Currency Pair of the Week: NZD/USD

The Reserve Bank of New Zealand (RBNZ) meets this week to discuss interest rate policy. Like so many other central banks, the RBNZ had cut their key interest rate to record lows at 0.25%. At the previous meeting in April, the central bank left its Large-Scale Asset Purchase Program unchanged at “up to” $100 billion. They noted that a full recovery would take time, and, like the US Fed, RBA, and ECB, they would look past temporary factors which may drive inflation higher. They even said they would lower the OCR if necessary. Since their last meeting, Q1 data has been released and it has been strong, especially labor. The Employment Change was 0.6% for Q1 vs an expectation of 0.2%, while the unemployment rate fell to 4.7% from 4.9%. Expectations are that the RBNZ will leave things unchanged, while upgrading forecasts. Note that due to rampant speculation in the housing market, government restrictions were put in place to try and keep housing prices low. The RBNZ now also considers the effects of their decisions on the housing market. In addition, last week, the government announced a spending package which includes rebuilding Scott Base in Antarctica, rebuilding infrastructure, and boosting benefits for welfare recipients.

On the US front, recent economic data has been weaker. Non-farm payrolls, retail sales, and inflation were all worse than expected, however last weeks Markit PMI flash data for May was stronger than April. The weaker data has continued to push the US Dollar Index lower, as market participants expect any tapering from the Fed to be pushed back. The Fed currently buys $120 billion in bonds per month. Many are blaming the continued extra unemployment benefits as the reason for poor employment data. The US government continues to spend on stimulus and infrastructure, which is also keeping the US dollar lower. Inflation is creeping into the markets; however, the Fed considers it to be transitory. Current expectations seem to be for the Fed to announce tapering in the late summer or early fall. Note that the BOE and BOC have already begun tapering their bond buying program. This week, housing data, Durable Goods, and PCE, the Fed’s preferred measure of inflation. Watch to see if the economic data continues to be weaker while inflation is moving higher.

Everything you need to know about the Federal Reserve

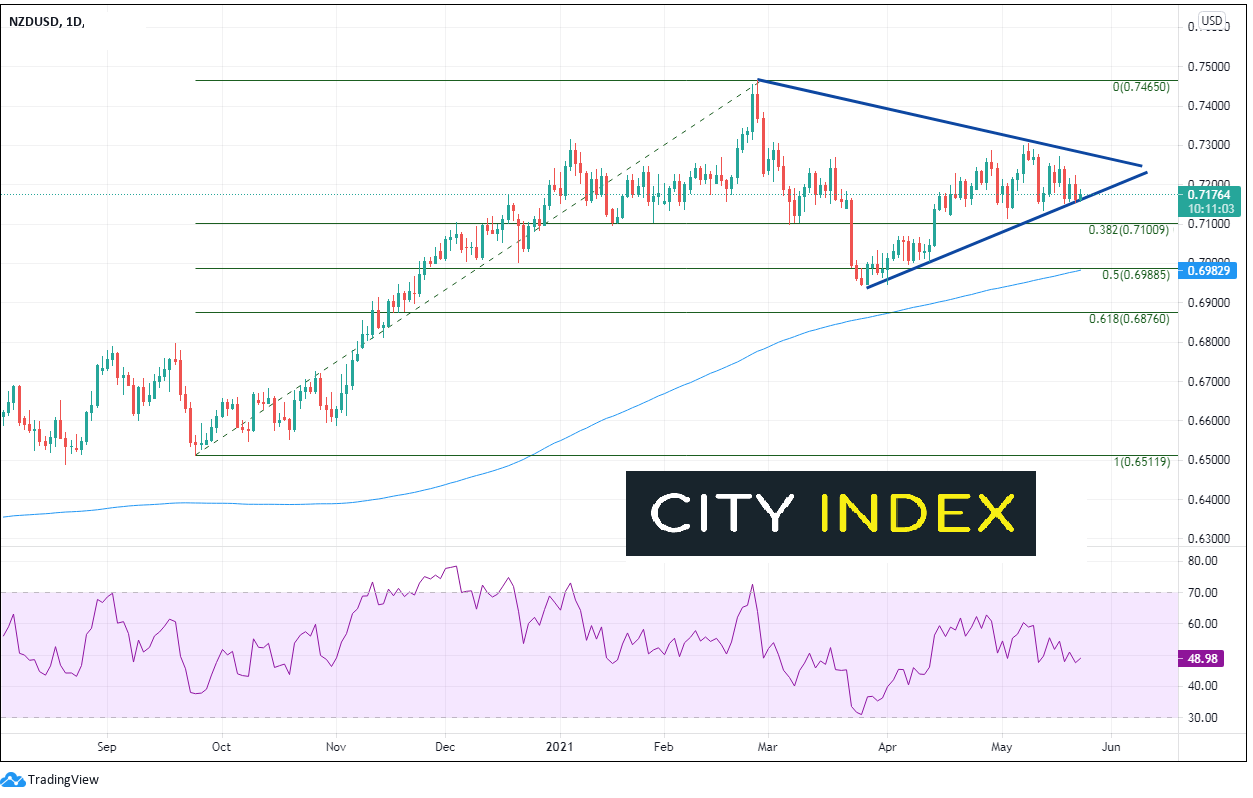

NZD/USD has been moving higher from its pandemic low is March 2020. After a pause last summer, the pair resumed its move higher in the Fall of 2020. The pair peaked on February 25th at 0.7465 and pulled back to the 50% retracement level from the September 25th lows to the February 25th highs, near 0.6989 Since then, price has bounced and is trading in a symmetrical triangle, which is nearing the apex.

Source: Tradingview, City Index

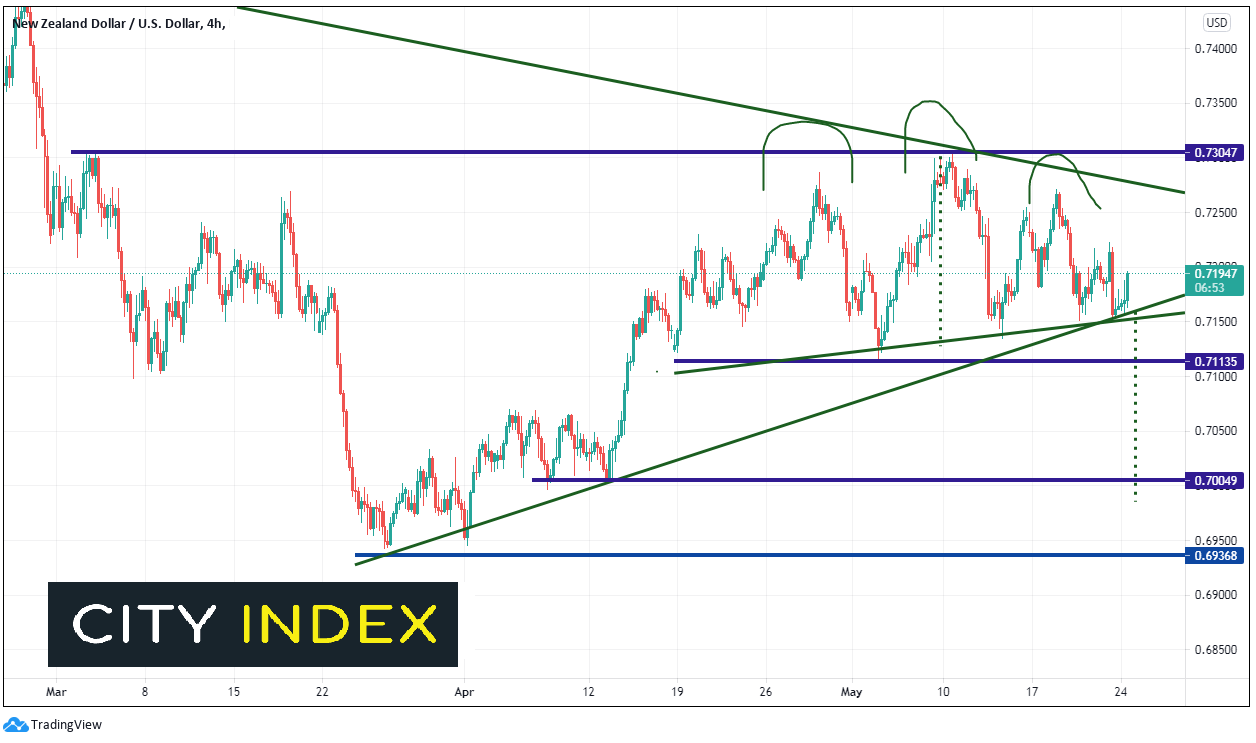

On a 240-minute timeframe, within the symmetrical triangle, NZD/USD appears to be forming a head and shoulders pattern, with the neckline near today’s lows of 0.7158. There is also the upward sloping trendline of the symmetrical triangle at that level which acts as support. Below there is horizontal support at the May 4th lows of 0.7113. The target for the Head and Shoulders pattern is the distance from the Head to the neckline, added to the breakdown point, which is near 0.6990. However just in front of that is horizontal support near the psychological round number support of 0.7000. Resistance above is at the top, downward sloping trendline of the triangle near 0.7275, ahead of the May 10th highs, near 0.7305. If price breaks above there, the next level of resistance isn’t until the February 25th highs at 0.7465.

Source: Tradingview, City Index

NZD/USD has been in a consolidation between 0.7115 and 0.7305 since April 15th. However, a surprise from the RBNZ could push the pair out of the range. In addition, price is near the apex of the symmetrical triangle, signaling it may be time for a breakout. Also, if NZD/USD breaks the neckline of the Head and Shoulders pattern on the 240-minute chart, the pair could be in for a quick move lower.

Learn more about forex trading opportunities.