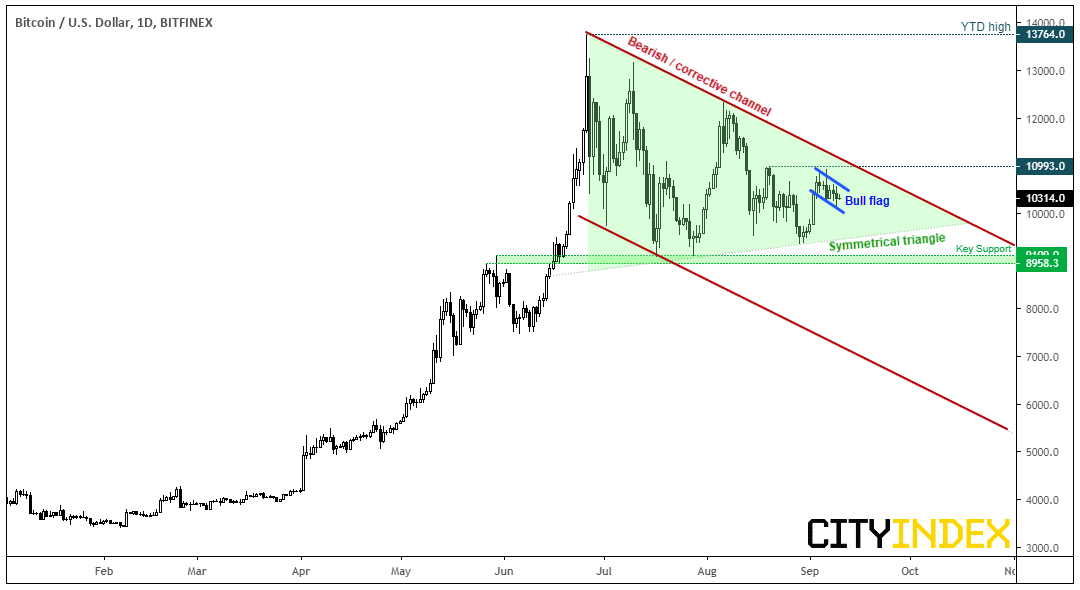

Whilst volatility on Bitcoin has subsided, we highlight contradictory patterns for bulls and bears to monitor ahead of its next directional move.

From price action alone, we suspect Bitcoin could indeed break to new highs over the coming months. Yet since topping out in June, price action appears mostly corrective so we cannot rule out new lows before the bullish trend resumes.

A rule of thumb that has served me well from a technical perspective; if you identify several contradictory patterns then, chances are, prices are likely still within a complex correction or reversal pattern. Whilst trends may present themselves on the lower timeframes, it appears equally possible for a bullish or bearish scenario on the daily chart from the following patterns:

Bearish channel: The bearish trendline from the June high remains valid, and last week’s bearish engulfing candle presents a lower high which has failed to retest the trendline. If prices remain below 10,993, bears could look for a swing trade short to target the lower channel. That said, key support resides around 9,000, which makes it a likely interim target (and vulnerable for a correction around those lows).

Topping Pattern: In ways, similar to the bearish channel scenario, traders could monitor for a break below the 9,000 area to confirm a larger topping pattern. Given we’ve seen three lower highs since the 2019 high, a solid break of the 9,000 zone could be confirmation of a descending triangle breakout. If successful, it would target the 4,000 region.

Symmetrical Triangle: Prices are currently oscillating within a tighter range within a potential triangle (a continuation pattern). If successful, the minimum projected target is around 15,300. Within the triangle we’ve noted a potential bullish flag on the daily chart, which itself could be part of an inverted head and shoulders pattern (with the flag forming the right shoulder). Bulls could either use a bullish close with range expansion, or for a break of 10,993 to confirm a bull-flag breakout. However, a more conservative approach would be to wait for the break of the upper trendline – and this may not be a bad idea, given how volatile Bitcoin can become once volatility erupts.

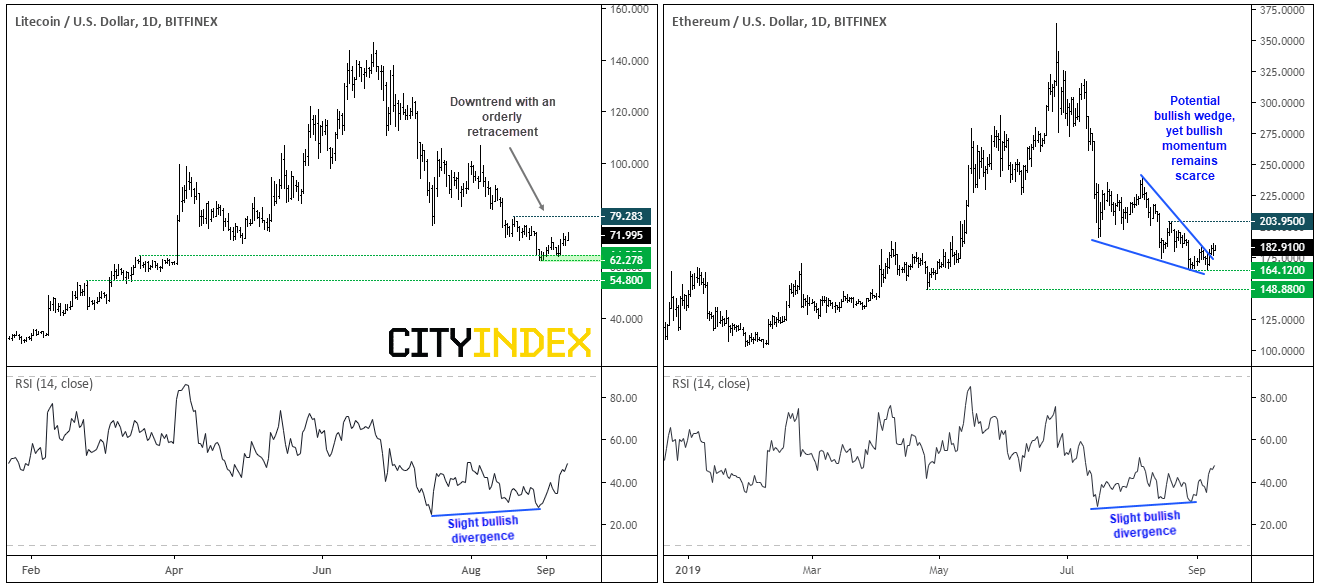

However, if there is a reason to be wary of a bullish breakout, it’s the lacklustre performance of crypto in general.

We can see that altcoins such as Ethereum and Litecoin have continued to trend lower, yet Bitcoin has managed to build a base above 9,000. Whilst this could generate a spread-trade setup (long bitcoin / short altcoin) it mostly underscores that crypto in general does not have the appeal it did leading up to June. So one approach to consider is to wait for altcoins to generate a bullish reversal signal before assuming a Bitcoin breakout will be sustained.

Technically, both Litecoin and Ethereum are within downtrend, although a slight bullish divergence ha formed to show the downtrends are losing momentum. At a stretch we could suggest a potential bullish wedge on Ethereum but, until we see a swing high break of momentum shift form the lows, must be on guard for a break to new lows.

Litecoin, for example appears to have carved out a 3-wave move yet remains beneath its prior swing high. This suggests a correction could be nearing completion and for bears could look for a break to new lows.

Related analysis:

Bitcoin And Gold's Divergence Could Be About To Get Tested

Bitcoin: Do Volatile Bullish Sessions Lead To Further Gains?