Guinea competes with Australia as Chinas largest supplier of bauxite, the world’s most common sauce of Aluminium. Last week, Aluminium touched a new ten-year high on strong demand, and when Chinese smelters have been under pressure from authorities to rein in the countries carbon emissions. Aluminium is trading 3.2% higher today on the Shanghai Futures Exchange.

Guinea is also the home of the Simandou mine, the largest high-grade iron ore deposit in the world. The Simandou mine will come online later this decade and play a crucial part in China’s efforts to diversify its iron ore supplies away from Australia and Brazil.

Contractors have begun building a railway 679km through the Guinean countryside to the coast. Plans are afoot to excavate a deep-water port at Matakong on the Atlantic coast to load the iron ore. On the Shanghai futures exchange, iron ore futures are trading over -6% lower today at 736 yuan per tonne.

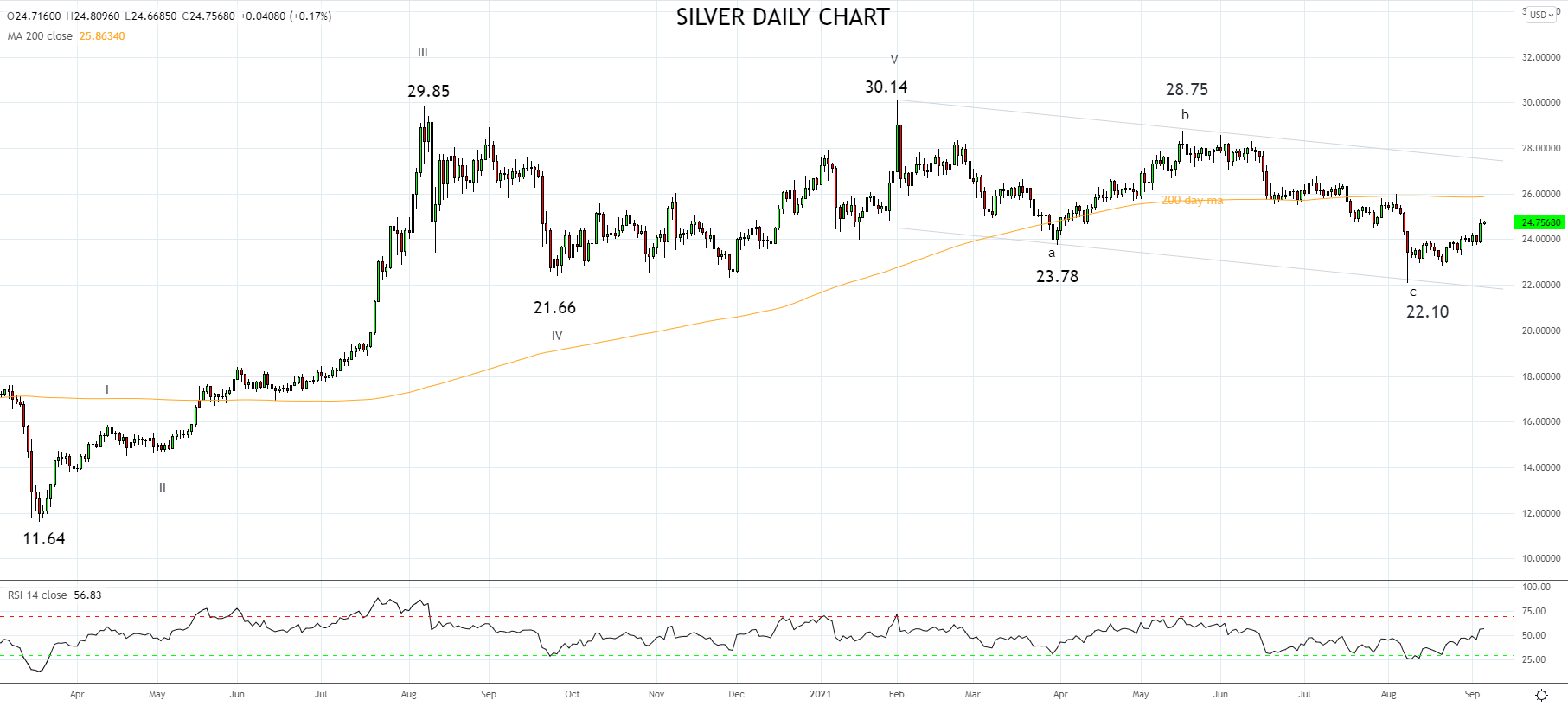

Silver is another metal that has caught the eye after drifting off the radar following the failed trader rebellion silver squeeze in February and after its flash crash in early August, closing 3.39% higher on Friday at $24.69.

The “flash crash” $22.10 low appears to have completed a corrective sequence from the February $30.14 high and the rally from the $22.10 low now has a more impulsive look after Friday’s rally. Providing silver can hold above support $24.00/$23.70 allow the rally to extend towards the 200 day moving average at $26.00, before trend channel resistance at $27.40.

Source Tradingview. The figures stated areas of September September 6th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM