When?

Wednesday 3rd February

What to expect ?

Vodafone is due to update the market with Q3 earnings. The share price trades down 17% over the past 12 months under performing the broader market.

Results so far across the pandemic have been mixed. Whilst roaming charges have fallen owing to travel restrictions, demand for data usage remains elevated thanks mainly to strong demand in emerging markets.

H1 results back in November revealed organic revenue declined 0.4%, ahead of the -2.3% forecast. Pre-tax profits came in at €2 billion a vast improvement on the previous year after it wrote down the value of its Indian business. The better than forecast earnings saw management lift full year guidance.

Traders are hoping to see further improvements to top line growth and guidance to remain at EBITA of €14.4- €14.6 billion. Services revenue which had declined sharply in the first two quarters is expected to stabilize -0.14% in Q3. Cash flow will also be in focus and investment in 5G services.

Any update concerning the ongoing tax rebate legal challenge by India for $2 billion will be eyed. Whilst an independent tribunal in Netherlands ruled in favour of Vodafone an Indian official has said that India will challenge the ruling.

Vodafone technical analysis

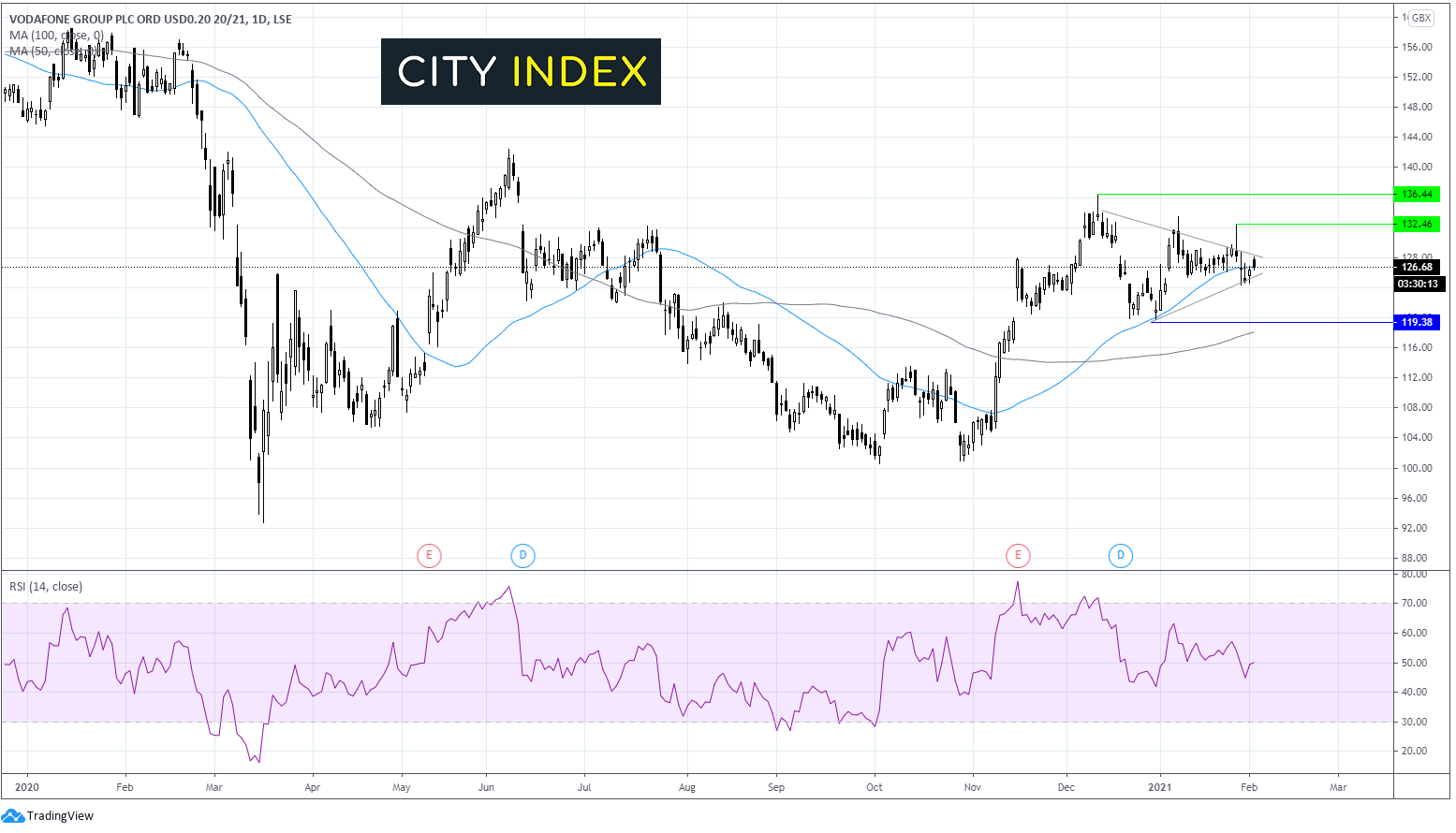

After rallying from early November, the Vodafone share price has been consolidating across the start of this year forming a triangle consolidation pattern. The price is sitting on the 50 sma at 126.6 and the RSI is also neutral bang on 50.

Q4 results could be the catalyst that causes a breakout for the stock price. Stronger than forecast results could see the share price breakout to the upside and continue its upward trend towards 132.50 horizontal support (yearly high) and on to 136 (high 11th December).

On the flip side, weak results could see the price break out to the downside heading towards 119/8 December low & 100 sma.

Learn more about trading equities

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM