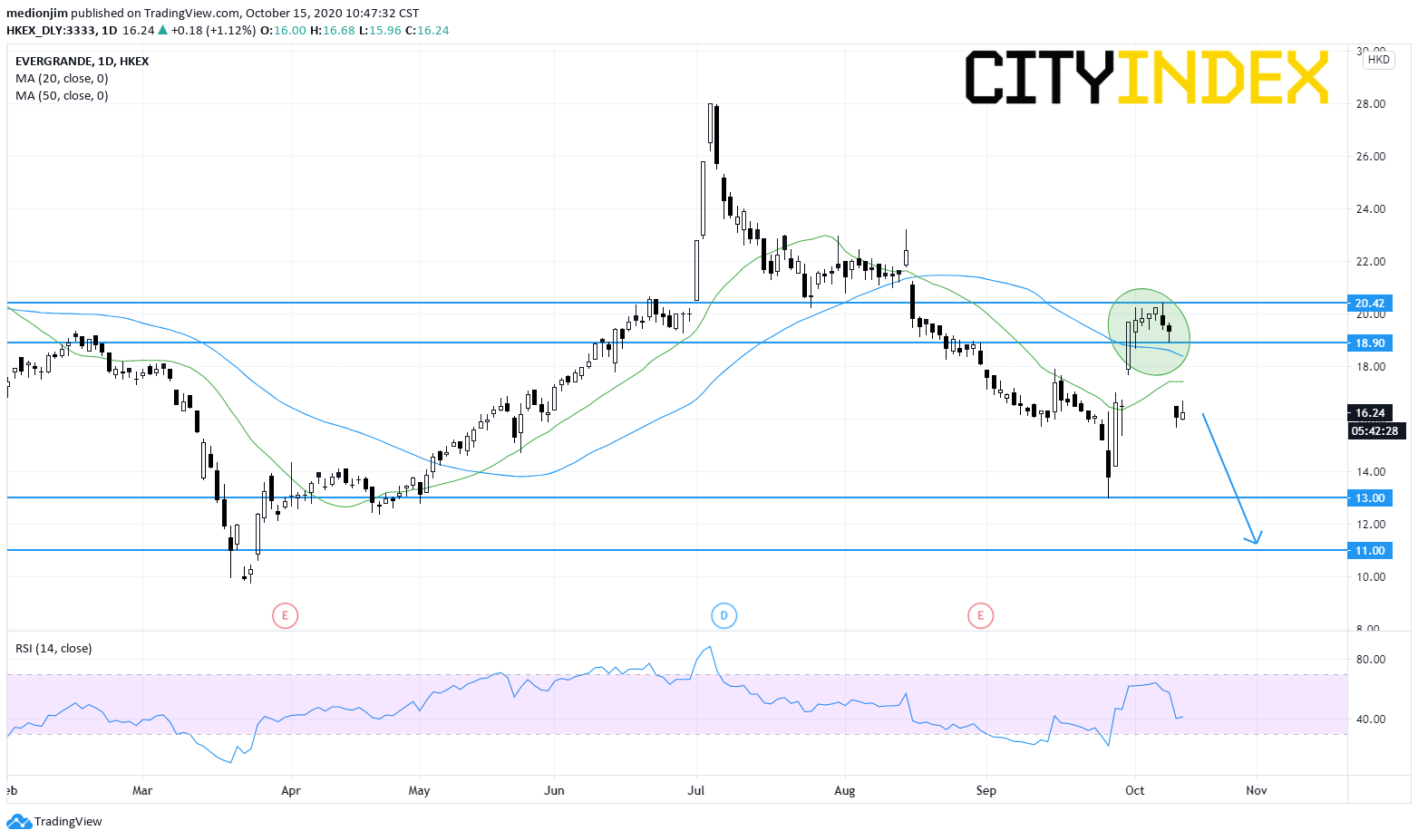

China Evergrande (3333): Isolated island reversal signal

China Evergrande (3333), a major Chinese property group, has raised 4.3 billion Hong Kong dollars through 260.7 million shares placement at 16.50 Hong Kong dollar per share, representing a 14.7% discount to its closing price on Monday, according to Bloomberg. After that, the share prices slumped 17% after the company's announcement

From a technical point of view, the stock validated an isolated island pattern and returned the level below both declining 20-day and 50-day moving averages. Unless the previous gap at HK$18.90 is filled, the stock could consider a drop to the support level at HK$13.00 and HK$11.00

From a technical point of view, the stock validated an isolated island pattern and returned the level below both declining 20-day and 50-day moving averages. Unless the previous gap at HK$18.90 is filled, the stock could consider a drop to the support level at HK$13.00 and HK$11.00

Source: GAIN Capital TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM