CK Hutchison (1.HK): Trading Within the Symmetric Triangle

CK Hutchison (1), a multi-industry company, reported that 1H net income was down 29% on year to 13 billion Hong Kong dollars on revenue of 189.94 billion Hong Kong dollars, down 12%. The interim dividend per share declined 29% on year to 61.4 Hong Kong cents.

The Chairman of the Company, Victor Li, said the reduction of dividend could ensure the safety of the group and prepare for any unexpected scenarios and identify potential acquisitions.

After the announcement of interim results, Nomura kept the rating at buy and lowered the forecast price from HK$68.6 to HK$64.7. The securities firm said the company's telecommunication business reorganization and weaker USD could be a tailwind in 2H20.

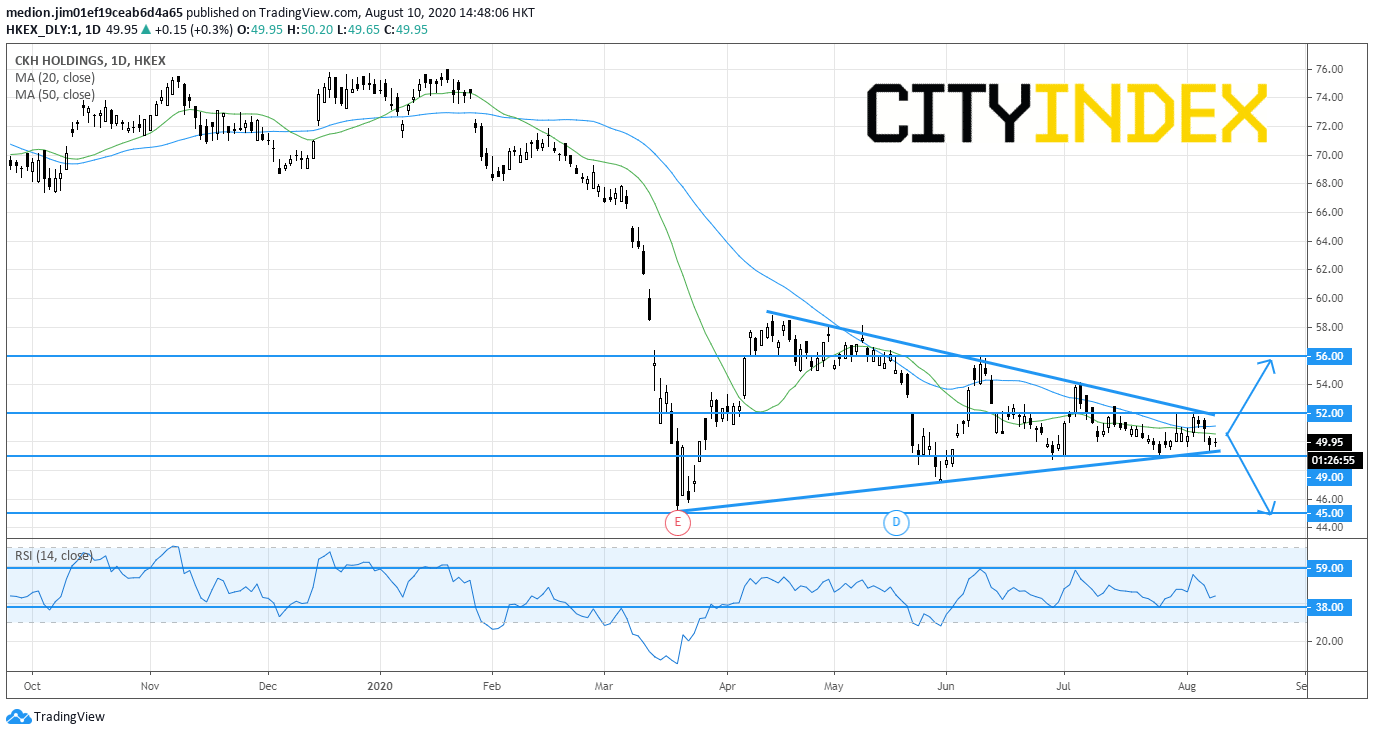

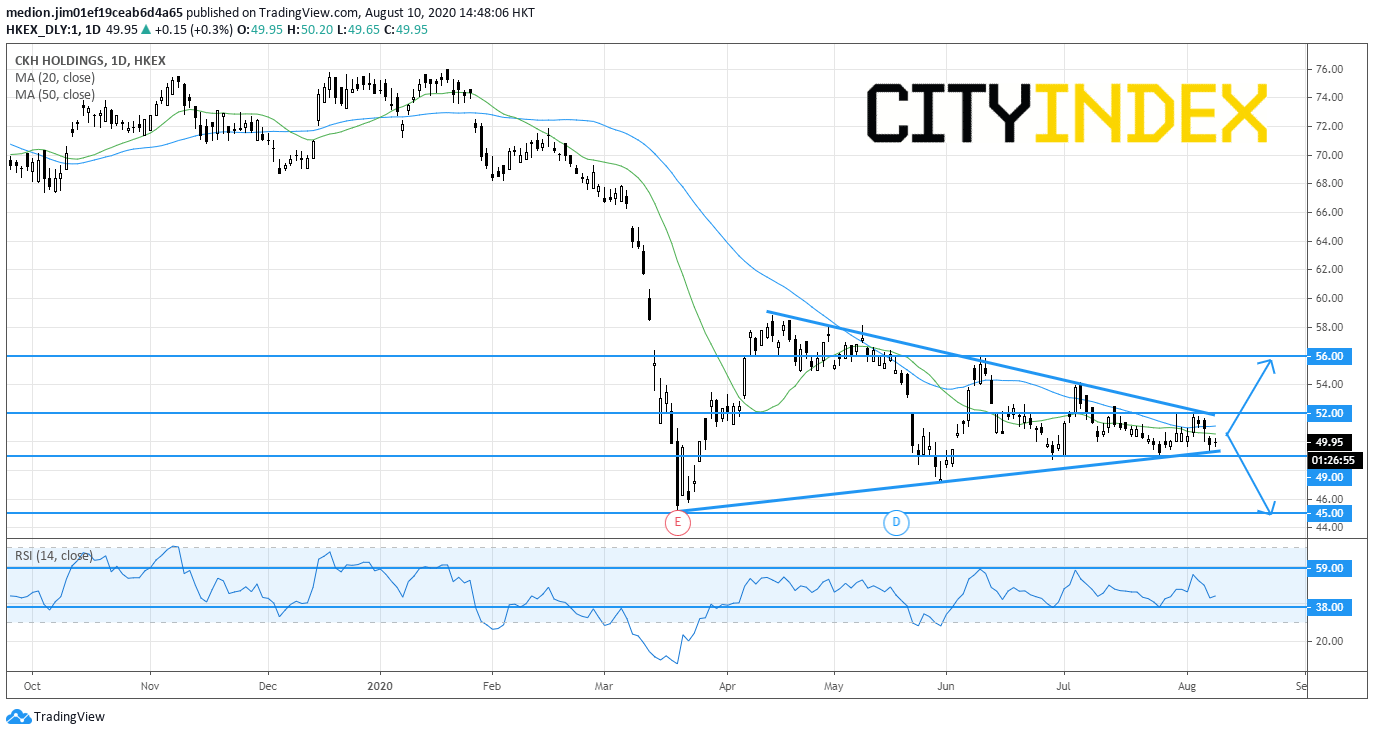

The stock is trading within the symmetric triangle, while the relative strength index is ranging within 49 and 59. Both technical configurations suggest the lack of momentum for the prices.

Source: GAIN Capital, TradingView

The Chairman of the Company, Victor Li, said the reduction of dividend could ensure the safety of the group and prepare for any unexpected scenarios and identify potential acquisitions.

After the announcement of interim results, Nomura kept the rating at buy and lowered the forecast price from HK$68.6 to HK$64.7. The securities firm said the company's telecommunication business reorganization and weaker USD could be a tailwind in 2H20.

The stock is trading within the symmetric triangle, while the relative strength index is ranging within 49 and 59. Both technical configurations suggest the lack of momentum for the prices.

Investors should stay neutral and wait for the breakout signal. A break above the previous high at HK$52.0 would bring a rise to the resistance level at HK$56.0. Alternatively, a break below HK$49.0 would trigger a drop to March low at HK$45.0.

Source: GAIN Capital, TradingView