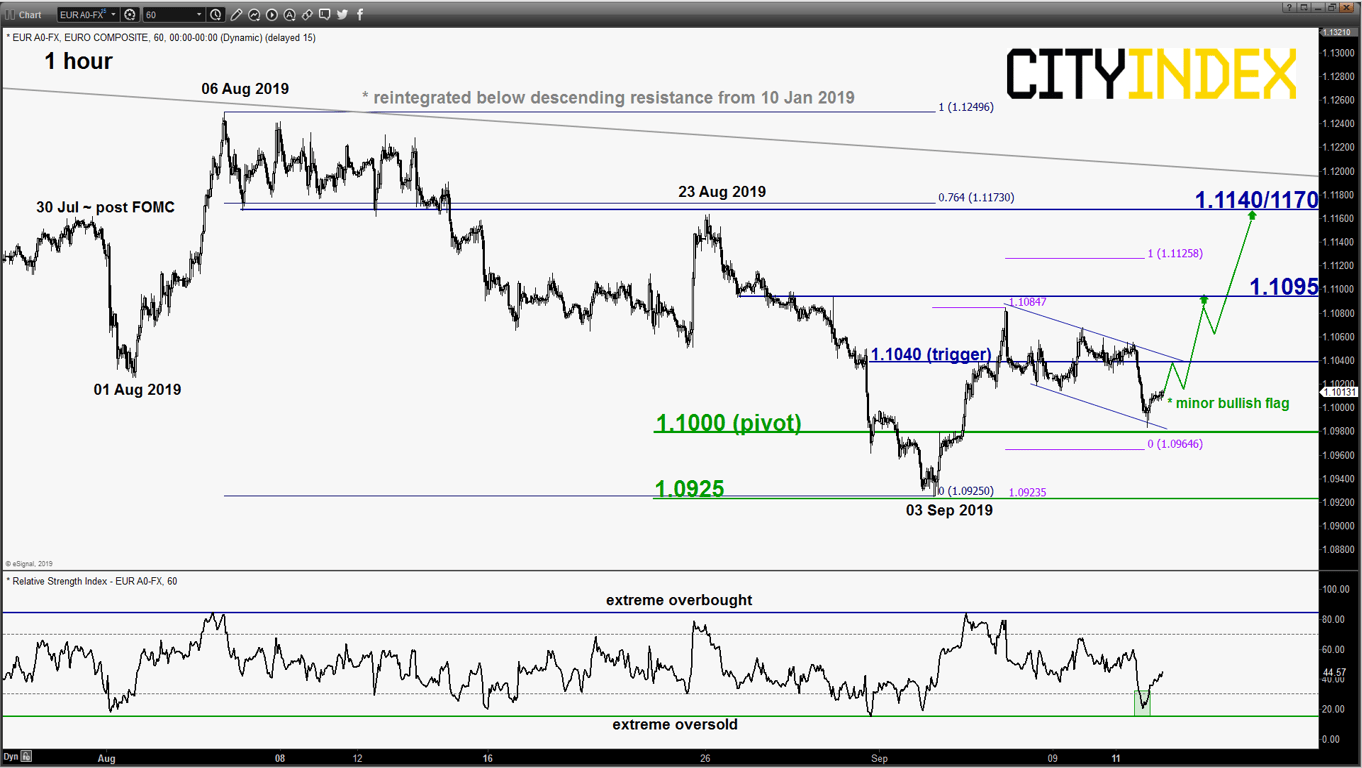

EUR/USD – 2nd leg of corrective rebound phase remains intact

click to enlarge chart

- The recent pull-back of 100 pips from its 05 Sep high of 1.1085 has stalled right at the 1.1000 key short-term pivotal support as per highlighted in our previous report (click here for a recap) ahead of ECB’s monetary policy meeting today.

- Short-term elements are still positive; and the past 4-day of slide can be considered as a “bullish flag” range configuration. Maintain bullish bias with 1.1000 remains as the key short-term pivotal support and added 1.1040 as the upside trigger level (upper limit of the “flag”) to reinforce another leg of potential corrective rebound to target the next resistance at 1.1095 follow by 1.1140/1170 next.

- However, a break with an hourly close below 1.1000 negates the bullish tone to see a further slide to retest 1.0925.

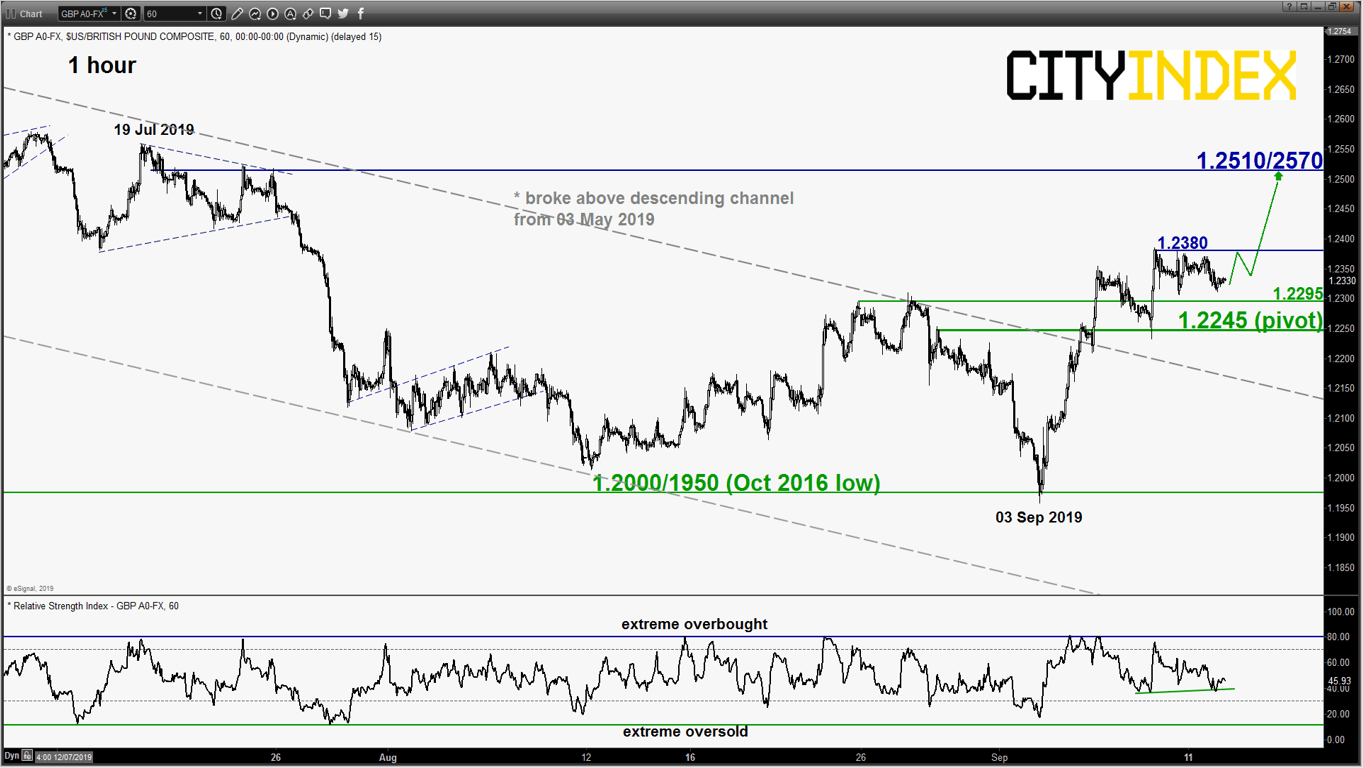

GBP/USD – 1.2245 remains the key support to watch

click to enlarge chart

- Maintain bullish bias in any dips above 1.2245 key short-term pivotal support and a break above 1.2380 reinforces another leg of potential corrective rebound to target the key resistance at 1.2510/2570 (upper boundary minor ascending channel from 03 Sep 2019 low & former major ascending support from 07 Oct 2016 low).

- However, a break with an hourly close below 1.2245 invalidates the corrective rebound scenario for a bearish reversal to retest 1.2000/1950 in the first step.

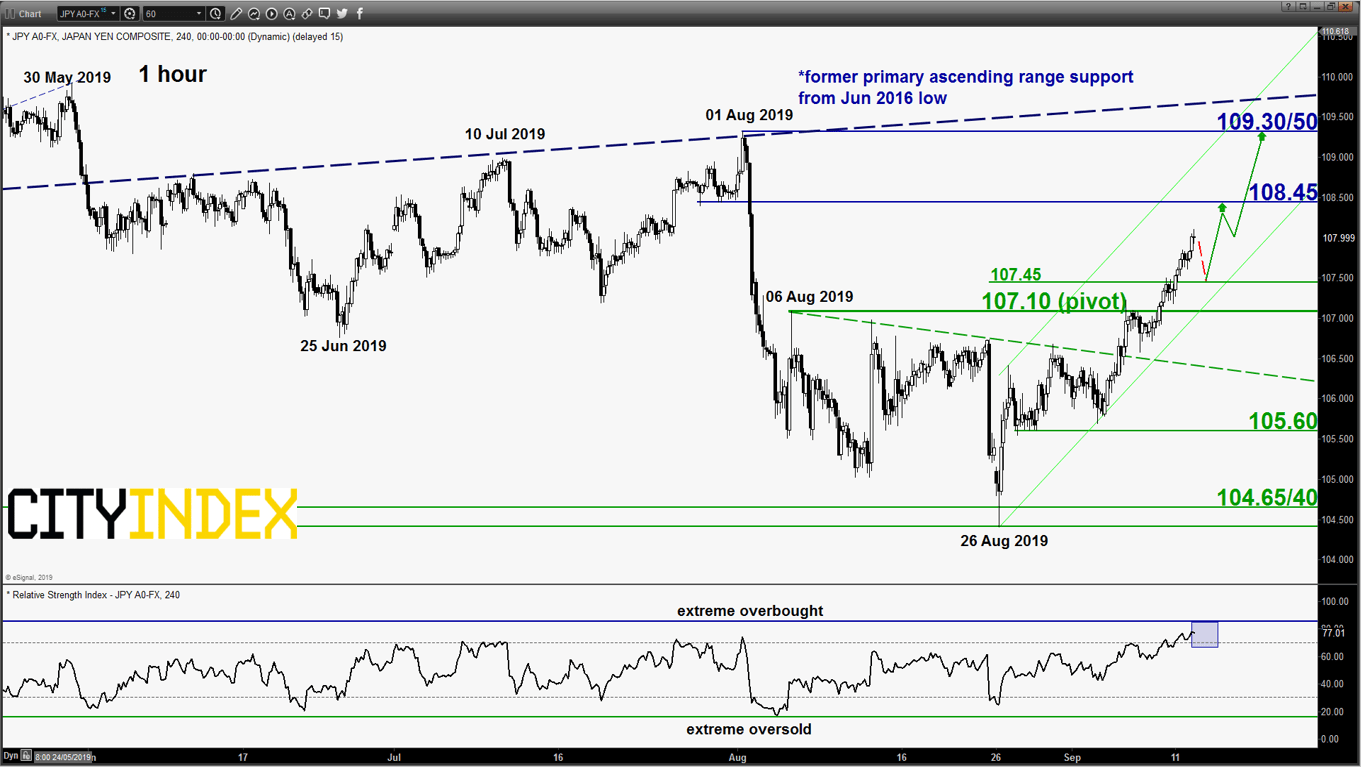

USD/JPY – Pull-back before another leg of corrective rebound

click to enlarge chart

- The pair has staged the expected push up towards the 108.45 short-term target/resistance in line with the on-going “risk on” environment as per highlighted in our previous report. It has printed a current intraday high of 108.10 in today’s Asian session.

- The hourly RSI oscillator is not coming close to an extreme overbought level but without any bearish divergence signal which favours a minor pull-back rather a bearish reversal of the on-going rebound from 26 Aug 2019 low. Maintain bullish bias in any dips above the adjusted key short-term pivotal support now at 107.10 for a further potential corrective rebound to target 108.45 before the key resistance of 109.30/50.

- However, a break with an hourly close below 107.10 invalidates the corrective rebound scenario for another round of choppy slide back towards 105.60 and even 104.65/40 next.

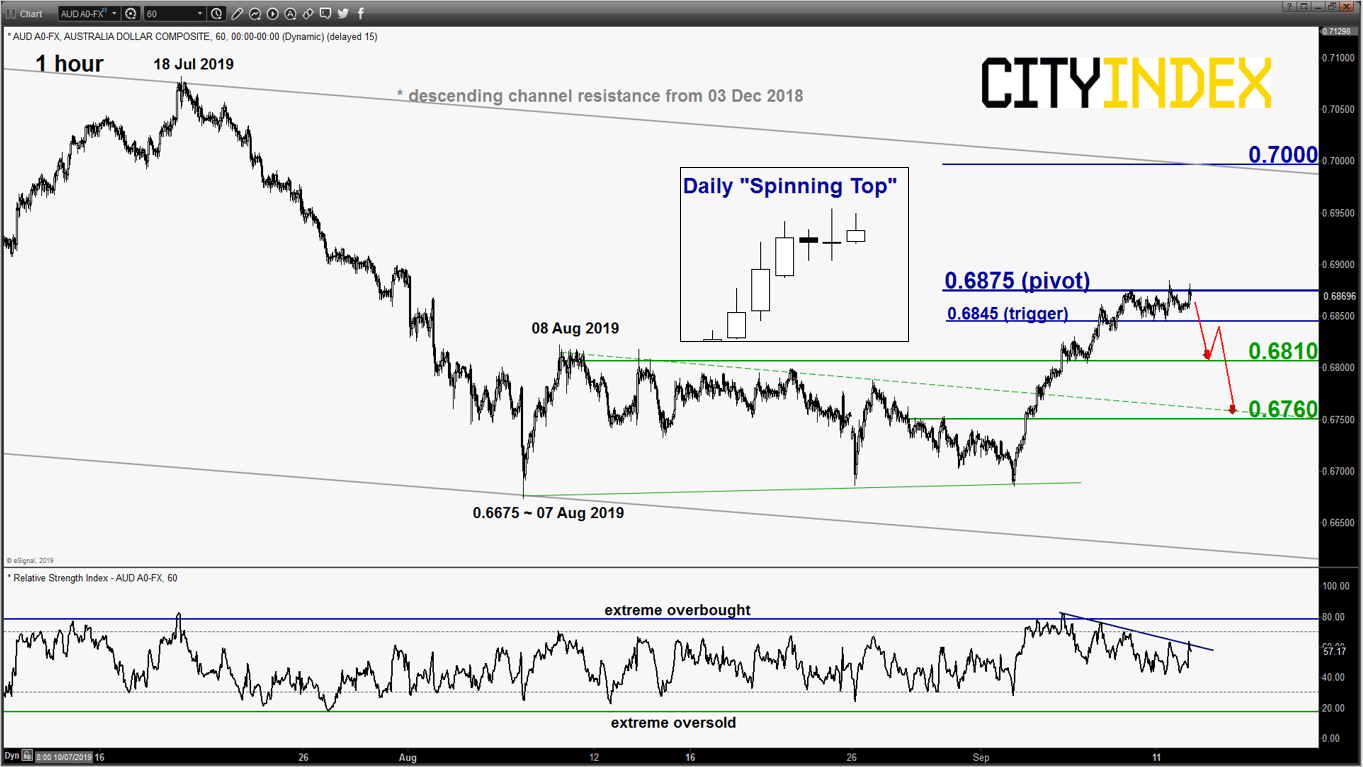

AUD/USD – 0.6875 remains the key resistance to watch

click to enlarge chart

- Interestingly, the pair has failed to make a clean break above the 0.6875 key short-term pivotal resistance as per highlighted in our previous report despite the on-going “risk on” environment.

- Elements are still advocating for a potential minor slide in the first step with a daily “Spinning Top” candlestick pattern formed at the end of yesterday, 11 Sep U.S. session. This observation indicates indecisiveness by the bulls to push prices higher.

- Maintain bearish bias and added 0.6845 as the downside trigger level where a break below it reinforces the potential slide to target 0.6810 and even 0.6760 next. However, a clearance with an hourly close above 0.6875 sees the continuation of the corrective rally towards 0.7000 next (upper boundary of the descending channel from 03 Dec 2018 high).

Charts are from eSignal

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM