Chinese Concept Stocks with Promising Signals

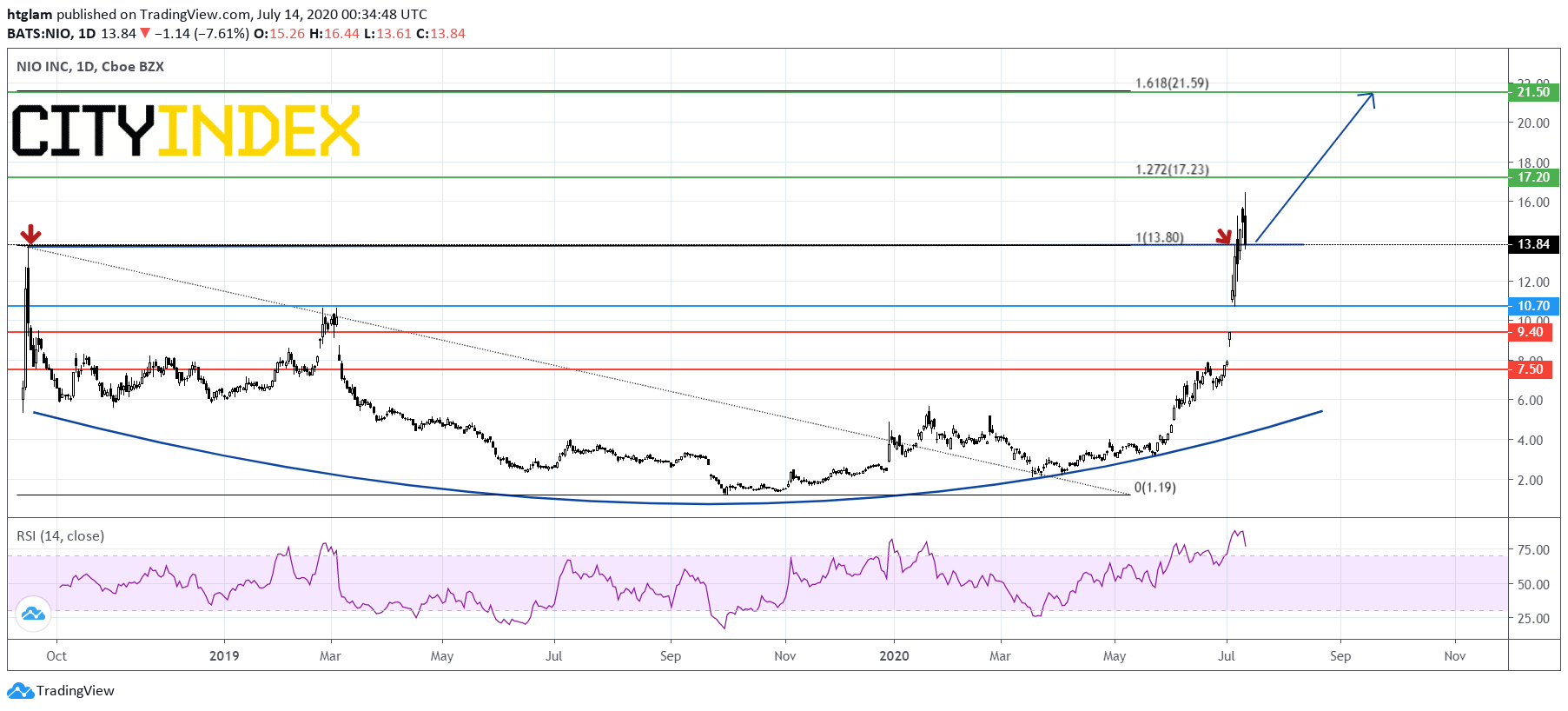

NIO (NIO): Strong Bullish Momentum

NIO (NIO), a Chinese electric vehicle manufacturer, has surpassed its historical after forming a rounding bottom pattern as shown on the daily chart. For the stock to maintain its strong bullish momentum, the 61.8% Fibonacci retracement level of the rally from March at $10.70 should act as the nearest support, with prices trending to test the 1st and 2nd resistance at $17.20 and $21.50 respectively. Alternatively, a break below $10.70 might trigger a pull-back to the next support at $9.40.

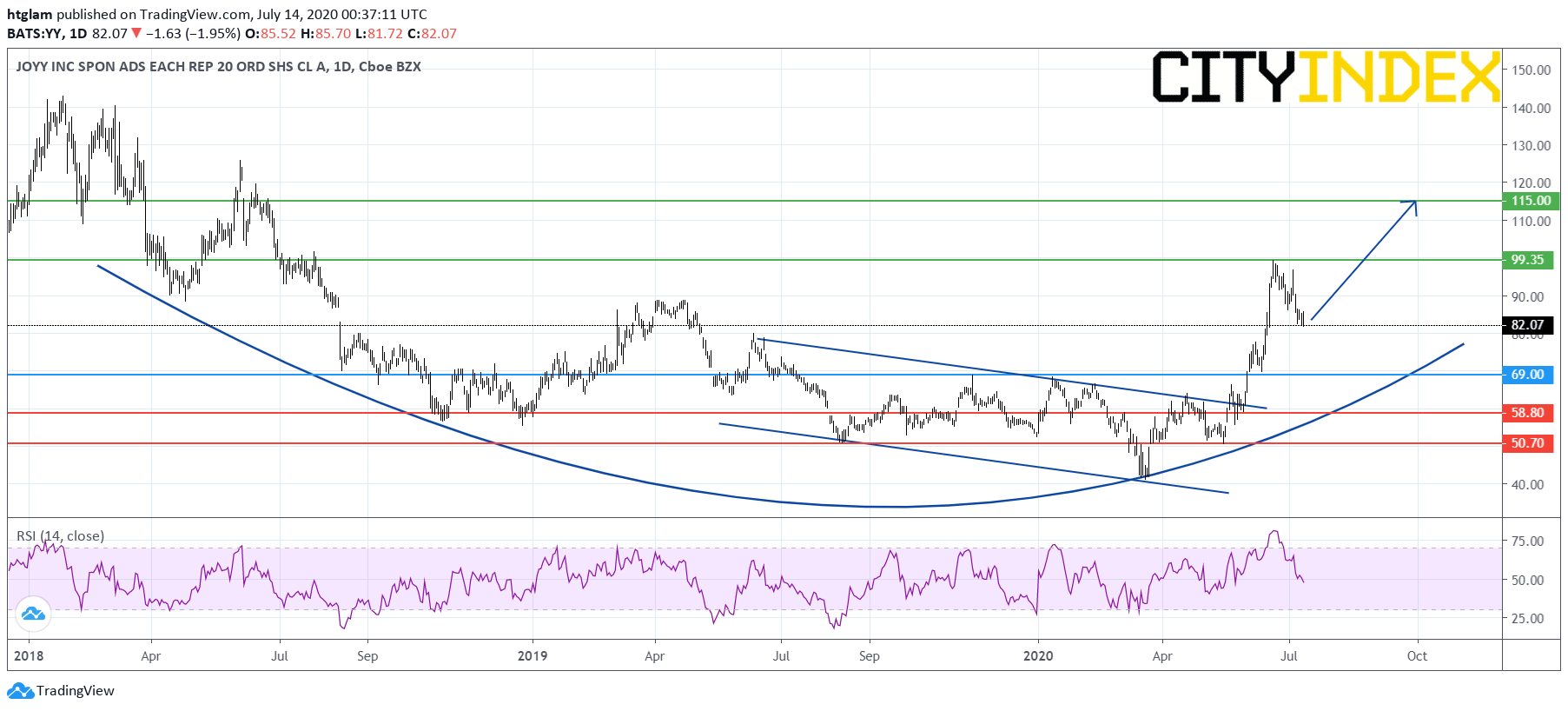

JOYY (YY): Long-term Rounded Bottom

JOYY (YY), a Chinese video-based social network, has accelerated to the upside after breaking above a bearish channel as shown on the daily chart. In fact, it is building a rounding bottom pattern in the longer term. Despite a modest pull-back, the level at $69.00 might be considered as the nearest support, while a break above the nearest resistance at $99.35 would open a path to the next resistance at $115.00. Alternatively, losing $69.00 would suggest that the next support at $58.80 is exposed.

Source: TradingView, Gain Capital