CSPC Pharmaceutical (1093.HK): Focus on the Ascending Triangle

CSPC Pharmaceutical (1093), a drug maker, announced that 1Q net income rose 21.8% on year to 1.16 billion yuan and operating profit grew 0.6% to 1.16 billion yuan on revenue of 6.13 billion yuan, up 11.5%.

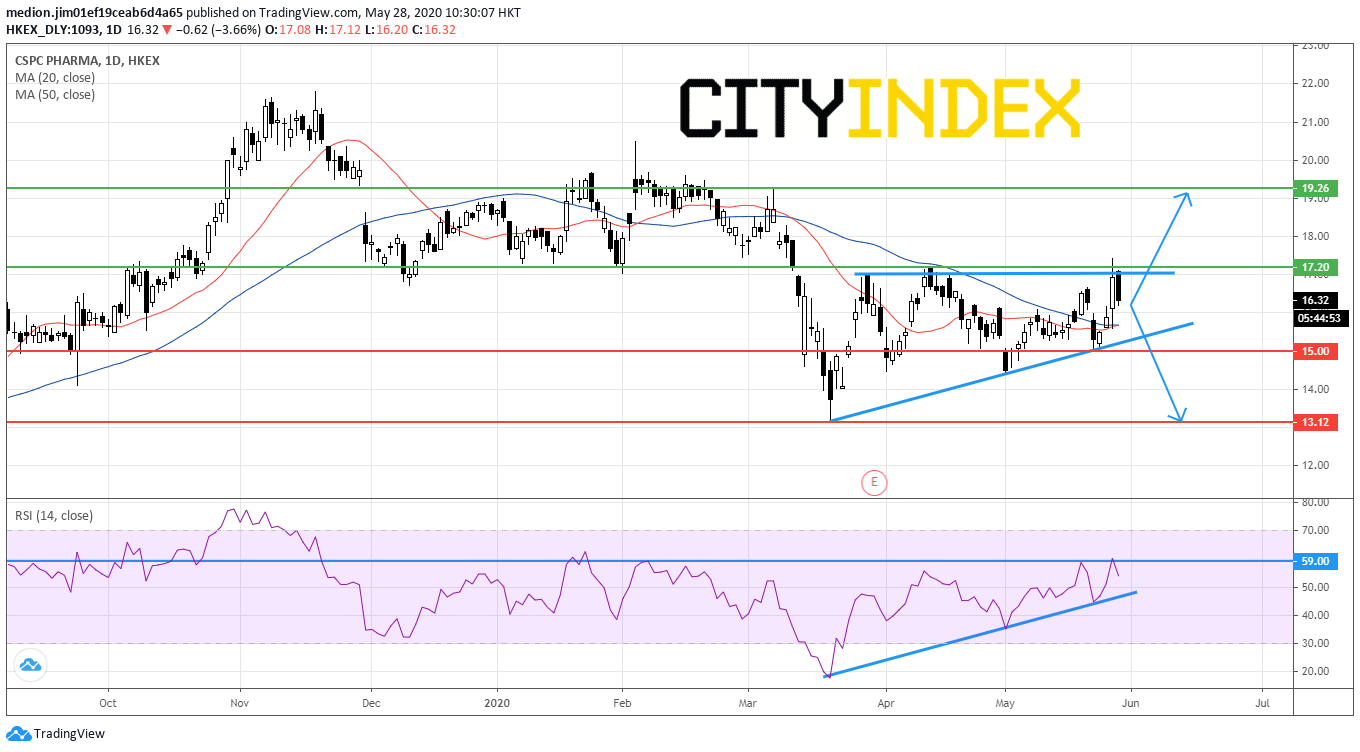

After the announcement of 1Q result, the stock jumped 6%. However, the stock failed to close above the April high at HK$17.20. Currently, the stock eased around 3%.

Source: GAIN Capital, TradingView

On a daily chart, the stock remains trading within the ascending triangle. A upside breakout could mean the bullish reversal signal. Otherwise, A break below the rising trend line could signal a continuation of the previous down trend.

In fact, both 20-day and 50-day moving averages are flattening. The RSI is capped by a resistance level at 59, but supported by a rising trend line at same time. Both indicators would suggest the lack of momentum for the prices.

In this case, the reader should consider a neutral bias and focus on the breakout signal in the future.

A clear break above HK$17.20 (the high of April) could consider a rise to the next resistance level at HK$19.26 (the high of March.

In an alternative scenario, crossing below HK$15.00 (the previous low) might bring a return to $13.12 (the low of March).

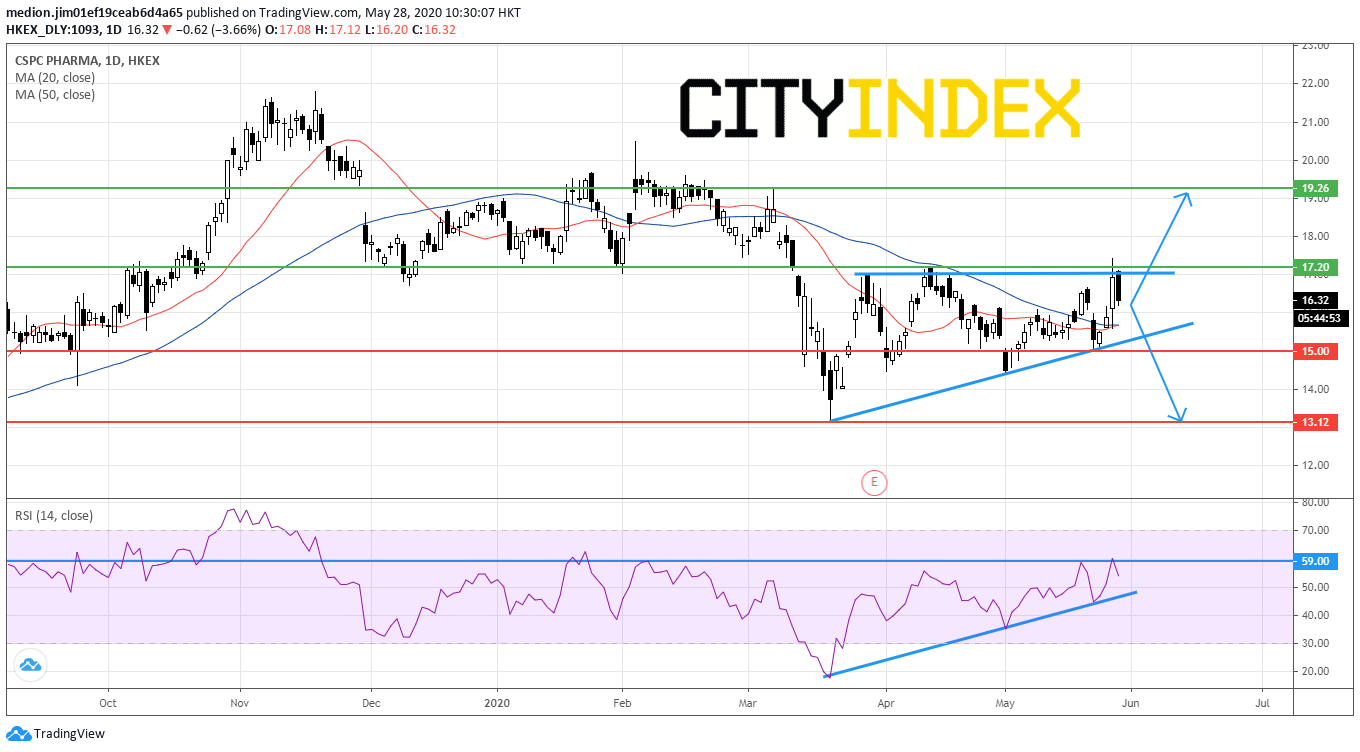

After the announcement of 1Q result, the stock jumped 6%. However, the stock failed to close above the April high at HK$17.20. Currently, the stock eased around 3%.

Source: GAIN Capital, TradingView

On a daily chart, the stock remains trading within the ascending triangle. A upside breakout could mean the bullish reversal signal. Otherwise, A break below the rising trend line could signal a continuation of the previous down trend.

In fact, both 20-day and 50-day moving averages are flattening. The RSI is capped by a resistance level at 59, but supported by a rising trend line at same time. Both indicators would suggest the lack of momentum for the prices.

In this case, the reader should consider a neutral bias and focus on the breakout signal in the future.

A clear break above HK$17.20 (the high of April) could consider a rise to the next resistance level at HK$19.26 (the high of March.

In an alternative scenario, crossing below HK$15.00 (the previous low) might bring a return to $13.12 (the low of March).