Commertzbank : new down leg in sight ?

Commertzbank announced that it swung to a 1Q net loss of 295 million euros from a net profit of 122 million euros in the prior-year period, where the risk result increased fourfold to -326 million euros from -78 million euros due to the coronavirus effects. Operating loss totaled 277 million euros, compared with an operating profit of 246 million euros last year, on net interest income of 1.32 billion euros, up 7.2%. Also, CET1 ratio climbed to 13.2% from 12.7%. The bank adjusted its target for the CET1 ratio from at least 12.75% to at least 12.5% at the end of the year.

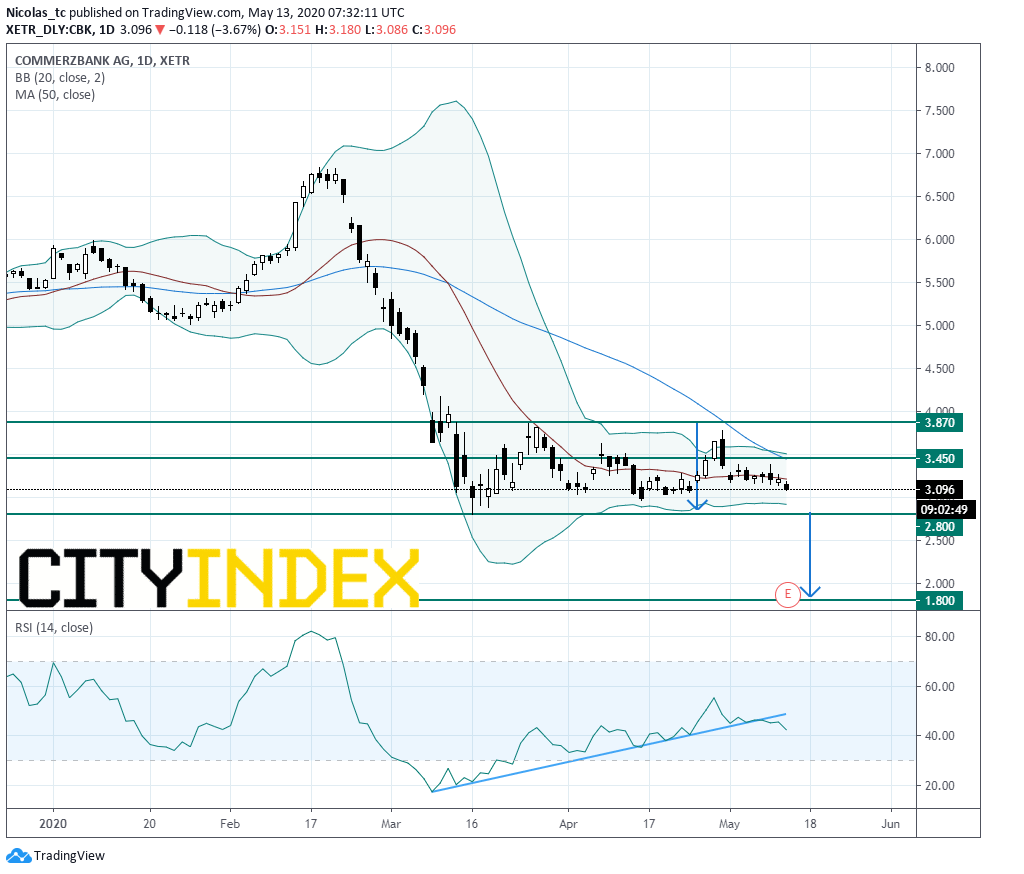

From a chartist’s point of view, the stock price remains stuck in a short term trading range between 3.87E and 2.8E. The daily Relative Strength Index (RSI, 14) has just broken below its rising trend line indicating that the trend could turn down again. Readers may want to consider the potential for short positions below the horizontal resistance at 3.45E. A break below 2.8E would validate a new bearish signal. The measured down move target of the range is set at 1.8E.

Alternatively, a break above 3.45E would call for a test of the upper end of the range at 3.87E.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM