China Eastern Airlines (670.HK) Rallied Ahead of China National Day Holiday

China Eastern Airlines (670), an airline group, rallied above 50% from March low. Currently, the stock is holding on the upside despite the worsen monthly result.

The company posted passenger traffic slid 44.0% on year in August, and the passenger load factor decreased by 12.06 percentage points to 73.32%.

Citigroup said the valuation of China airlines is attractive and that any progress on a coronavirus vaccine would further boost investor sentiment in the short term.

Besides, the long National Day holiday is coming in October, which could boost the airlines income in the short term.

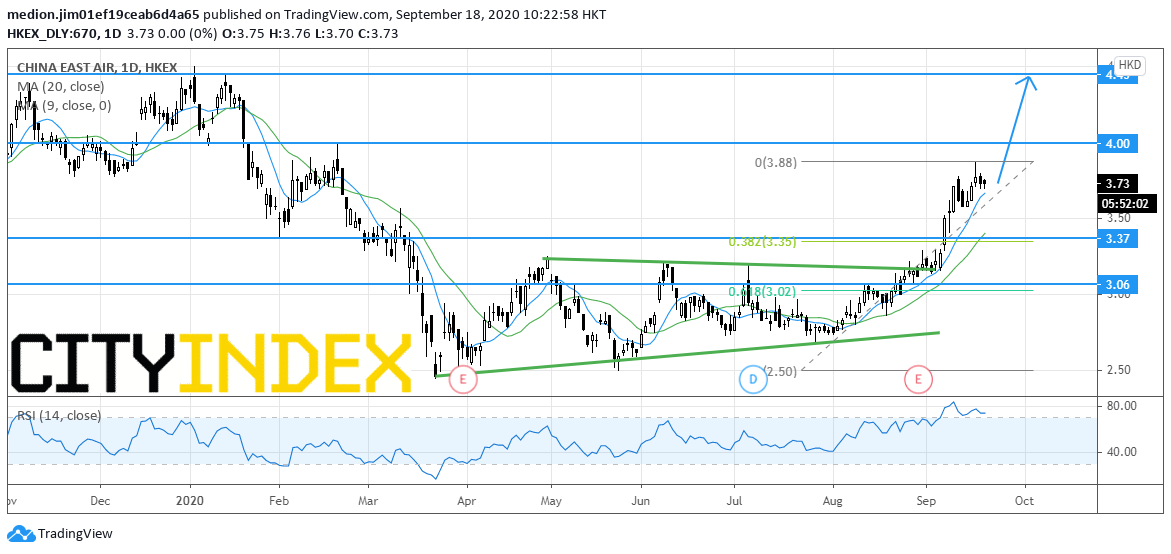

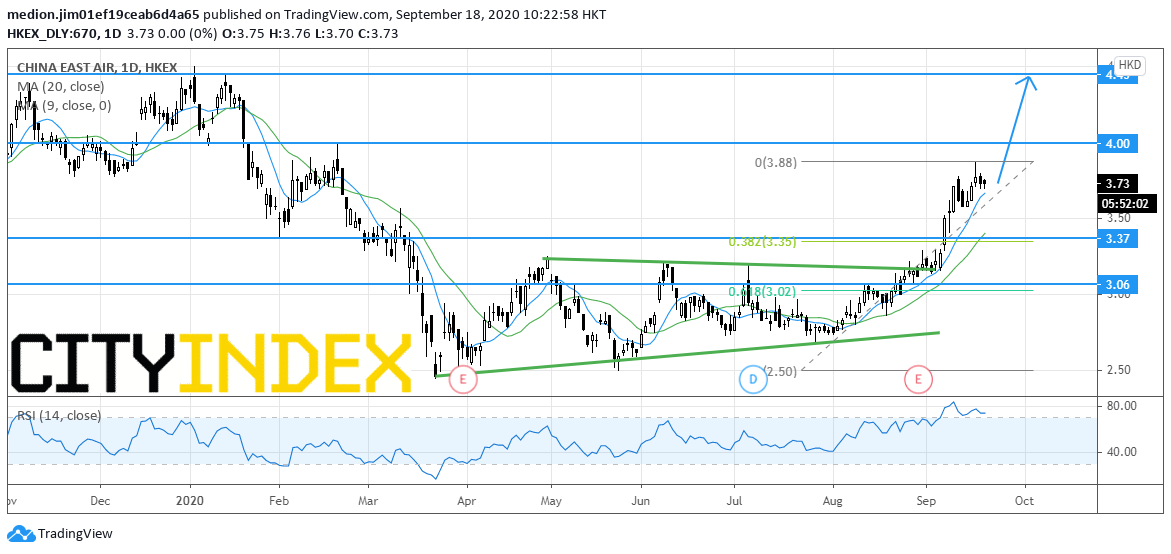

From a technical point of view, the stock climbed along the rising 20-day moving average after breaking above the ascending triangle pattern.

The RSI is above its overbought level at 70, but has not displayed any reversal signal.

Bullish readers could set the nearest support level at HK$3.37, while resistance levels would be located at HK$4.00 and HK$4.45.

Source: GAIN Capital TradingView

The company posted passenger traffic slid 44.0% on year in August, and the passenger load factor decreased by 12.06 percentage points to 73.32%.

Citigroup said the valuation of China airlines is attractive and that any progress on a coronavirus vaccine would further boost investor sentiment in the short term.

Besides, the long National Day holiday is coming in October, which could boost the airlines income in the short term.

From a technical point of view, the stock climbed along the rising 20-day moving average after breaking above the ascending triangle pattern.

The RSI is above its overbought level at 70, but has not displayed any reversal signal.

Bullish readers could set the nearest support level at HK$3.37, while resistance levels would be located at HK$4.00 and HK$4.45.

Source: GAIN Capital TradingView

Latest market news

April 25, 2024 03:09 PM

April 25, 2024 03:00 PM

April 25, 2024 01:12 PM

April 25, 2024 11:14 AM