What to expect in the week ahead

Welcome to our first Market Outlook of the New Year. The markets kicked off 2017 in fine form, a sharp contrast to the sell off which pushed us into 2016.

Although the week was shortened thanks to the extended New Year weekend, economic data has been coming through thick and fast, helping to build a more solid picture as to the state of the UK economy in the final weeks of 2016 and in the States, the outlook for the Federal Reserve.

There are also a number of new records all round.

Look ahead: The markets that matter

FTSE

The FTSE closed 2016 at a record high of 7162 and has continued to power onwards and upwards this week, hitting an all-time intraday high of 7120 on the first day back to school, whilst also managing an all-time closing high for each close this week. An impressive start but can it continue?

House builders

A hat-trick of strong PMI’s have without doubt offered some support to the index and sterling alike. Construction PMI’s sent the house builders soaring with Persimmon putting in a notable performance up 10% on the week to date. The sector was also boosted by a positive note from Deutsche Bank which suggests that the house builders still have around 30% upside, so still plenty of potential; although not for the faint hearted as volatility is also expected to be high as we head into an uncertain year. Looking to next week, the Halifax house price report could knock some wind out the recent rally if Brexit fears are starting to appear and it comes in significantly lower than expected.

Retailers

On the other hand, the retail sector has been the sick dog of late, after Next set off alarm bells for the sector with disappointing sales over the festive period and a weak outlook for the year ahead. Next was just the first of the retailers to report on sales over the festive period and the fear is that they have set the tone for further disappointment from other retailers to come. Retailers are in a tough environment right now, shop prices are in decline, the post referendum weaker pound is pushing costs up and on the horizon more clouds are forming as consumers will be faced with a squeeze on their disposable income as inflation is set to rise. As we step forward into the next week retailers will remain very much in focus, with investors looking keenly towards Christmas sales figures as they are reported. More fragile numbers could see investors look to sell out of retailers quickly, especially given the tough environment that lies ahead.

Energy Stocks

Energy stocks were once again in focus after the OPEC led oil production cut deal kicked off on January 1st giving a boost to the price of oil. With more countries set to confirm their compliance to the cuts, in addition to the slightly weaker greenback, plus encouraging oil inventory data energy stocks and oil majors are set for another bumper week. However, any signs that Russia or Saudi Arabia are not looking to play ball, will put a quick end to the oil rally.

US

The US markets have also kicked off the New Year with a bang. Only not so long ago the Dow Jones powered through 19,000 and this week it is once more flirting with historic level of 20,000. With Trump only two weeks away from taking the oval office, markets are remaining centered on what could be in store for the year ahead.

The minutes from the Federal Reserve’s policy meeting in December highlighted the level of uncertainty and the lack of clarity that still exists as far as wild card Trump is concerned and his plans for fiscal policy and spending. An air of caution is still holding policy makers back with only half of members actually factoring in fiscal stimulus into their forecasts. Yet complicating the issue further, there are growing concerns over the economy overheating and the increased strength of the dollar.

The uncertainty is set to stay, at least for a few more weeks until there is more clarity on Trumponomics and the Fed can gauge the pace of rate hikes more accurately that right now.

The dollar has also been on fine form, hitting fresh 14 year highs, however following the release of the Fed minutes it paired back slightly giving relief to the yen and putting euro parity slightly further into the distance. As we look towards next week, and as more details come to light regarding Trumps transfer into power, we can expect to see more volatility surrounding the dollar.

Emerging market currencies have already seen an increase in volatility with the Mexican peso falling to its weakest level versus the dollar as Trump fears heat up once more. Any further vocal attacks by Trump similar to his outburst against GM for manufacturing in Mexico, could pull the peso to new record lows.

Look ahead: Non-farm Payrolls

Consensus expectations for this Friday’s NFP, which will be accompanied by key related data on the unemployment rate and average hourly earnings, are currently around 175,000 jobs added for the month of December. The December unemployment rate is expected to come in at 4.7%, while average hourly earnings are expected to have increased by 0.3% after last month’s surprise -0.1% decrease.

Thursday’s ADP private sector employment report, which sometimes serves as a limited indicator for NFP Fridays, came in significantly worse than expected at 153,000 jobs added in December against prior forecasts of around 170,000.

As for other key employment-related data releases for December: the ISM manufacturing PMI employment component expanded at a faster pace in December than the previous month – 53.1 versus 52.3 in November. In contrast, the even more critical ISM non-manufacturing (services) PMI showed a marked slowing of growth in December at 53.8 versus November’s 58.2.

Finally, December’s weekly jobless claims data has been relatively consistent, but generally a mixed bag. The most recent release on Thursday covering the last full week of December showed a significantly better-than-expected (lower) number of claims at 235,000 vs 262,000 expected.

Forecast and Potential Market Reaction

Overall, the trend of solid employment numbers is likely to have continued from previous months into December. With that said, the number could skew lower if the worse-than-expected ADP and ISM non-manufacturing employment data are to serve as any guide. With consensus expectations of around 175,000 jobs added in December, our target range is around 160,000-180,000.

If the actual data falls above this range, the report should increase expectations of a faster pace of Fed rate hikes, thereby boosting the dollar further while potentially extending gold’s decline. An outcome that is substantially lower than this range, however, could make a significantly negative impact on the strong dollar, and lead to a further relief rebound for depressed gold prices.

NFP Jobs Created and Potential USD Reaction:

> 200,000

Strongly Bullish

181,000-200,000

Moderately Bullish

160,000-180,000

Neutral

140,000-159,000

Moderately Bearish

<>

Strongly Bearish

Look ahead: Commodities

Both oil contracts managed to bounce back on Wednesday after suffering big drops in the first trading day of the year. Tuesday’s sell-off took most people by surprise as there was no fundamental news behind the move. It was likely triggered by a general “risk-off” trade that also caused stocks to decline.

Equities bounced back along with oil prices by the very next day, but they decoupled somewhat on Thursday: oil was higher and equity markets were a little soft. Crude oil has been boosted in part by the surprisingly large drawdown in US oil stocks, as first reported by the American Petroleum Institute. According to the API, oil inventories fell by a good 7.4 million barrels last week, much more than expected.

This was more or less confirmed by official government data later on Wednesday: the EIA estimated the drawdown to be 7.2 million barrels. However the EIA also reported big rises in inventories of oil products: gasoline and distillate stocks surged by a good 8.3 and 10.1 million barrels respectively. As a result, oil prices pared their gains to trade flat at the time of this writing.

Generally speaking, though, the focus remains firmly fixated on the OPEC and the big deal now is whether the cartel and non-OPEC producers will honour their agreement or whether cracks will start to appear. We would be very surprised if producer nations breached their agreed quotas by noticeable margins because while that might be profitable in the short-term, it could be very costly in the long-term.

Why sell more oil for less when there is a chance to sell less oil for more in the future? For that reason, we do think that oil prices will probably rise further in the weeks and months to come. Indeed, Iraq is already doing its part in trying to trim production by the agreed 200 thousand barrels per day, according to oil minister Jabar Ali al-Luaibi. Saudi, too, has apparently cut its oil output by at least 486,000 b/d to 10.058 million b/d, thus fully implementing OPEC cut pledge, according to Wall Street journal.

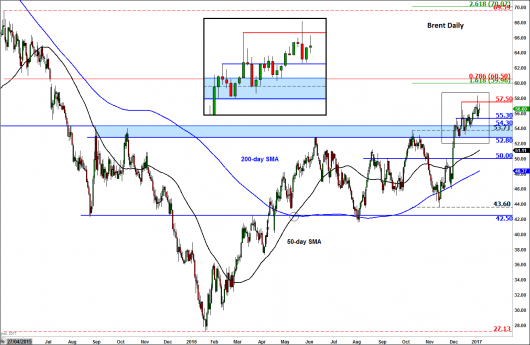

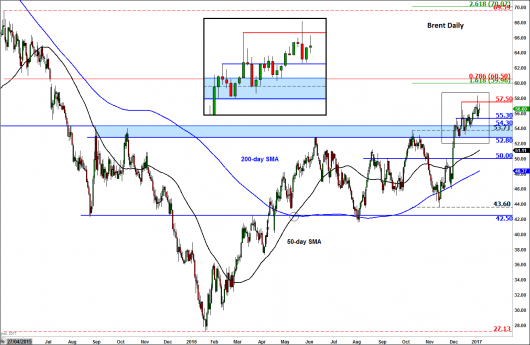

Thanks to a brighter fundamental outlook, oil prices made significant technical breakthrough at the end of last year as they finally broke out of their consolidation ranges. Unless prices now fall back into their old ranges, the path of least resistance remains to the upside for both contracts. Brent’s technical bias remains bullish above the shaded $52.80-$54.30 range, possibly towards the Fibonacci conflux area of $60.00-$60.50. WTI’s corresponding support range is at $50.90-$51.90 area. The latter was testing short-term resistance at $53.75 at the time of this writing.