective bounce cannot be ruled out

click to enlarge chart

- The pair has staged the expected bearish reaction right below the 109.20 key medium-term resistance and plummeted beyond the short-term downside target/support of 106.80 as per highlighted in our previous report. It printed a low of 105.50 yesterday, 06 Aug on the back of rising risk aversion since the start of this week.

- Right now, short-term elements are advocating for a minor corrective rebound to retrace the recent steep slide from 01 Aug 2019 high. Flip to a bullish bias for another potential leg of corrective bounce towards the 107.30 intermediate resistance (former minor ascending support from 25 Jun 2019 low & Fibonacci retracement/projection cluster).

- However, a break with an hourly close below 105.50 opens up scope for the continuation of the impulsive down move towards 104.65 (close to 03 Jan 2019 flash crash low & 23 Mar 2018 swing low)

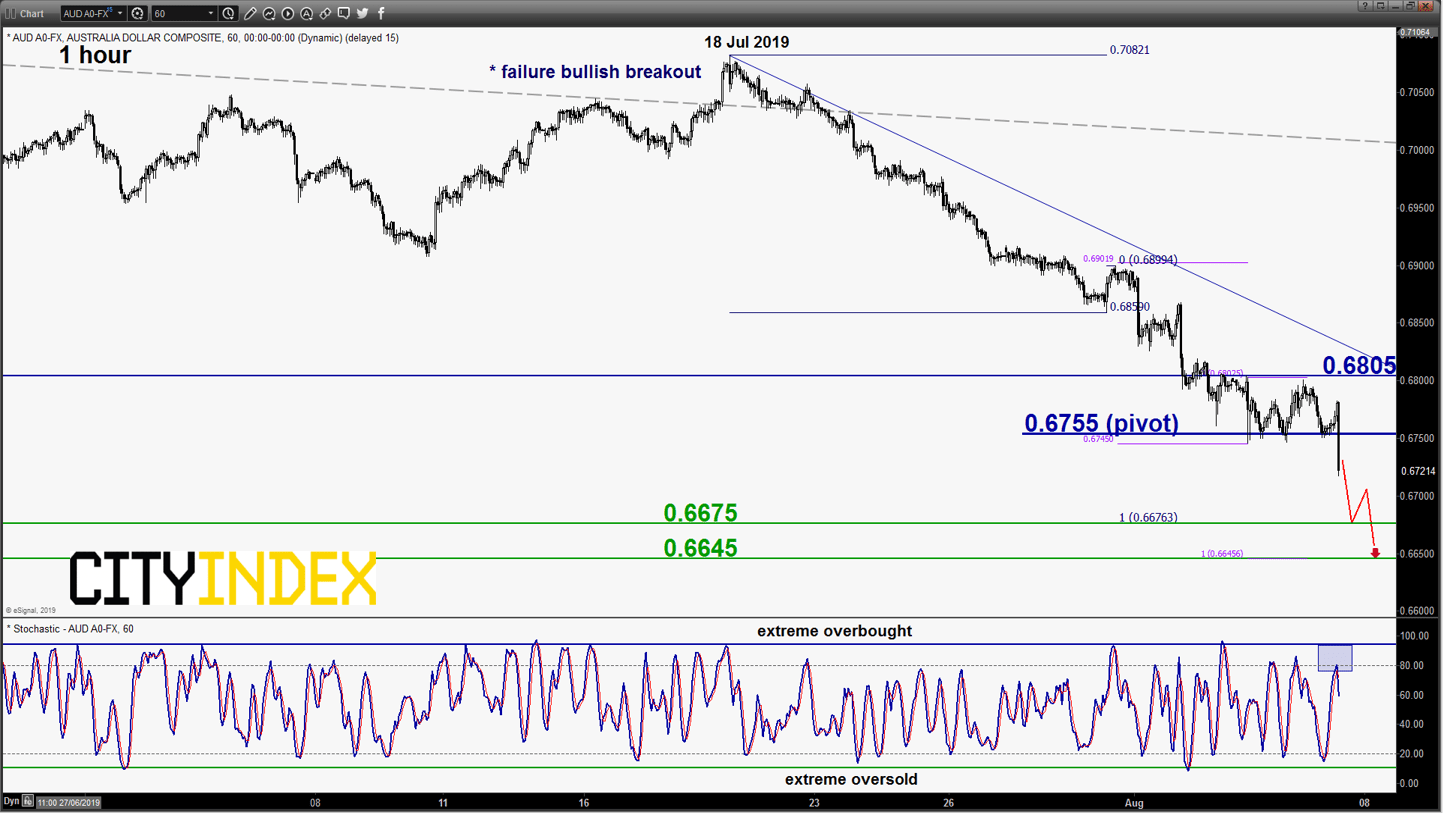

AUD/USD – Bears remain in control

click to enlarge chart

- The pair has continued its expected downward drift and broke below the 0.6770/6740 downside target/support as per highlighted in our previous report. It has broken below the 03 Jan 2019 flash crash low of 0.6740 in today’s Asian session reinforced by a bigger than expected interest rate cut of 50 bps from RBNZ to take the official cash rate to a record low of 1.00%.

- Maintain bearish bias with a tightened key short-term pivotal resistance now 0.6755 for a further potential push down to target the next near-term supports at 0.6675 and 0.6645.

- However, a clearance above 0.6755 negates the bearish tone for a squeeze up to retest the minor range top at 0.6805 (also the descending trendline from 18 Jul 2019 high).

Charts are from eSignal

Latest market news

April 25, 2024 03:09 PM

April 25, 2024 03:00 PM

April 25, 2024 01:12 PM

April 25, 2024 11:14 AM