CK Infrastructure (1038.HK): Under Pressure On Deteriorating Result

CK Infrastructure (1038), a global real assets investment company, reported that 1H net income plunged 52% on year to 2.89 billion Hong Kong dollars. The Company proposed maintaining an interim dividend at 68 Hong Kong cents per share. After releasing the result, the stock plunged around 3.6%.

The company listed factors for the decline of net income: "One-off Charges on the Re-measurement of Deferred Tax Liabilities in the United Kingdom (...) One-off Divestment Gains in 2019 (...) COVID-19 Disruption Impact (...) Lower Contribution from Northumbrian Water following Regulatory Reset."

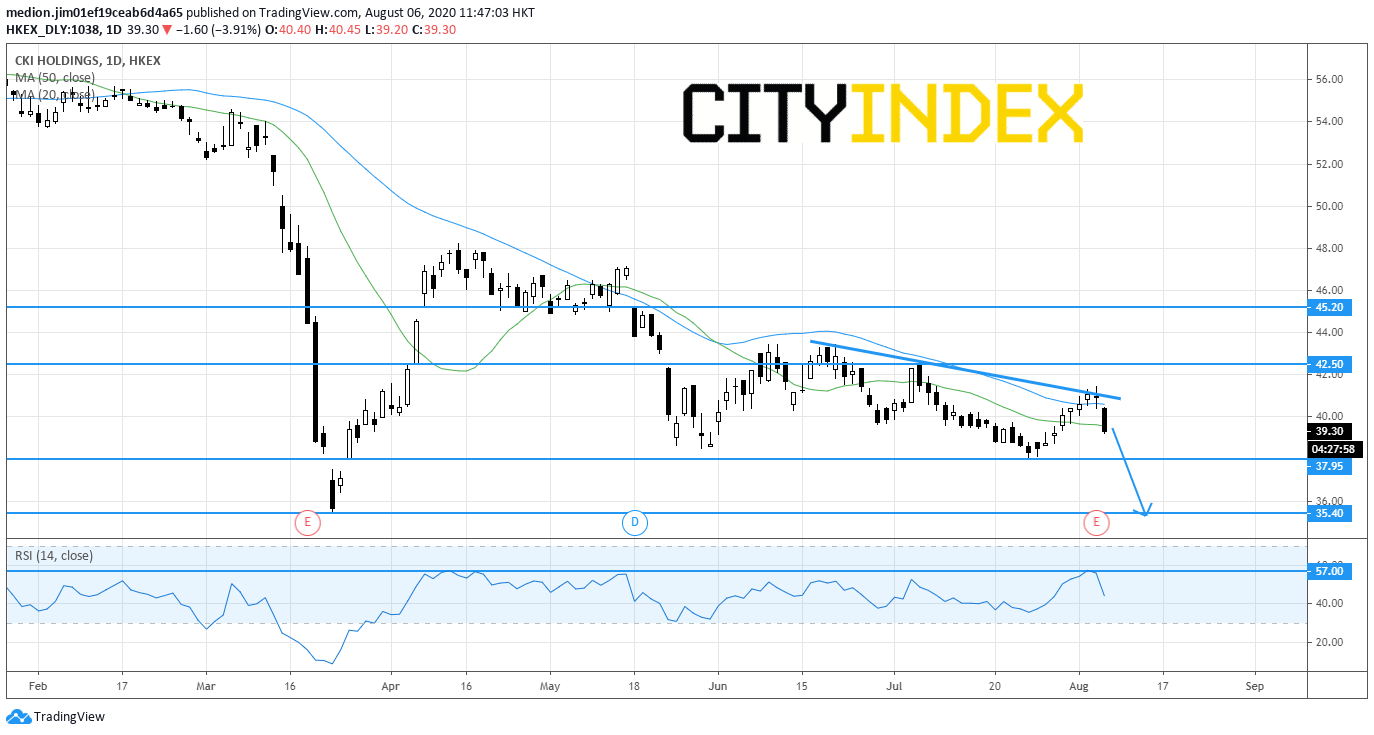

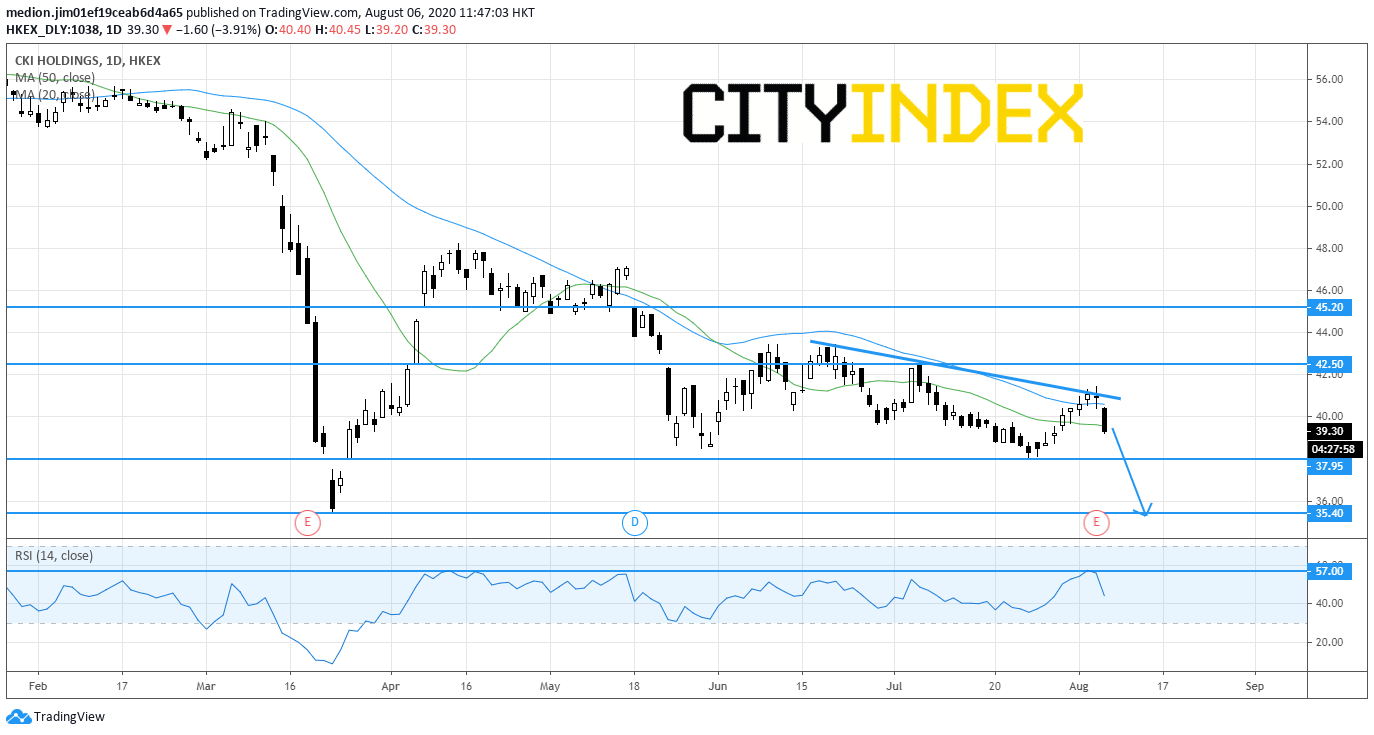

From a technical point of view, the stock retreated after touching the declining trend line and 50-day moving average. Currently, the stock returned the level below the 20-day moving average. The RSI also failed to penetrate the previous high at 57, suggesting that the momentum remains down.

In this case, as long as the resistance level at HK$42.5 (the previous high0 is not surpassed, stock could consider a return to the support levels at HK$37.95 (the low of July) and 35.40 (the low of March).

Source: GAIN Capital, TradingView

The company listed factors for the decline of net income: "One-off Charges on the Re-measurement of Deferred Tax Liabilities in the United Kingdom (...) One-off Divestment Gains in 2019 (...) COVID-19 Disruption Impact (...) Lower Contribution from Northumbrian Water following Regulatory Reset."

From a technical point of view, the stock retreated after touching the declining trend line and 50-day moving average. Currently, the stock returned the level below the 20-day moving average. The RSI also failed to penetrate the previous high at 57, suggesting that the momentum remains down.

In this case, as long as the resistance level at HK$42.5 (the previous high0 is not surpassed, stock could consider a return to the support levels at HK$37.95 (the low of July) and 35.40 (the low of March).

Source: GAIN Capital, TradingView