China Gas (384-hk): Potential Rebound

China Gas (384-hk), a Chinese natural gas company, recently announced that full-year net income rose 11.7% on year to 9.19 billion yuan on revenue of 59.54 billion yuan, up 0.3%. The company proposed a final dividend of 0.40 Hong Kong dollar per share, taking full-year dividend to 0.50 Hong Kong dollar per share, up 13.6% from the prior year.

China Gas's share price has dropped about 30% from the high of November last year, amid coronavirus outbreak. However, as China's indicators showed a rebound in economic and industrial activity since March, the coronavirus impact on the current full-year earnings might not be as big as investors would have thought initially.

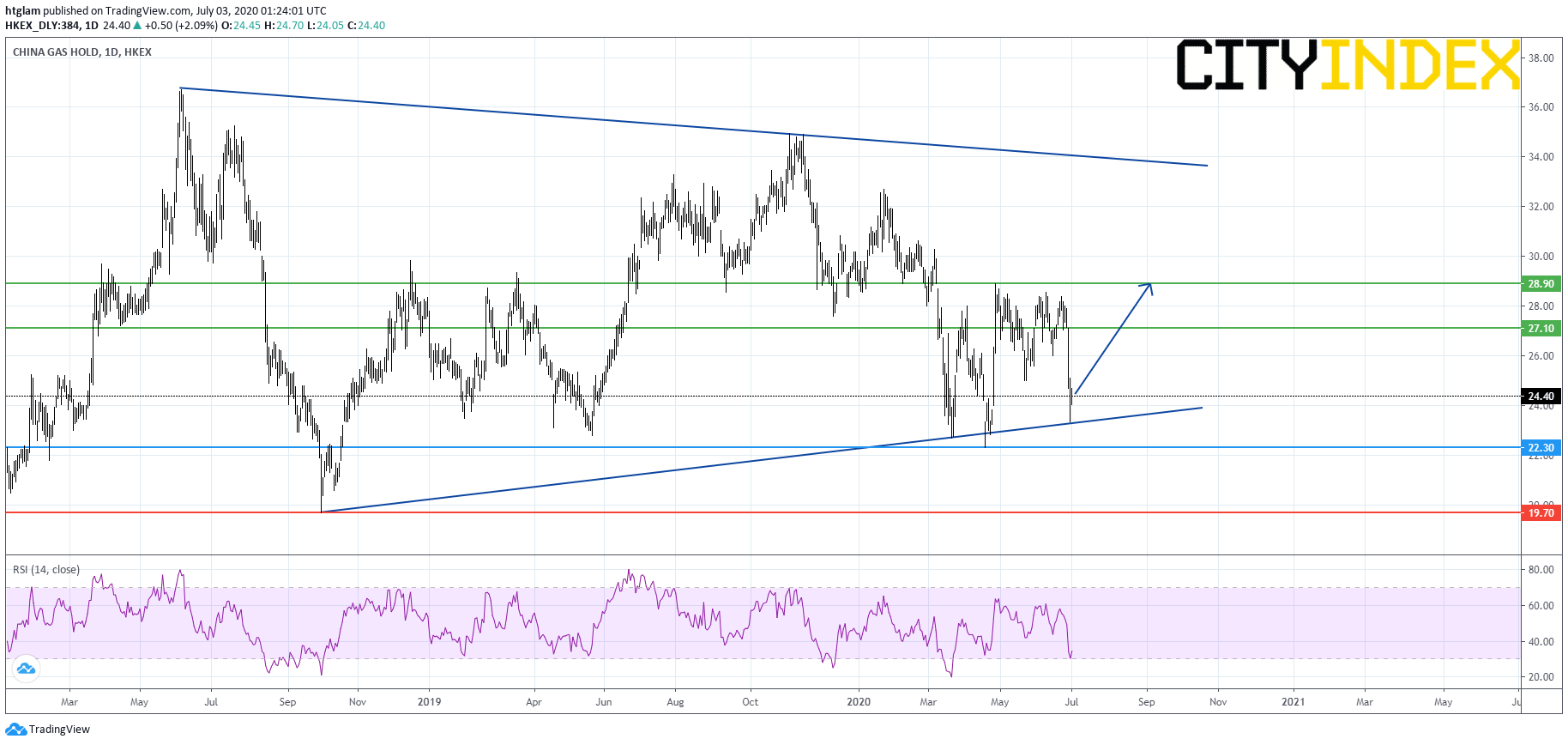

From a technical point of view, China Gas's share price shows signs of stabilizing after approaching its previous low as shown on the daily chart. In fact, it has reached the lower boundary of a long-term symmetrical triangle, while the relative strength index shows a bullish divergence. Bullish investors might consider $22.30 as the nearest support, with prices likely to rebound to test the 1st and 2nd resistance at $27.10 and $28.90. Alternatively, a break below $22.30 would be a bearish signal and may open a path to the next support at $19.70.