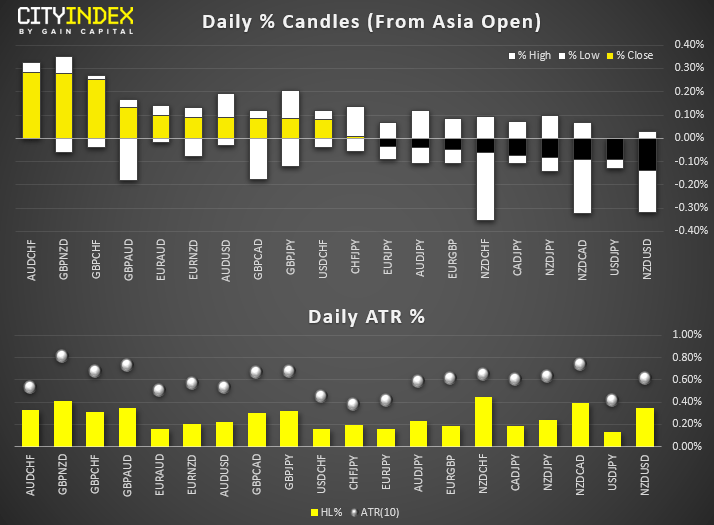

View our guide on how to interpret the FX Dashboard

FX Brief:

- Trump was reported to have spoken to Trudeau over NAFTA (North American Free Trade Agreement) and house speaker says they’re close, but a NAFTA deal is not quite done. Canada’s Deputy PM will attend talks later today, so AUD and NZD pairs are higher on the back of improvement in trade sentiment.

- House Democrats are reported to be drafting two articles of impeachment against President Trump.

- Chinese CPI rises 4.5% YoY, its highest rate since January 2012 although pork prices are the main driver, having risen an incredible 110% YoY. So, it’s not exactly the broad-based, demand driven inflation central banks are after, but instead a supply shock due to the African swine flu outbreak on their livestock. Meanwhile, producer prices fell for a 5h consecutive month.

- Australian business confidence remains flat at zero, teasing the potential to revert to pessimism for the first time since 2013. Although conditions have risen to a 6-month high and suggest a trough could be in place.

- ANZ upped New Zealand’s GDP forecasts, just a day after raising their currency forecast for 2020.

Price Action:

- NZD and AUD are the strongest majors, JPY and CHF are the weakest amid a very mild risk-on session.

- Minor ranges overall with lack of any real catalysts ahead of tomorrow’s FOMC meeting and the UK election on Thursday night. USD/JPY holds support above the 100-day eMA, and DXY sits just above the 200-day eMA.

- USD/CHF printed a dark cloud cover (-bar, bearish reversal) below the 200-day eMA. One to watch if this one break below support around 0.9845.

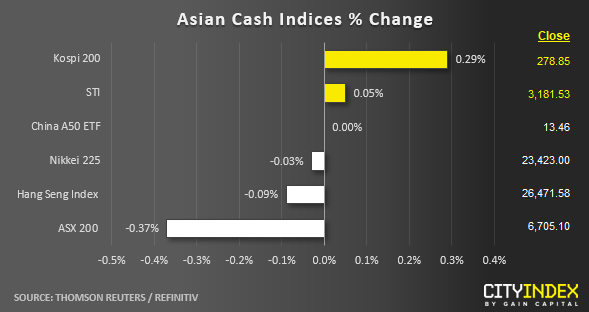

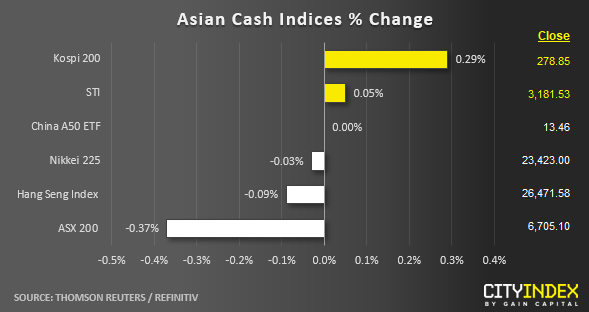

Equities Brief:

- Key Asian stock markets are still in some form of “holding patterns” as traders wait for new catalysts to drive prices; Fed monetary policy outcome on Wed, 11 Dec, UK General Election on Thurs, 12 Dec and the 15 Dec deadline on the additional U.S. tariffs to be imposed on China goods.

- Macro data out from China are still indicating headwinds on economic growth as Production Price Index (PPI) for Nov has declined by -1.4% y/y, the 5th consecutive month of slump albeit it has managed to beat consensus forecast of -1.5% y/y slightly. Consumer Price Index (CPI) has increased to 4.5% y/y in Nov, the fastest rate since Jan 2012 on higher persistent pork prices due to the outbreak of African swine fever. However, core CPI that excludes food only rose at a modest pace of 1.4% y/y in Nov, below the 1.5% y/y rate recorded in the previous 3 months since Aug 2019.

- Meanwhile, some positive U.S-China trade related news flow where U.S Agriculture Secretary Perdue has commented that the Administration is unlikely to impose the extra tariffs on US$160 billion worth of Chinese products when the 15 Dec deadline hits.

- The worst performer so far is the Australia’s ASX 200 that has declined by -0.34% dragged down by Industrial and Technology sectors; recorded losses of -0.71% and -0.97% respectively.

Price Acton (derived from CFD indices):

- Japan 225: Yesterday’s price action has been rejected again just below the 23650 range resistance in place since 07 Nov 2019. No clear directional bias in the short-term, expect sideways movement between 23250 and 23650. A break below 23250 sees a deeper slide towards the medium-term range support area of 23150/23050 (also the minor ascending trendline in place since 21 Nov 2019 low & 61.8% retracement of the recent push up from 03 Dec low to 09 Dec 2019 high).

- Hong Kong 50: Today’s Asian session opening push up has been rejected at the former minor ascending trendline support from 03 Dec 2019 low now acting as at pull-back resistance at 26570. At risk of a dip to retest today’s current intraday low of 26264.

- Australia 200: Minor mean reversion rebound target/resistance of 6740/780 met; printed a high of 6751 in yesterday, 09 Dec U.S. session. Hourly RSI oscillator has traced out a prior bearish divergence signal and it is now breaking below the 50-level. These observations suggest short-term downside momentum has resurfaced, at risk of shaping a slide towards 6630 minor support.

- Germany 30: Churning below intermediate range resistance of 13200 with minor support at 13150. A break below 13150 sees a slide to retest the 12900 swing low area of 03 Dec 2019.

- US SP 500: Yesterday’s price action has staged a bearish breakdown below the minor ascending trendline support from 03 Dec 2012 low now turns pull-back resistance at 3140. Thus, it seems that the Index is now undergoing a potential minor retracement of the recent rally from 03 Dec low of 3070 to last Fr, 06 Dec high of 3151 towards the next minor support zone at 3120/3110 (05 Dec minor swing low area & 38.2%/50% retracement of the recent rally from 03 Dec low to 06 Dec high).

Matt Simpson and Kelvin Wong both contributed to this article

Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM