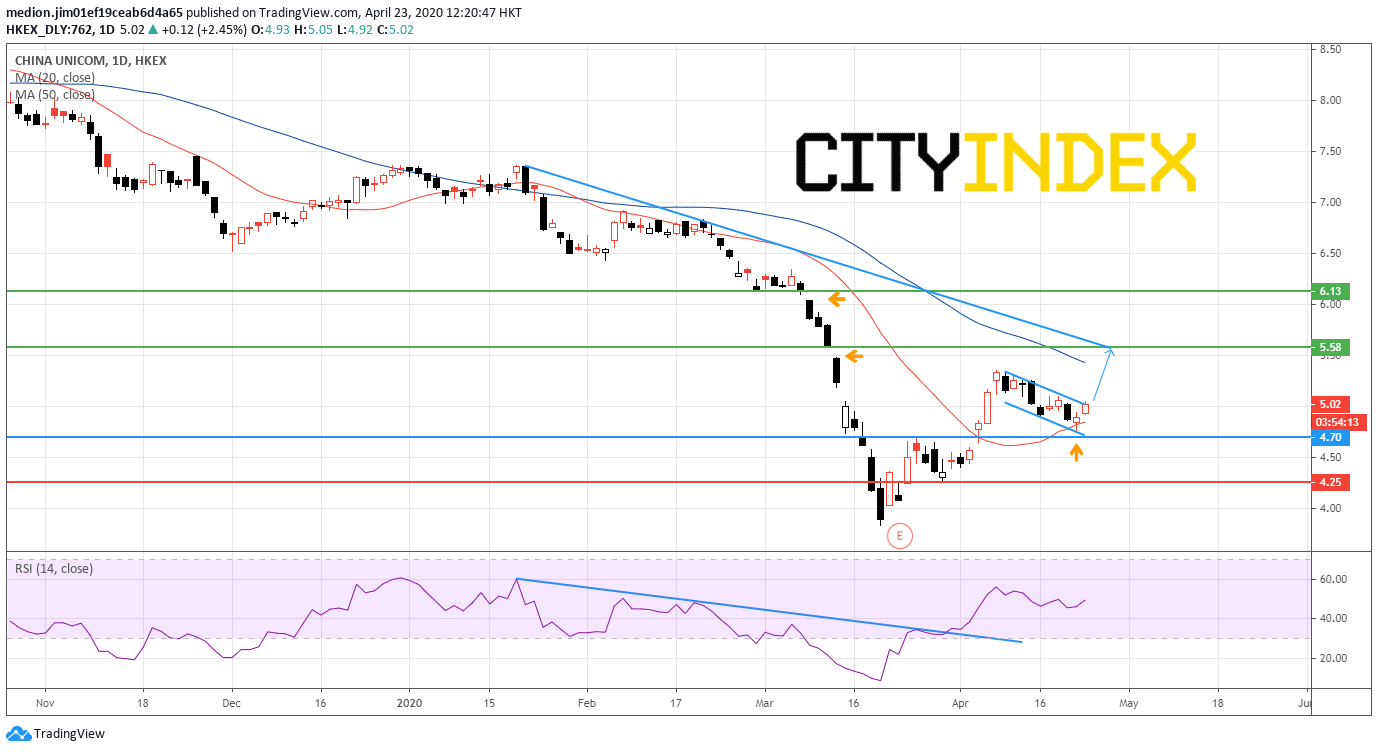

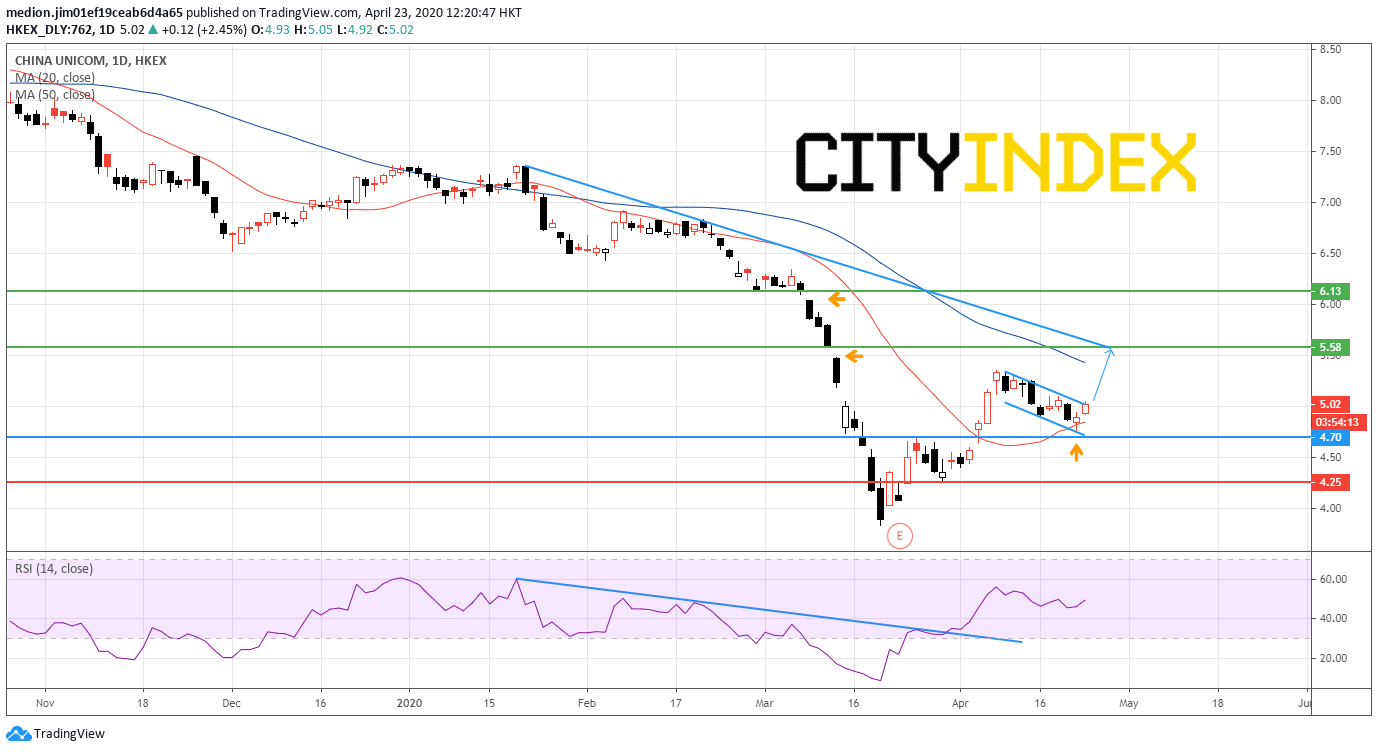

China Unicom Forms a Falling Flag

China Unicom rose around 2% after announcing its 1Q result. At the same time, Hong Kong's Hang Seng Index was slightly up 0.2%. It suggests that the company is out-performing today.

China Unicom (762), one of the largest Chinese telecommunications groups, announced that 1Q net income dropped 13.9% on year (+110.1% on quarter) to 3.17 billion yuan and EBITDA fell 5.8% (+11.1% on quarter) to 23.56 billion yuan on revenue of 73.82 billion yuan, up 0.9%.

From a technical point of view, the stock is forming a falling flag, a bullish continuation pattern, on a daily chart. A break above $5.10 would validate this pattern and bring a resumption of recent uptrend. Recently, the prices reversed up after touching the rising 20-day moving. The RSI also breaks above the declining trend line drawn from January.

Source: GAIN Capital, TradingView

China Unicom (762), one of the largest Chinese telecommunications groups, announced that 1Q net income dropped 13.9% on year (+110.1% on quarter) to 3.17 billion yuan and EBITDA fell 5.8% (+11.1% on quarter) to 23.56 billion yuan on revenue of 73.82 billion yuan, up 0.9%.

From a technical point of view, the stock is forming a falling flag, a bullish continuation pattern, on a daily chart. A break above $5.10 would validate this pattern and bring a resumption of recent uptrend. Recently, the prices reversed up after touching the rising 20-day moving. The RSI also breaks above the declining trend line drawn from January.

In this case, as long as the previous high at $4.70 is not broken, the stock would bring a rise to the resistance level at $5.58 (a gap occurred on March 12 and also the level around the declining trend line). A break above $5.58 would extend the up move to second resistance level at $6.13 (a gap created on March 9)

On the other hand, a break below $4.70 would call for a return to the previous low at $4.25.

Source: GAIN Capital, TradingView

Latest market news

April 25, 2024 03:09 PM

April 25, 2024 03:00 PM

April 25, 2024 01:12 PM

April 25, 2024 11:14 AM