Medium-term technical outlook on Geely Automobile (0175 HKG)

click to enlarge charts

Key Levels (1 to 3 weeks)

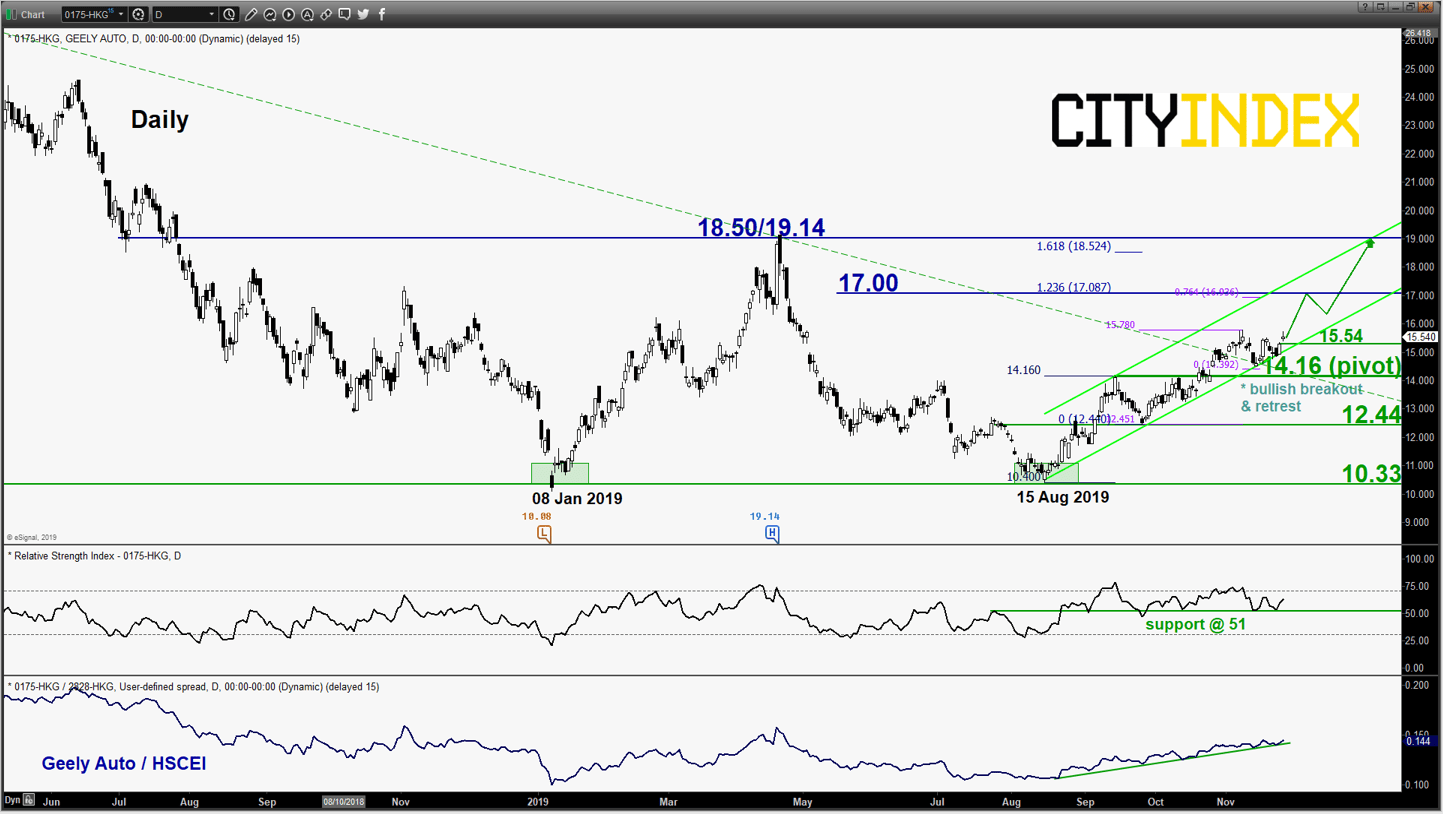

Intermediate support: 15.54

Pivot (key support): 14.16

Resistances: 17.00 & 18.50/19.14

Next supports: 12.44 & 10.33

Directional Bias (1 to 3 weeks)

Geely Auto, a major automobile manufacturer in China that engages in the research and development, production and the sale of automobiles (sedans, sport utility vehicles &electric vehicle models).

Bullish bias for Geely Auto above 14.16 key medium-term pivotal support for another round of potential upleg to target the next medium-term resistance at 17.00 and the major resistance zone of 18.50/19.14.

However, a daily close below 14.16 indicates a failure bullish breakout for a slide back to retest 12.44 and even the major support at 10.33.

Key elements

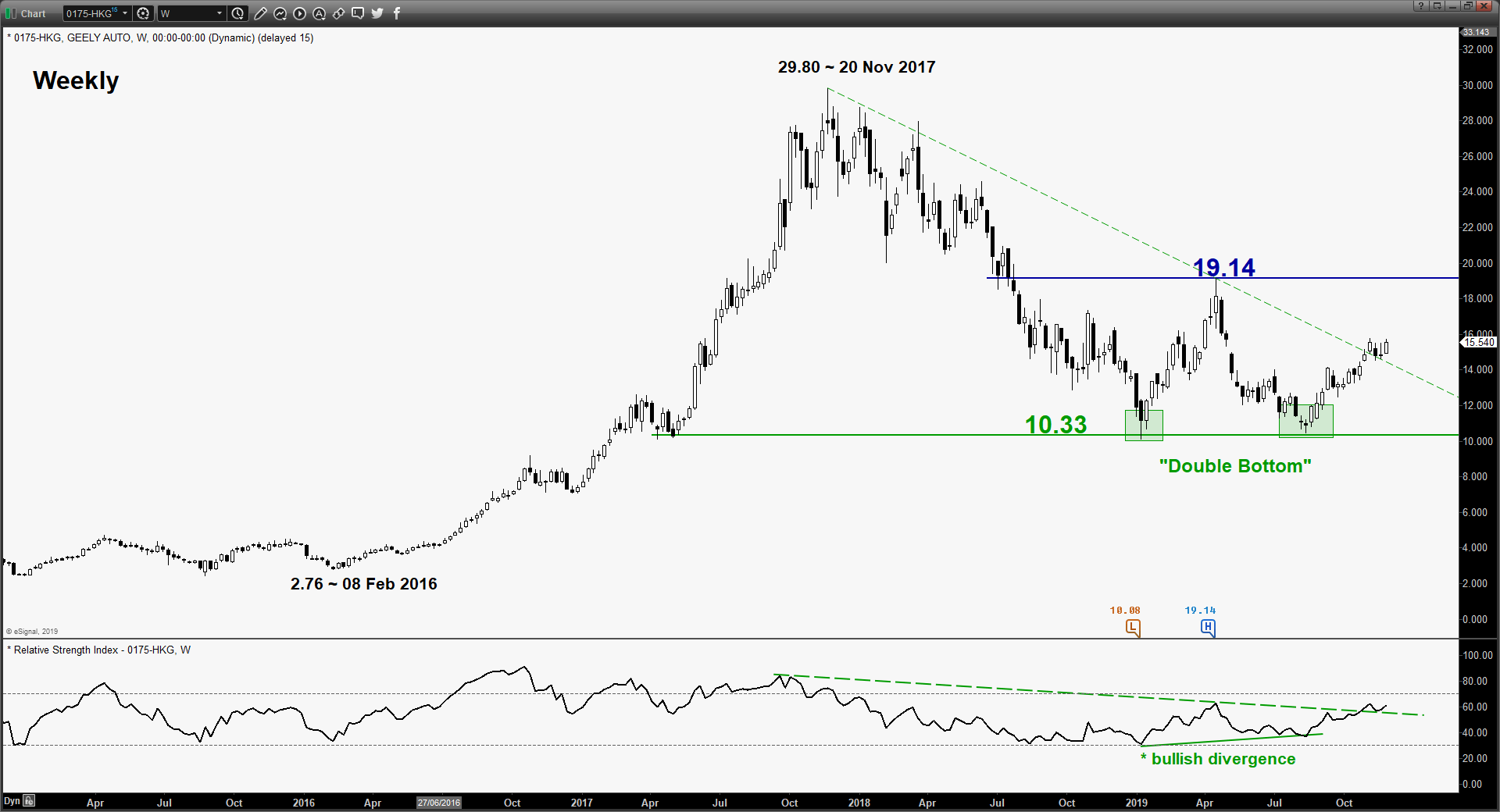

- The major downtrend phase of Geely Auto from 20 Nov 2017 high of 29.80 has started to shown signs of “bottoming out” after a 19% decline.

- Since its 08 Jan 2019 swing low area of 10.33, Geely Auto has traced out a bullish reversal “Double Bottom” configuration with its neckline resistance at 19.14.

- The weekly RSI oscillator has staged a bullish breakout above a corresponding significant descending resistance in place since 20 Nov 2017 (the start of the major downtrend in price action) with the daily RSI oscillator that is still hovering above its support at the 51 level. These observations suggest that medium-term upside momentum has resurfaced.

- The 14.16 key medium-term pivotal support is defined by the pull-back support of the former major descending trendline from 20 Nov 2017, former 19 Sep 2019 swing high and the 50% Fibonacci retracement of the on-going 2-month up move from 25 Sep 2019 low to 08 Nov 2019 high.

- Since 15 Aug 2019, the price action of Geely Auto has evolved into a medium-term ascending channel.

- Relative strength analysis from its ratio chart suggests outperformance of Geely Auto against its benchmark Hang Seng China Enterprises Index (HSCEI), an index that a comprises a basket of China stocks that are listed in Hong Kong.

Charts are from eSignal