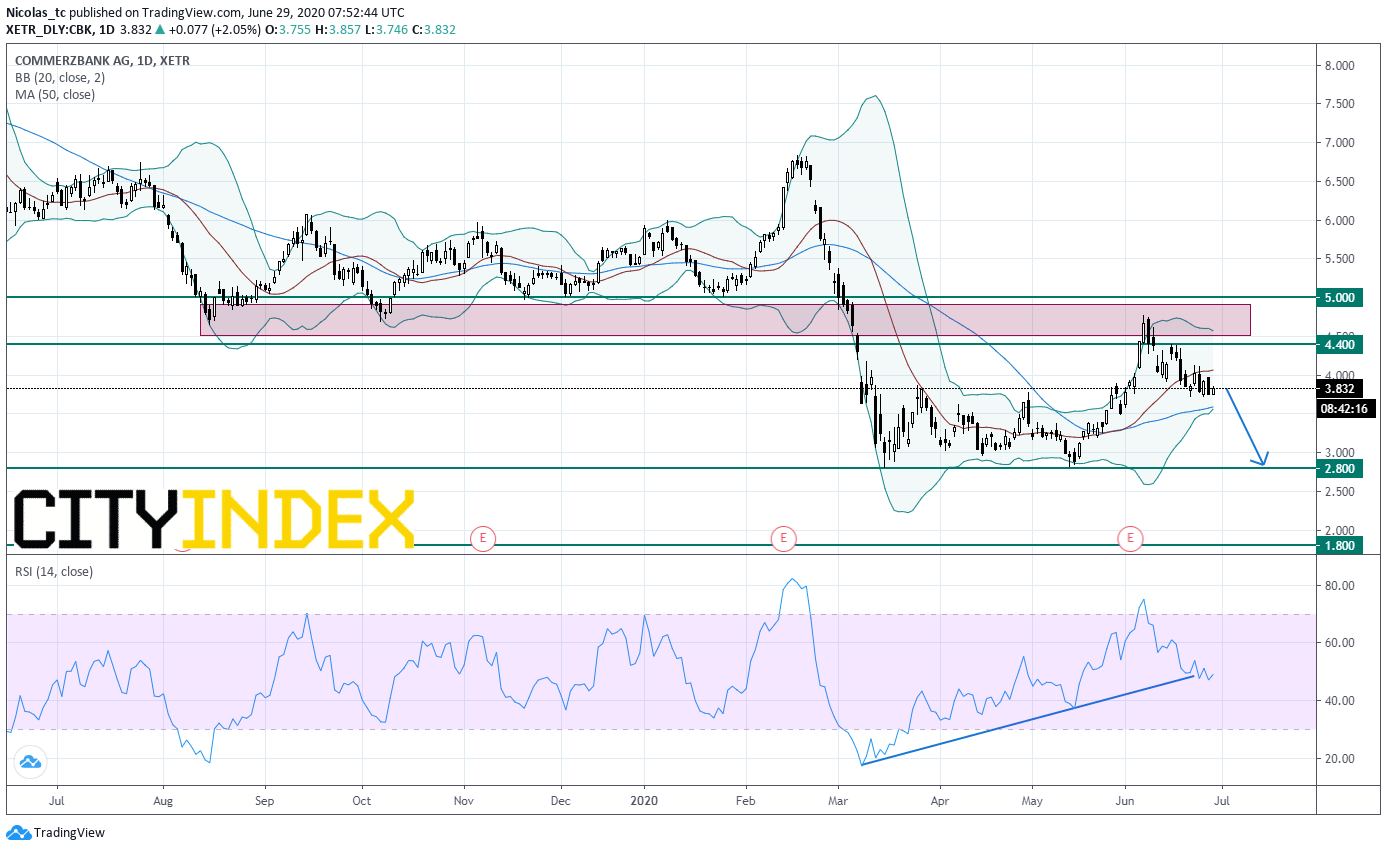

Commerzbank to cut jobs – Chart points to further weakness

Commerzbank, a banking group, is considering shedding 7,000 jobs and close 400 branches, amid pressure from shareholder private equity fund Cerberus Capital Management, reported Bloomberg citing people familiar with the matter.

From a chartist’s point of view, the stock price struck against the key resistance zone around 4.4E – 5E (overlap) and is reversing down. Prices fell below the 20Day- simple moving average. In addition, the daily Relative Strength Index (RSI, 14) has just broken down a rising trend line. The trend remains bearish. Readers will keep an eye on key resistance at 4.4E. As long as 4.4E is not broken, a down move towards 2.8E is likely. Alternatively, a push above 4.4E would call for a bullish acceleration towards 5E.

Source: GAIN Capital, TradingView

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM