Reports that the U.S is weighing the release of oil from its reserve to help counter surging inflation has triggered a 6% dive in the price of crude oil to below $101.50.

The full release could be as much as 180 million barrels, which if spread out over 180 days would equate to 1 million barrels a day.

Can a release of this magnitude lead to a sustainable fall in the price of crude oil?

The IEA forecasts global consumption of petroleum and liquid fuels of 100.6m b/d for 2022. Russian imports would be expected to account for 11% or ~11m b/d of that demand in average years.

Supply

After Western sanctions were imposed on Russia following its invasion of Ukraine and Western companies, including ExxonMobil, Shell, BP, and Equinor, announced they were stopping operations in Russia, the best guess is that the Russian supply shock will range from 2-4 m b/d.

OPEC+

At its meeting today, OPEC+ is expected to keep current production plans in place and greenlight the return of 400k bpd in June. Keep in mind many OPEC + members have missed production targets recently after years of underinvestment

Kazakhstan outage

Kazakhstan ships around 1 m b/d of crude oil through the CPC pipeline to Russia’s Black Sea port of Novorossiysk. The pipeline was reportedly damaged last week, likely impacting 1m b/d for up to two months.

Demand

On the demand side of the equation, there is evidence that consumers are beginning to react to record-high fuel prices.

Elsewhere the spread of the highly infectious Omicron variant and subsequent lockdowns in China has the potential to be an even more direct impact on regional fuel consumption than high prices.

Conclusion

If we assume that the combined impact of the loss of Russian and Kazakhstan output, minus the fall in demand from higher prices and lockdowns in China, were to leave a net shortfall of ~3m b/d, then the release of 1-1.5m b/d could undoubtedly have a meaningful impact on the price of crude oil.

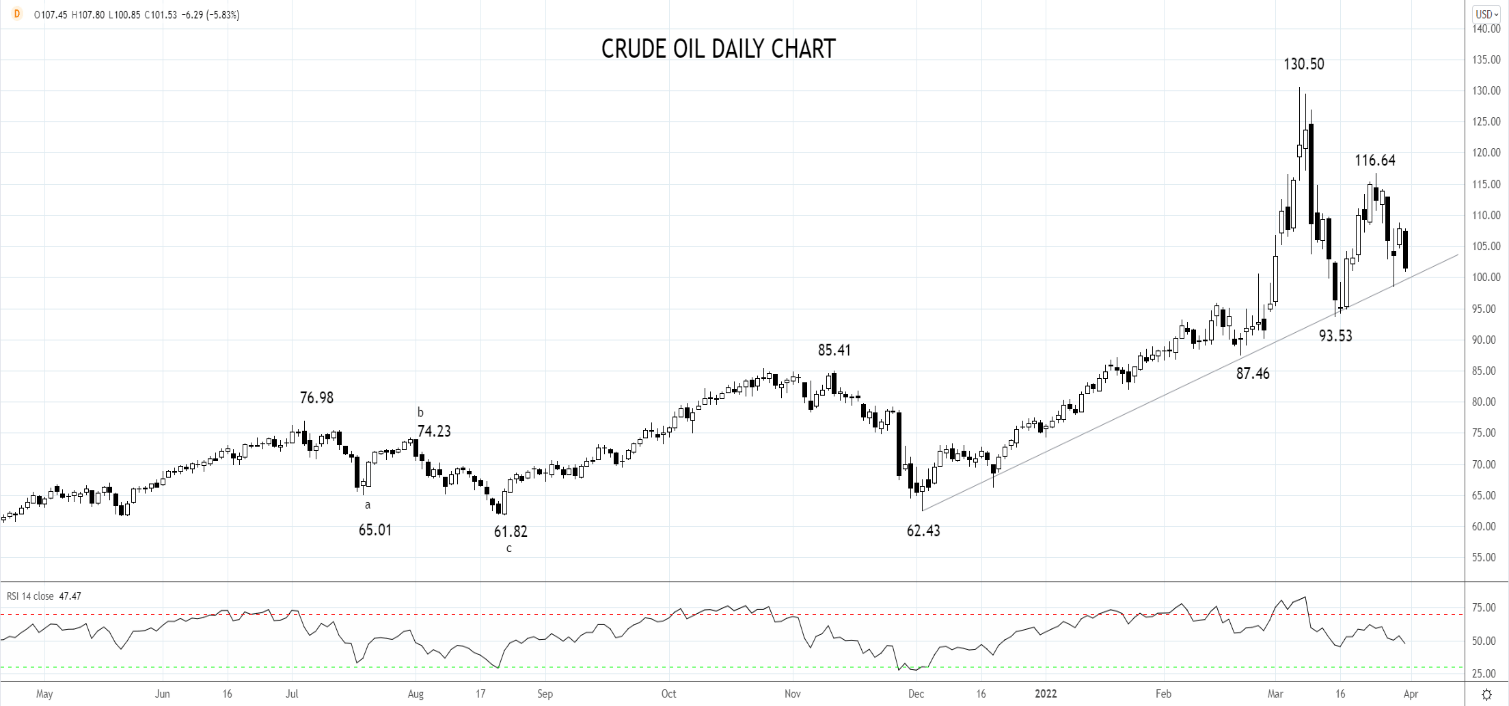

If the price of crude oil was to see a sustained break of the uptrend support coming in currently around $100, as viewed on the chart below, it could lead to a retest of the $93.53 low of mid-March.

Source Tradingview. The figures stated are as of Mar 31, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade