Currency Pair of the Week: GBP/USD

The UK will release jobs data for March this week. The Claimant Count Change is expected to have risen by 150,000 vs 86,600 in February. If this month’s print is above February's, it will be the most since May 2020. Also, the unemployment rate is expected to uptick to 5.1% from 5%, and average hourly earnings is expected to remain unchanged at 4.2%. However, traders may be looking past this data as the country was still in a lockdown for most of March. It was not until April that the reopening began in earnest, as pubs, gyms, hairstylists and other service sector merchants began to open. With the recovery under way, GBP may outperform many of its peers. Jobs and spending should begin to increase, particularly in the service sector. The vaccine rollout continues to be strong, despite the AstraZeneca hiccup, with 32 million people receiving at least the first jab. The BOE doesn’t meet again until May 6th, however with the resignation of chief economist Haldane, the biggest hawk of the group, don’t expect much. They may also require more time to see how the recovery unfolds.

The US data has exploded in recent weeks, with March employment data, retail sales, and manufacturing data all strong and better than expected. This trend is likely to continue as the US reopening continues into the summer months. Travel and leisure, as well as restaurants, will be re-hiring and employment and spending should continue to rise. Similar to the UK, the vaccine rollout has been strong despite the hiccup with the Johnson and Johnson vaccine. 25% of the total US population has been fully vaccinated. In some states, neither restrictions nor masks are required. However, despite all the good news, the US Federal Reserve insists that they will remain with current monetary policy until ACTUAL inflation is sustained within their 2%-3% target. They feel inflation expectations are transitory and the rise in bond yields is unsustainable. This is good news for stocks and bad news for the US Dollar. With the stimulus plan approval behind us, Joe Biden is now working on a infrastructure program worth $2 trillion, however the debate in Congress is expected to last months.

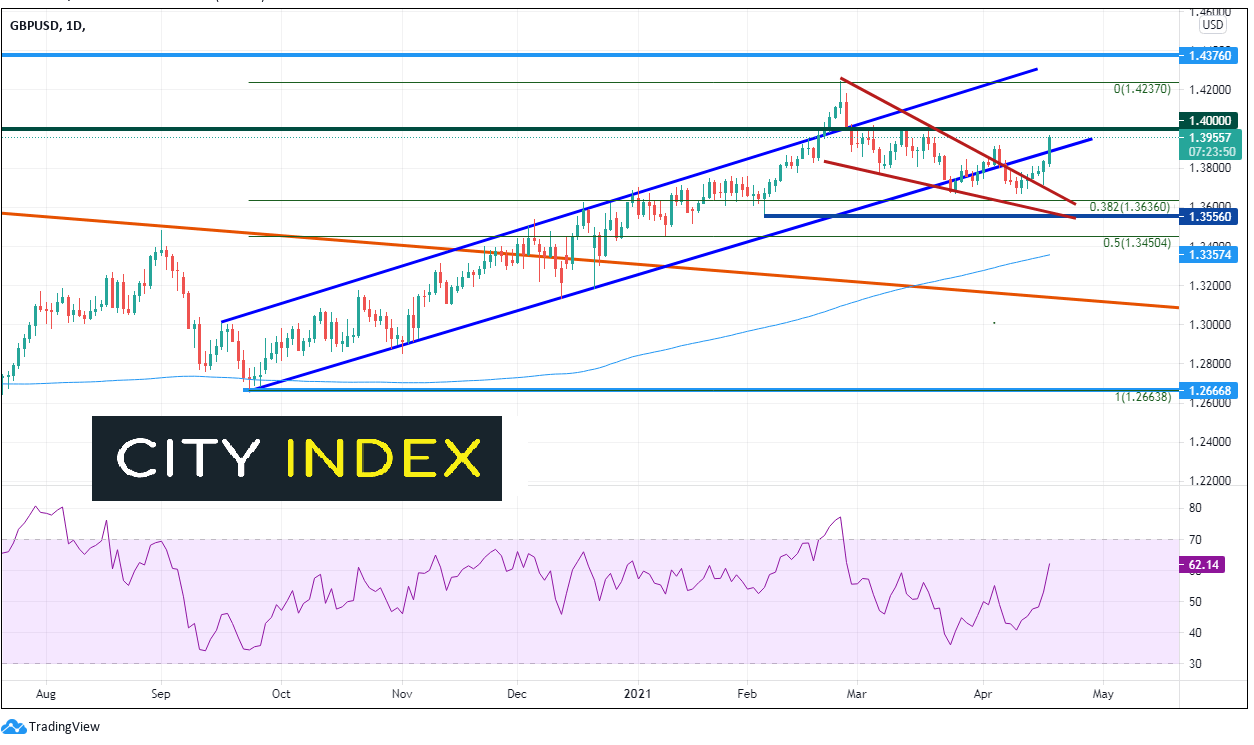

GBP/USD has been in a channel uptrend since early September 2020. The pair briefly broke above the top of the channel on February 19th, only to put in a shooting star candlestick on February 24th at 1.4376. The pair then pulled back into the channel. As we often see, a false breakout on one side of the channel often leads to a test of the opposite trendline. GBP/USD formed a descending wedge off the highs and moved below the bottom, upward sloping channel of the trendline. The pair held the 38.2% Fibonacci retracement level from the September 23rd, 2020 lows to the February 24th highs, near 1.3630. Last week, GBP/USD broke above the descending wedge and has since moved higher back into the channel. The target for the breakout of a descending wedge is a 100% retracement, which is the recent highs at 1.4237.

Source: Tradingview, City Index

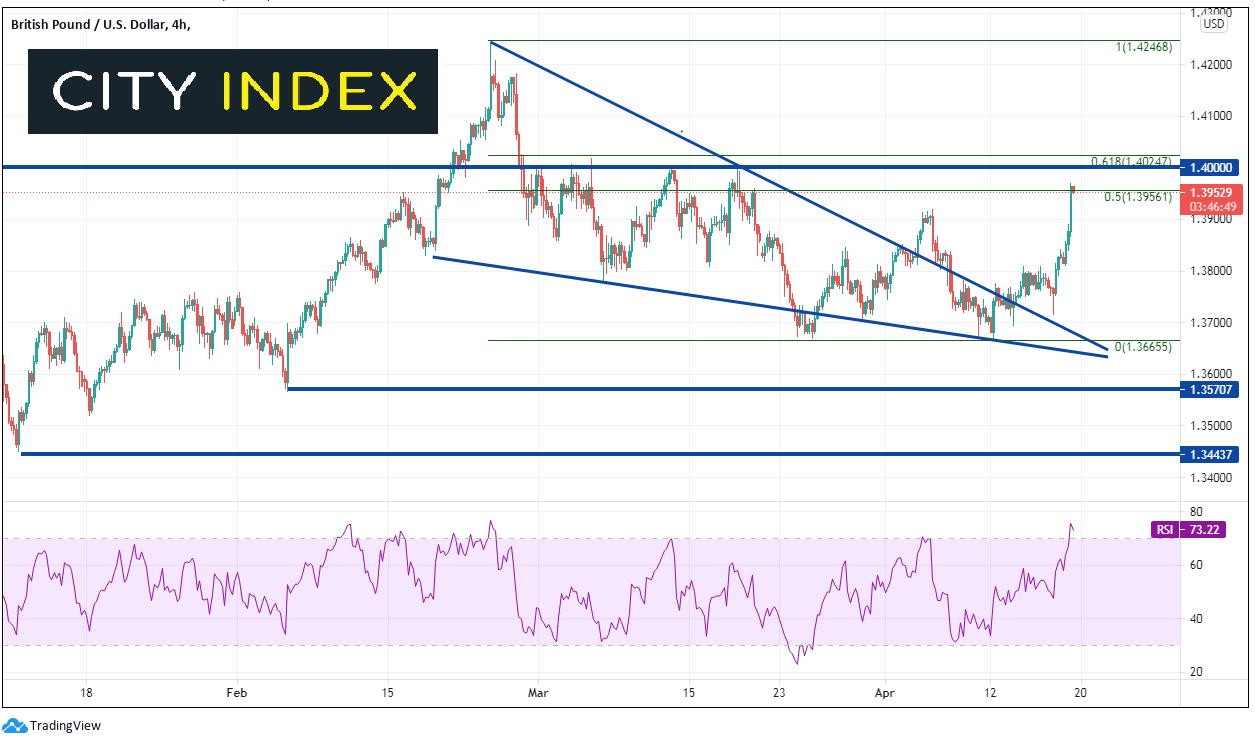

On a 240-minute timeframe, as of the time of this writing, GBP/USD is at resistance at the 50% retracement level from the February 23rd highs to the April 12th lows near 1.3956. The psychological round number 1.4000 level acts as the level of resistance above, and then the 61.8% Fibonacci retracement level from the same time period at 1.4025. First support is at Monday’s lows near 1.3810. The next level of support is the top, downward channel of the wedge near 1.3680, and then the recent lows near 1.3665. Notice that the RSI has moved into overbought territory above 70, which indicates that the pair may be ready for a near-term pullback.

Source: Tradingview, City Index

With the reopening of the UK underway and the reopening of the US in full swing, the British Pound may outperform the US Dollar. In addition, the pullback on the daily chart to the 38.2% longer-term Fibonacci retracement level indicates a weak pullback and that the bulls are in control. A break below the 50% level near 1.3450 would indicate the pair is in trouble.

Learn more about forex trading opportunities.