Currency Pair of the Week: AUD/USD

The Reserve Bank of Australia meets on Tuesday and expectations are for the central bank to leave monetary policy unchanged, with interest rates sitting at a record low of 0.1%. Although this is the most likely outcome, there could be an uneasy feeling beginning to brew through some board members. The RBA has indicated that that they will not raise the cash rate until inflation in sustainably within the 2%-3% range, which they don’t expect until 2024. Markets seem to think this may be sooner. As with most central banks, the RBA is focusing on employment over inflation. Note that Australia let its JobKeeper wage subsidy expire last week, therefore the RBA must be on its toes and watch for employment to recede in the near-term. Australia’s March Employment Change showed that 88,700 jobs were added to the economy vs 30,000 expected. This was the most since October 2020. The next employment print is due on April 15th, with early estimates calling for only +20,000. In addition, although the ongoing rise in inflation seems to be a minor concern, housing prices are rising, along with yields. The RBA will continue is bond buying program over the next month. The vaccine rollout has been slow; however, Australia has done a great job of containing the coronavirus. This doesn’t seem to be much of an issue at this point.

As with the RBA, the US Federal Reserve is turning their attention almost entirely towards maximizing employment. Last week, the US released its Non-Farm Payroll report which showed the US added 916,000 jobs to the economy in March vs a consensus of 650,000. In addition, the January and February prints were revised higher by 156,000! With stimulus checks rolling out and Biden’s proposed infrastructure (spending) project, nearly $4 trillion will be added to the economy. However, the infrastructure proposal comes with an asterisk, and that is higher corporate taxes and higher taxes on individuals making over $400,000. Watch for Republicans to go toe-to-toe with Democrats over tax increases. But at this point, economists are looking for a summer boom in job creation and spending. The vaccine rollout has increased significantly over the past few weeks, and US President Joe Biden has indicated that he hopes all Americans will be eligible to receive the jab by May 1st. Although the Fed feels the rise in yields and in inflation expectations is transitory and unsustainable, it may take until Q3 to see if the spending and hiring boom ends, once the stimulus checks run out.

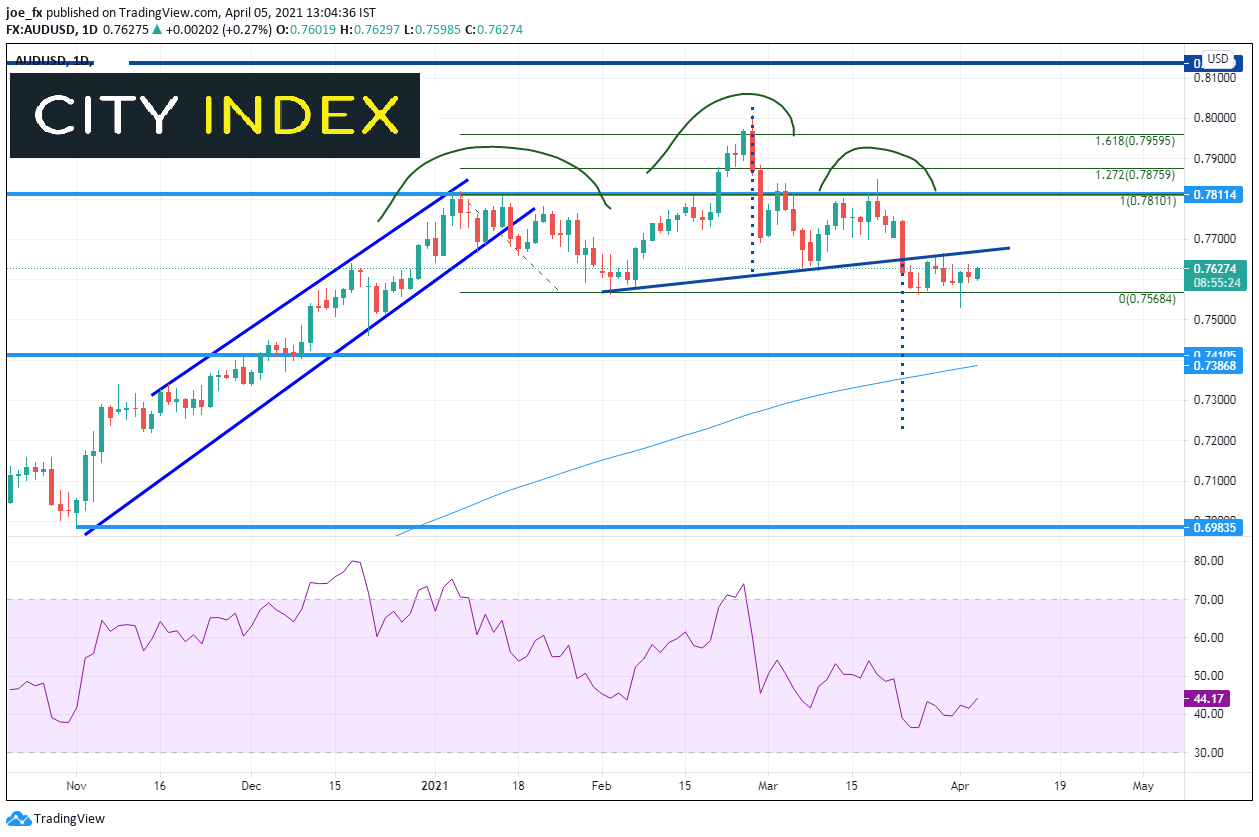

As pointed out by my colleague Matt Weller, AUD/USD has formed a long-term head and shoulders patten. In the run up to the left shoulder AUD/USD rose from early November near 0.6991 until January 6th near 0.7820 in an upward sloping channel. Price pulled back, and in forming the head, price traded to the 161.8% Fibonacci extension of the January 6th highs to the February 2nd lows, near 0.8007. Price failed to hold above the psychological round number 0.8000 level and pulled back. In mid-March, price formed the right shoulder and broke the neckline on March 23rd. Price has held the February 2nd lows near 0.7568, however AUD/USD is threatening to trade lower after retesting the neckline above. The target for a head and shoulders pattern is the length of the head added to the breakdown from the neckline, which is near 0.7225. However, price must first break though the April 1st lows of 0.7531, horizontal support dating back to September 1st, 2020 at 0.7410, and the 200 Day Moving Average, currently at 0.7387.

Source: Tradingview, City Index

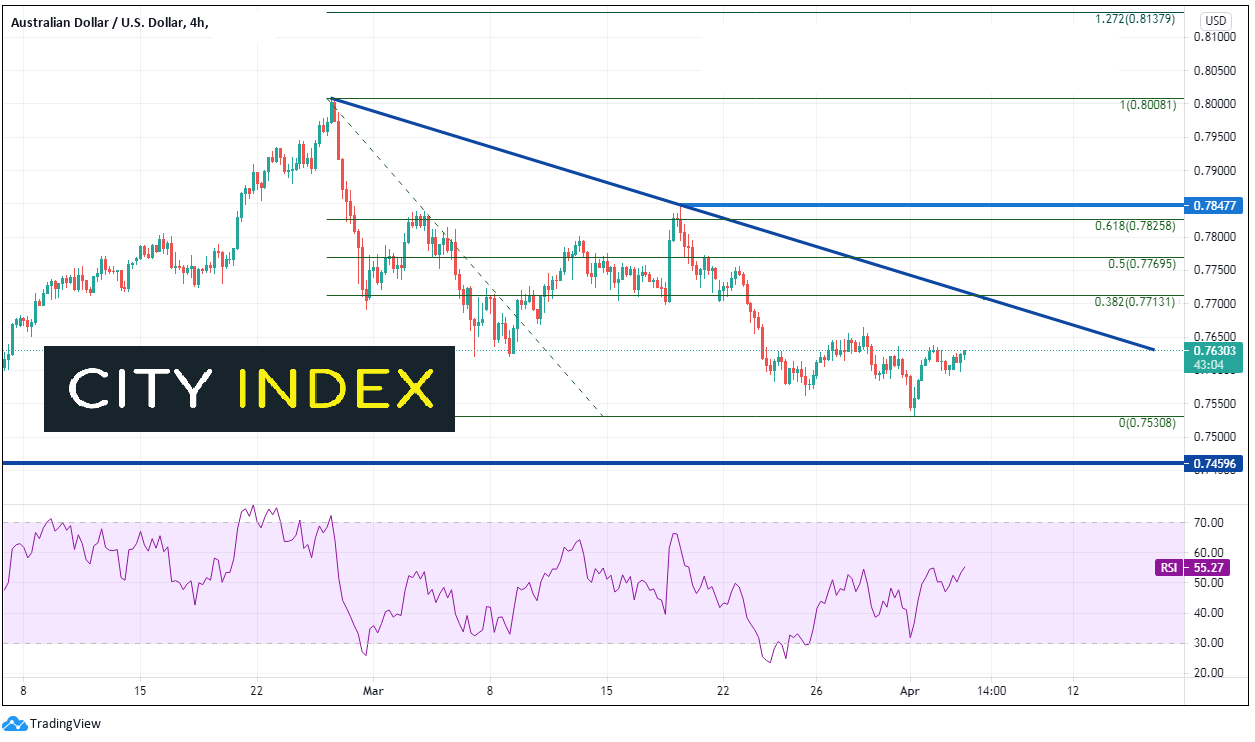

If price bounces, resistance is at the downward sloping trendline (off the head and the right shoulder), which confluences with the 38.2% Fibonacci retracement level from the February 5th highs to the April 1st lows at 0.7713. The 50% retracement level is 0.7770 and the 61.8% Fibonacci retracement level, along with horizontal resistance crosses between 07826/0.7848.

Source: Tradingview, City Index

With the RBA meeting likely to remain dovish and strong jobs from the US, traders may expect a weaker AUD/USD. The technical picture appears to be that way as well. However, use caution if trading this pair. When many in the markets may be looking for a pair to move lower, there may be a short squeeze first, which could bring AUD/USD higher.