Despite the best efforts by Chinese authorities to limit the fall out of the coronavirus on financial markets, the mainland Chinese equity benchmark, the Shanghai Composite has fallen by approximately 8% in its first session since closing for an extended Lunar New Year break.

Today’s fall was in line with the moves seen in closely related indexes including the China A50 and the Hang Seng which remained open for trading during the Lunar New Year period and has helped S&P 500 futures rally from session lows. Likewise, the ASX200 earlier today tagged and bounced from the upper bound of the 6900/6850 support zone highlighted in this article last week. https://www.cityindex.com.au/market-analysis/asx200-correction-to-continue/

Which prompts the question “Will calm heads prevail?” when it comes to the fate of the Chinese stock market.

On one hand, the argument is the coronavirus has already spread faster and infected more people in China than the entire SARS epidemic in 2003. It comes at a time when Chinese economic data was beginning to show signs of improvement, a trend that is likely to be at least temporarily reversed with most business and production shut down until February 9.

On the flip side, Chinese authorities as demonstrated by today’s liquidity injection are willing to support the economy with stronger fiscal and monetary support. Amongst the tools at their disposal are MLF and RRR cuts, temporary tax exemptions and raising the local special bonds quota. Because the global recovery continues to gain traction, there is likely to be strong demand for Chinese made goods when production resumes.

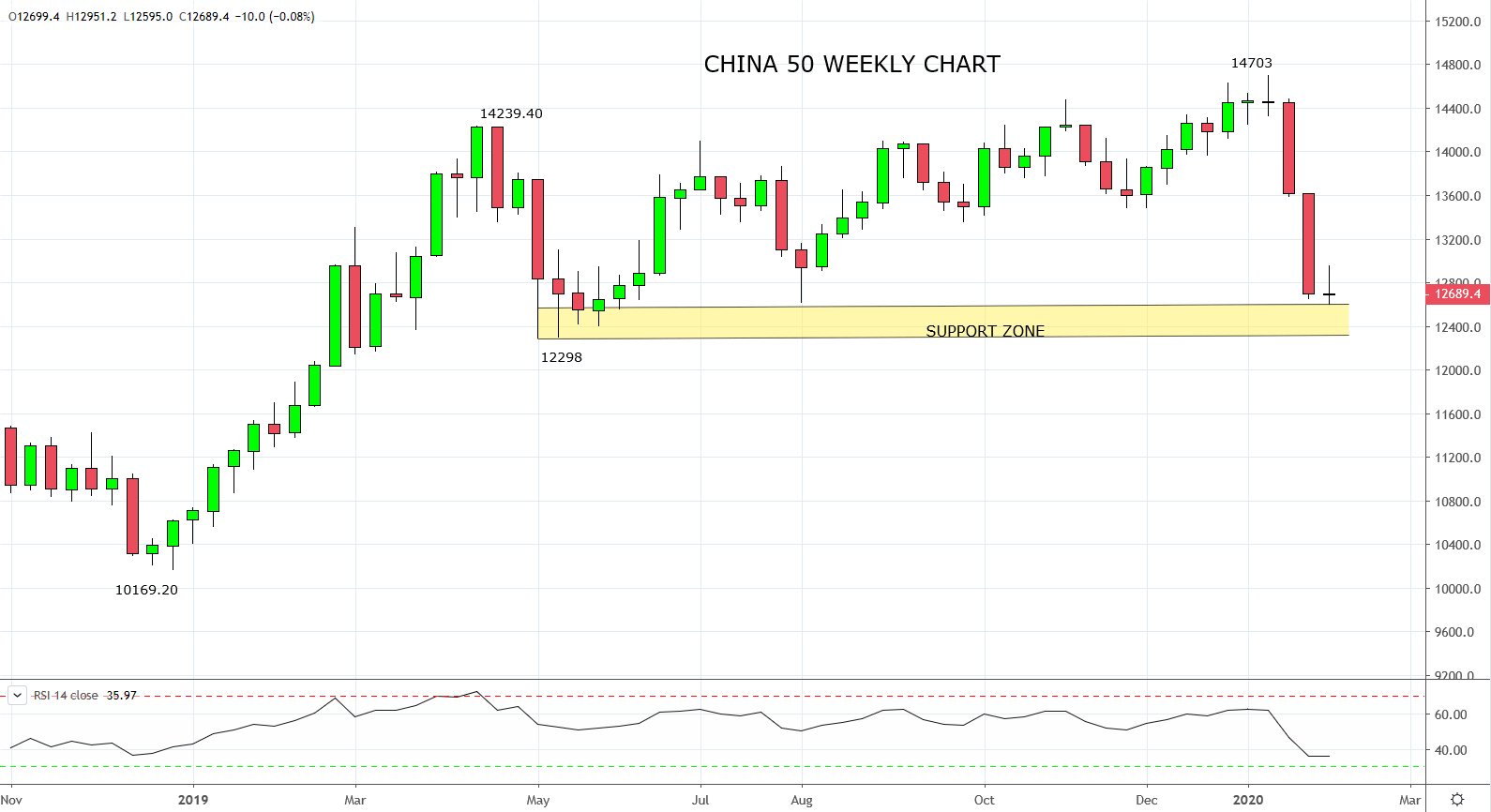

Technically when looking at Chinese stocks my preference is to refer to the China A50 because it is more easily accessible to foreigners. As can be viewed on the chart below after an almost 15% drop over the past three weeks, the China A50 index is now approaching the upper bound of a band of horizontal support between 12600 and 12300. If cool heads are to prevail, I would expect to see signs of buying emerge in this support region in the sessions ahead.

Source Tradingview. The figures stated areas of the 3rd of February 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation