At half time during a BBQ for last weekend’s Australia vs England Rugby World Cup Quarter Final, the topic of conversation turned to Bitcoin and about possible catalysts for a revival in price.

One of my buddies who works in the real estate industry and by virtue enjoys all things market related was confident that the next leg higher in Bitcoin would be a result of the scheduled 2020 halving of Bitcoin. The halving refers to a reduction in the reward that miners received for creating new bitcoin bocks from 12.5 Bitcoin to 6.25 Bitcoin thereby reducing the supply of new Bitcoin coming into the market by half.

I argued that the halving event was already well known to the market and the upcoming reduction in supply should mostly be baked into the price of Bitcoin. After canvassing a few other possibilities our attention returned to the game.

Of course, the other possibilities discussed did not extend to Chinese President Xi Jinping making comments just a few days later that China should “seize the opportunity” of blockchain technology. After previously banning exchanges and cryptocurrencies President Xi’s comment put pressure on other leaders to either embrace or ban the blockchain technology which underpins Bitcoin.

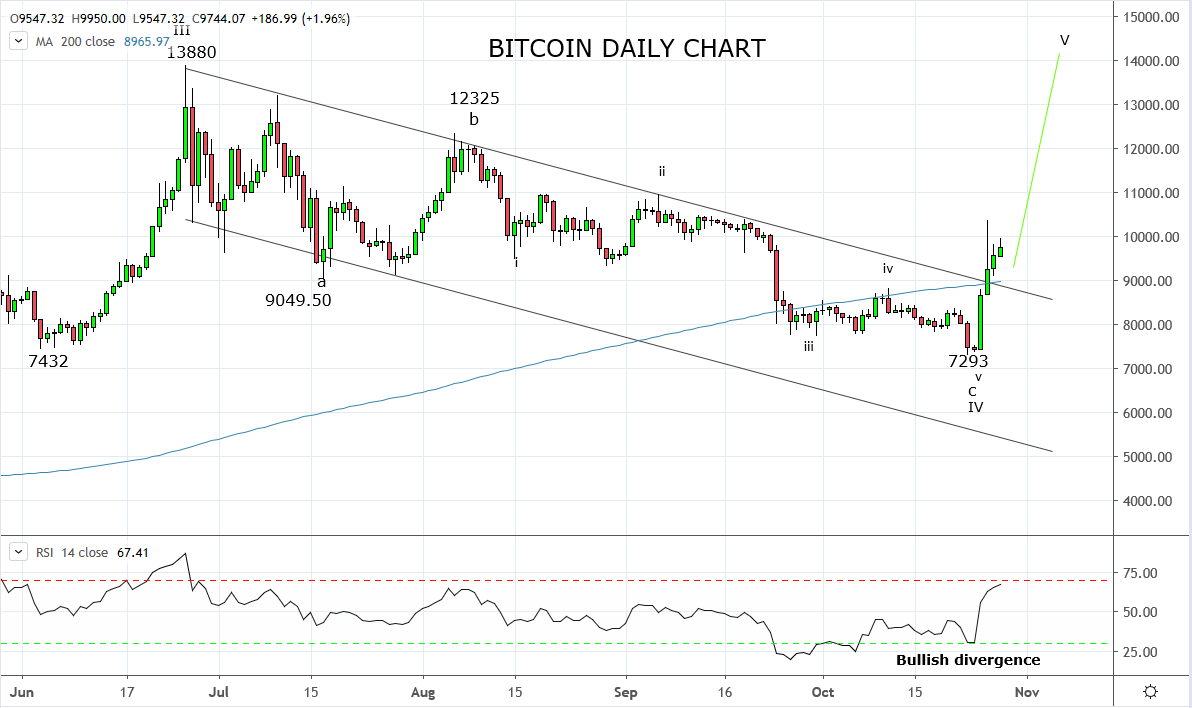

In the lead up to President Xi’s comments, there was some reasons to expect Bitcoin should hold the support ahead of $7k, which included the 61.8% Fibonacci retracement of the rally from the December $3.1k low up to $13.8k high of June, including a 5 wave decline and bullish divergence via the RSI indicator.

Technically, the weekends break and close above the trend channel resistance and the 200 days moving average at $8.9k goes a long way towards confirming Bitcoin put in tradable Wave IV low at last week’s 7293 low. We favour opening longs in Bitcoin on dips back towards $9.2k with stops placed below $7.2k. The target for the trade is a move to the $15/16k area.

Source Tradingview. The figures stated areas of the 28th of October 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.