Crude Gives Back Some of Yesterday's Gains

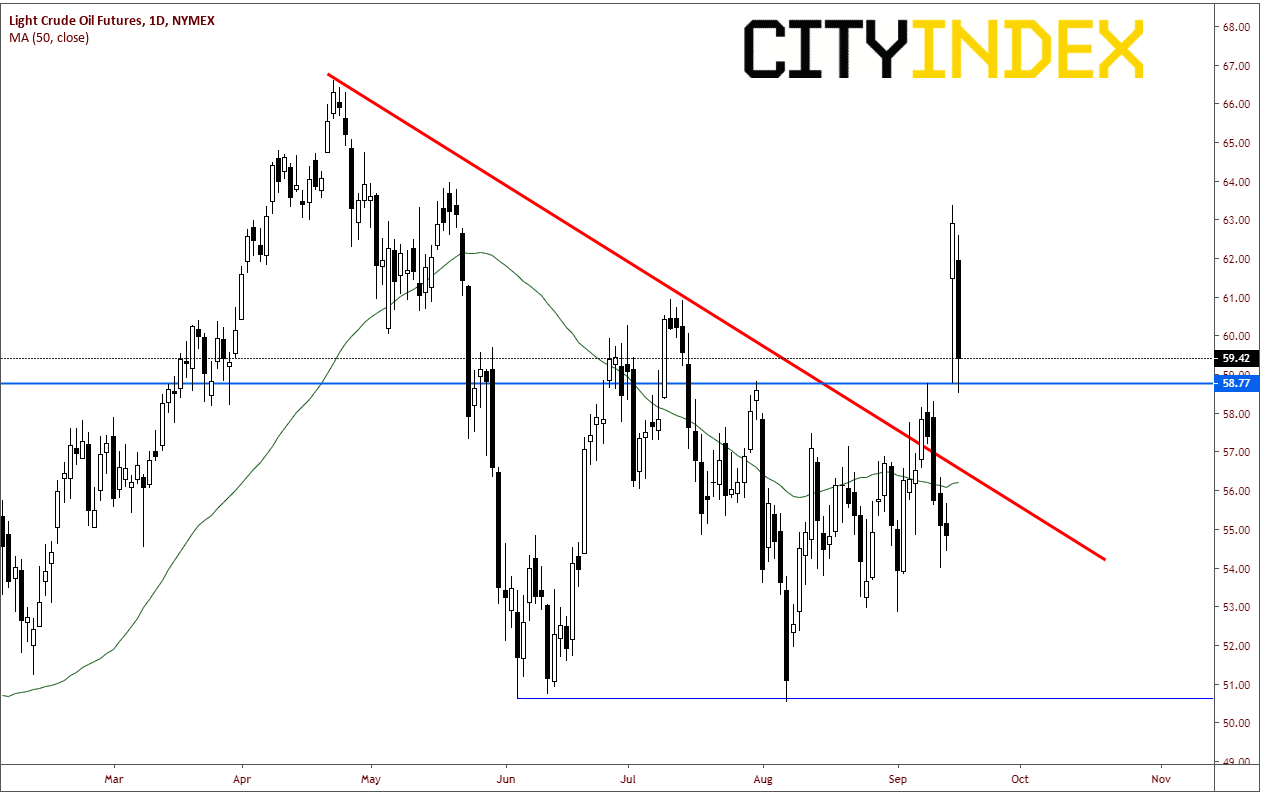

After yesterday’s breakout in Crude Oil, closing up near 14%, the market gave back some of those gains as bearish comments trickled out throughout the day. Earlier in the day, Saudi sources reported that Saudi oil output will return to normal levels quicker than initially assumed. Later towards the close, a Aramco source said that Abqaiq processing plants be at normal capacity by the end of September. Light Crude Oil Futures closed down roughly 5.5% today as price briefly touched support at the highs from September 10th, trading as low as 58.50. However, trading at a prior high does mean that the gap in Crude Oil has been filled. In order to fill the gap, price must reach the prior price from before the gap at 54.58, which in this case is Fridays close.

Source: Tradingview, City Index, NYMEX

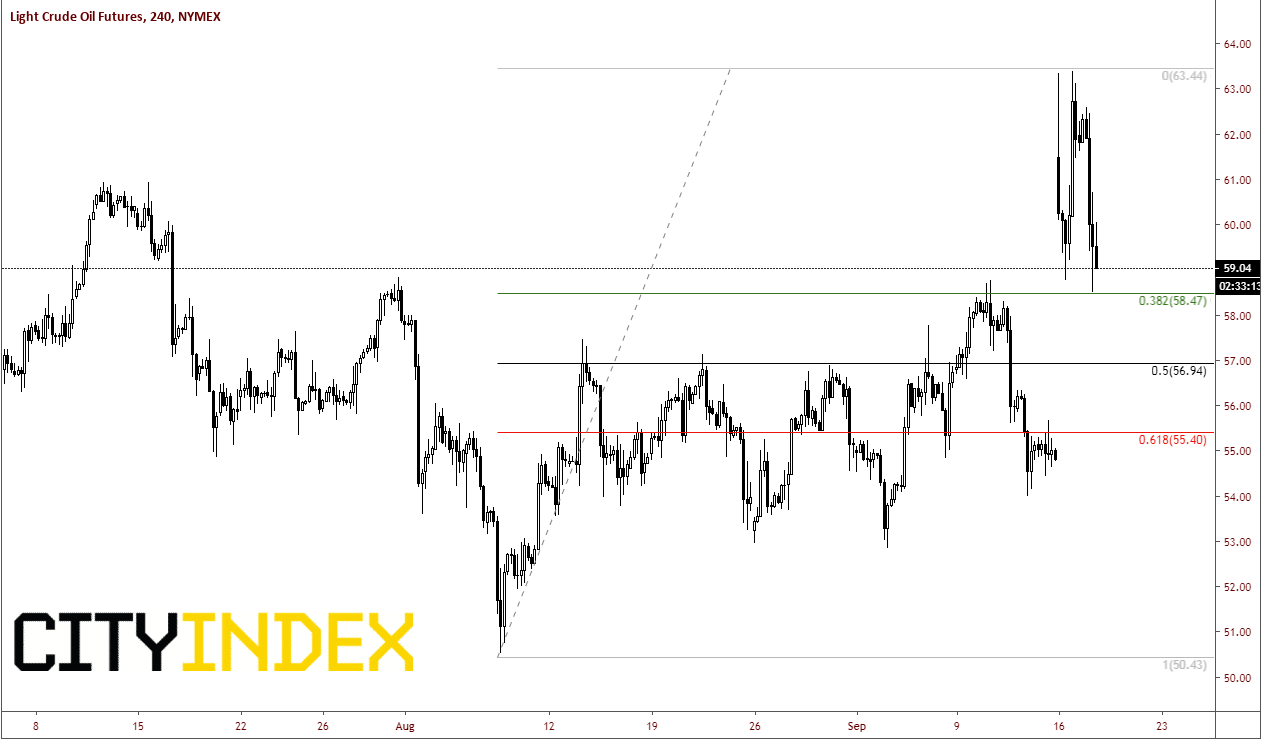

The 58.50 low in Crude Oil also marketed support at the 38.2% retracement level from the low on August 7th to yesterdays highs.

Source: Tradingview. City Index. NYMEX

Support below arrives at the previously mentioned days lows and 38.2% retracement at 58.50. Next support is near 57, which is the 50% retracement and horizontal support. Below that support is 56.20, which is the 50 Day Moving Average and Trendline Support (see Daily chart above). Horizontal resistance comes in at 61.50, Next resistance is yesterday’s highs at 63.38.

Tomorrows price action in Crude Oil can still be volatile as more comments are released regarding the attacks. On a separate note, the much anticipated FOMC rate meeting is also tomorrow. Watch for comments in the statement and the Q&A regarding China, growth, and a global manufacturing slowdown. Any comments in these areas many also move the price of Crude Oil.