China Life Insurance: Positive Reactions to First Quarter Results

China Life Insurance, one of the largest Chinese insurance groups, announced that 1Q net income dropped 34.4% on year to 17.09 billion yuan while operating income grew 8.2% to 33.78 billion yuan on insurance revenue of 307.78 billion yuan, up 13.0%. While headline results showed the negative impacts of coronavirus, decline in equity markets and a downward trend in interest rates, a spotlight was placed on new business value which grew 8.3% on year. Chinese investment bank CICC said new business value was better than the company's rivals and sees growth "significantly outpacing" peers in 2020.

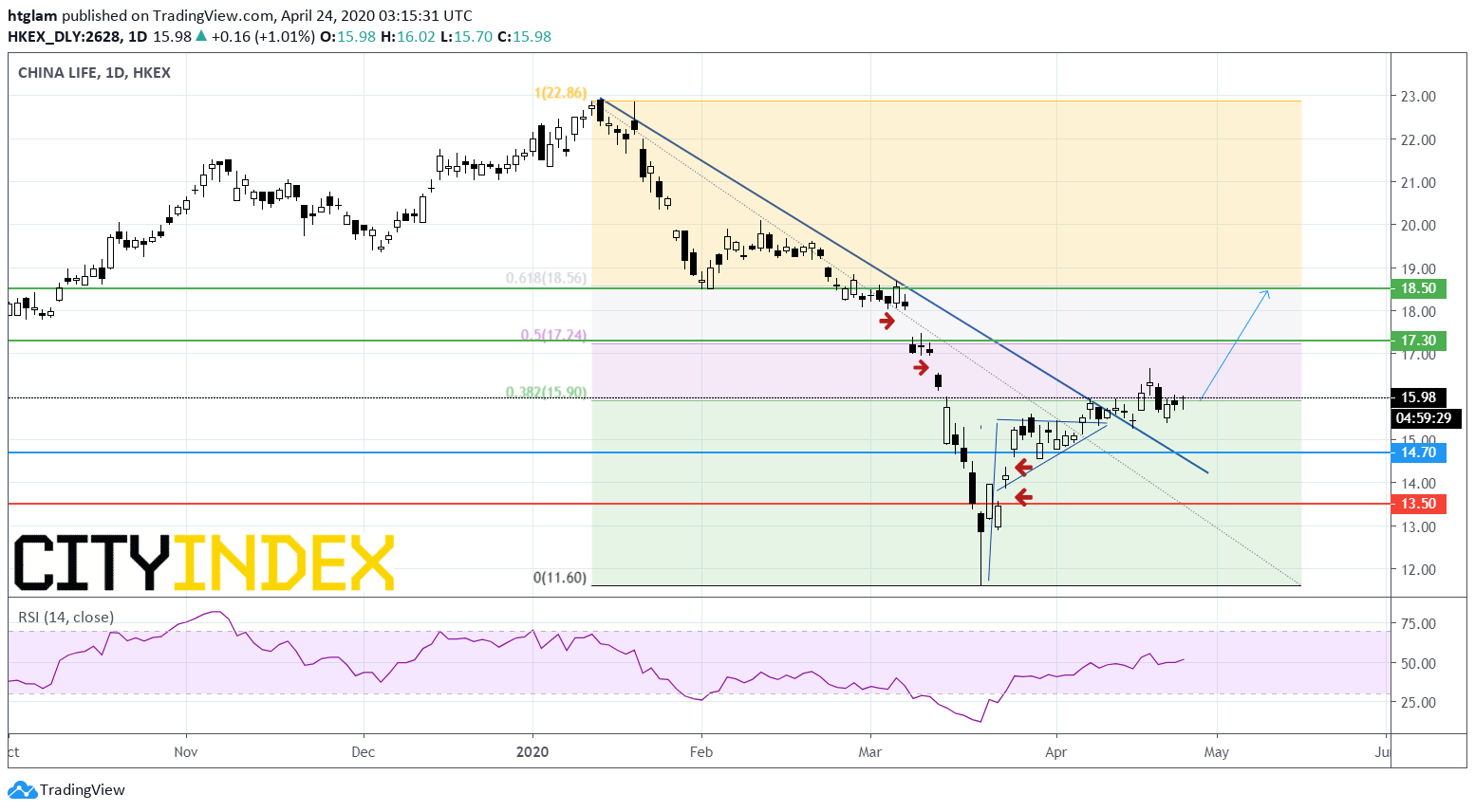

From a technical point of view, China Life Insurance H share (2628.HK) is extending its rebound as shown on the daily chart. It has broken above a bearish trend line drawn from January, after forming a bullish flag pattern in March. Bullish investors might consider $14.70 as the nearest support, with prices likely to advance to the 1st and 2nd resistance at $17.30 and $18.50 respectively, filling the gaps previously made in early March. In an alternatively scenario, a break below $14.70 may trigger a pull-back to the next support at $13.50.

Source: TradingView, GAIN Capital

Latest market news

Yesterday 10:36 PM

Yesterday 05:36 PM

Yesterday 05:00 PM

Yesterday 01:31 PM

Yesterday 12:26 PM

Yesterday 11:30 AM