Central bank divergence

Will central bank divergence become more apparent this week? FOMC minutes & ECB special meeting on tap.

FOMC minutes

The latest Federal Reserve meeting, mid-June saw the Fed announce an unexpected hawkish shift. The Fed caught the market off guard by announcing that it now expects two interest rate rises in 2023, when before it didn’t expect any until 2024. The move boosted the US Dollar which went on to hit a 3 month high.

Federal Reserve speakers since then have painted more of a mixed picture. Whilst the likes of Federal Reserve Chair Powell and Federal Reserve President of New York, Williams have remained cautious and attempted to put a dovish spin on the announcement, other Federal Reserve members have been considerably more hawkish. St Louis Fed President James Bullard made his case for a rate rise in 2022!

The minutes from the latest Fed meeting are due to be released this week and could provide further insight into the discussions surrounding the changes to the dot plot and how transitory the Fed sees the recent spike in inflation. Investors will be scrutinizing the minutes for any clues over the likely timeline and criteria for QE tapering.

ECB special meeting

The economy in Europe is starting to rebound following the pandemic induced contraction. Today’s PMIs came in stronger than initially expected boding well for the growth this quarter. Europe, as in the US has seen inflation jump higher above the ECB’s tager level, although the latest print has seen it slip mildly lower to 1.9% YoY.

Similarly, the ECB is divided about where policy should be heading and the timeline involved. ECB President Christine Lagarde just last week said that the recovery in the bloc is still fragile. Lagarde added that she was simply not ready to wind up the Pandemic Emergency Purchase Programme just yet.

The ECB will hold an extraordinary meeting this week to finalise its 18 month long strategy review. The meeting is due to start on Tuesday and potentially continue through the Thursday. The central bank is widely expected to shift its inflation target from “close to, but below 2%” which is currently is now to something more like “around 2%”.

This would effectively mean that the chances of the ECB hiking rates is pushed back even further.

Where next for EUR/USD?

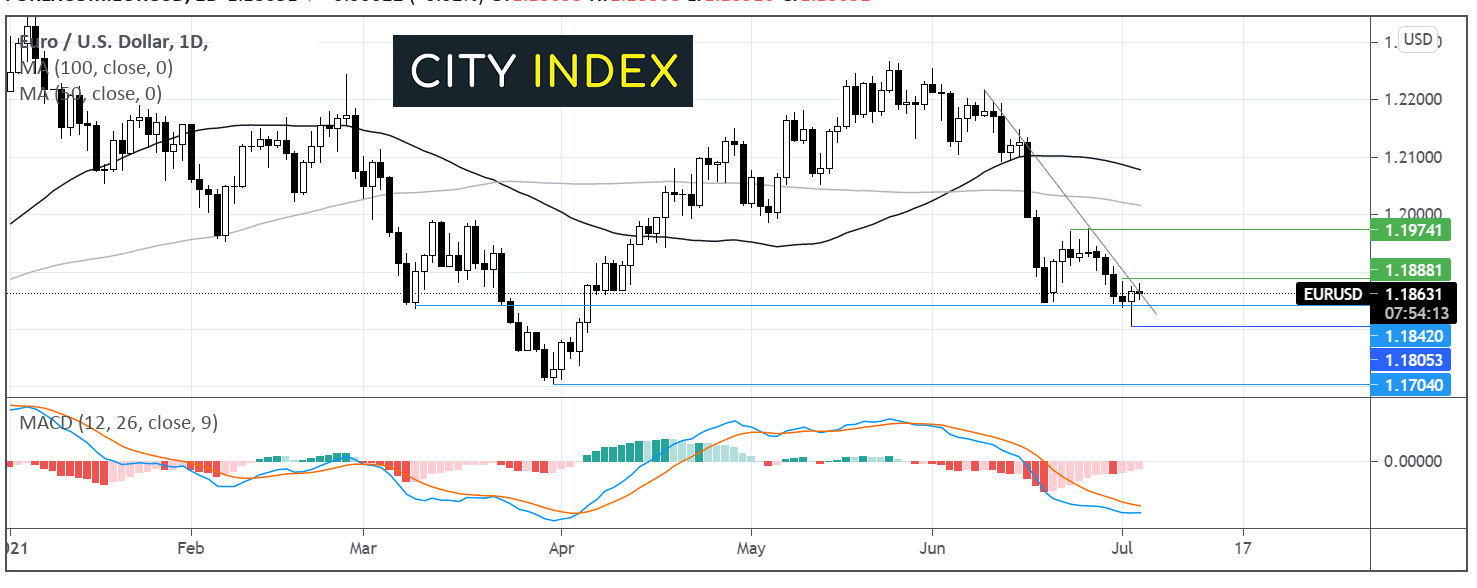

The EUR/USD trades within a bearish trend, below its steeply descending trendline dating back to early June.

The pair is attempting to cross above the descending trendline and the receding bearish picture on the MACD is keeping the buyer’s hopeful. This can indicate that a bullish move is coming. Watch for a bullish crossover on the MACD, which could be forming.

However, it was take a move over 1.1885 the July high and 1.19 round number to raise the prospect of a meaningful move higher and to bring 1.1975 back into the picture.

On the flip side a move through 1.1850 could see the seller look to test 1.18 July low and round number ahead of a deeper sell off to 1.17 the year to date low.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.