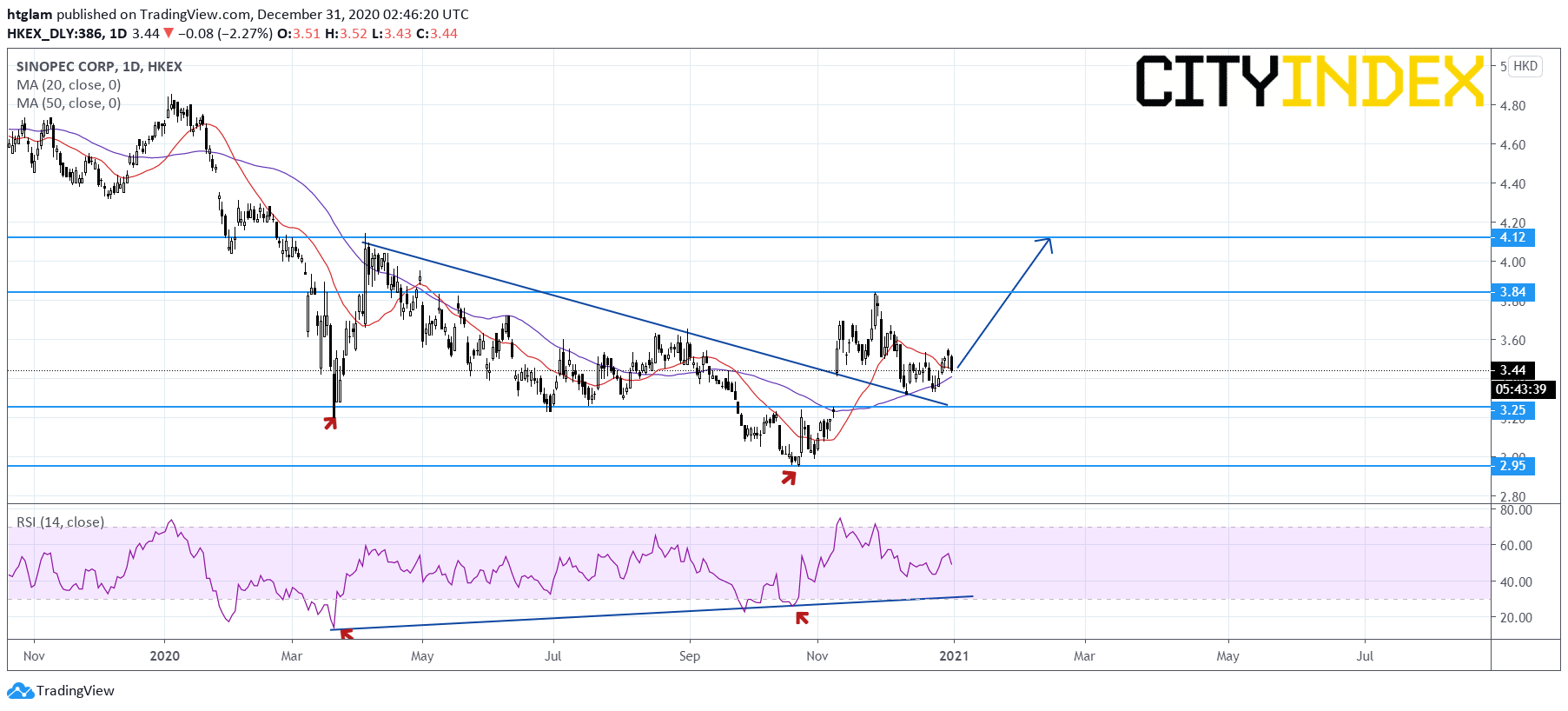

China Energy Stocks In Focus: Sinopec (386) and China Gas (384)

Source: GAIN Capital, TradingView

Chinese investment bank CICC pointed out that OPEC's decision to gradually increase crude production and positive coronavirus vaccine development have supported oil prices, and it said investors should keep an eye on undervalued Sinopec (386).

From a technical point of view, Sinopec's (386) recent rebound remains intact as shown on the daily chart. It has potentially formed a higher-low and support is provided by the 50-day moving average, which has turned upward. The level at HK$3.25 may be considered as the nearest support, while the 1st and 2nd resistance are expected to be located at HK$3.84 and HK$4.12 respectively.

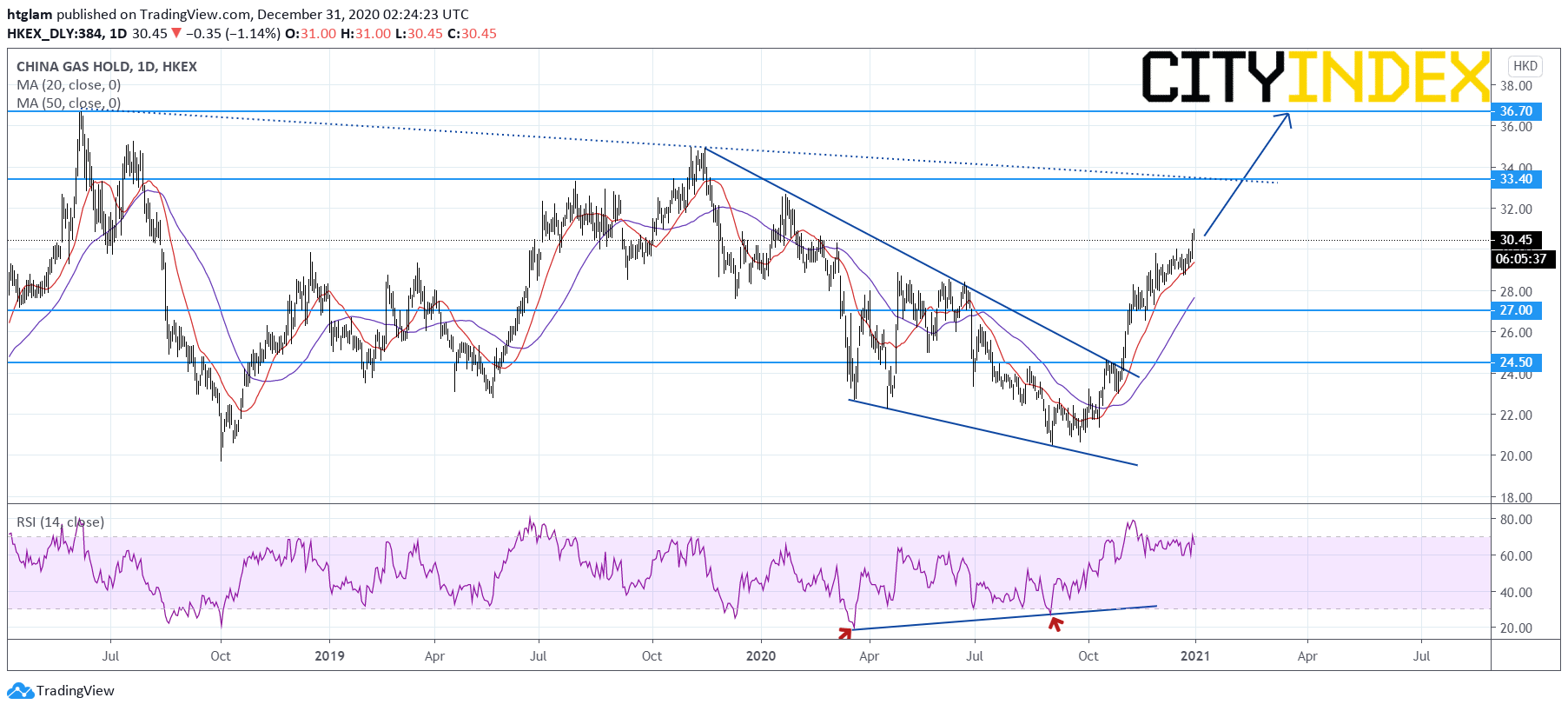

China Gas (384): Extending its Rally

Source: GAIN Capital, TradingView

JPMorgan affirmed its "overweight" rating for China Gas (384), point out that the company's share price has outperformed its peers by around 4% since interim result released in late November. The investment bank expects the company's free cash flow, which turned positive in the first half of the year, to be sustainable.

From a technical point of view, China Gas (384) is gathering more upside momentum as shown on the daily chart. In fact, it has accelerated to the upside after breaking above a bullish falling wedge pattern, with the 20-day moving average rising further above the 50-day one. The level at HK$27.00 might be considered as the nearest support, while the 1st and 2nd resistance are expected to be located at HK$33.40 and HK$36.70 respectively.