Currency Pair of the Week: EUR/CAD

EUR/CAD could be a volatile pair this week. With both the Bank of Canada (BOC) and the European Central Bank (ECB) interest rate decisions this week, an unexpected outcome could significantly move the pair.

The BOC is meeting on Wednesday and is likely to leave rates unchanged at 0.25% and asset purchases unchanged at CAD $5 billion per week. However, there is talk that the central bank may begin looking at yield curve control to help regulate interest rates, as the US Federal Reserve had considered. Employment has been improving since the height of the coronavirus, with the unemployment rate falling from a high of 13.7% in May to 10.2% in August (released this past Friday). However, at the same time, the inflation rate has been hovering near 0%. In addition, the price of the Canadian Dollar also is greatly affected by the price of Crude Oil. Last week, light crude oil futures fell nearly 7.5%. If the selloff in oil continues, the Canadian Dollar may sell off as well.

The ECB is meeting on Thursday and is also likely to leave rates unchanged at 0.0% and asset purchases unchanged at 1.35 trillion Euros. However, the recovery hasn’t been as kind to Europe as it has been to some other areas. The number of new coronavirus cases have fluctuated over the last 6 months. The same can be said for Europe’s economic data. And although the month over month inflation rate has turned negative, policy makers have expressed concerns about the strength of the Euro, which traded above 1.2000 vs the US Dollar last week. Christine Lagarde may try and talk down the value of the Euro on Thursday.

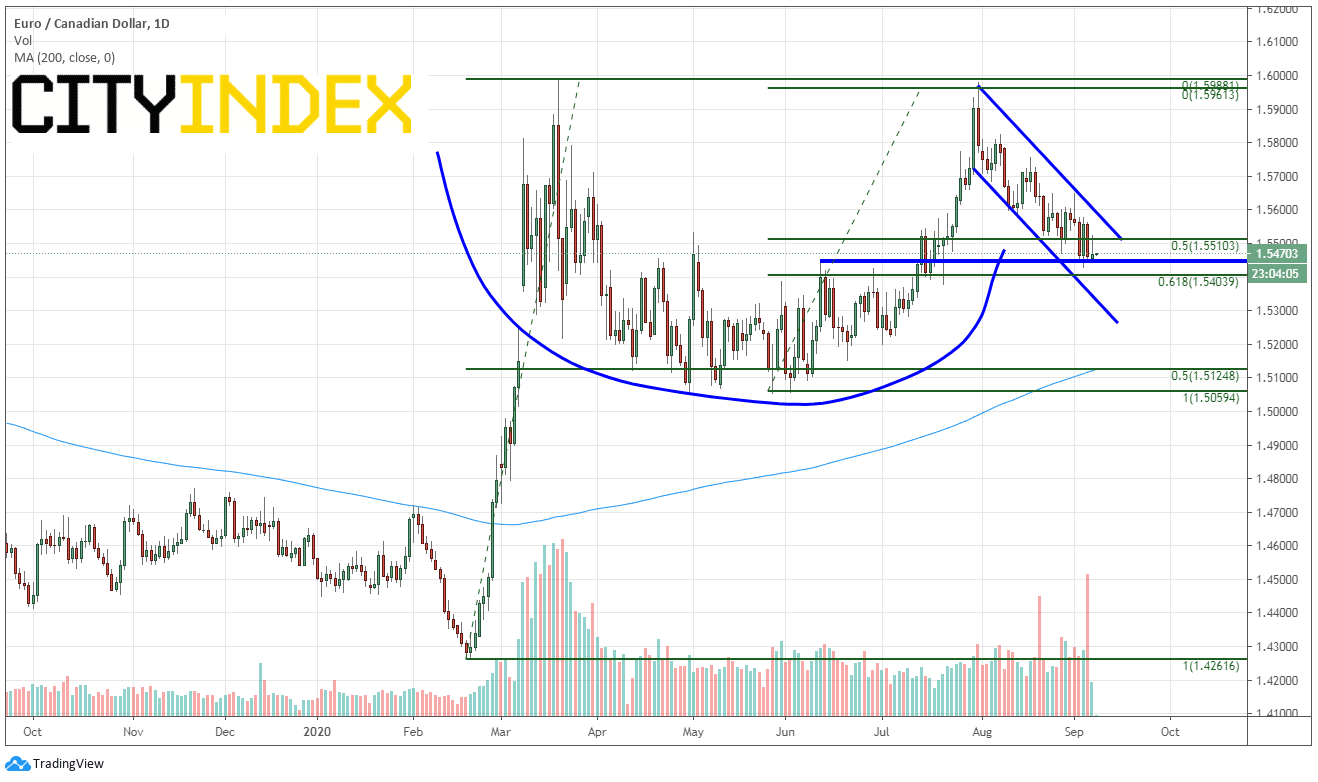

EUR/CAD has been in a cup-and-handle formation since February 20th on a daily timeframe. The pair moved to a high of 1.5991 on March 9th, before pulling back to just below the 50% retracement of the same timeframe. The EUR/CAD made a run at the previous highs on July 31st (to complete the “cup”) and has pulled back in a downward sloping channel to horizontal support near 1.5468 (the “handle”). This level is also between the 61.8% retracement level from the June 1st lows to the July 31st high. A break of this level would negate the cup-and-handle pattern, however it may not negate the downward sloping channel.

Source: City Index, Tradingview.com

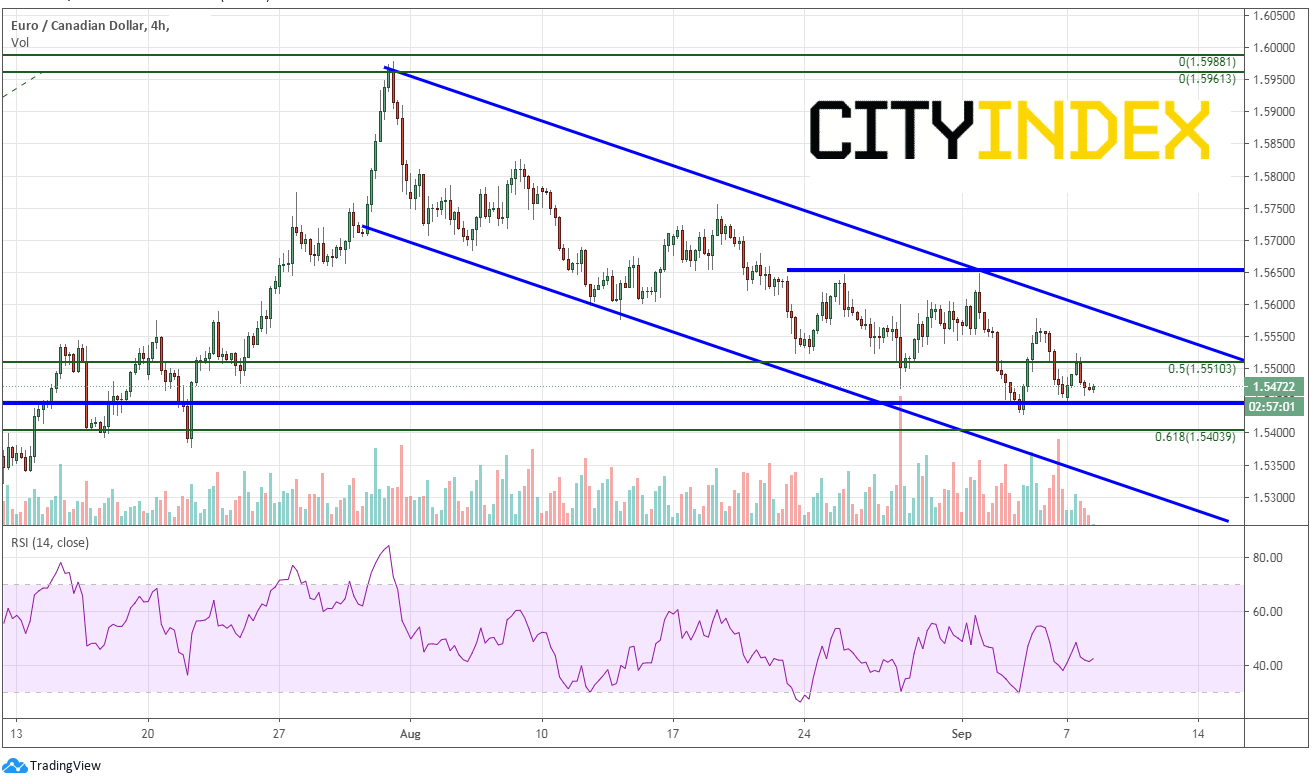

On a 240-minute timeframe, the 1.5400 level in EUR/CAD (which is also the previously mentioned 61.8% Fibonacci retracement level) is key support. Below there is the bottom trendline of the channel near 1.5325. Resistance on the top side is at the top channel line near 1.5575, then the September 1st highs near 1.5650.

Source: City Index, Tradingview.com

Watch closely for comments from both the BOC and the ECB, which could significantly move this pair. Comments, plus a larger move in oil, could see EUR/CAD quickly trading outside the “handle”.