China Evergrande (3333-hk): Sell on Rumors

China Evergrande (3333-hk), a top tier Chinese property group, had exceeded our bullish forecast made in early June after surging to a 15-month high in July. However, its share price has retreated sharply, amid downbeat first half results and negative rumors.

In September, the company announced a staggering 30% discount on all of its properties until early October, a period that is supposed to be traditional Chinese peak home-buying season, as an attempt to improve its cash flow.

Furthermore, the property giant may face a potential default as it may need to repay investors 19 billion dollars by January 2021, unless regulators approve its listing on the Shenzhen stock exchange, according to Bloomberg.

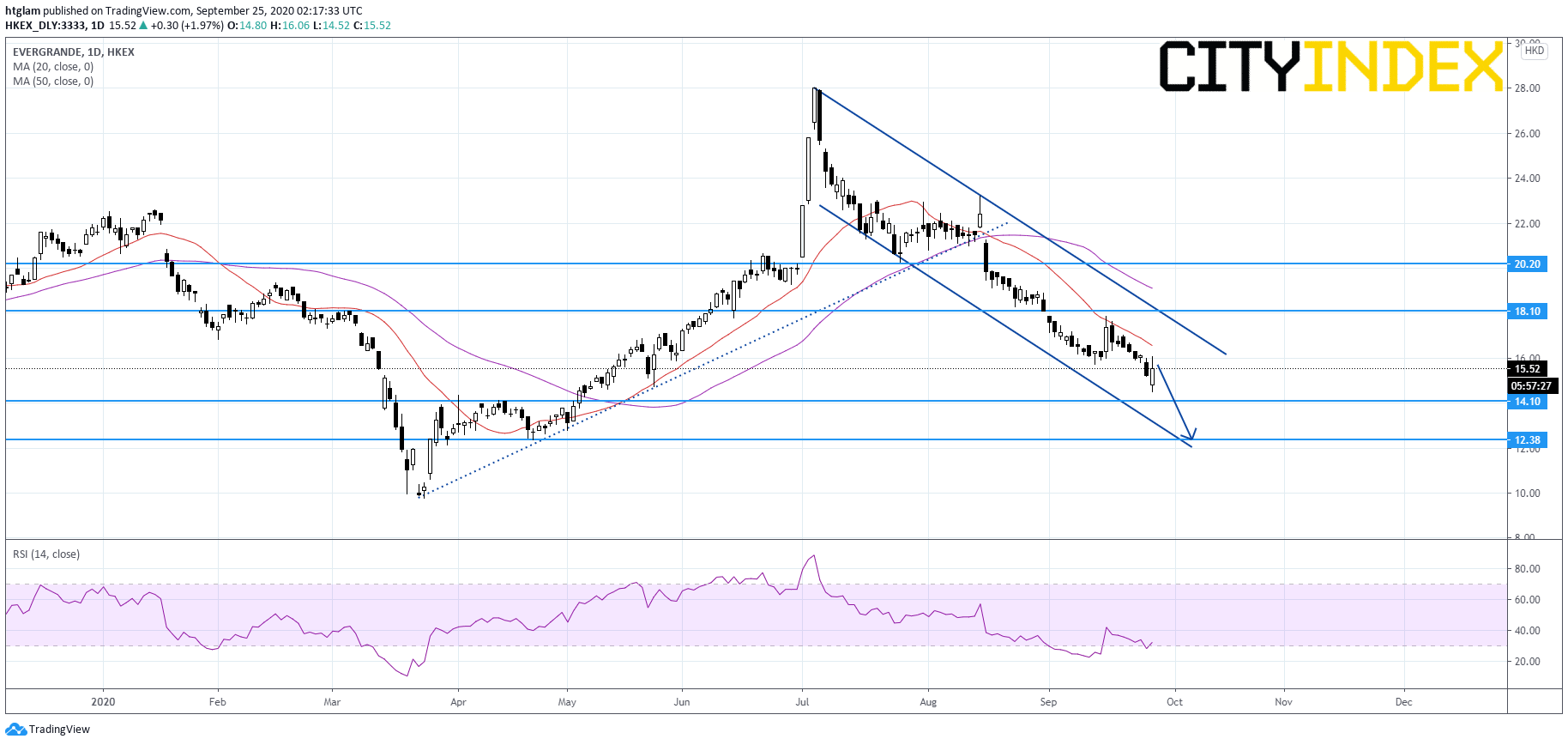

From a technical point of view, China Evergrande (3333-hk) remains under pressure as shown on a daily chart. Despite the fact that it has just shown a bullish divergence, it remains trading within a bearish channel drawn from July. The upside potentially is likely to be limited by the upper boundary of the channel. The level at $18.10 might be considered as the nearest resistance, with prices likely to test the 1st and 2nd support at $14.10 and $12.38. Alternatively, a break above $18.10 might suggest a further rebound to test the next resistance at $20.20.