The week has started quietly with many investors looking ahead to a meeting between Presidents Donald Trump and Xi Jinping on the side-lines of the G20 summit later this week after the recent escalation in US-China trade dispute. But there is no secret in terms of what FX traders are thinking of the dollar. The Dollar Index is now on its 4th consecutive down day following a dovish Fed meeting last week. This has allowed commodity dollars to top the leader board in a quiet day for data, with gold and Bitcoin also extending gains.

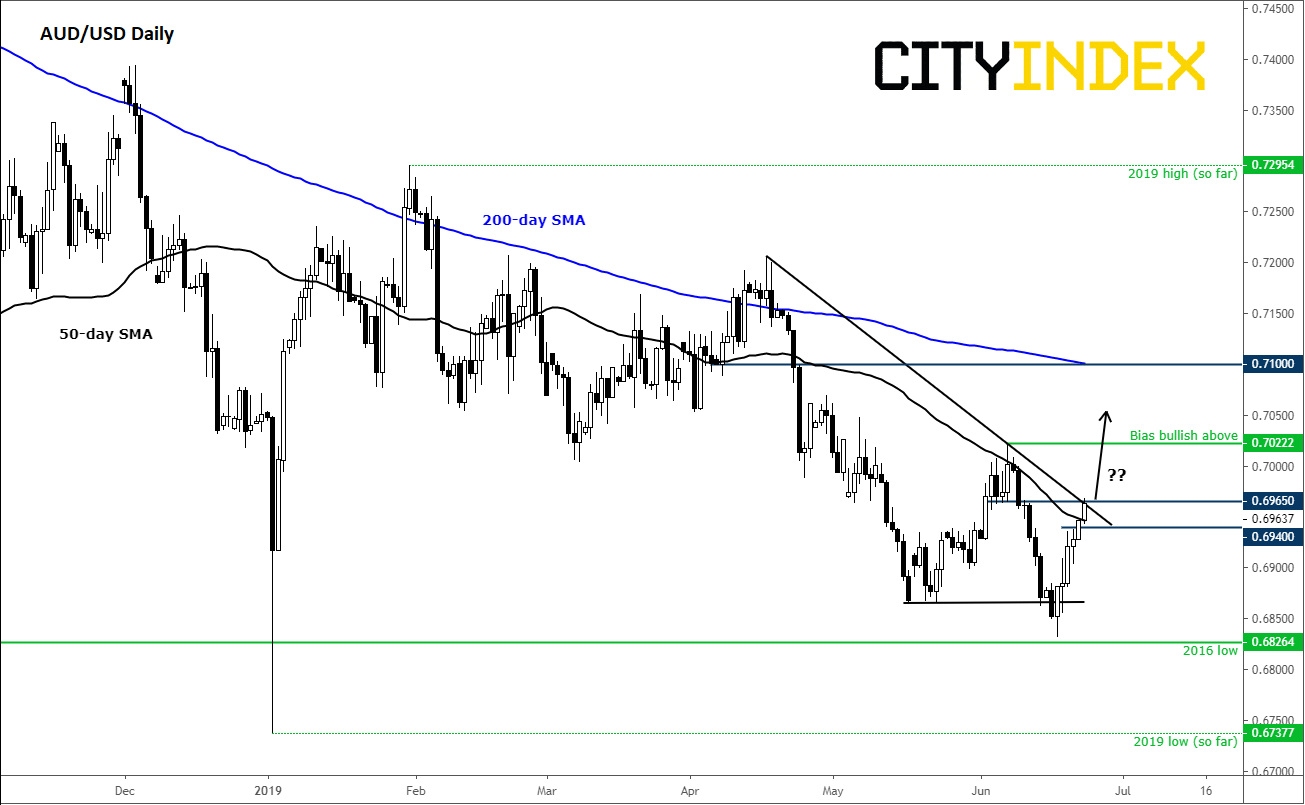

Given gold’s breakout, the positively-correlating Aussie dollar could be next to breakout, despite the Reserve Bank of Australia’s warning that there might be more rate cuts to come. The AUD/USD is currently pushing up against a short-term bearish trend line at around 0.9665. If this level breaks, then we may see a push towards liquidity that would be resting above the most recent high at 0.7020. and if and when 0.7020 breaks, then we will have our first higher high in place, confirming the bullish reversal. So, the Aussie is definitely one to watch for a potential breakout soon. In terms of support, Friday’s high at just below 0.6940 is the level that needs to hold now.

Source: Trading View and City Index