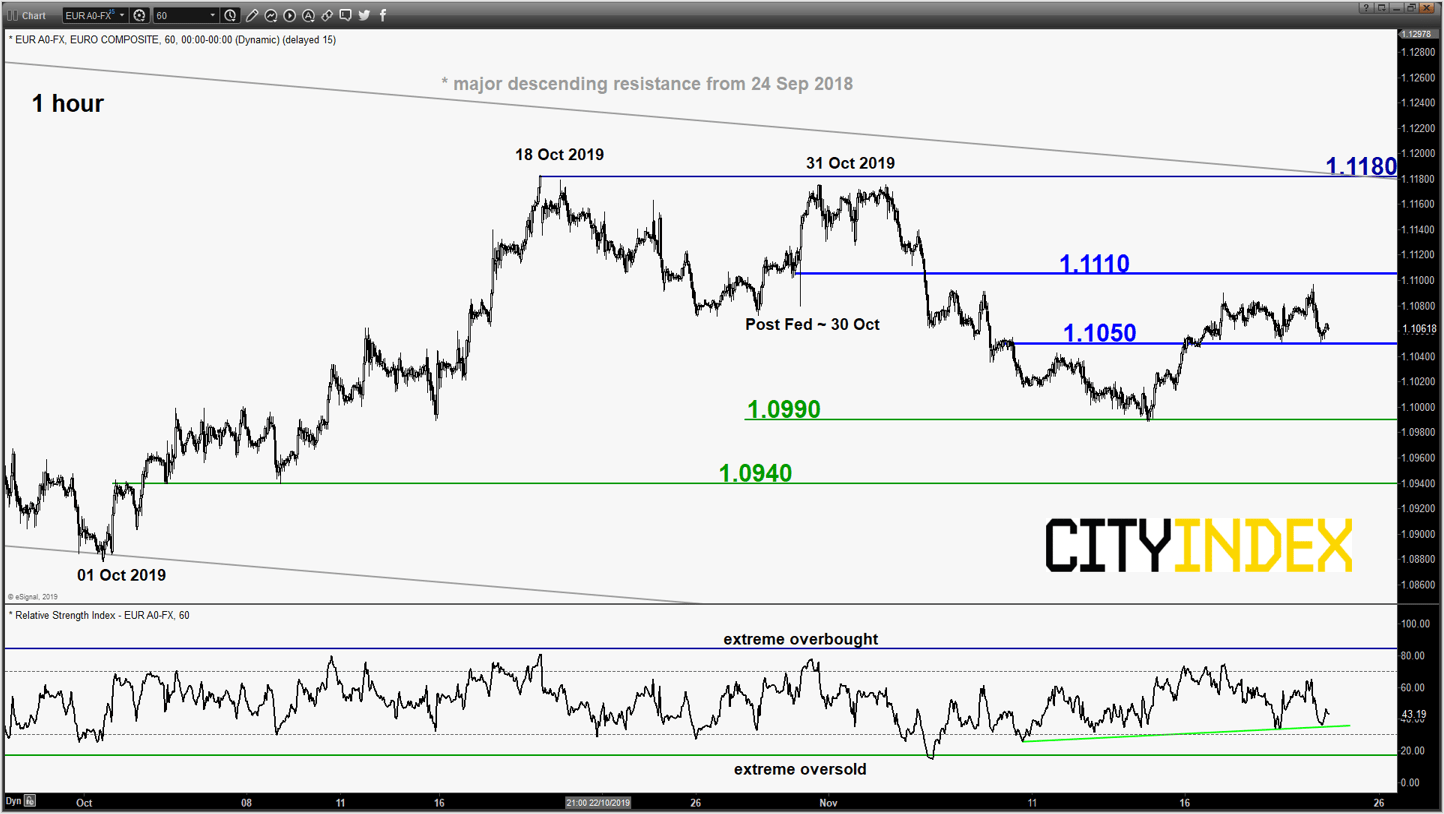

EUR/USD – Sideways

click to enlarge chart

- The pair has continued to churn in a sideways fashion in the past two days. No change, maintain neutrality stance within a zone of 1.1110 and 1.1050. A clearance with an hourly close above 1.1110 sees an extension of the minor corrective rebound to target the 1.1180 major descending resistance from 24 Sep 2018 high.

- On the flipside, an hourly close below 1.1050 opens up scope for a slide towards 1.0990 and 1.0940 next.

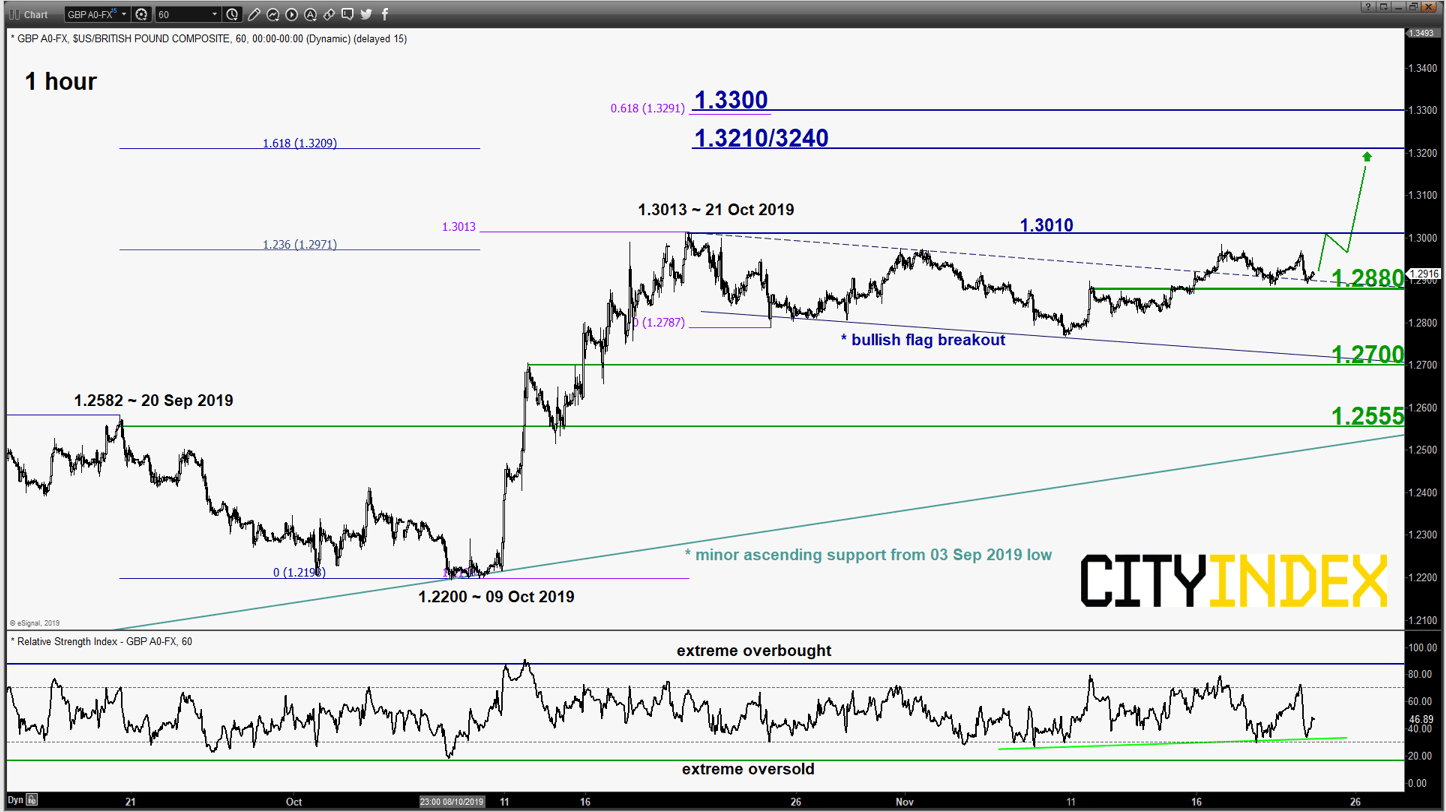

GBP/USD – 1.2880 remains the key short-term support

click to enlarge chart

- The pair has pull-backed and traded sideways righted at the pull-back support of the former minor “bullish flag” resistance from 21 Oct 2019 high. In addition, the hourly RSI oscillator has staged a bounce from a corresponding support that is closed to its oversold region which indicates a revival of short-term upside momentum.

- Maintain bullish bias as per highlighted in our previous report (click here for a recap) above the 1.2880 key short-term pivotal support for another round of potential upleg to retest 1.3010 before targeting the next intermediate resistance at 1.3210/3240 (3 Apr/03 May 2019 swing high area & Fibonacci expansion).

- However, a break with an hourly close below 1.2880 implies a failure bullish breakout to see the continuation of the corrective decline towards the next support at 1.2700.

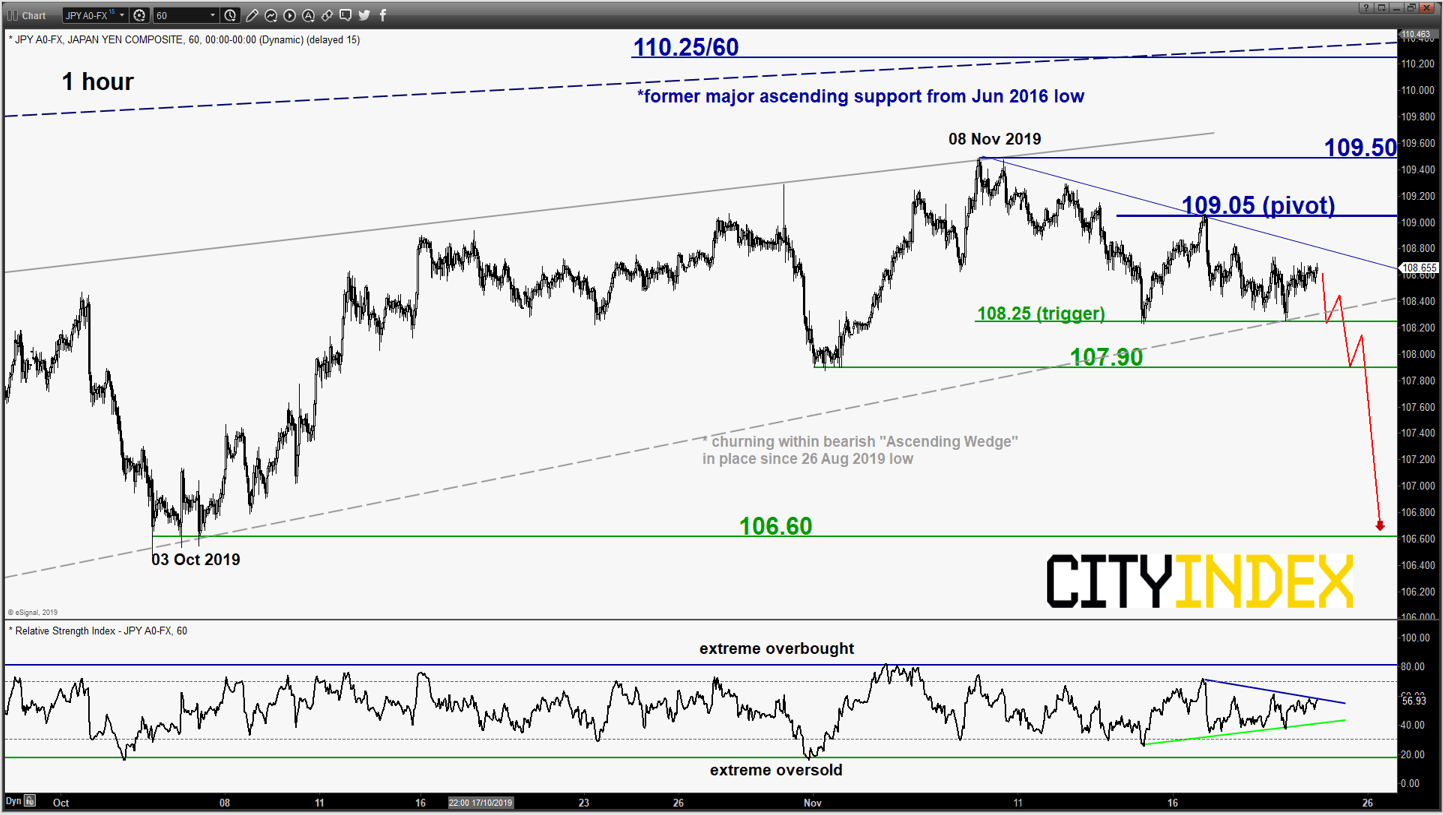

USD/JPY – Bears need to break below 108.25

click to enlarge chart

- The pair has drifted lower as expected to test the medium-term bearish Ascending Wedge support in place since 26 Aug 2019 swing low area and started to churn sideways again.

- Maintain bearish bias below 109.05 key short-term pivotal resistance and a break with an hourly close below 108.25 (Ascending Wedge support & 15 Nov 2019 low) is likely to reinforce the bearish breakdown to target the next supports at 107.90 follow by 106.60 next.

- On the other hand, an hourly close above 109.05 negates the bearish tone for a push up to retest the recent 08 Nov 2019 swing high of 109.50.

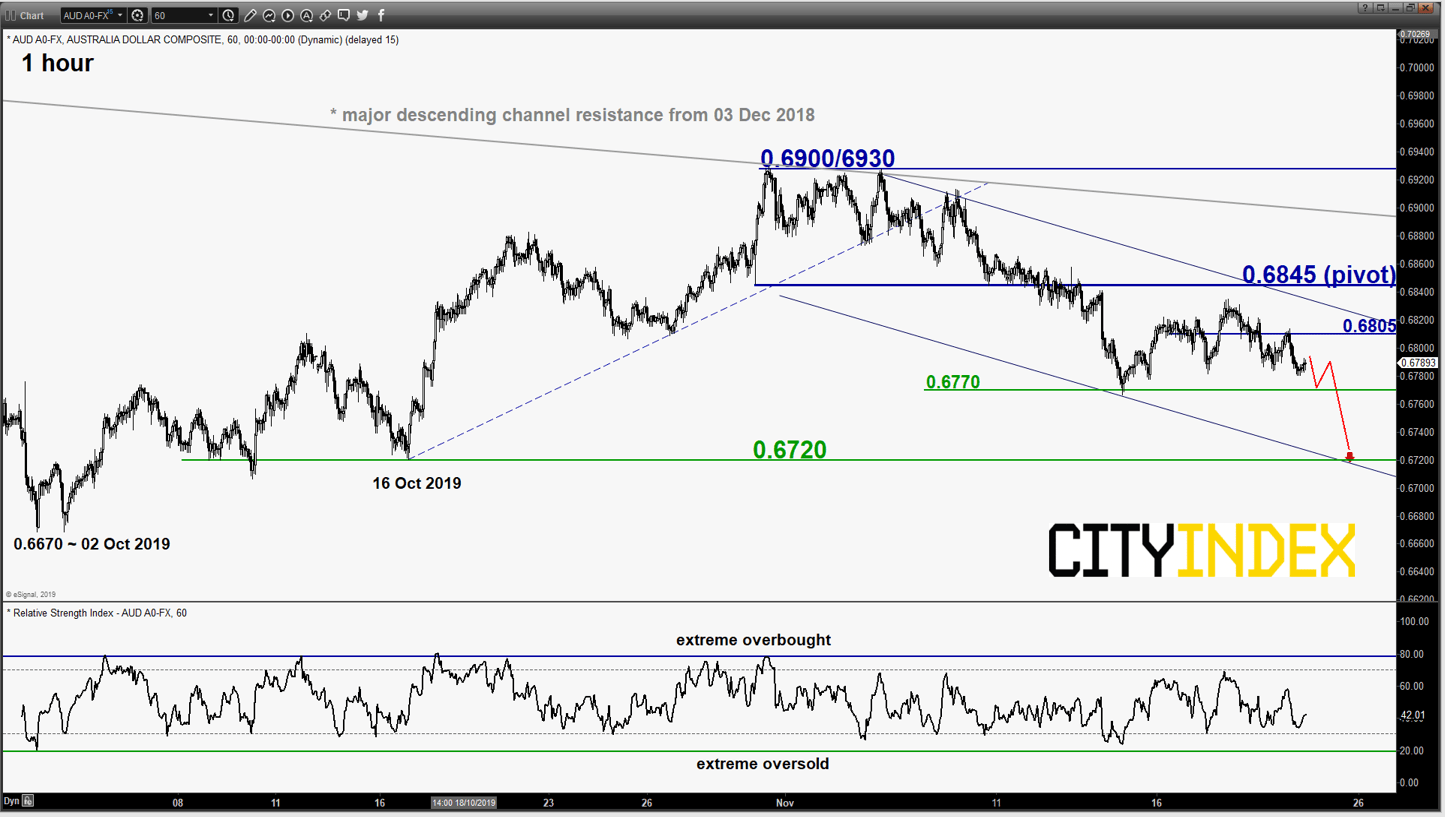

AUD/USD – Further potential drop in progress

click to enlarge chart

- The pair has shaped a series of minor “lower highs” since 19 Nov 2019; maintain bearish bias below 0.6845 key short-term pivotal resistance for a further potential drop to retest 0.6770 before targeting the next near-term support at 0.6720 (09/16 Oct 2019 swing low areas & lower boundary of the minor descending channel in place since 05 Nov 2019 high).

- On the other hand, a clearance with an hourly close above 0.6845 negates the bearish tone for squeeze up to retest 0.6900/6930 (31 Oct/05 Nov 2019 swing high & the major descending channel resistance from 03 Dec 2018 high).

Charts are from eSignal

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM