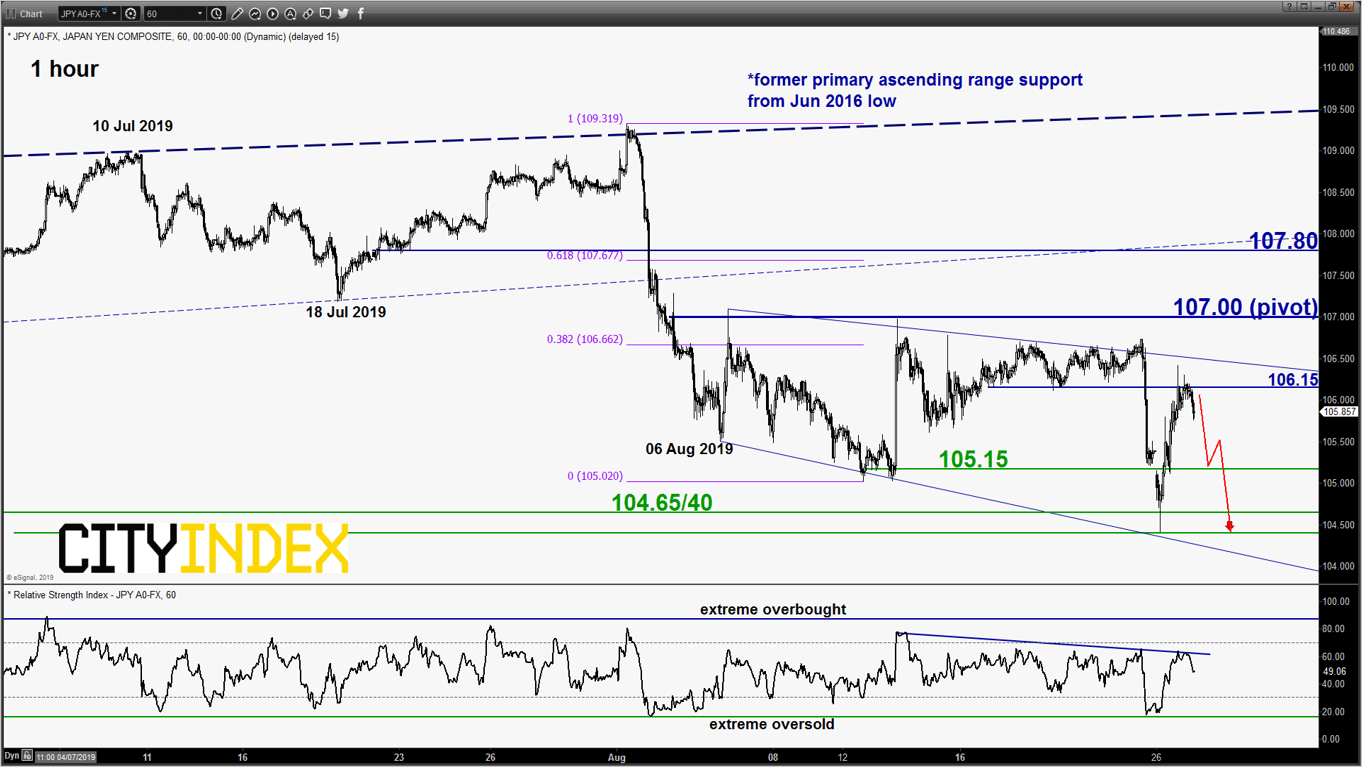

USD/JPY – Potential push back down towards range lower limit

click to enlarge chart

- The pair has staged the expected push down and met the downside target/support of 104.65 yesterday, 26 Aug Asian session (click here to recap our previous report). Thereafter, it has reversed swiftly by 196 pips to print an intraday high of 106.41 on the backdrop of U.S/China trade deal optimism.

- Technical elements are still now showing any clear signs of a major bullish reversal. Also, the 1-hour RSI oscillator has retested a significant corresponding resistance at the 62 level and retreated. Maintain bearish bias in any bounces below 107.00 key short-term pivotal resistance for another round of potential push down towards 105.15 follow by 104.65/40 (lower limit of a complex range configuration in place since 06 Aug 2019). However, a clearance with an hourly close above 107.00 sees an extended corrective rebound towards 107.80 (former ascending range support from 25 Jun 2019 low)

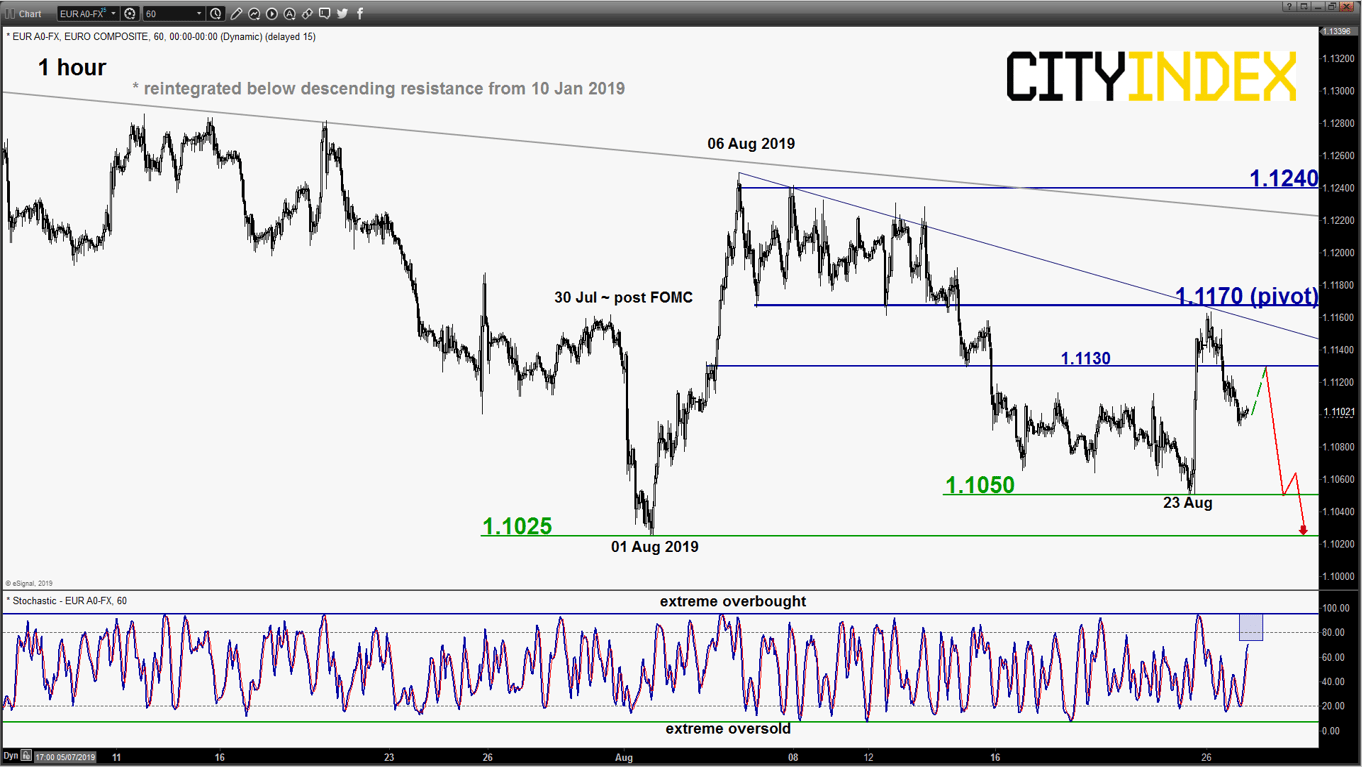

EUR/USD – 1.1170 key short-term resistance to watch

click to enlarge chart

- Last Fri, 23 Aug, the pair has staged a squeeze up above the 1.1115 tightened key short-term resistance and almost reached the alternate target of 1.1170 (the former minor range support & descending trendline from 06 Aug high).

- Thereafter, it has retreated by 70 pips to print a low of 1.1093 in yesterday, 26 Aug U.S. session. It is still evolving within a range configuration since 01 Aug 2019 low, 1.1170 will be the short-term pivotal resistance for a potential push down towards 1.1050 before the 01 Aug 2019 swing low of 1.1025. However, a clearance with an hourly close above 1.1170 negates the bearish tone for an extended corrective rebound towards 1.1240 (06 Aug 2019 swing high area & descending trendline from 10 Jan 2019 high).

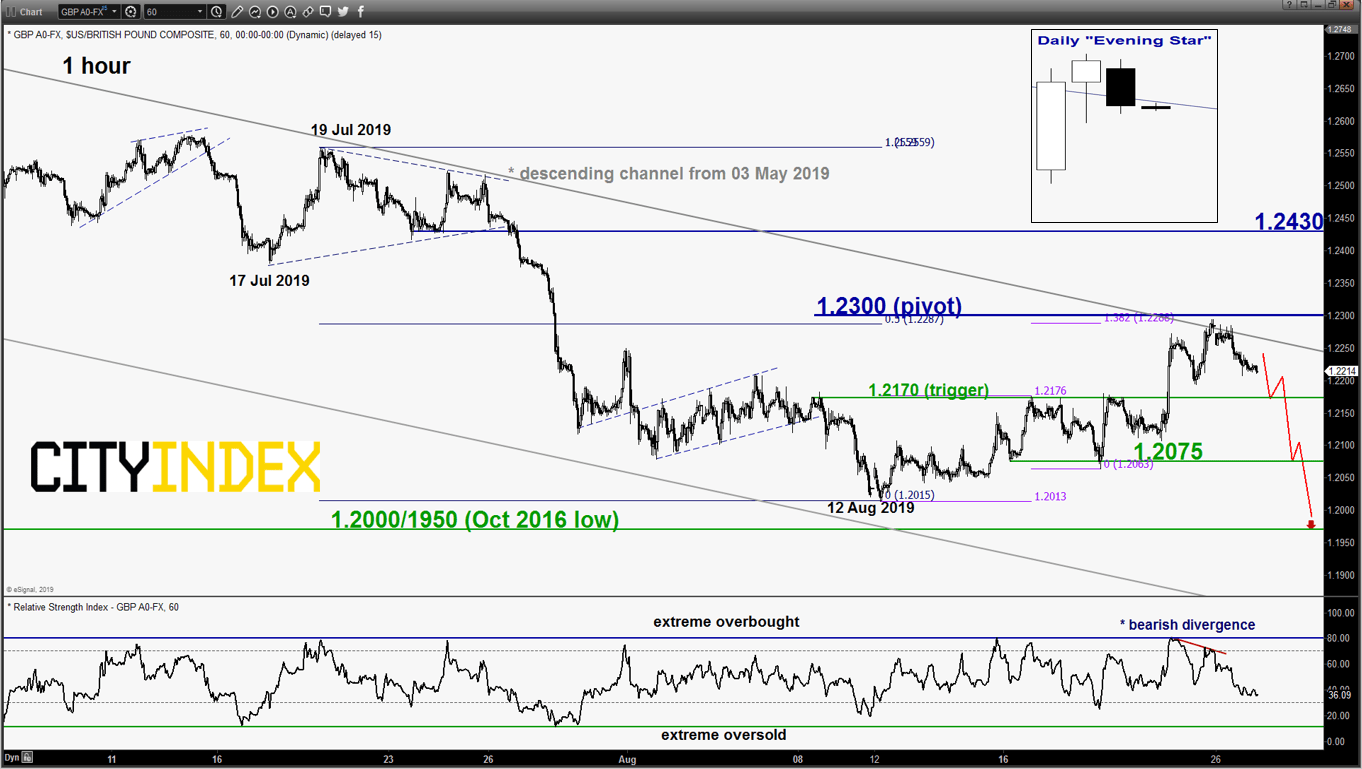

GBP/USD – Retreated from 1.2300 with bearish elements

click to enlarge chart

- The pair has pushed up and staged a retreat right below the 1.2300 upper limit of the short-term neutrality range as per highlighted in our previous report. Bearish elements have emerged, the pair has ended yesterday, 26 Aug U.S. session with a daily “Evening Star” bearish candlestick pattern coupled with a bearish divergence seen in the 1-hour RSI oscillator.

- Flip back to a bearish bias below 1.2300 key short-term pivotal resistance and a break below 1.2170 is likely to reinforce a potential downleg to target 1.2075 and 1.2000/1950 next. However, a clearance with an hourly close above 1.2300 invalidates the bearish scenario for an extended corrective rebound towards the next intermediate resistance at 1.2430.

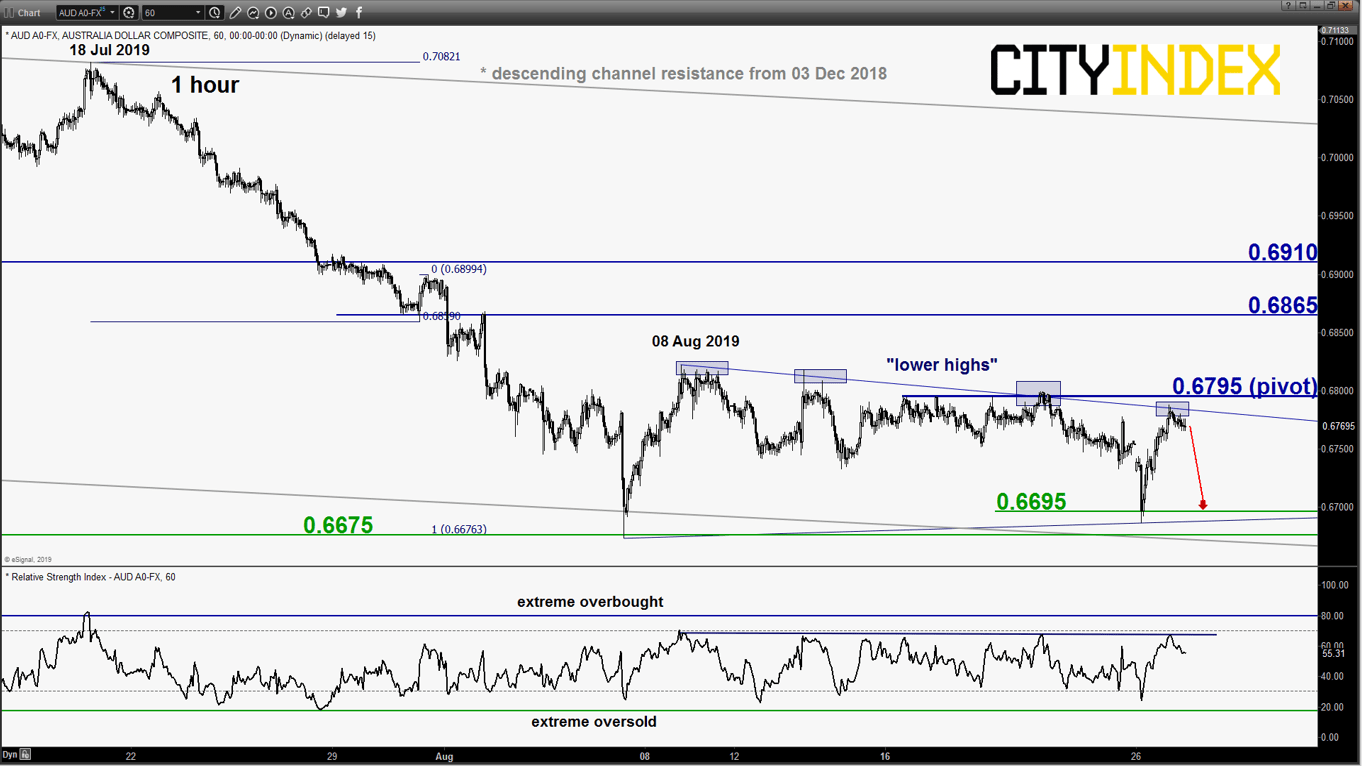

AUD/USD – Potential push down to retest range support

click to enlarge chart

- The pair has staged a push up to retest the upper limit of its minor range configuration in place since 07 Aug 2019 after it hit a minor swing low area of 0.6695 seen yesterday, 26 Aug Asian session.

- Bearish bias below 0.6795 key short-term pivotal resistance for a potential push down to retest the range support zone of 0.6695/6675. However, a break with an hourly close above 0.6795 sees an extension of the corrective rebound towards the next resistance at 0.6865 (also close to the 50% Fibonacci retracement of the recent steep decline from 18 Jul high to 07 Aug 2019 low).

Charts are from eSignal

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM