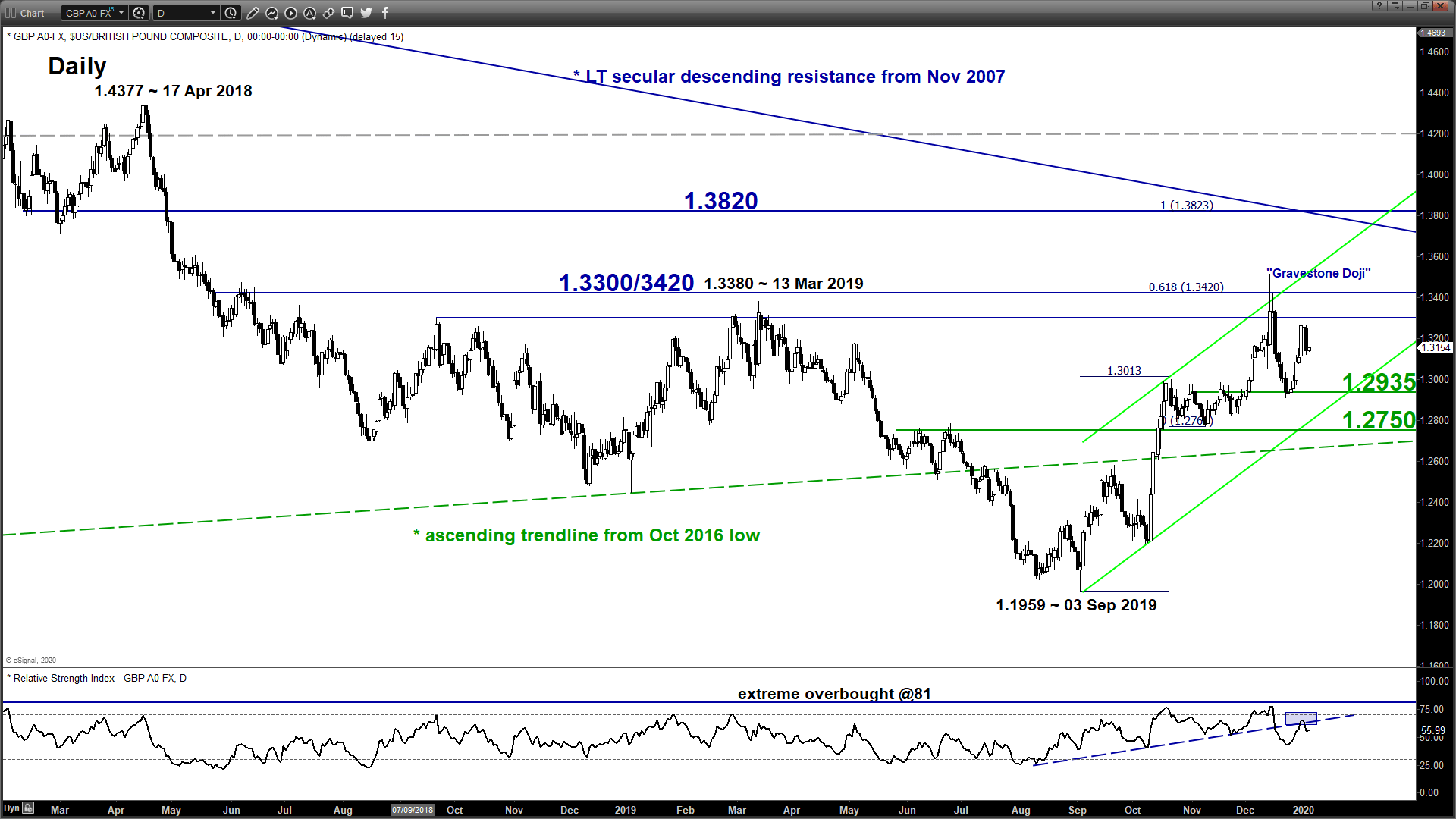

GBP/USD – Potential start of another downleg within medium-term uptrend

click to enlarge charts

- The pair has staged the expected minor rebound after it made a low of 1.2903 on 23 Dec 2019 and hit the target/resistance of 1.3215 where it printed a high of 1.3284 on 31 Dec 2019 (click here for a recap).

- Interestingly, the recent rebound of 360 pips has been rejected again right at the significant medium-term resistance zone of 1.3300/3420 that also confluences with the 61.8% Fibonacci retracement of the previous downleg from 13 Dec 2019 high of 1.3515 to 23 Dec 2019 low of 1.2903 (see daily chart). In addition, the daily RSI oscillator has also retreated from its overbought region and a corresponding resistance.

- Thus, the pair now may see the start of another minor downleg sequence with 1.3300 as the pivotal resistance (where a potential bounce can materialise first due to the oversold condition seen on the hourly RSI) to target the next near-term supports of 1.3010 and 1.2920.

- On the other hand, an hourly close above 1.3300 negates the bearish scenario for a squeeze up to retest the 13 Dec 2019 swing high of 1.3515.

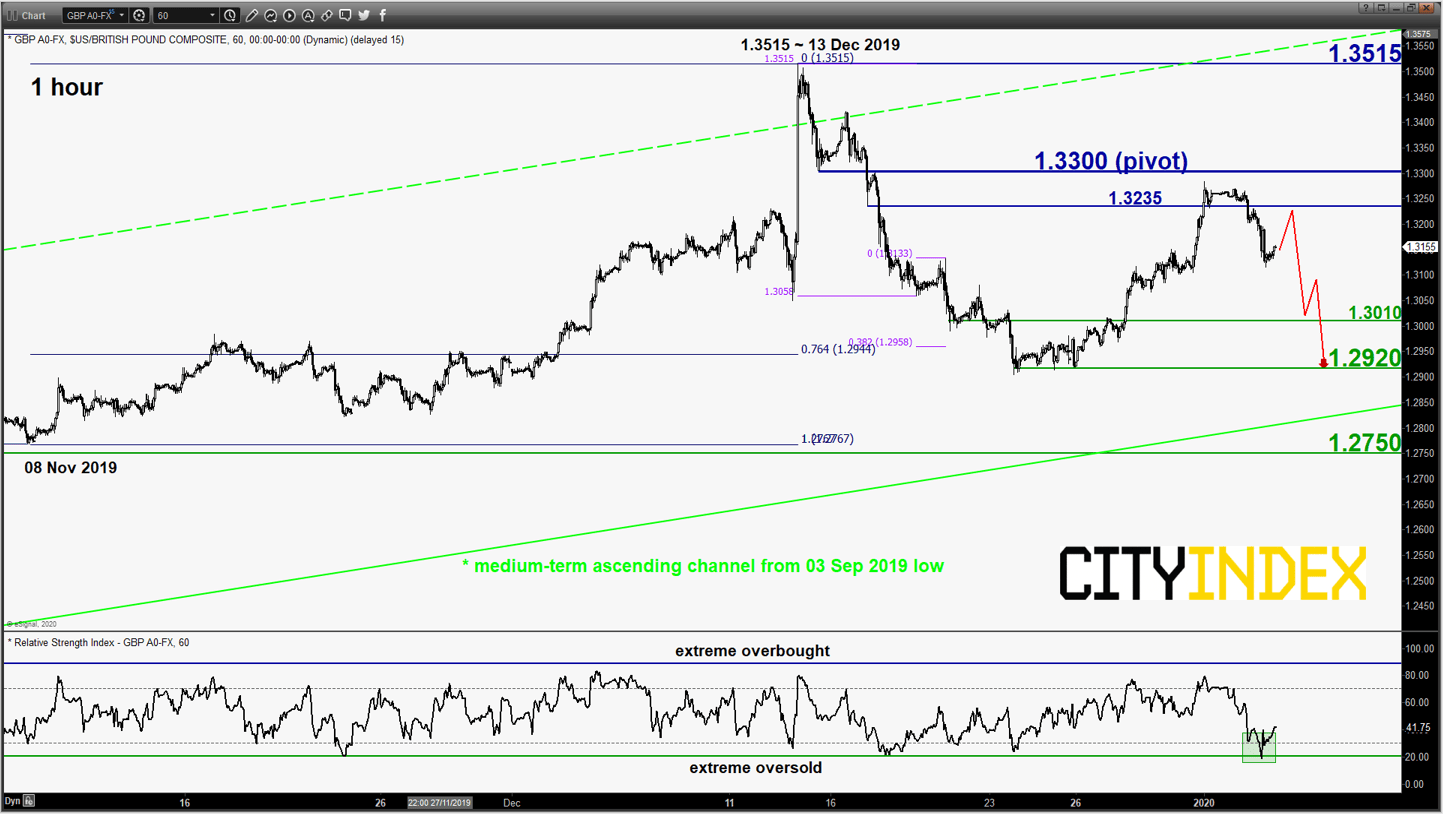

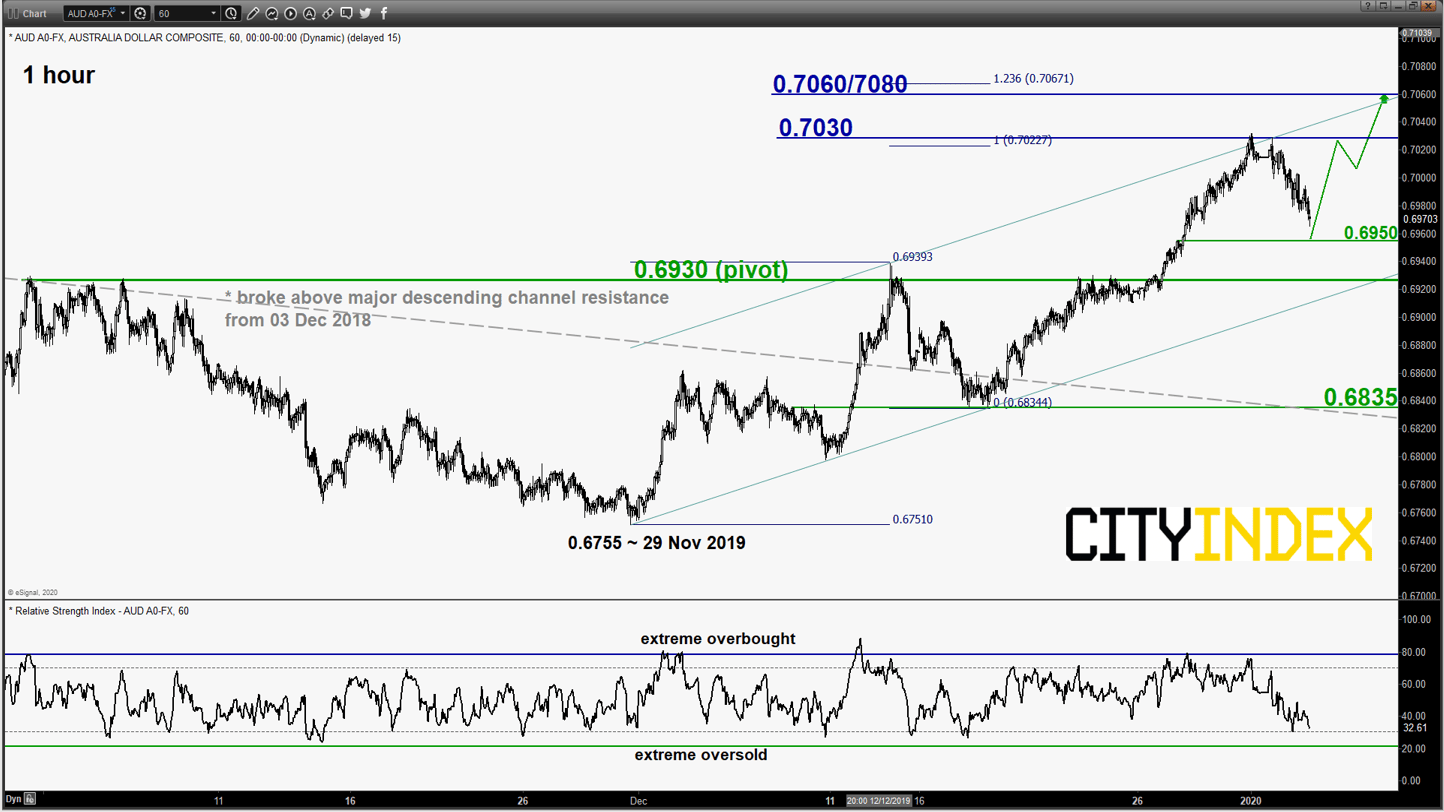

EUR/USD – Medium-term up move in progress

click to enlarge charts

- The pair has staged a bullish breakout from its medium-term range configuration in place since 18 Oct 2019 and a major descending resistance from 24 Sep 2018 swing high.

- Flip to a bullish bias in any dips above 1.1115 pivotal support for a potential push up to retest the recent swing high of 1.2390 printed on 31 Dec 2019 before targeting the next intermediate resistance of 1.1285 (minor ascending channel resistance & Fibonacci retracement/expansion cluster).

- On the other hand, an hourly close below 1.1115 negates the bearish scenario for a further slide towards the 1.1060/1040 medium-term support.

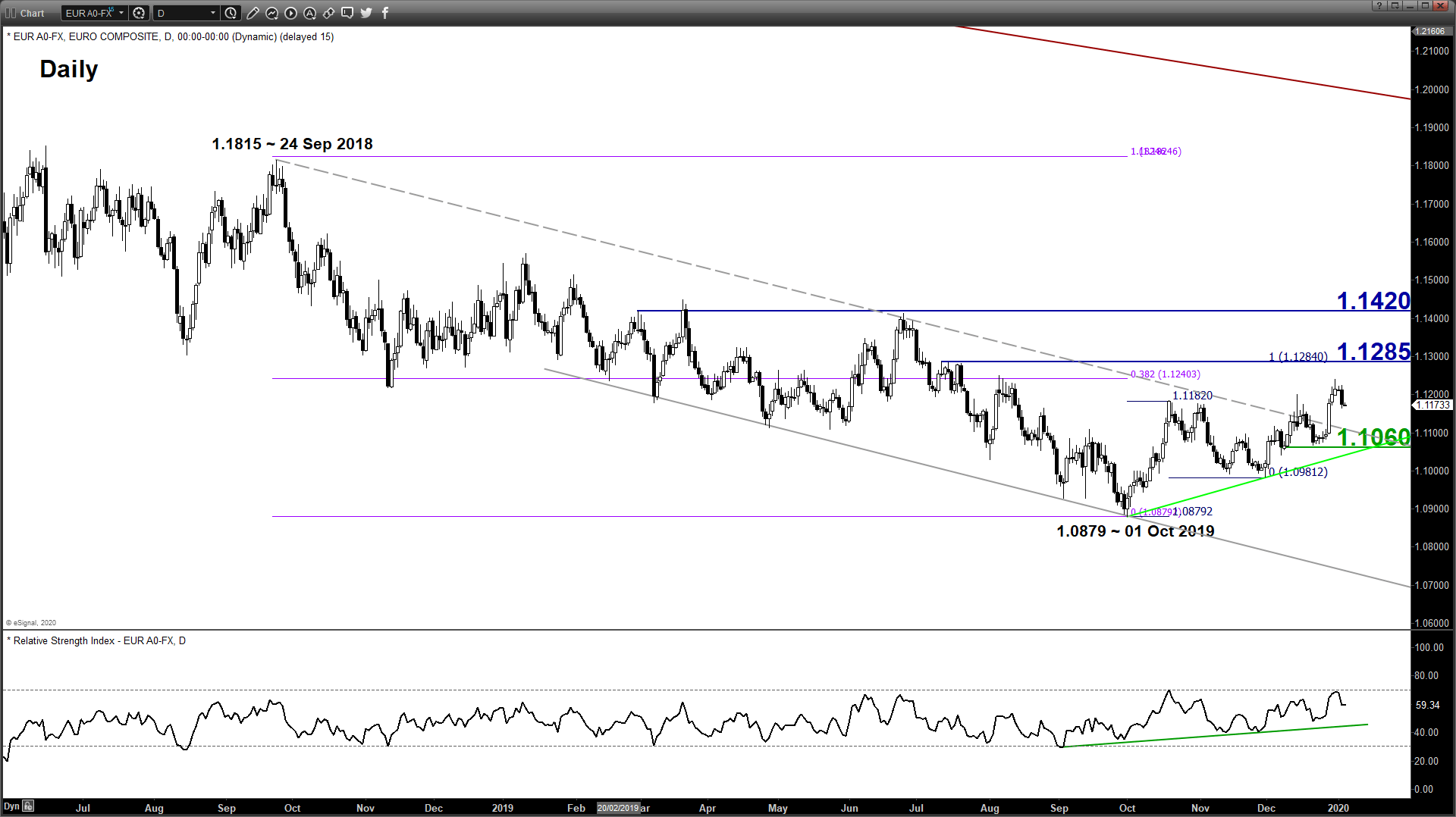

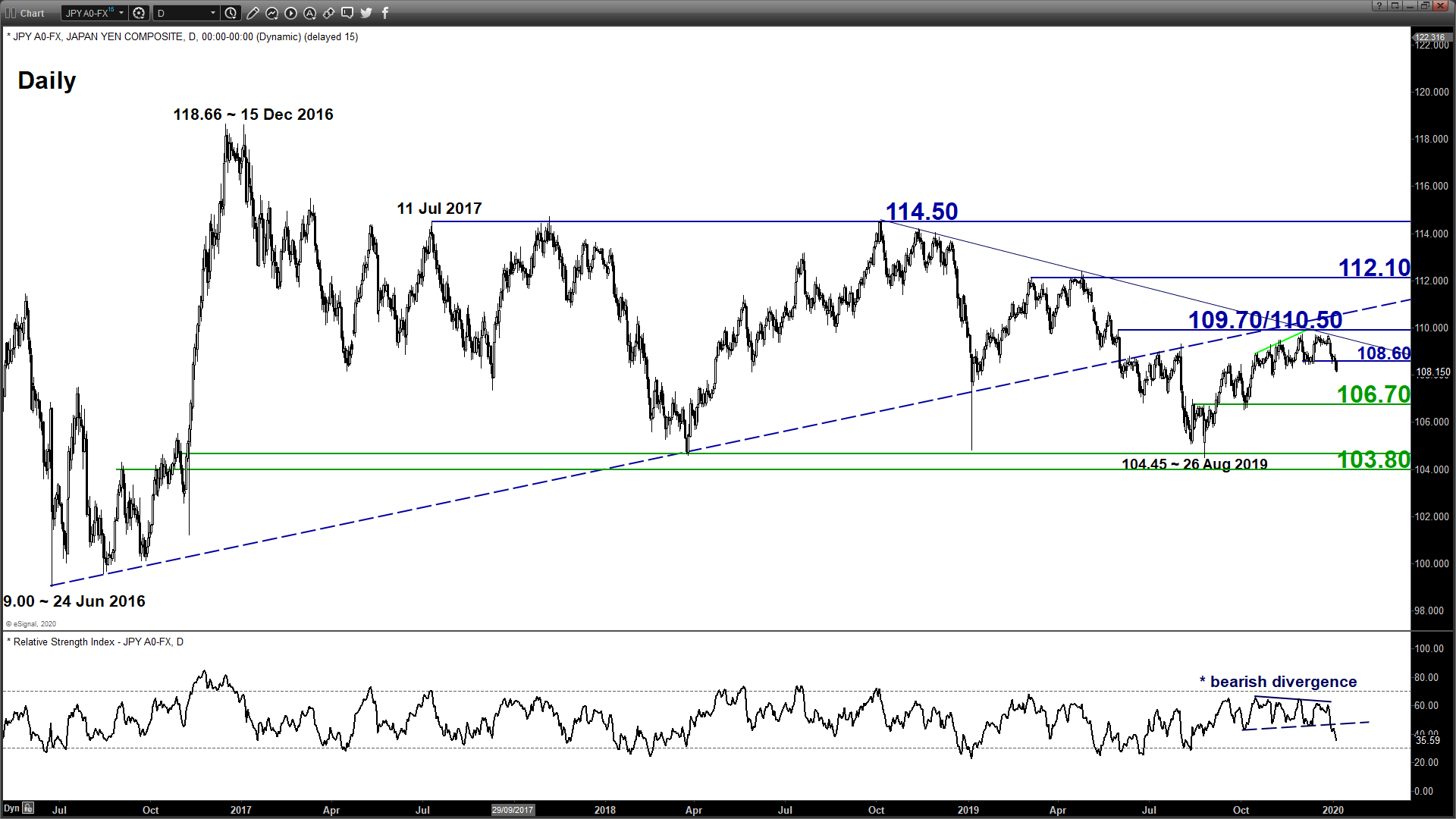

USD/JPY – Bears gain a foothold below 109.70/110.50

click to enlarge charts

- The pair has staged the expected slide in the last week of 2019 and hit the downside target of 103.30 as per highlighted in our previous report.

- Key elements remain negative; maintain bearish bias with an adjusted short-term pivotal resistance now at 108.95 for a potential continuation of the downleg sequence to target the next near-term supports of 107.90 and 107.60 next.

- On the other hand, a clearance with an hourly close above 108.95 negates the bearish scenario for a push up to retest the recent 109.70 range resistance.

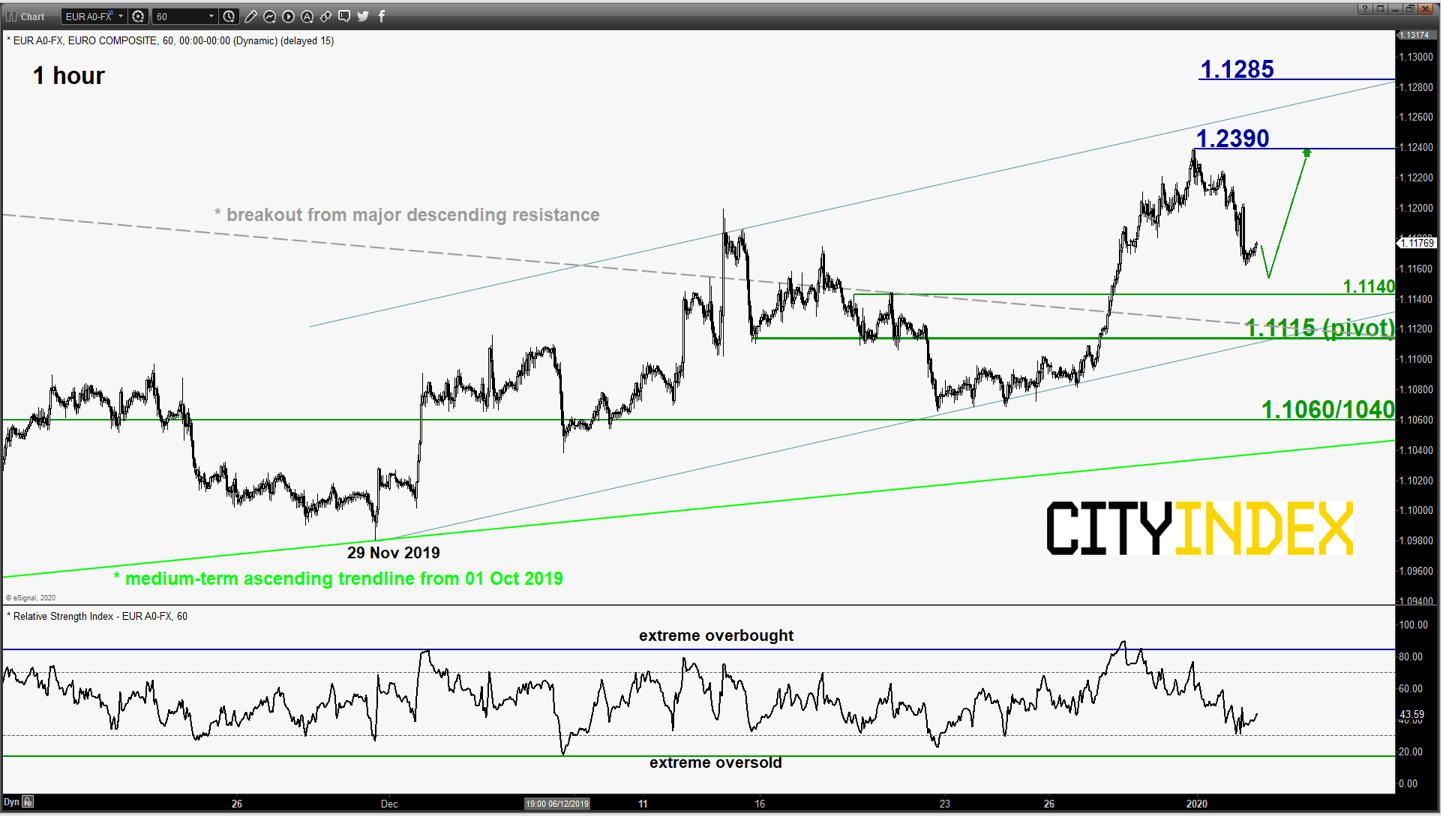

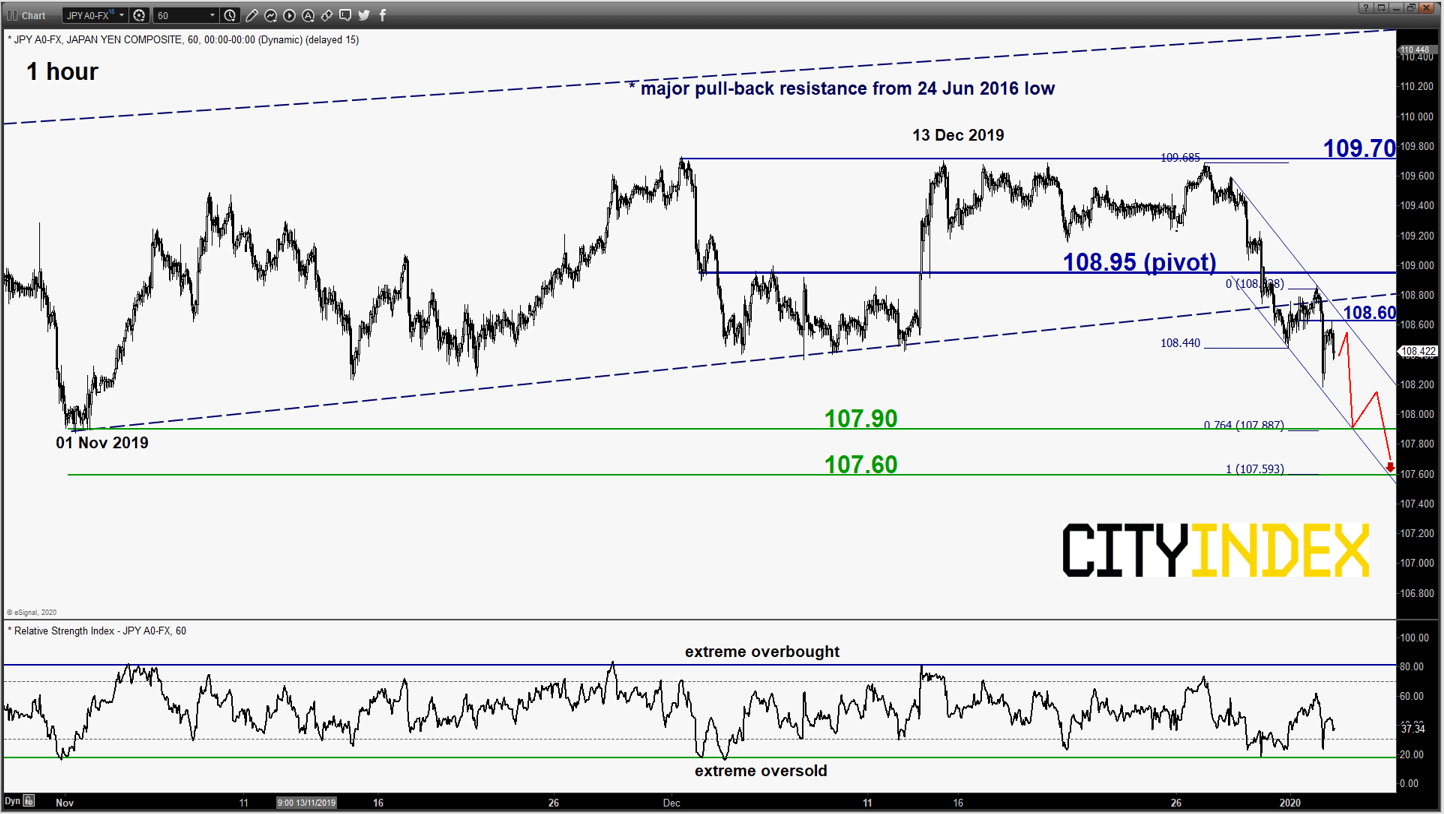

AUD/USD – Further potential upside

click to enlarge charts

- The pair has broken above the 0.6930 upper limit of the neutrality range as per highlighted in our previous report where at least a minor/short-term upleg sequence has been validated.

- Flip to a bullish bias in any dips above the 0.6930 short-term pivotal support for a potential push up to retest the recent swing high of 0.7030 (printed on 31 Dec 2019) before targeting the next intermediate resistance of 0.7060/7080.

- On the other hand, a break with an hourly close below 0.6930 invalidates the bullish scenario for a further slide towards the medium-term support at 0.6835.

Charts are from eSignal

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM