Evidence of this was the sharp selloff yesterday in the Chinese currency, the yuan after the PBOC cut the 20% reserve requirement for forwards contracts to 0%, effective yesterday. The 20% reserve requirement was first introduced in late 2015 when the yuan was under significant pressure following exchange rate reforms.

It was reintroduced in August 2018 to slow yuan weakness coming from the escalation in U.S-China trade tensions. However since May 2020, the yuan has rallied strongly and gained pace over the past week, reflecting the increased probability of a Biden victory in the U.S election and an easing of U.S-China trade tensions.

The removal of the 20% reserve requirement is likely to be aimed at slowing the pace of further yuan appreciation and not an attempt to reverse its direction. Apart from removing a deterrent for companies to hedge currency risk, it will also help maintain the growth path of China’s economic recovery.

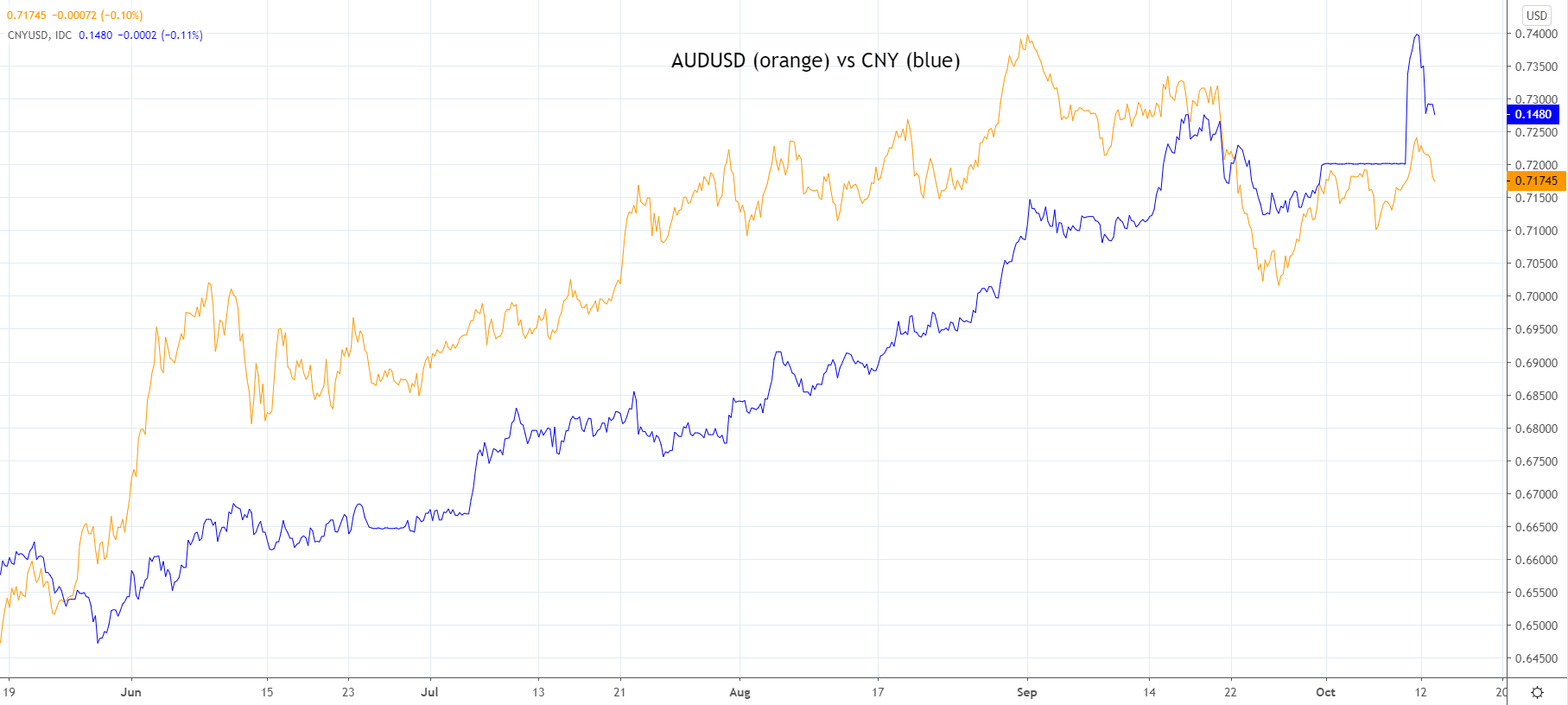

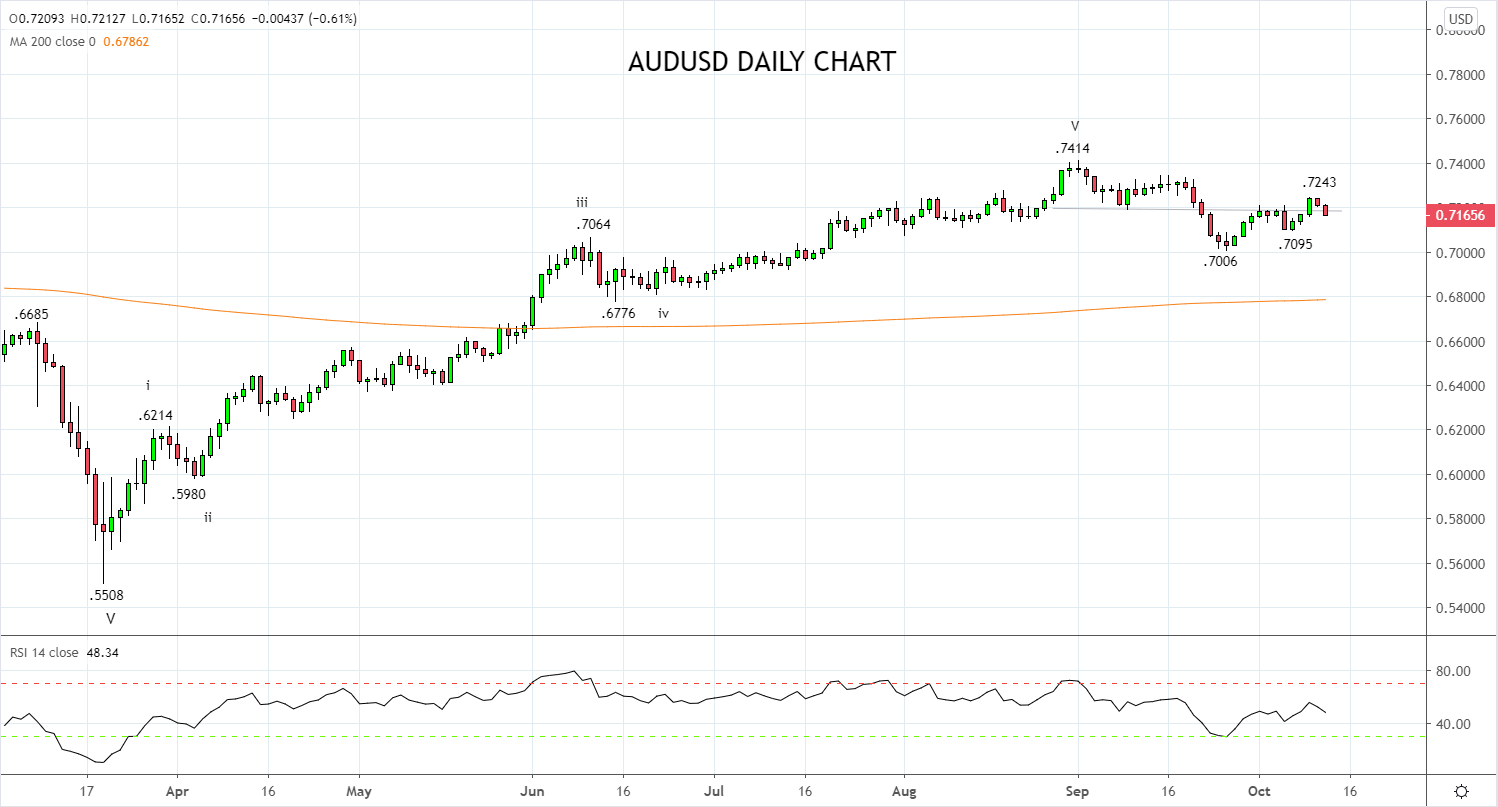

As the chart below shows, the AUDUSD and the CNY have rallied strongly together since May of this year. The emergence of a headwind in the CNY yesterday, also represents a headwind to the AUDUSD.

Also weighing on the AUDUSD reports that Chinese authorities have verbally instructed Chinese power stations and steel mills to stop using Australian coal. This would represent an escalation in diplomatic tensions between Australia and China that have already resulted in China suspending imports of Australian wheat, beef, and wine to varying degrees.

The two developments outlined above have sent the AUDUSD back below key support at .7210c and this opens up a test of last weeks .7095 low. In a nutshell, after the events of the past 24hours, there is enough reason to warrant a more cautious near term view of the AUDUSD and other AUDXXX rates, including AUDJPY and AUDNZD.

Source Tradingview. The figures stated areas of the 13th of October 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation