A hawkish Fed could certainly help!

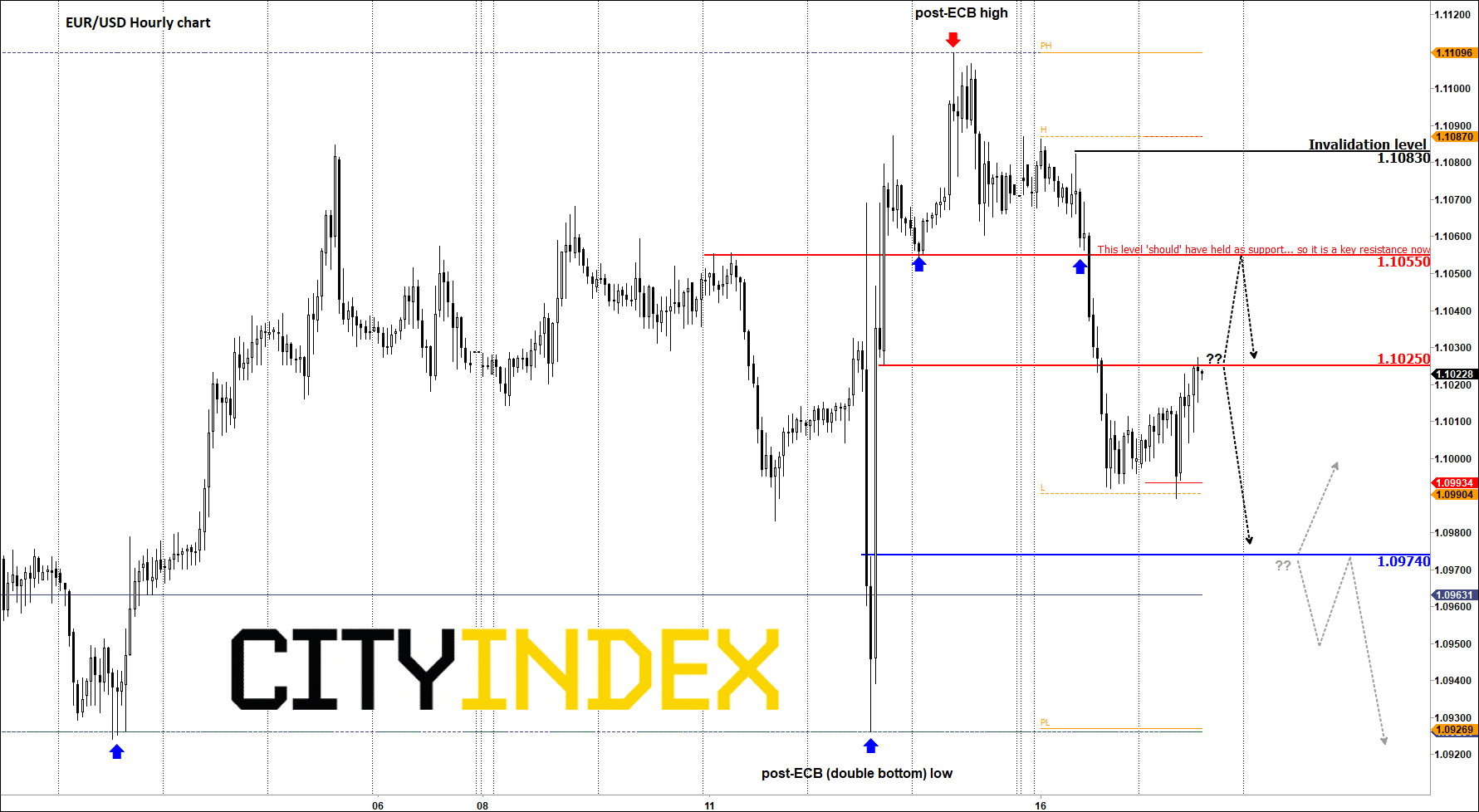

Today we are looking at in intraday chart of the EUR/USD, showing price action before and after the ECB’s meeting last week. Now that the dust has settled, I thought it might be the best time to share my thoughts and highlight key levels on this popular currency pair, ahead of the FOMC decision tomorrow.

So far today, the single currency has been on the front foot, thanks in part to good news from Germany. Here, the ZEW economic sentiment survey improved noticeably to -22.5 from -44.1, beating expectations of -38.0. However, I remain sceptical about the prospects of a sharp recovery in the euro. With the ECB restarting QE, I reckon the shared currency could fall further over the coming days.

Against the US dollar, though, a lot will depend on the outcome of tomorrow Fed decision. A 25-basis point hike is already baked in. So, anything more than a 0.25% cut ‘should’ send the EUR/USD higher, while if the Fed is less dovish than expected then the dollar could find support, undermining the EUR/USD exchange rate.

Source: eSignal and FOREX.com.

From a purely technical point of view, the fact that the euro has failed to old its own above 1.1055 is bearish because this was meant to be a support level created in the immediate aftermath of the ECB. With lots of stop orders now potentially resting below the “double bottom” low around 1.0925, I think rates could crash lower to probe liquidity there in the coming days.

Ahead of this level, the 1.0975ish area could provide a bit of support, so watch out for a potential reaction should we get there.

At the time of writing, the EUR/USD was hovering around 1.1025, a short-term pivotal level. If rates turn lower from here, then we may not see that re-test of that 1.1055 level.

The invalidation level is at around 1.1085 – a move beyond this level would indicate that I am reading price action wrong and in which case I will consider the bullish argument.