The fall coming about against the backdrop of an accelerating COVID-19 second wave and as the U.S congress made little progress towards agreeing on a fiscal package deal before tomorrow’s deadline, set by House Speaker, Nancy Pelosi.

The reaction of the market highlights its continued sensitivity to talks on a stimulus deal. Putting my politicians hat on for the moment, I can’t think of any good reasons why the Democrats would agree to a fiscal package that might boost the ailing re-election prospects for U.S President Trump.

More so given the Democrats will soon be able to launch their own fiscal stimulus package shortly after the election, if election polls are proved correct.

In light of the fading prospects of a short-term fiscal deal, the chances of more disappointment this week seem reasonably high. The recent unwinding of the largest short positions in the Nasdaq futures since the Global Financial Crisis, indicates position in the high beta Nasdaq is much cleaner than it was during September's correction.

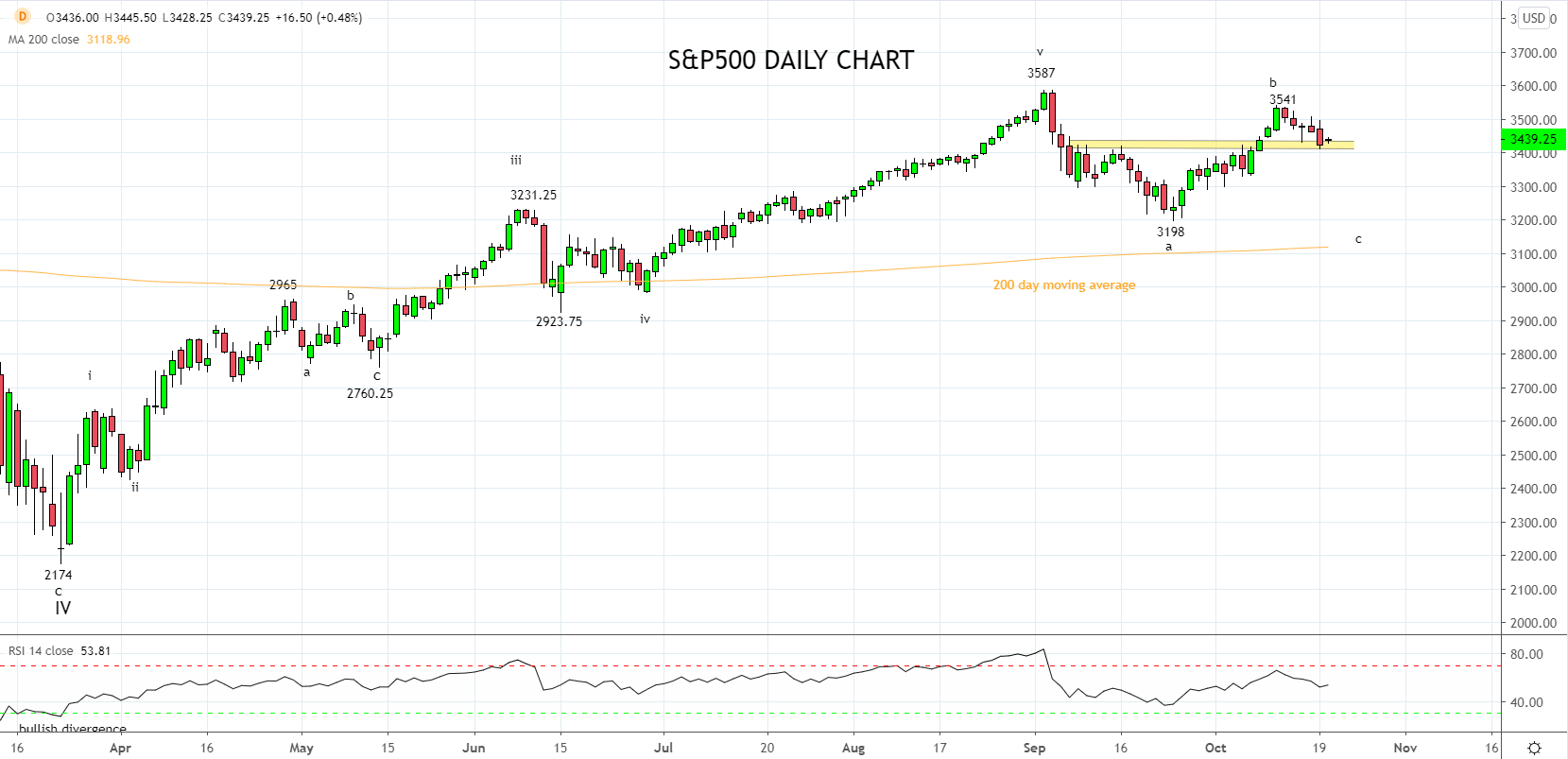

Turning now to the charts. In our last update on the S&P500 in early October, the view was that the pullback from the 3587 high to the 3198 low during September completed an “abc” corrective pullback. However, further confirmation that the uptrend had resumed was required ”in the form of a break and daily close above key resistance 3420/30 area.”

Following this, the S&P500 traded to a high of 3541, and the upside breakout level at 3430/20 outlined above, now becomes key support.

Hence for a positive short term positive bias to remain in place, the S&P500 mustn't break/close below 3430/10. Otherwise, the risks are for a retest of the bottom of the range coming from the September 3198 low.

Source Tradingview. The figures stated areas of the 20th of October 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation