CK Hutchison Holdings (0001 HKG)

click to enlarge charts

Key Levels (1 to 3 weeks)

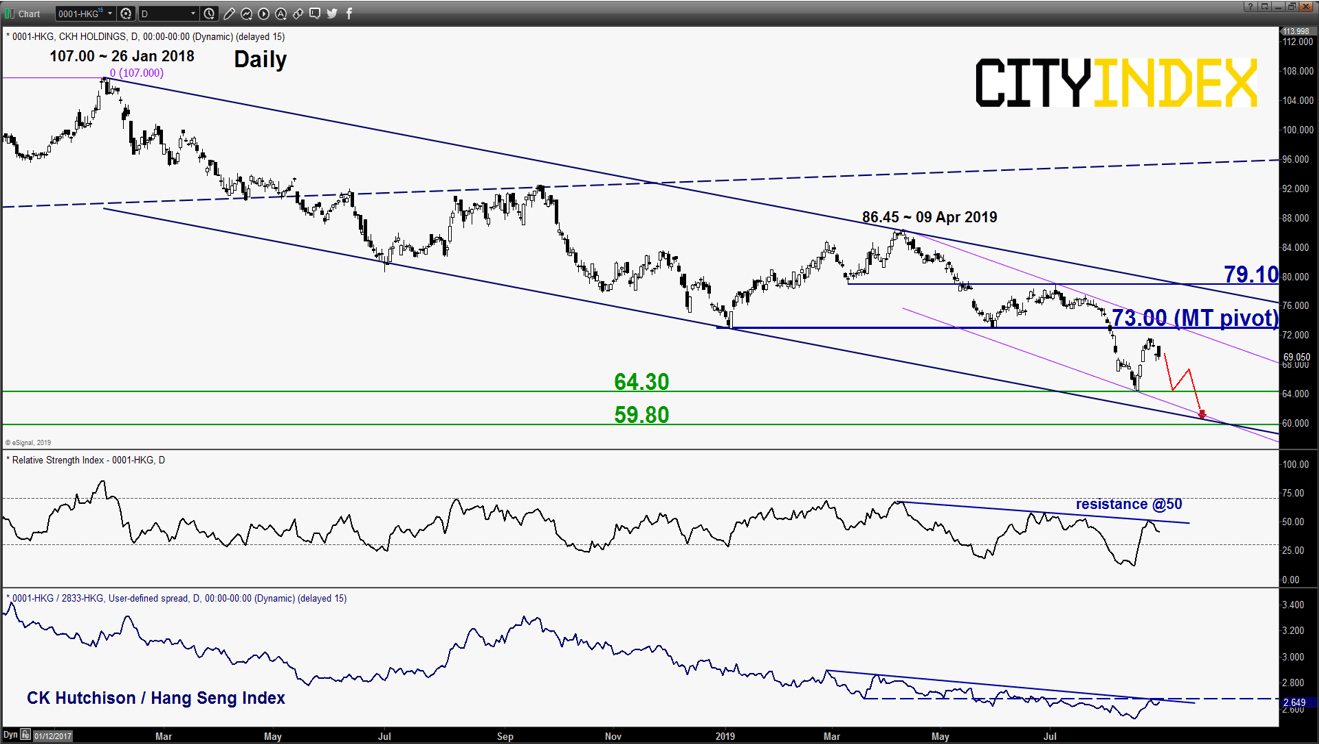

Pivot (key resistance): 73.00

Supports: 64.30 & 59.80

Next resistance: 79.10

Directional Bias (1 to 3 weeks)

Bearish bias below 73.00 key medium-term pivotal resistance for another round of potential impulsive downleg to retest 15 Aug 2019 low of 64.30 before targeting the next significant medium-term support at 59.80.

However, a clearance with a daily close above 73.00 invalidates the bearish scenario for a continuation of the corrective rebound towards the major resistance at 79.10 (former swing low areas of Oct 2011/Jun 2016 & upper boundary of the primary descending channel from Jan 2018 high).

Key elements

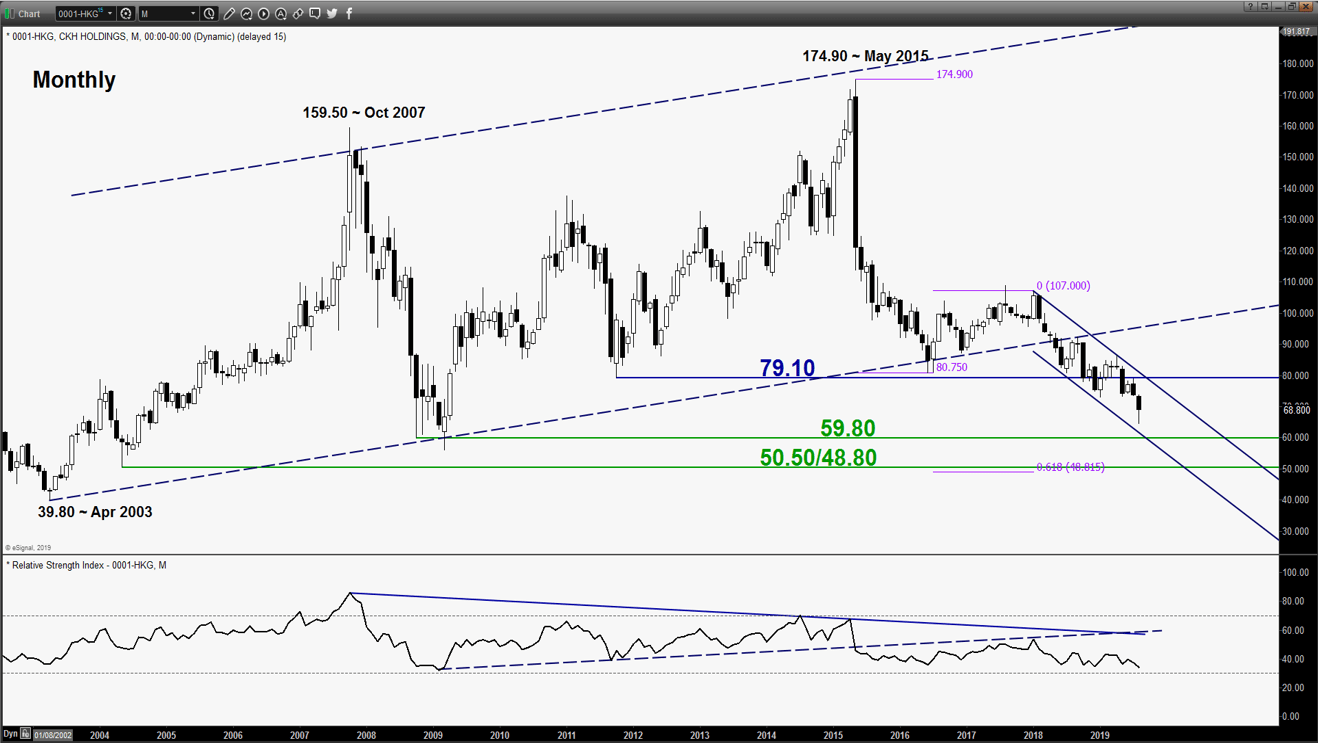

- CK Hutchison Holdings, ranked number 11th in the Hang Seng Index based on market capitalised, also chaired by Hong Kong’s richest man, Li Ka-Shing has been evolving within a primary downtrend in place since 26 Jan 2018 high of 107.00.

- The daily RSI oscillator remains bearish below a corresponding resistance at the 50 level after a test and retreat from it. These observations suggest that medium-term downside momentum remains intact.

- The key medium-term resistance stands at 73.00 which is defined by the upper boundary of a medium-term descending channel from 09 Apr 2019 high and former swing low areas of 04 Jan/30 May 2019).

- Today, 27 Aug price action is considered as negative as it has staged a push up to fill up the “gapped down” formed on Mon, 26 Aug and ended the session with a bearish daily candlestick.

- The significant medium-term support rests at 59.80 which is defined by the intersection point of the primary and medium-term descending channels and the former major swing low area of Oct 2008.

- Relative strength analysis of CK Hutchison Holdings against the market (Hang Seng Index) is still not showing any clear signs of reversal from its underperformance.

Charts are from eSignal

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM